AI’s future relies upon much less on algorithms and extra on the bodily realities of silicon, energy, capital, and geopolitics

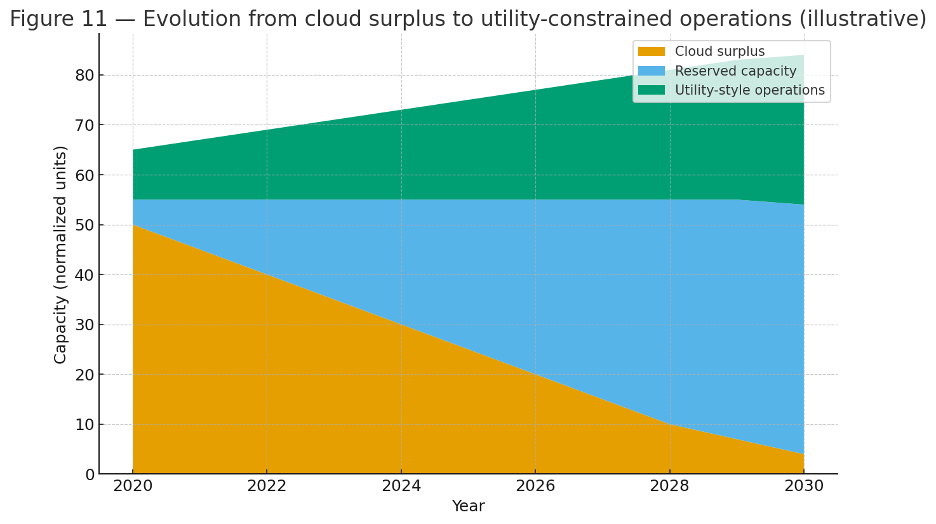

The bogus intelligence sector has entered a brand new industrial section. For 20 years, the cloud enterprise mannequin created the phantasm that computing capability was an elastic, on-demand useful resource. That mannequin labored as a result of capital was low cost, semiconductors had been considerable, and power was cheap. At this time, every of these foundations is beneath stress.

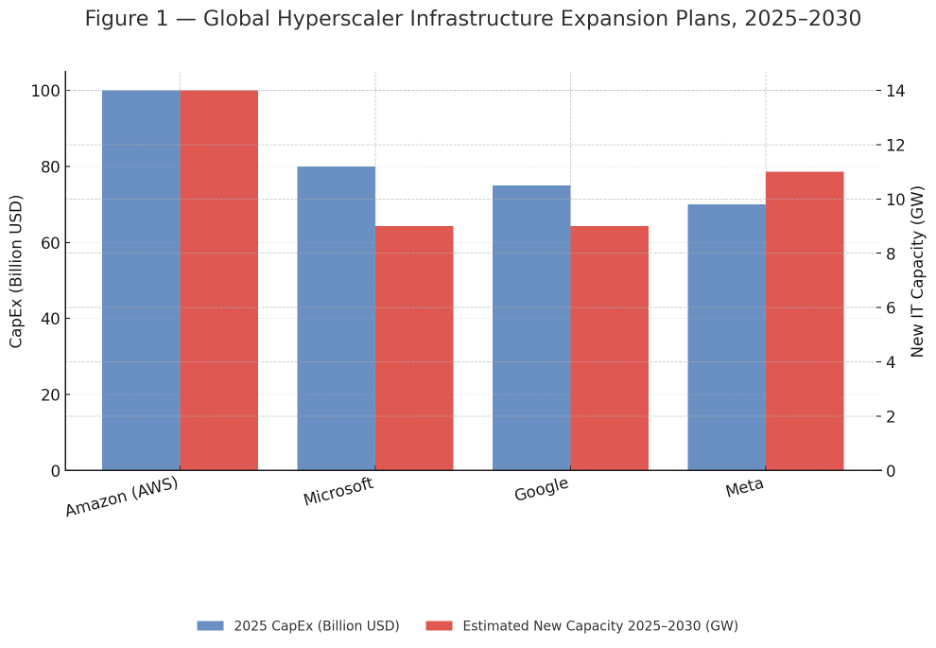

The October 2025 announcement of a strategic collaboration between OpenAI and Broadcom to co-develop as much as 10 gigawatts of customized AI accelerators symbolizes this shift. The quantity itself is a projection, not a verified deployment, but it surely captures the commercial scale of ambition that now defines the sector. What was as soon as an train in software program optimization is turning into an train in industrial logistics.

