I’ve been writing in regards to the UK’s slowdown in productiveness progress for a couple of decade, as I mentioned right here. I believe it’s honest to say that this problem is well-understood amongst economists and a few coverage folks, however productiveness is an summary idea. So, it’s maybe unsurprising that, even now, the seriousness of our financial state of affairs isn’t totally understood by commentators and journalists, not to mention the broader public.

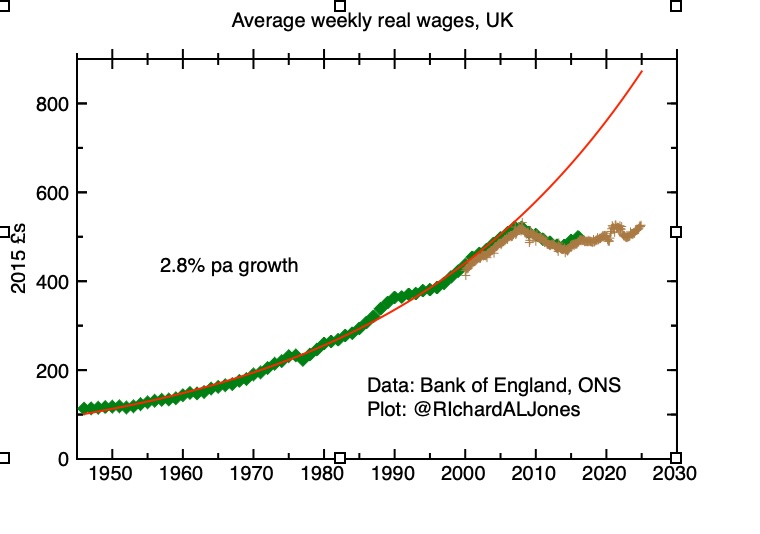

However there’s a technique wherein our productiveness slowdown has very seen on a regular basis penalties – and that’s in the long run of wage progress. As my plot reveals, wages have flatlined within the UK over final 15 years. This lengthy interval of stagnation is unprecedented in residing reminiscence, & marks a decisive & unwelcome break from the UK’s postwar financial trajectory.

Common actual weekly UK wages. Inexperienced: Composite Common Weekly Earnings sequence, corrected for inflation utilizing client costs index. Thomas, R and Dimsdale, N (2017) “A Millennium of UK Information”, Financial institution of England OBRA dataset. Brown: ONS, Actual Common Weekly Earnings, complete pay, utilizing CPI (seasonally adjusted). 18/2/2025 launch.

The interval from the top of the Second World Conflict proper as much as the mid 2000s reveals a remarkably constant file of wage progress. There are moments of financial turbulence which might be mirrored in deviations from the development of steady 2.8% pa progress; a short-lived interval of extra fast progress within the late 60s and early 70s – the Barber growth – with the surplus progress unwinding within the mid-Nineteen Seventies disaster. And once more, extra fast progress within the late Eighties Lawson growth, with the surplus features misplaced in weaker wage progress within the subsequent recession.

However nothing compares to the stagnation that we’ve seen for the reason that international monetary disaster. By the financial measure that arguably issues most to folks at massive – how their wages develop – the final decade and a half is by far the worst interval for the reason that struggle. As compared, the financial turbulence of the 1970’s appears like a golden age.

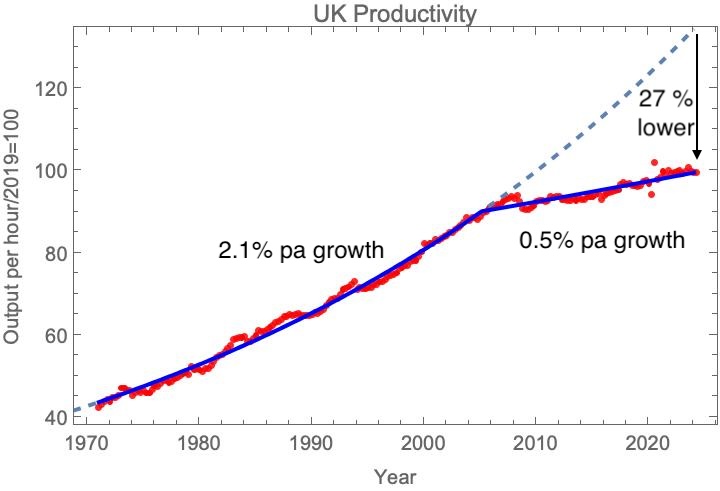

UK labour productiveness, index 2022=100. Information: ONS, 15/11/2024 launch. Line: non-linear least squares match to 2 exponential capabilities, steady on the break level, which happens at 2005 for the perfect match. See When did the UK’s productiveness slowdown start? for extra particulars of the becoming strategy.

The tip of wage progress within the UK is a direct consequence of the top of productiveness progress. It’s price making a few factors in regards to the hyperlink between productiveness progress and wage progress. Within the USA, that hyperlink is weaker than it was. However the UK just isn’t the USA; whereas within the USA the labour share of GDP – the share of general financial exercise that goes to wages, quite than rewarding the house owners of capital – has considerably fallen, this isn’t so within the UK. For no matter motive, within the UK, over the past decade, the labour share of GDP has truly elevated.

After all, my plot of wage progress presents a single common, and it’s a good query to ask how the distribution of wages has modified with time – has this change into extra unequal, with extra of the advantages of productiveness progress going to increased earners? It seems that, whereas there was a considerable enhance in inequality within the Eighties, general measures of earnings inequality have been comparatively regular since then.

The wage progress plot explains a lot about state of UK politics immediately. Few folks have an intuitive really feel within the summary for what productiveness progress – or its absence – means, however the sense of stalling residing requirements, and worse prospects for younger folks, is all too palpable.