Nobody has but outlined what 6G truly is, not to mention the way it will succeed economically

Editor’s observe: That is the primary installment of a three-part collection from Analyst Vish Nandlall. Maintain a watch out for components two and three, coming quickly.

Each cell era has been greater than only a technical improve. It has been an financial story about how worth is created, delivered, and captured. 3G, 4G, and 5G every got here to market with a well-formed enterprise mannequin and a transparent foundation of competitors. They grew within the context of increasing machine penetration and unmet demand, giving operators room to seize new worth. However because the business now friends towards 6G, one reality is obvious: Nobody has but outlined what 6G truly is, not to mention the way it will succeed economically. The desk isn’t set for achievement.

| Characteristic | 3G (The Catalyst) | 4G (The Revolution) | 5G (The Bifurcation) | 6G (The Dilemma) |

| Period | Cellular Telephony | Cellular Compute | Cellular and Edge Compute | ? |

| Main Worth Created | The opportunity of the cell web. | The mobile-first app financial system. | Aggressive broadband various (FWA) & city capability aid. | Unclear. A “community of cognition” for speculative use circumstances. |

| Foundation of Competitors | Protection & Primary Reliability. | Velocity & Community Efficiency. | Mid-Band Spectrum Depth. | Unclear. Excessive efficiency metrics with diminishing marginal worth. |

| Key Demand Driver | Preliminary adoption of cell/wi-fi units. | Explosion of smartphone penetration and app utilization. | Demand for residence broadband competitors; city knowledge congestion. | None demonstrated. Assumes future demand for AR/VR and sensing. |

| MNO Income Development (CAGR, Peak Rollout) | N/A (Pre-IPO/Early Knowledge) | ~4.3% (Verizon, 2010-2015) | ~0.6% (Verizon, 2019-2024) | Speculative. |

| MNO ROIC vs. WACC | N/A | > WACC (Worth Accretive) | ~ WACC (Worth Impartial/Harmful for some) |

3G: The cell web

3G emerged within the aftermath of the dot-com and telecoms crash, when capital was scarce and skepticism was excessive. Its worth proposition was easy however highly effective: cell entry to the web. E mail and primary internet searching went from tethered desktops to handsets. Operators monetized this shift by tiered knowledge plans, and the idea of competitors was protection and reliability. It was not glamorous, nevertheless it created a sturdy new income stream that carried the business by a interval of monetary retrenchment.

Macroeconomic context mattered. International cell penetration was nonetheless in its progress part, with huge populations but to be related. Traders, although cautious, noticed upside in subscriber progress. Common income per consumer (ARPU) was modest however rising steadily as customers shifted from voice and SMS to knowledge bundles. Capital depth was excessive, however the incremental income justified the spend.

4G: Cellular apps and video

If 3G made cell web potential, 4G made it indispensable. Launched in a market already primed by the iPhone and the App Retailer, 4G was the right enabler of the mobile-first digital financial system. Video streaming, social networking, and ride-sharing grew to become mass-market realities. For operators, this was the golden age: customers willingly paid for extra knowledge, limitless plans proliferated, and community pace grew to become the brand new aggressive benchmark. The worth was clear, the shopper want was confirmed, and operators captured significant progress.

The macro context was equally favorable. Smartphone penetration skyrocketed from underneath 20% in 2007 to greater than 60% by the mid-2010s. Knowledge consumption per consumer grew at double-digit annual charges. ARPU held agency, even rising in lots of markets as customers upgraded to bigger knowledge packages. Capital expenditures have been vital (eg spectrum auctions and LTE rollouts consumed billions) however operators loved income progress that exceeded price of capital. Within the U.S., Verizon’s revenues rose from $106.6 billion in 2010 to $131.6 billion by 2015, a compound annual progress fee of 4.3%. Traders rewarded the sector, and for as soon as, telcos captured a significant share of ecosystem worth.

