Some of the disagreeable surprises new and fast-growing eCommerce corporations face is how rapidly they run out of money. There are just a few culprits right here that trigger an organization with file gross sales gross sales to rapidly develop into money starved:

Financing Buy Orders: The most important drain on money is having to entrance funds for for buy orders of ever-increasing measurement. As a way to preserve having merchandise to promote, you’ve acquired to order items 4-6 months forward of time which is an enormous drain in your money reserves.

Stock Purchases Aren’t Tax Deductible: Situation #1 is compounded by the truth that stock purchases are usually not bills that decrease your tax invoice. So if you happen to made $200K in revenue final 12 months and used all of it to purchase $200K in stock, that doesn’t remove your revenue.

It means you continue to made $200K in revenue and now owe the federal government a giant, fats tax cost with out the money to pay it. Tips on how to keep away from working out of money and getting your self in a pinch or, worse, doing time with a cellmate named Bubba for missed tax funds?

To the Rescue: The Cashflow Forecast Mannequin

Salvation lies in one thing referred to as cashflow forecasting which is the method of projecting your financials into the long run perceive if/when you might run out of cash so you possibly can pro-actively cope with the scenario NOW.

On this submit I’m going to show you methods to do a correct cashflow forecast. And since it’s a reasonably advanced course of and doubtless not your first selection of methods to spend a day I’ve put collectively a mannequin to make the method simpler for you. You possibly can generally use Xero or Quickbooks to do that however their instruments are sometimes restricted and never very customizable. Therefore, our mannequin constructed particularly for eCommerce sellers.

Cashflow Mannequin Obtain: You possibly can obtain the customizable mannequin right here and I’ll stroll you thru the method of utilizing it beneath. The mannequin is read-only in Google Docs so that you’ll must make your personal copy as a way to edit and play alongside.

…

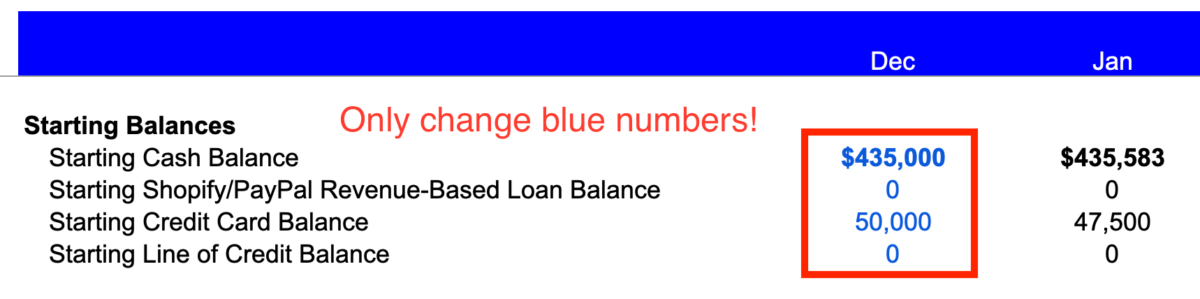

Necessary: Within the mannequin it’s VERY essential that you simply solely change numbers which might be blue. Blue numbers point out cells which might be meant to be modified and customised by you. They’re the assumptions that drive the mannequin. Black numbers are formulation that shouldn’t be edited. In the event you do, you’ll break the mannequin.

This mannequin is meant to function a high-level forecasting instrument solely. Please chat together with your accountant and tax advisor earlier than you make any essential tax, finance or enterprise choices.

Step 1: Set Your Assumptions

First, set the assumptions on the high of the mannequin. Right here’s a fast rationalization of every:

Product Margin: That is the margin in your product ONLY. It’s essential to differentiate between your product margin and your complete gross margin which incorporates variable prices (like transport, cc charges, and so on) as a result of product prices are usually not a money expense on the time of sale (you pull from stock) whereas transport and bank card charges are a money expense that occurs once you make a sale.

Gross Margin After CC Charges, Transport and so on: That is your gross margin AFTER making an allowance for product prices and money variable prices. This must be decrease than your product margin. If not, you’ve completed one thing mistaken.

State/Federal Tax Price: Fairly straight ahead, your general revenue tax price that you simply’ll want to contemplate for tax funds.

PayPal/Shopify Mortgage Rev. Compensation Price: If in case you have a revenue-based reimbursement mortgage that is the % of income is allotted towards mortgage reimbursement.

Credit score Card Avg. Curiosity: The approximate rate of interest to your bank card debt. If in case you have a number of playing cards and charges do your guess the blended price.

Curiosity Price on Line of Credit score: The rate of interest on any line of credit score you’ve gotten.

Step 2: Set Starting Balances

The following step is to enter the start stability of money and debt. That is fairly easy, you’ll merely enter your starting money stability in addition to any excellent debt balances you’ve gotten throughout strains of credit score, bank cards or any revenue-based loans.

