Key takeaways

- Science Based mostly Targets initiative’s net-zero revision introduces a brand new company classification for firms with lower than $450 million in gross sales.

- Some necessities, comparable to third-party assurance of carbon accounting, are non-obligatory.

- It holds particular enchantment for companies in lower- and middle-income nations.

Most firms with validated net-zero objectives are large multinational organizations, however the Science Based mostly Targets initiative’s proposed revisions embody adjustments supposed to spice up adoption by small and midsize enterprises (SMEs) — particularly these in rising economies.

The 132-page proposal circulated for suggestions by June 1 suggests a revised categorization mannequin based mostly on firm dimension and geography. Class A refers to giant multinationals. The brand new Class B consists of small and micro enterprises with lower than $50 million in annual income and fewer than 250 staff; and medium companies from low- and middle-income nations with as much as $450 million in gross sales and 250 to 1,000 staff.

Class B firms will get extra time to have net-zero targets validated after they commit: two years as a substitute of the one-year deadline set for bigger firms. As well as, some necessities — comparable to the necessity to get carbon accounting verified by a 3rd celebration or to hint provide chain emissions inside a selected interval — are non-obligatory.

The proposed revisions are extra welcoming to small firms, permitting them to remain centered on immediately making “good high quality reductions” to emissions from their amenities and electrical energy purchases which can be extra inside their management, mentioned Cooper Wechkin, founder and CEO at consulting agency RyeStrategy.

“It was arduous accountable an organization for balking,” he mentioned. “This may be difficult and costly.”

Massive-company mindset

The brand new mannequin replaces standards SBTi beforehand set for smaller firms and are extra “practical” for SMEs and enterprises in growing nations than the earlier framework, mentioned Chris Hocknell, director of consulting agency Eight Versa.

“This can be a shift from the beforehand almost uniform strategy, which might supply some companies extra attainable paths towards web zero,” he mentioned.

Many small firms that Eight Versa has suggested have been annoyed with the rigidity of SBTi’s necessities, and a few have chosen to not act due to that. “It’s this all-or-nothing mentality,” Hocknell mentioned. “That’s a part of the issue. There’s not a perceived alternate route of even second greatest that’s thought of credible sufficient.”

Whereas SBTi’s new net-zero commonplace is extra versatile, it nonetheless requires absolute reductions for Scope 1 and a couple of, which generally is a explicit problem for fast-growing startups — together with these growing local weather applied sciences that may assist scale back emissions.

“It betrays a naivete about enterprise that hasn’t been addressed,” Hocknell mentioned.

Ripple impact throughout provide chains

One-third of the roughly 1,500 firms that have already got validated net-zero methods are small and midsize companies — the U.S. classifies SMEs as these with fewer than 500 staff and $1 billion in annual income. Small firms symbolize a rising share of these booked for validation within the second quarter, in keeping with SBTi.

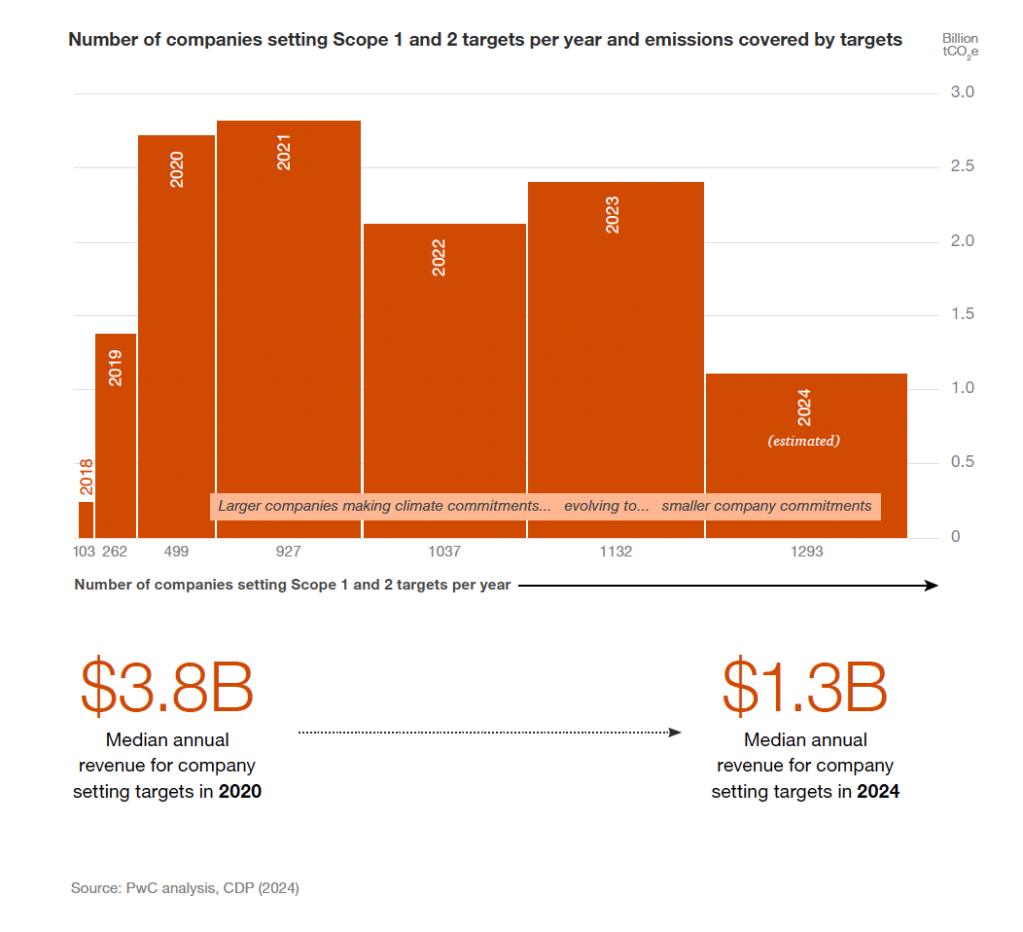

That aligns with PwC’s latest evaluation of disclosures to CDP. Between 2020 and 2023, the variety of firms setting greenhouse gasoline emissions reductions objectives surged however their median annual income shrank to $1.3 billion in 2024 in contrast with $3.6 billion in 2020.

Many smaller firms are transferring to set targets as a result of they’ve been inspired to take action by giant multinationals. “We name this a ripple impact,” mentioned PwC Associate David Linich. “Over time, they’ll flip to their very own suppliers and ask them to do the identical factor.”

Major motivators for SMEs

Small firms contemplating whether or not to set emissions discount objectives typically weigh three questions, mentioned Mahesh Ramanujam, CEO of World Community for Zero, which helps firms with net-zero certification. They’re:

- Can I minimize my prices?

- Can I get extra enterprise by doing this?

- Will I lose a buyer if I don’t take this motion?

“This shouldn’t be one dimension matches all,” he mentioned, speaking concerning the problem most firms have in calculating emissions inventories and reporting progress. “On the identical time, it mustn’t require a guide. It needs to be a easy plug-in.”

Roughly 60 p.c of SMEs are setting targets in response to consumer expectations, up from 40 p.c in 2024, in keeping with a latest survey by We Imply Enterprise Coalition.

“Our buyers need to see actual, measurable progress, whereas our friends select us for our dedication to sustainability,” mentioned Ananda Putra, sustainability supervisor for OXO, an Indonesian property developer. “Since publicly disclosing our emissions, we’ve seen stronger investor confidence, elevated visitor loyalty and diminished pointless vitality and water, immediately chopping prices.”