5G: eMBB, edge, and FWA

5G promised to repeat the 4G playbook: quicker speeds and revolutionary new use circumstances. Enhanced Cellular Broadband (eMBB) was meant to raise shopper experiences, whereas edge computing and ultra-reliable low-latency communications have been touted as enablers for the enterprise. In follow, nevertheless, 5G grew to become a narrative of incremental positive aspects. For customers, the distinction was quicker downloads, this proved helpful, however not transformative. The enterprise revolution by no means materialized at scale. As a substitute, Fastened Wi-fi Entry (FWA) emerged because the lone breakout, lastly giving telcos a reputable strategy to problem cable broadband. In any other case, 5G has largely been a churn-management software, a strategy to hold prospects from defecting somewhat than a brand new progress engine.

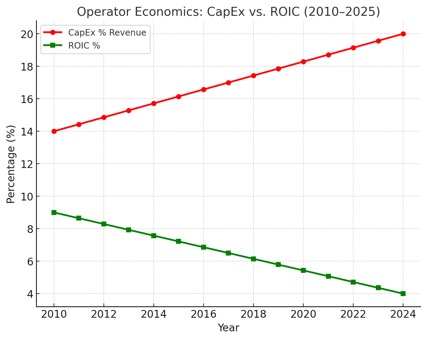

Right here the macro context was far much less forgiving. By the point 5G launched, cell penetration in superior markets had reached saturation (over 100% SIM penetration in lots of nations). ARPU had been in regular decline for years as competitors intensified and regulators pushed down roaming and termination charges. Capital depth soared, with international operators spending greater than $600 billion on 5G networks by 2023. But income progress barely budged. Verizon’s CAGR from 2019 to 2024 was solely 0.6%. Returns on invested capital struggled to exceed weighted common price of capital, elevating severe doubts about whether or not the era created or destroyed shareholder worth.

The query of 6G: What’s it?

This brings us to 6G. Each previous era had a transparent reply: 3G was the cell web, 4G was cell apps and video, 5G was eMBB and FWA. However what’s 6G? No consensus exists. Futuristic visions just like the “Web of Senses” or holographic communications seize creativeness however crumble underneath financial scrutiny. With no clear worth proposition, 6G dangers turning into the primary era launched with no outlined enterprise mannequin.

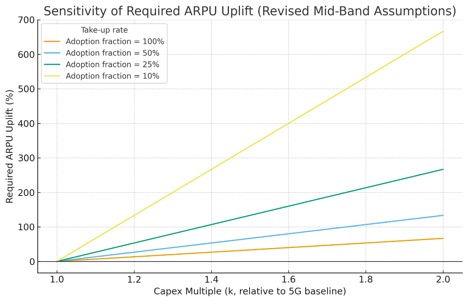

The economics are daunting. Mid-band 6G, essentially the most life like path, calls for 20–100% greater capex than 5G. That would work if adoption is broad, requiring solely a ten–30% uplift in ARPU. But when 6G is area of interest (say, solely 10–25% of customers use premium AR/VR) ARPU would wish to rise by 100–275%, ranges the market has by no means tolerated. In brief, the numbers don’t add up.

In the meantime, the macro context is even harsher than for 5G. Penetration is already saturated, leaving little room for subscriber-driven progress. ARPU continues to face downward strain from aggressive bundling, OTT substitution, and regulatory intervention. Capital markets are more and more skeptical of telcos’ potential to generate returns, punishing operators whose ROIC lags price of capital. With capital depth projected to climb once more, operators face the prospect of upper spending with no clear path to monetization.

The strategic crossroads

The business can’t assume that efficiency enhancements alone will generate demand. As soon as a community is “ok” for 4K video and cell apps, incremental positive aspects in pace or latency now not transfer markets. With no new foundation of competitors, operators are left holding the invoice for infrastructure whereas hyperscalers and machine makers seize the application-layer worth.

That is the value-capture disaster on the coronary heart of 6G. The know-how roadmap is wealthy with prospects, however the enterprise logic stays absent. Until the business defines what 6G is (not technically, however economically) it’ll threat turning into a $600 billion train in constructing the world’s quickest bit pipe.

The stakes

The development from 3G to 5G teaches us that know-how alone doesn’t assure success. 3G, 4G, and 5G every are aligned with a transparent financial context, increasing penetration, and an identifiable foundation of competitors. 6G, in contrast, stands at a crossroads with no outlined mannequin. The desk isn’t set. Until operators and requirements our bodies anchor 6G to confirmed demand drivers and sustainable enterprise fashions, it might go down in historical past not as a revolution, however as a cautionary story.