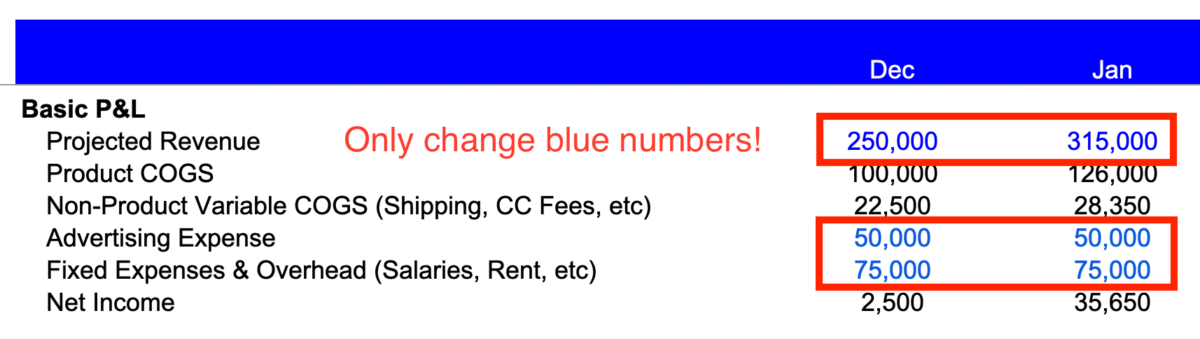

Time to tug up an revenue assertion from the final 12 months! Referring to your previous monetary efficiency make your greatest estimates for the next:

Step 3: Income, Overhead and Promoting

Projected Income: Utilizing your present progress price and any business-related insights mission month-to-month income over the course of the approaching 12 months.

Promoting Expense: Mission your month-to-month promoting spend on a month-to-month foundation. This would come with something you spend for paid site visitors, PR, and so on. If you recognize you ramp up spending at sure instances of the 12 months do your greatest to replicate that in your month-to-month forecasts vs. price averaging it throughout the 12 months.

Mounted Bills & Overhead: That is how a lot you spend on something non-product or achievement associated. These are bills you’d incur even if you happen to didn’t promote a single factor throughout a month and would come with lease, salaries, insurance coverage, and so on. Check out your complete mounted bills during the last 12 months, divide by 12 and add in any incremental month-to-month bills you anticipate having.

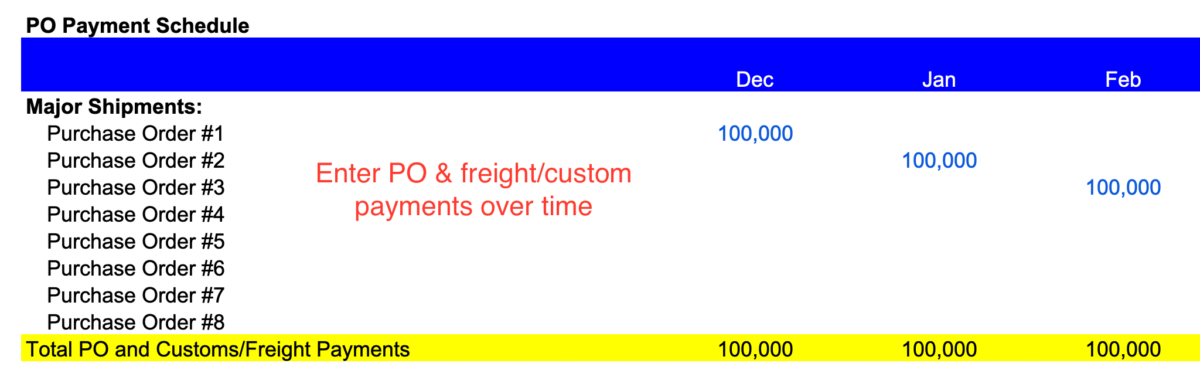

Step 4: Buy Order Forecast

This half will in all probability take essentially the most time. your income forecasts and contemplating the precise phrases you’ve gotten with suppliers do your greatest to mission out your buy order funds to suppliers going ahead over the following 12 months. There’s a particular line merchandise every particular person buy order to assist preserve them organized over time.

These quantities ought to embody all funds to suppliers in addition to charges for customs, importing and transport.

…

At this level it is best to have a high-level monetary mannequin of your monetary enterprise. Earlier than we begin utilizing the mannequin to foretell the long run let’s discuss the way it truly works.

Step 5: Understanding How the Mannequin Works

As talked about above, the tough factor a few cashflow forecast is differentiating between bills in your P&L and precise money motion in your small business. In the event you’re doing accrual primarily based accounting (which any inventory-based enterprise ought to actually be doing) these are usually not the identical factor.