The true bottleneck: Semiconductors, not power

Public debate typically focuses on AI’s power urge for food. Whereas knowledge facilities devour rising quantities of energy, the extra elementary constraint lies in semiconductor provide.

Vitality: Increasing, however erratically usable

International renewable era capability continues to increase quickly. The Worldwide Renewable Vitality Company reported that in 2024, the world added 585 gigawatts of renewable energy capability, a year-on-year development charge of about 15%. The Worldwide Vitality Company initiatives that international renewable capability might virtually double by 2030, reaching greater than 4,600 further gigawatts.

But capability development is just not the identical as dependable era. Variability, transmission bottlenecks, curtailment, and the restricted deployment of grid-scale storage imply that dispatchable energy stays a limiting issue. For big AI knowledge facilities that should function repeatedly, the constraint is commonly the standard and availability of energy, not the headline amount of put in capability.

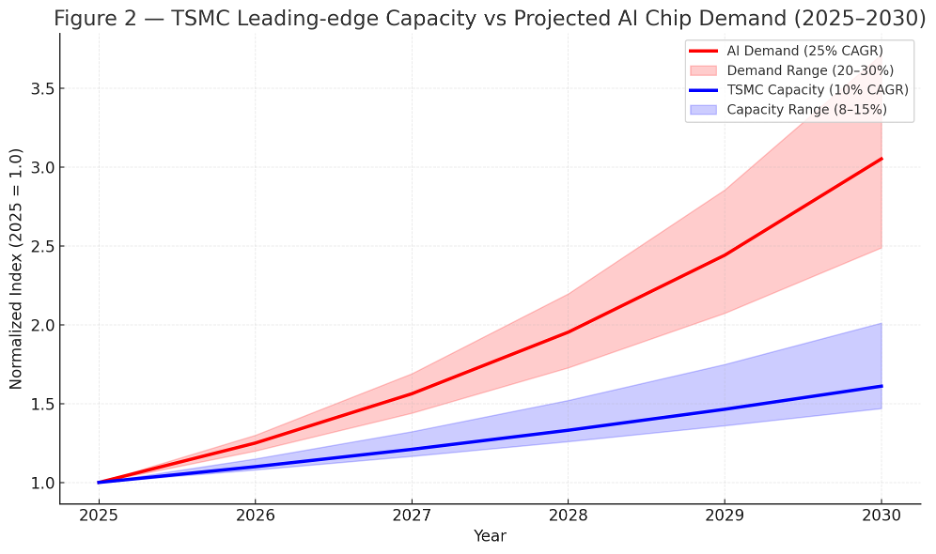

Silicon: The finite substrate of AI

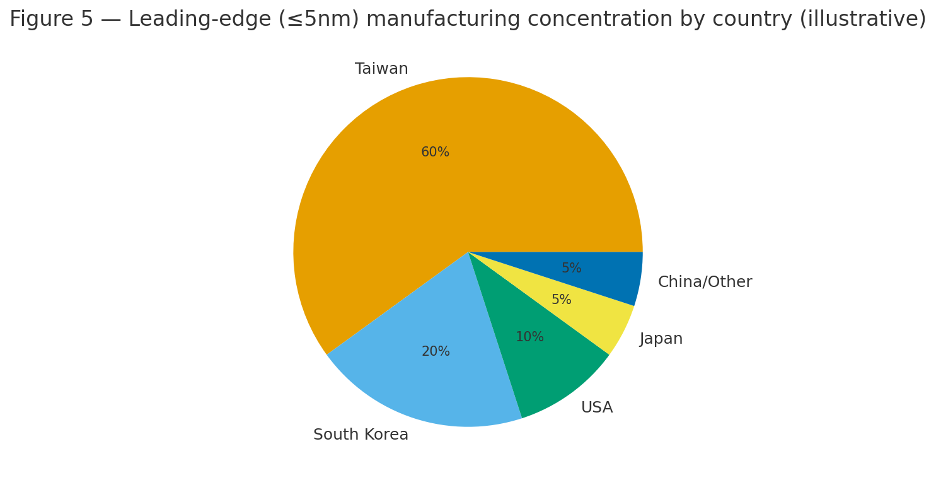

On the coronary heart of AI computing lies a semiconductor provide chain with just a few viable actors. TSMC, Samsung, and Intel function the world’s most superior fabrication amenities, and TSMC continues to dominate exterior foundry manufacturing on the five-nanometer class and under. Constructing new capability requires multi-year investments and entry to excessive ultraviolet lithography techniques which might be obtainable solely from a single provider, ASML.

