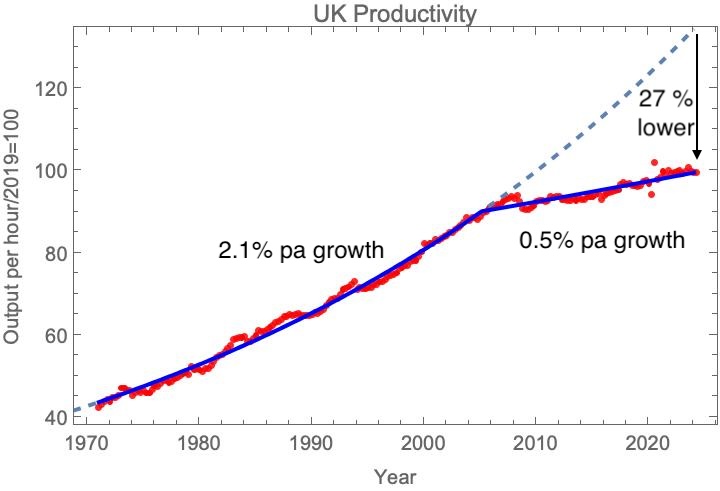

A bonus of getting a long-running weblog like this one, which is now twenty years previous, is that it provides me a simple approach of trying out a few of the matters that have been most exercising me at numerous factors up to now. But it surely’s nonetheless a little bit of a shock to grasp that it’s been 10 years since I began banging on in regards to the dramatic fall within the UK’s productiveness development price. My plot emphasises that nothing has occurred within the final ten years to alter that dismal pattern.

UK labour productiveness, index 2022=100. Information: ONS, 15/11/2024 launch. Line: non-linear least squares match to 2 exponential features, steady on the break level, which happens at 2005 for the perfect match. See When did the UK’s productiveness slowdown start? for extra particulars of the becoming method.

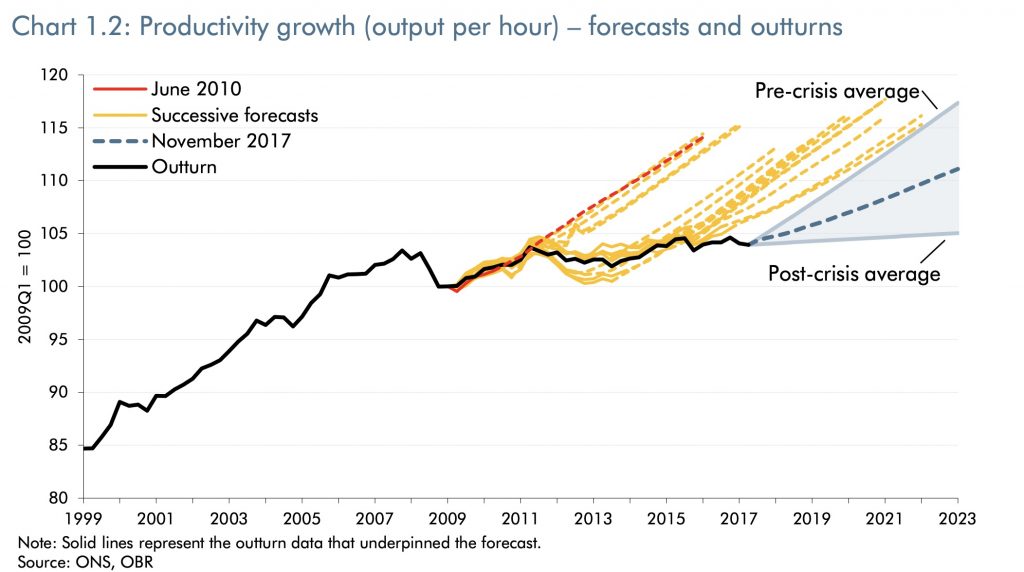

The consensus on the time was that the issue was more likely to be self-correcting, and that one may anticipate a resumption of the sooner pattern of productiveness development (if not a restoration of misplaced floor). Nothing illustrates this higher than the successive predictions of the Workplace of Budgetary Accountability, which took till 2017 to grasp {that a} new daybreak for productiveness development may not be instantly across the nook.

Successive estimates, made between 2010 and 2017 by the Workplace of Budgetary Accountability, of future productiveness development, as reported within the November 2017 Financial and Fiscal Outlook

In discussing productiveness, my preliminary focus was on analysis and improvement. I’d already drawn consideration to the lengthy fall within the UK’s enterprise R&D depth, and in my June 2014 piece Enterprise R&D is the weak hyperlink within the UK’s innovation system I linked this with two of the UK’s issues – its droop in productiveness development, and its persistent present account deficit.