Instance: Whenever you run your revenue assertion for July you might even see $200,000 in income and $60,00 in COGS. The $200,000 might very nicely be true money that entered your small business however that $60,000 is NOT a money expense for July.

Why not? Since you nearly definitely ordered that stock and paid for it again in April, Could or another time within the enterprise.

It’s right to account for $60,000 of expense in July as a result of below accrual accounting guidelines you need to line up your bills in the identical time interval as you incurred them. It’s the best approach of your small business from a profitability standpoint. Nevertheless it makes cashflow planning a nightmare. 🙂

Our little mannequin creates a primary monetary forecast and makes use of it to trace solely actions that affect money. At a really high-level right here’s the way it does it:

- Beginning with starting money place

- Modify for financing actions (add new borrowings that creates money, subtract curiosity expense and precept reimbursement)

- Modify for working actions (add income, subtract non-product achievement prices, promoting, overhead, taxes, dividends)

- Modify for stock purchases (subtract buy orders and freight/customized bills)

- Compute ending money place

If in case you have a variety of accounts receivable (maybe you do wholesale and supply phrases) or accounts payable outdoors of POs you’ll need to add/tweak this mannequin accordingly because it’s not constructed with these in thoughts.

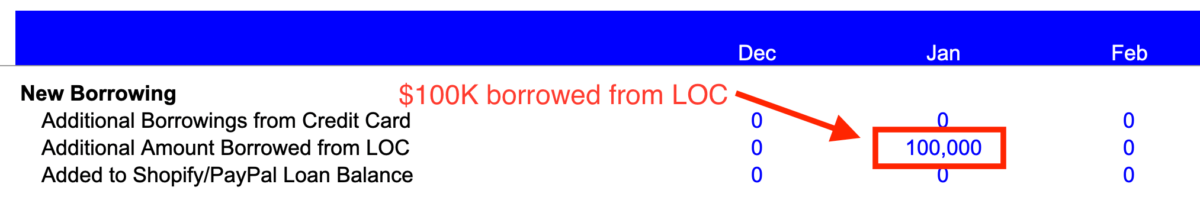

Step 6: Evaluating Your Money Place and Fill Gaps

Now that you’ve got a tough concept of what we’re doing let’s dive-in and see how good (or dire) your money scenario is!

Check out your Ending Money Stability line over the upcoming 12 months. Does it get worrying low? And even go damaging? If in order that’s an indication you’ve acquired some points arising and must take some motion.

What to do?

When you establish an space the place you’re brief on money use the ‘New Borrowing’ part to enter further funds out of your desired supply. The mannequin will robotically observe the brand new debt stability, curiosity funds and affect on money circulation going ahead.

Money is the lifeblood of an eCommerce enterprise. In the event you want money we’ve a information for eCommerce Financing which lays out the professionals and cons of every financing methodology. Listed below are among the commonest financing choices:

Credit score Playing cards: You shouldn’t use bank cards as your first choice given their very excessive rates of interest. They do have good rewards, particularly Chase Ink Enterprise and American Specific Enterprise Gold that are talked about within the financing article.

PayPal/Shopify Income Loans: Income primarily based masses have among the highest APR charges, particularly if paid again rapidly, these loans normally require no private assure and will be acquired rapidly. One draw back is that they’re repaid from a hard and fast % of income which implies it has the potential to starve your organization for money. PayPal and Shopify supply this loans in addition to many others together with corporations like ClearCo.

Letter of Credit score: Issued from a financial institution these will be good choices for short-term financing wants.

Notice that whereas Income-based loans from Shopify/PayPal embody the curiosity and precept as one cost, bank card and line of credit score funds within the mannequin go solely towards curiosity. If you wish to work to pay down the stability you’ll want to point that in them mannequin within the respective part beneath.

Renegotiating Provider Phrases

One financing choice that always will get ignored is negotiating higher phrases together with your provider. I do know plenty of house owners who’ve been capable of develop their enterprise extra rapidly and depend on much less financing by merely negotiating higher cost phrases with their suppliers.

Sean Frank, from Ridge pockets who I interviewed right here on the podcast, negotiated 180 day phrases with their provider which allowed them sufficient time to promote by the ordered items earlier than their POs had been due!

That’s a fairly distinctive case however there’s usually room for higher phrases with suppliers, particularly if you happen to’ve labored with them for some time and have constructed up some belief and rapport.

Getting Extra Assist from Right here

Hopefully this helps offer you a way of your money wants for the following 12 months and made the method a bit much less painful!

In the event you’re eager about enhancing your money place, forecasting and accounting chops much more it is best to think about becoming a member of us contained in the eCommerceFuel Group. We’re the world’s largest group of 7- and 8-figure retailer house owners.

Inside you’ll discover a whole bunch of veteran retailer house owners keen to assist with issues like:

If that sounds attention-grabbing and you personal a 7- or 8-figure enterprise you possibly can apply to affix us proper right here.