Each wafer allotted to AI comes on the expense of one other trade. This inelasticity makes semiconductor throughput the true bottleneck in scaling AI. Even when electrical energy had been free and capital considerable, the absence of superior wafer capability would nonetheless cap international compute development.

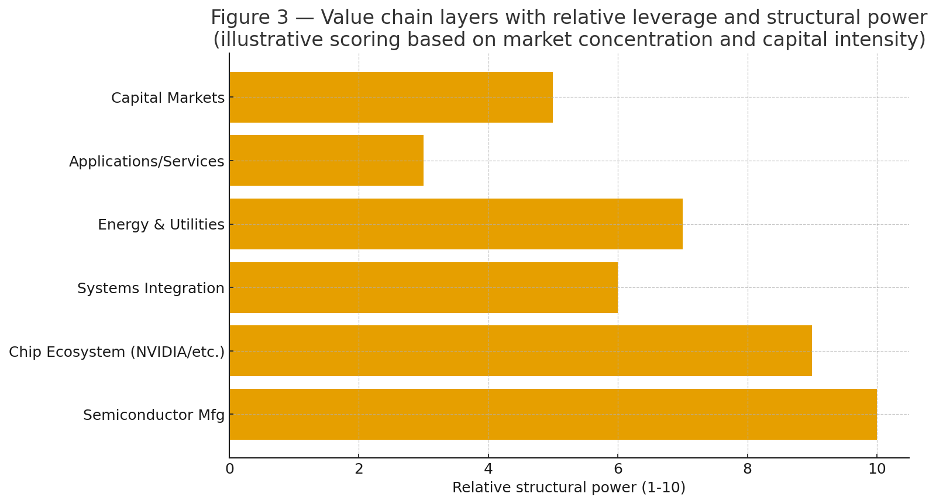

Worth chain energy and focus

The AI worth chain is very uneven.

- Semiconductor design and fabrication maintain the best leverage as a result of capability is scarce and enlargement is gradual.

- System integration and software program ecosystems, reminiscent of NVIDIA’s CUDA, stay robust however are going through new competitors from Google’s TPUs, AMD’s ROCm, and rising ASIC designs.

- Infrastructure operators, together with the hyperscalers, handle siting and scaling however stay depending on upstream suppliers.

- Vitality suppliers train leverage the place grids are tight or politically constrained.

- Functions and providers are extremely aggressive and seize a smaller share of whole worth.

Financial energy has migrated downward within the stack, towards bodily manufacturing and power availability moderately than purely digital belongings.

Modeling the dimensions of AI infrastructure

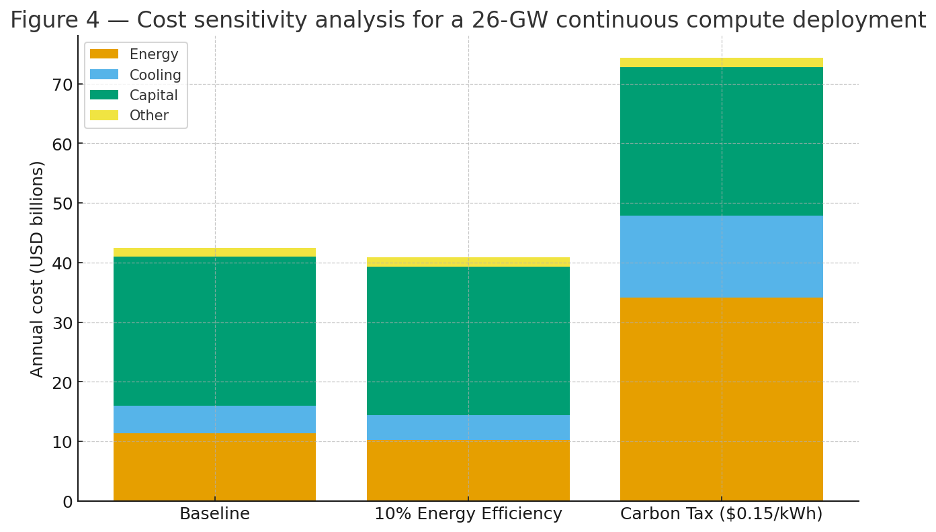

For instance the economics of hyperscale AI infrastructure, think about a notional deployment working at 26 gigawatts of steady load. It is a situation mannequin, not a forecast, but it surely demonstrates the dimensions of the commercial shift.

