Memorial Day Greetings from Florida, Iowa, and Missouri. The image is from our canine’s (Abby) current go to to the Springfield (MO) farm the place she awarded the Editor with a number of prize turtles. Spring within the nation – can’t beat it.

Along with the lengthy kind movies shared beneath, be sure you try the long-anticipated look on Roger Entner’s The Week With Roger podcast recorded this previous week. It needs to be posted by Tuesday right here in addition to in your favourite podcast app. We focus on all kinds of business tendencies together with the proposed Constitution/Cox and AT&T/ Lumen Mass Markets mergers. Roger is a terrific host and pal.

Lots of you may be attending the Fiber Join convention. CellSite Options will probably be represented on Tuesday, June 3rd. Please attain out immediately at [email protected] if you’re concerned about catching up. Additionally maintain your eyes open for an upcoming MoKan lunch in St Louis in mid-July – extra particulars on that right here.

One extra administrative observe – we will probably be publishing a Transient on June 8th and June 22nd and will probably be changing these of you who’re e mail subscribers to WordPress the week of July 6th.

The fortnight that was

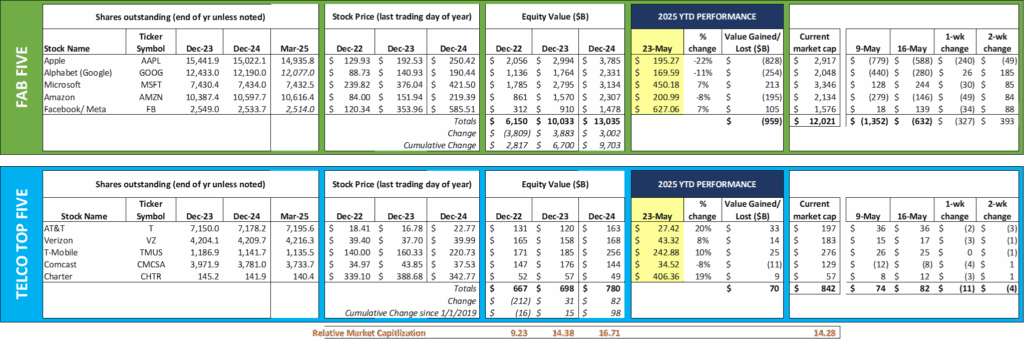

Vacation weeks are usually quiet. This market is trending decrease within the absence of stories due to international macroeconomic uncertainty. Each Microsoft and Google held developer convention occasions this week (Google’s is linked beneath), and each have been warmly obtained. Total, the Fab 5 have been down $327 billion for the final week however are up $393 billion during the last fortnight. Microsoft and Meta are each up for the 12 months, and the others have pared the worst losses from early April (Fab 5 are up $1.7 trillion from the April 6 lows).

The Telco Prime 5 are up $70 billion for the 12 months, with 4 of the 5 shares up up to now for 2025. AT&T and Constitution are each up ~20% year-top-date, and, coincidentally, are two who will probably be concerned in substantial M&A in 2025/2026 (Constitution with Cox – announcement from early Could right here, and AT&T with the Lumen Mass Markets acquisition – introduced final week – announcement right here). Fourteen billion {dollars} separate AT&T and Verizon (#2 and #3 of the Telco Prime 5), however the hole between Verizon and Comcast’s values has grown to $54 billion. To get some preliminary ideas on the advantages of a Constitution/ Cox tie-up, see final week’s Interim Transient right here.

T-Cell had a number one announcement on Friday once they provided early redemption phrases on $2.1 billion in US Mobile notes (announcement right here). We take this as an indication that the transaction will probably be accepted and shut within the subsequent 2-4 weeks. Wednesday represents the one-year anniversary of the unique acquisition announcement.

Three long-form movies

Like lots of you, now we have been spending time making an attempt to grasp the implications of Synthetic Intelligence (AI) on the telecom business and society as an entire. Particularly, now we have been figuring out the constructing blocks of AI: content material/context/consent, algorithms, interfaces, and purposes. Whereas we are able to get caught up in quite a lot of trivia, it’s vital to grasp that it takes volumes of knowledge to feed a big language mannequin (LLM) and the very best LLMs will possible be (semi-) proprietary.

With that preamble, we determined to go along with three long-form movies (most of those have summarized variations obtainable on YouTube):

- Jensen Huang’s opening keynote on the NVIDIA GTC 2025 Convention held final March (right here). If you’re new to AI and wish to perceive the excessive dependency on chipsets and computing {hardware} (and working system software program), it is a excellent video to soak up. After watching this video, we now perceive why the market locations a worth of $3.2 trillion on the inventory (and will probably be parsing each phrase throughout this week’s earnings name). It additionally highlights the significance of high-performing {hardware} to allow the promise of AI.

- The Google I/O opening Keynote held final week (right here). That is must-watch for all AI programmers, not due to Google’s Gemini LLM, however as a result of they’re actively constructing all Google apps round AI. We might write ten Briefs on the 5+ hours of movies we watched associated to I/O. In case you don’t depart this session with a protracted checklist of analysis gadgets in your firm, one thing is mistaken.

- Dr. Eric Schmidt’s TED Discuss on the “Underhyped” AI (right here).That is the shortest of the three long-form movies and needs to be considered after watching (some a part of) the primary two. We actually favored when Dr. Schmidt talked concerning the function of AI in protection (an space removed from this article’s focus).

From these (and several other different) movies, we come away with the next observations:

- AI has excessive transformation potential, however each {hardware} and software program should evolve at equal paces.

- AI’s influence will differ by business. The alternatives for well being care are going to be far totally different than how AI will influence state DMVs. Large for each, however totally different.

- Content material is (nonetheless the) king. Its cousin, consent, is important to constructing belief.

- Even when its adoption is slower than analysts/ futurists anticipate, AI will materially influence enterprise productiveness for the subsequent 10-20 years.

One remaining advice (that isn’t on matter): In case you have not watched the documentary Basic Magic concerning the Apple spinoff, and you have to be impressed about technological innovation, we might counsel you watch totally free (Tubi or Roku Channel) or for $2.99 on Amazon Prime.

That’s it for this week. Second quarter insights would be the matter of the subsequent two Briefs. Till then, in case you have buddies who want to be on the e-mail distribution, please have them enroll immediately by way of the web site.

Lastly – Go Royals and Sporting KC!

Essential disclosure: The opinions expressed in The Sunday Transient are these of Jim Patterson and Patterson Advisory Group, LLC, and don’t replicate these of CellSite Options, LLC, or Fort Level Capital.