For 6G, the battle is about requirements, spectrum, and belief architectures — selections immediately will form tomorrow’s economics

Editor’s word: That is the ultimate installment of a three-part sequence from Analyst Vish Nandlall. Learn the primary article right here and the second right here.

If 3G was the cell web, 4G was cell apps and video, and 5G was eMBB and FWA, then 6G faces a harder query: How will it’s outlined? With shopper markets saturated and ARPU below stress, the defining battles of 6G is not going to be fought on the bodily layer, however in requirements, spectrum, and new architectures for worth and belief. This text explores how selections made immediately within the 3GPP, by regulators, and inside vendor boardrooms are shaping the economics of the 6G period.

Standardization roadmap: A practical pivot to software program

The transition to 6G shouldn’t be a singular occasion however a fastidiously managed evolution inside the third Era Partnership Mission (3GPP). Latest landmark selections affirm that this evolution can be pragmatic, prioritizing financial actuality over technological revolution. Essentially the most important improvement: The 6G air interface will reuse the identical OFDM-based waveforms as 5G (CP-OFDM for downlink and DFT-s-OFDM for uplink).

This determination alerts that core innovation for 6G is not going to occur on the bodily layer however within the community structure, AI-native design, and seamless integration of heterogeneous networks. The roadmap unfolds throughout a number of releases:

- Launch 19 (In Progress): Extends 5G-Superior and introduces early research on Ambient IoT and AI/ML knowledge assortment.

- Launch 20 (2024–2025): Twin monitor — continues 5G-Superior whereas launching official 6G Examine Gadgets (new radio, AI-native structure, built-in sensing).

- Launch 21 (~2027–2028): First normative 6G specs, translating research into concrete Work Gadgets.

The strategic implication is obvious: 6G can be outlined much less by “Gs” than by software-driven capabilities layered onto present RAN infrastructure.

Vendor alignment and divergence

Whereas consensus exists round AI-native structure, vitality effectivity, and higher mid-band spectrum, distributors are emphasizing completely different fronts aligned to their strengths:

- Ericsson: AI-native RAN and deterministic networking for industrial/enterprise functions.

- Qualcomm: Built-in Sensing & Communications (ISAC) and high-accuracy positioning through machine management.

- Huawei: Aggressive bets on sub-THz and ISAC.

- Nokia: 4-pillar framework — value-centric, AI-native, sustainable by design, safe by design; analysis in Ambient IoT.

- Samsung: Deal with superior antenna methods, RIS, and cell-free MIMO.

The seller race is much less a couple of single “killer app” and extra about constructing patent portfolios and positioning for ecosystems the place belief, sustainability, and enterprise capabilities dominate.

The worldwide spectrum battle: A story of three bands

Regardless of the expertise, spectrum is the lifeblood of 6G. The battles are fierce:

- Higher 6 GHz (6.425–7.125 GHz): The most well liked battleground.

– MNO/GSMA Place: Important for licensed 6G providers, needing extensive channels (200–400 MHz).

– Wi-Fi Place: The FCC’s 2020 unlicensed allocation generated ~$870B in financial worth for Wi-Fi 6E.

– Regulatory Center Floor: Hybrid fashions like Ofcom’s and indoor Wi-Fi + future licensed use. - 7–8 GHz (7.125–8.4 GHz): The “Plan B” for licensed 6G.

– 5G Americas: Calls it the “Golden Band of 6G,” balancing protection and capability whereas reusing present 5G websites.

– Challenges: Heavy incumbency (authorities, satellite tv for pc). Clearing or sharing can be advanced. - Sub-Terahertz (>90 GHz): Technically wealthy, commercially unsure. Extreme propagation limits, silicon immaturity, and regulatory hesitation make it a long-term R&D play, not a near-term workhorse.

Spectrum technique will decide the fee curve of 6G deployment and the aggressive positioning of operators.

Reimagining spectrum administration for the 6G period

Spectrum is not only scarce. It’s the single most necessary financial lever for 6G. The best way it’s allotted and managed will outline the affordability of deployment and the enterprise circumstances that may thrive. A number of fashions are rising:

- Migration instruments: Multi-RAT Spectrum Sharing (MRSS) presents a sensible strategy to transition between generations with minimal disruption. Early research counsel overheads of just a few p.c, much better than the inefficiencies of DSS. If validated, MRSS can easy the 5G–6G migration with out forcing expensive refarming.

- Mid-band enlargement (FR3, 7–24 GHz): The higher mid-band is shaping up because the 6G workhorse. It balances protection with capability, and regulators see it because the candy spot for each shopper broadband and enterprise personal networks. AI-driven allocation and uplink/downlink decoupling can be key to maximizing its effectivity.

- Spectrum-as-a-Service: Impressed by CBRS within the U.S. and Ofcom’s native licenses within the U.Ok., spectrum leasing fashions might allow enterprises to purchase slices on demand. If standardized, this may create a brand new income line for operators whereas catalyzing enterprise adoption. The chance is cannibalization if MNOs don’t align fashions with their very own enterprise choices.

