The large image: As tech giants pour extra money into AI, some warn {that a} bubble could also be forming. Drawing comparisons to the dot-com crash that worn out trillions on the flip of the millennium, analysts warning that immediately’s market has change into too reliant on still-unproven AI investments.

Torsten Slok, chief economist at Apollo International Administration, not too long ago argued that the inventory market at the moment overvalues a handful of tech giants – together with Nvidia and Microsoft – much more than it overvalued early web firms on the eve of the 2000 dot-com crash. The warning suggests historical past may quickly repeat itself, with the buzzword “dot-com” changed by “AI.”

Within the late Nineties, quite a few firms attracted enterprise capital in hopes of making the most of the web’s rising recognition, and the inventory market vastly overvalued the sector earlier than stable income may materialize. When returns failed to satisfy expectations, the bubble burst, wiping out numerous startups. Slok says the inventory market’s expectations are much more unrealistic immediately, with 12-month ahead price-to-earnings ratios now exceeding the height of the dot-com bubble.

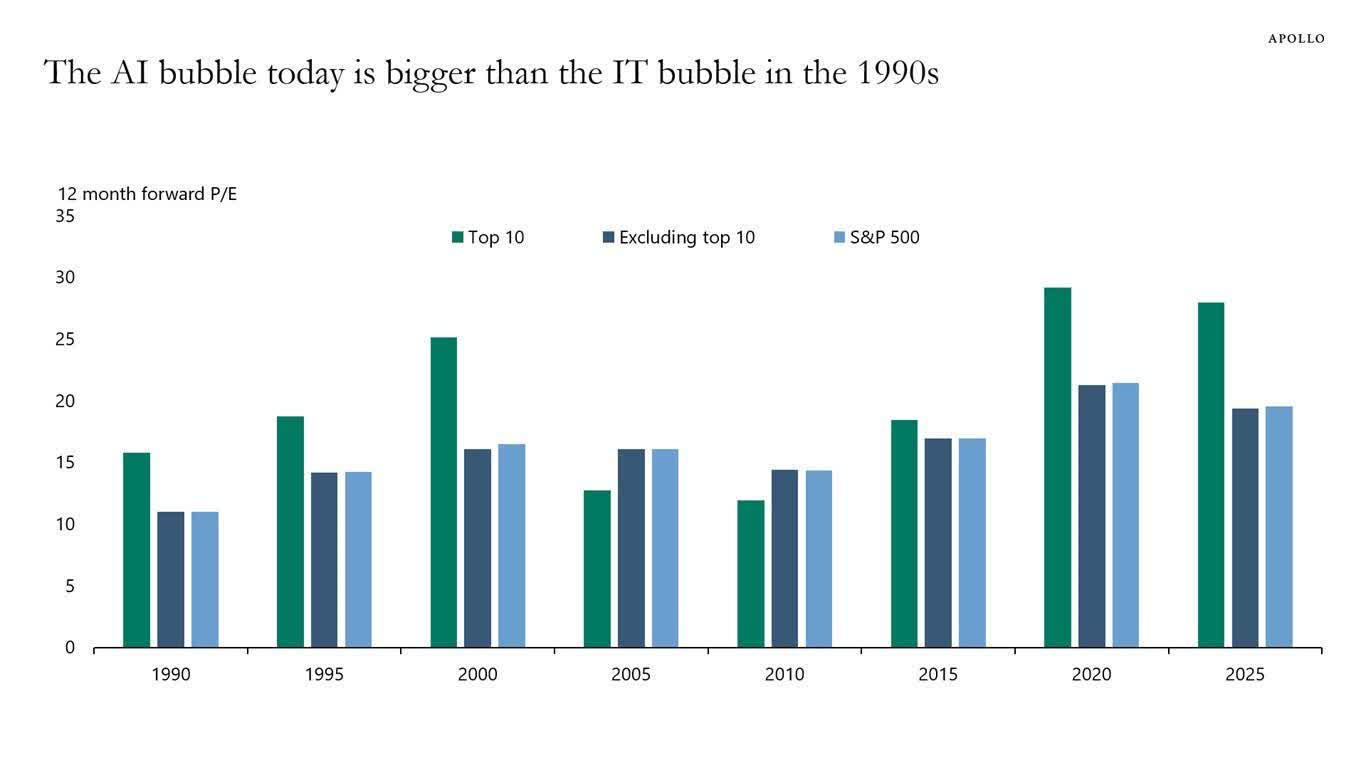

An organization’s P/E ratio measures the connection between its inventory worth and the revenue it generates, with a excessive ratio reflecting optimism about future returns. Evaluating S&P 500 ratios at five-year intervals from 1990 to 2025 clearly exhibits the dot-com spike in 2000. Related spikes in 2020 and 2025 recommend the AI bubble could also be much more pronounced.

What’s extra regarding is that in every spike, the highest 10 firms’ ratios far exceed the remainder of the index. Such disparity suggests investments in these corporations – principally tech giants closely betting on AI – have indifferent from actuality earlier than their latest expertise can generate actual income. Corporations like Nvidia, Microsoft, Apple, Amazon, Meta, Alphabet (Google), and Tesla account for many of the S&P 500’s latest progress.

Slok’s warning echoes considerations from different business leaders in regards to the dangers dealing with AI firms. Robin Li, CEO of Chinese language web big Baidu, predicted that solely about one % of AI corporations will survive if and when the bubble bursts. He mentioned it will finally result in a extra steady market with extra sensible AI functions.

Tech giants proceed to make large investments as AI’s recognition grows, underscoring the excessive stakes on this quickly evolving subject. OpenAI is growing an AI-powered internet browser to problem Google Chrome’s dominance. Meta is spending over $60 billion to construct new AI information facilities. Microsoft not too long ago lower 9,000 jobs to offset prices from its new AI infrastructure, estimated at $80 billion. Amazon has unveiled plans for agentic AI, signaling that the race for AI management exhibits no indicators of slowing.