In a follow-up piece, Rebuilding the UK’s innovation economic system, I linked low enterprise R&D to the broader drawback of short-termism, as recognized within the 2012 Kay Evaluate of UK Fairness Markets and Lengthy-Time period Resolution Making, writing that “our shrinking R&D base is a part of a much bigger drawback of short-termism, wherein the buildings of our capital markets and the reward buildings for firm managers excessively reward good monetary efficiency within the current on the expense of long run prospects for development”.

What did I feel must be achieved about it? What I used to be clear wouldn’t work by itself is what I name “provide facet innovation coverage” – the concept that if one helps primary science in universities and gives a provide of expert folks, that may routinely result in economically vital personal sector innovation: “However there’s no level driving [university based] scientists to be extra collaborative with utilized researchers within the personal sector, if the personal sector doesn’t have the R&D capability to collaborate with”.

As an alternative, I argued that we wanted to construct that capability, in key areas like well being associated analysis and vitality: To be clear, right here I’m not primarily speaking about tutorial science; what is required is directed R&D centered on delivering merchandise. For a few of these merchandise – for pharmaceutical and medical improvements – the federal government would be the foremost buyer, in addition to being the direct monetary beneficiary of financial savings in areas just like the social care finances.

For vitality, I argued that the emphasis ought to be on driving prices down for low carbon vitality, together with nuclear: “Within the case of vitality, the prices will likely be imposed on future prospects by way of long-term assured costs. For instance, the Hinckley Level deal, for only one nuclear energy station, will outcome within the switch of a number of tens of billions of kilos from home and enterprise electrical energy customers to the abroad suppliers of the expertise and finance. As an alternative of merely standing again and paying these payments (or imposing them on future taxpayers and prospects),the federal government ought to use its energy because the purchaser or guarantor to verify new applied sciences are developed for the which the UK can seize vital worth.”

To know the causes of the productiveness slowdown extra totally, one must dive right into a extra detailed evaluation of productiveness efficiency in numerous sectors. My January 2015 piece,

Progress, technological innovation, and the British productiveness disaster, took a primary have a look at this, utilizing early estimates from the ONS for whole issue productiveness by sector. Right here there was a distinction between regular development in ICT and manufacturing, and peaks – and subsequent falls – in two broad sectors: Agriculture, forestry & fishing, mining & quarrying, utilities, and Monetary and Insurance coverage. For the sectors together with mining and quarrying, the height was at 2003, and I consider that this largely mirrored the output of the oil and gasoline sector – manufacturing of North Sea oil peaked round 2000. For the sectors together with monetary companies, the height was at 2007, so unsurprisingly correlated with the onset of the worldwide monetary disaster. My conclusion was primarily that the UK had been a sufferer of what economists name “Dutch illness”, following the peaking of North Sea oil and the bursting of a monetary companies bubble: “Manufacturing and ICT have been squeezed out by the apparently better, however in the end unsustainable, returns from oil and finance, and when these wells dried up the economic system was left stranded.”

I nonetheless consider that Dutch illness is a useful, although partial, lens to have a look at our productiveness slowdown by way of. However since then we’ve learnt much more in regards to the proximate causes of the UK’s sluggish productiveness development, and the sectors which have most contributed to the slowdown. overview may be present in The Productiveness Agenda, from the College of Manchester primarily based Productiveness Institute (together with a piece by me on R&D).

For instance, cautious econometric evaluation has recognized that the important thing contributors to the slowdown, in sectoral phrases, have been transport tools, prescribed drugs, pc software program and telecommunications. That is counterintuitive, in that these sectors are typically considered strengths of the UK economic system.

Extra typically, there appears to be a consensus that low ranges of funding – in each the private and non-private sectors – is a significant proximate explanation for low productiveness development. I would come with on this low total funding document, the low ranges of enterprise R&D that first attracted my consideration, greater than a decade in the past. Since it’s extensively accepted that technological innovation gives the premise for productiveness development, and R&D gives a proper construction for growing and implementing technological improvements, I might nonetheless insist on its significance.

However this doesn’t not but reply the query of what it’s in regards to the UK’s political and financial system that has led to this state of persistent underinvestment, or what ought to be achieved to deal with that. The implications, although, are clear – gradual productiveness development has led to stagnating residing requirements and difficulties in funding public companies on the stage folks anticipate. For my final phrases right here, I’ll quote what I wrote in July 2014:

“The erosion of the UK’s capability to technologically innovate was not inevitable – it was the unintended consequence of a sequence of political and coverage decisions over a long time. We have to reverse this lack of capability. This must be achieved as a part of a broader rethinking of the number of capitalism the UK economic system is at the moment primarily based on. With out this rethinking, we will likely be condemned to proceed on our present trajectory of low development, poor commerce efficiency and in the end, lack of nationwide sovereignty.”