- Sensing-based and cooperative sharing: Lengthy-discussed however hardly ever deployed, sensing-enabled dynamic sharing might enable opportunistic use of spectrum throughout mobile, satellite tv for pc, Wi-Fi, and radar. The concept is elegant, however adoption will hinge on regulatory belief and sturdy AI frameworks for interference administration.

Strategic takeaway: Anchor near-term spectrum plans in FR3 and MRSS for financial certainty, whereas selectively piloting spectrum-as-a-service and cooperative sharing to hedge towards future disruption.

The community as an anti-deepfake root of belief

6G has the prospect to show the community right into a platform for digital belief. As deepfakes and AI-generated fraud proliferate, enterprises and governments can pay for proof of authenticity. Operators management distinctive knowledge sources that no machine vendor or cloud participant can replicate:

- SIM-backed location and time attestations: Networks can cryptographically certify {that a} SIM was current in a given place and time, enabling fraud-resistant funds and verified transactions.

- Hybrid attestations (machine × community): Combining machine safe enclaves with community proofs creates provenance tokens that assure authenticity throughout each {hardware} and infrastructure.

- Behavioral telemetry: Solely operators see cross-subscriber anomalies, like SIM swaps or bot-driven site visitors, enabling fraud detection at scale.

- RF/channel-state fingerprinting: Every transmitter leaves distinctive radio fingerprints. Although nonetheless in R&D, these can function unclonable identifiers in industrial IoT.

The economics are favorable: APIs for attestations and fraud detection may be applied cheaply on high of present infrastructure. Banks, e-commerce companies, and governments already categorical willingness to pay. If operators transfer rapidly, they’ll commercialize the belief economic system as a service. In the event that they fail, hyperscalers will seize the market.

The personal community frontier: A brand new buyer or a competitor?

Personal RAN is now not a fringe experiment, it’s a structural shift. Enterprises see connectivity as strategic infrastructure, not only a utility. The rise of CBRS within the U.S. has proven how spectrum innovation creates area for micro-operators, impartial hosts, and enterprise-owned networks.

For enterprises like Siemens or Volkswagen, the logic is compelling: a non-public 5G/6G community presents safe, deterministic, customizable connectivity that public slices can not match. Some could even spin off connectivity divisions as “Industrial ConnectivityCos,” commercializing their networks past their partitions.

However personal RAN faces unmet wants that 6G should deal with:

- Simplified lifecycle administration: Enterprises want plug-and-play, zero-touch networks. In the present day, it’s telco-grade complexity.

- Deterministic efficiency ensures: Industrial automation requires bounded-latency SLAs. 6G should bake in deterministic primitives.

- Built-in safety and sovereignty: Enterprises demand on-prem management over knowledge and id. Requirements should codify this.

- Versatile spectrum: Dynamic subleasing and pooling frameworks are important to make personal and public methods coexist.

- Edge-native architectures: Enterprises need RAN scheduling tied on to native compute.

- Light-weight cores: In the present day’s personal cores are overengineered. 6G should outline micro-core requirements optimized for small-scale deployments.

Strategic takeaway: 6G should evolve to serve enterprises as first-class clients, not afterthoughts. If not, the worth of 6G could accrue to new micro-operators somewhat than conventional MNOs.

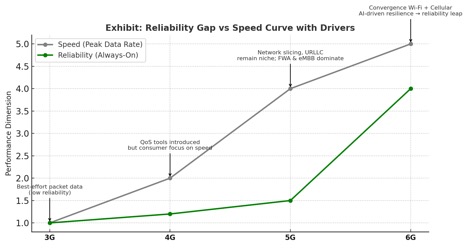

The convergence crucial: Mobile + Wi-Fi for reliability

Peak pace is now not the promoting level, reliability is. Customers, enterprises, and governments want always-on connectivity. Distant work, cell funds, telehealth, and cloud gaming have made connection failures expensive.

Previous efforts at convergence failed as a result of weak expertise and operator resistance. That’s altering:

- Mature expertise: Multipath QUIC (MP-QUIC) and Wi-Fi 7’s Multi-Hyperlink Operation (MLO) now enable packet-level multipath throughout networks.

- Confirmed demand: Apple and others have proven proprietary multipath can enhance reliability. A standardized model would scale.

- Financial stakes: Dropped calls and failed transactions carry actual prices. Enterprises and customers can pay for reliability.

For 6G, convergence ought to be a core community function, not a tool trick. Standardizing dynamic packet-level steering and creating industrial settlement frameworks throughout broadband, Wi-Fi, and mobile suppliers would redefine reliability as the worth proposition of 6G.

Conclusion: The strategic crossroads

6G shouldn’t be a couple of new waveform; it’s a couple of new financial id. Spectrum should be managed extra pragmatically, belief should be monetized as a service, personal networks should be embraced as structural, and convergence should lastly remedy reliability. These will not be speculative visions, they’re strategic imperatives.

The operators that thrive within the 2030s can be people who cease promoting “Gs” and begin promoting reliability, belief, and outcomes. 6G’s battleground shouldn’t be physics, however technique.