- Steady 26,000 megawatts working 24 hours a day equals roughly 228 terawatt-hours of annual consumption.

- At a mean value of 5 cents per kilowatt-hour, the annual power expense would exceed 11 billion {dollars}.

- Including cooling and operational overhead raises that to roughly 14 to 17 billion {dollars}.

- {Hardware} depreciation, upkeep, and amortized capital might add 20 to 30 billion {dollars} yearly.

- The entire working value of such a worldwide system might subsequently attain 35 to 50 billion {dollars} per yr.

A ten% enchancment in power effectivity at this scale represents a financial savings of 1 to 2 billion {dollars} yearly. Effectivity positive factors matter, however they don’t essentially alter the economics of large-scale compute.

The delicate foundations of silicon provide

Semiconductor manufacturing stays geographically and technically concentrated. Superior node manufacturing is dependent upon a small variety of suppliers of lithography instruments, chemical precursors, and uncommon supplies reminiscent of gallium, germanium, and tantalum. Export controls or geopolitical disruptions might sharply scale back obtainable capability.

TSMC’s modern fabs are concentrated in Taiwan, a area uncovered to each seismic and geopolitical danger. Whereas expansions are underway in the US, Japan, and Europe, these new fabs will take a number of years to achieve quantity manufacturing. The worldwide AI financial system subsequently operates on a basis that’s highly effective but fragile.

Innovation on the fringe of physics

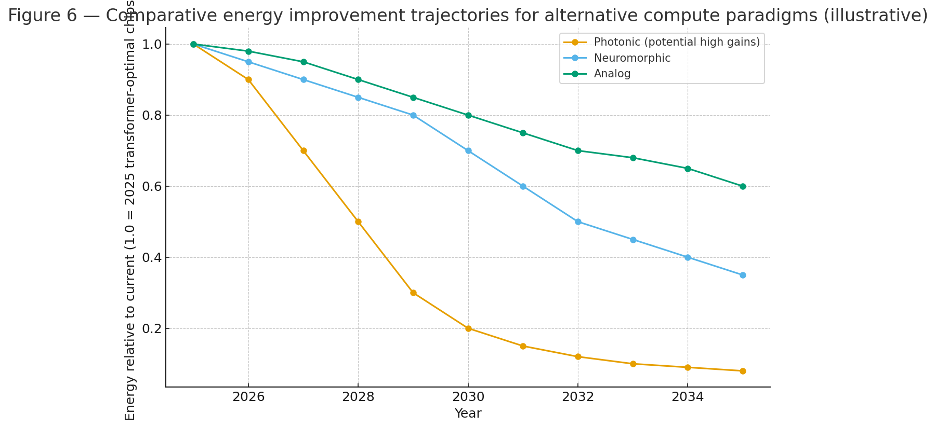

Researchers are exploring photonic, neuromorphic, and analog computing architectures that promise giant power reductions for particular workloads. Laboratory prototypes generally reveal one or two orders of magnitude higher power effectivity per operation. Nevertheless, these techniques stay removed from business viability on the scale or reliability demanded by giant language fashions.

Over the following three to 5 years, the extra credible effectivity positive factors will come from continued advances inside the digital area: mannequin sparsity, quantization, compiler optimization, and specialised ASICs optimized for transformer workloads. The long-term roadmap stays open, however near-term progress can be incremental moderately than revolutionary.

The price of carbon and the worth of continuity

Some analysts have speculated about carbon pricing elevating power prices from 5 to fifteen cents per kilowatt-hour. That tripling is unlikely beneath any present coverage regime. Extra sensible eventualities contain will increase of 1 to a few cents per kilowatt-hour in markets with carbon buying and selling techniques.

Even modest modifications in energy value have measurable influence on AI infrastructure economics. A 20% improve in electrical energy value can scale back challenge inner charges of return by a number of factors, relying on financing construction and cargo issue. For operators whose margins already rely on scale effectivity, such shifts could be materials.

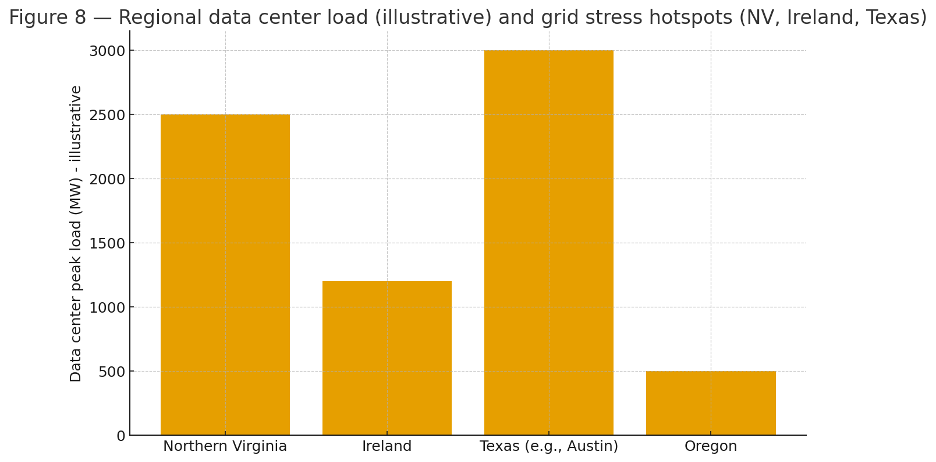

In areas reminiscent of Northern Virginia, Eire, and Singapore, native grids are already exhibiting pressure. Knowledge middle demand is prompting utilities to undertake new pricing fashions, curtailment guidelines, or energy allocation frameworks. The constraint is now regional grid resilience moderately than international power abundance.

The capital equation

AI infrastructure initiatives are extremely leveraged. They assume entry to long-term, low-cost financing and regular demand development. A sustained rise in rates of interest or capital value can rapidly erode challenge viability. When the price of capital strikes from 8 to 12%, a challenge designed for a ten% inner charge of return can grow to be uneconomic.

This dynamic favors hyperscalers and sovereign buyers that may safe funding at decrease charges. Smaller entrants face larger volatility and will wrestle to finance sustained deployments. The AI infrastructure race is subsequently not solely a expertise contest but additionally a capital allocation contest.

Geopolitics and the brand new industrial order

Semiconductors have grow to be devices of nationwide energy. Export controls on superior chips and lithography instruments have already redrawn provide chains. Governments are competing to draw fabs by way of subsidy applications such because the U.S. CHIPS Act, the EU Chips Act, and Japan’s semiconductor initiatives.

As nations view compute capability as a strategic asset, knowledge facilities and chip amenities more and more resemble crucial infrastructure. Some jurisdictions are starting to think about AI compute beneath utility or nationwide safety frameworks. The boundary between expertise and industrial coverage is dissolving.

The rise of compute as a utility

The following section of the AI financial system will resemble a utility mannequin greater than a software program market.

- Lengthy-term procurement contracts will substitute on-demand cloud scaling.

- Compute location will rely on entry to dependable energy and cooling, not on proximity to clients.

- Margins will normalize as infrastructure capital prices dominate.

- Vertical integration will speed up as corporations internalize chip design, manufacturing partnerships, and energy sourcing.

Aggressive benefit will rely on mastering industrial constraints moderately than optimizing algorithms. Possession of power, silicon capability, and interconnects will outline strategic management.

Adaptation and resilience

The constraint financial system is just not static. A number of adaptive forces are already seen:

- Main foundries are constructing new capability in the US, Europe, and Japan.

- Hyperscalers are exploring small modular reactors, microgrids, and direct renewable procurement to safe energy.

- AI fashions have gotten extra environment friendly by way of sparse architectures and quantization.

- Open {hardware} initiatives and domain-specific accelerators are lowering dependence on any single vendor or software program stack.

- Workloads are migrating to energy-rich areas and off-peak intervals to use decrease prices.

Constraints evolve by way of innovation, coverage, and capital coordination. The actors that deal with them as dynamic variables moderately than mounted boundaries will achieve the long-term benefit.

The industrialization of intelligence

Synthetic intelligence is now not outlined by code alone. It’s constructed on mines, fabs, grids, and capital markets. The businesses that grasp this industrial layer will outline the following decade of expertise management.

The AI period is not only about smarter algorithms. It’s about constructing, financing, and governing the bodily techniques that make intelligence attainable. The true measure of strategic power is shifting from software program velocity to industrial resilience.