In March, Local weather Impression Companions, a long-standing carbon challenge developer, signed a 30-year offtake settlement with Microsoft to ship 1.5 million carbon elimination credit from its Panna challenge, a community-led forest restoration effort in Madhya Pradesh, India. The challenge’s finance construction seems to be so much like a wind farm, stated Local weather Impression Companions CEO Sheri Hickok, who beforehand led Common Electrical’s worldwide windfarm improvement.

Hickok thinks borrowing classes from renewable power’s fast progress might speed up the growth of carbon elimination initiatives. Each incur the majority of their lifetime prices upfront, throughout challenge improvement, and repay that funding over years. Buy contracts for each usually span many years and sometimes lock in fastened pricing.

These long-term offtakes derisk the upfront funding, establishing the value certainty crucial for traders to finance challenge improvement with confidence, and concurrently safe consumers entry to the renewable power or carbon credit crucial to fulfill future local weather commitments.

“Corporates know the best way to do [virtual power purchase agreements] in renewable power,” stated Hickok. “We do [carbon purchase agreements] in carbon.” The similarity might give firms confidence in signing long-term carbon offtake agreements as a result of it’s a construction they’ve seen earlier than.

12 million new bushes

The Panna challenge will restore almost 50,000 acres of cropland and group lands in central India. The group will plant almost 12 million native and fruit bushes, drawing 3 million tons of carbon dioxide out of the environment over the challenge’s lifespan. Microsoft has already claimed half of those carbon credit; Local weather Impression Companions will promote the remaining half to different consumers. It’s Microsoft’s largest carbon elimination buy within the Asia Pacific area thus far, and first in India.

Terra Pure Capital, an environmental commodities funding firm, is offering the challenge finance in phases, based mostly on milestones that embrace planting charges and group engagement.

The challenge’s sturdy pilot, skilled workforce and demand dedication from Microsoft made it stand out as a robust funding, stated Terra Pure Capital Managing Director Erica Vertefeuille. As well as, Kita, a carbon credit score insurance coverage firm, is insuring the Panna challenge in opposition to under- and non-delivery, reassuring traders.

Be taught from renewable power’s success

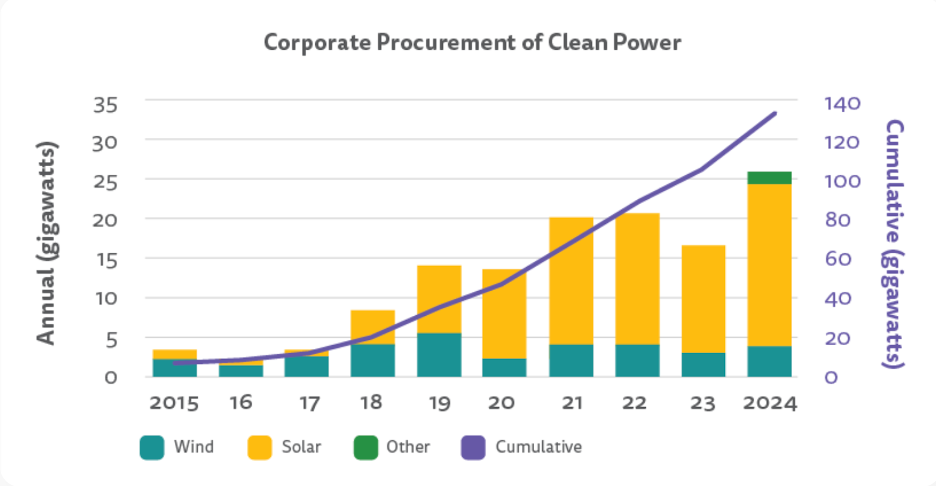

The fast growth and declining prices of renewable power present a roadmap for different local weather know-how deployment at scale. Two components have underpinned the renewable power growth over the previous three many years, in line with a 2024 report from Terra Pure Capital:

- Authorities insurance policies, equivalent to subsidies and tax credit, spurred demand and lowered danger.

- Company demand alerts supplied long-term value certainty.

These elements made renewable power challenge returns extra predictable, opening the door for monetary establishments to speculate and get initiatives off the bottom. And with the rising area expertise, know-how prices have steadily declined, making renewable power a extra enticing funding to consumers and making a constructive suggestions loop, resulting in a gradual enhance in deployments.

Supply: The Enterprise Council for Sustainable Power, right here

Carbon elimination can observe an identical path. “Carbon pricing is serving the identical position as authorities coverage did for renewable power,” stated Hickok, with long-term offtakes equivalent to Microsoft’s contract with the Panna challenge offering the value certainty vital for personal capital to dive in.

Though renewable power is experiencing document progress, its path wasn’t at all times clean. Early on, reliability considerations and demand uncertainty made many traders hesitant to commit massive sums. As soon as the market accelerated, early traders gained aggressive benefit.

Carbon elimination is now dealing with many related uncertainties. However early movers are poised to reap the identical advantages as those that acted early on renewable power buying.

“We’re working to exhibit actual returns, infrastructure-type returns, on long-term carbon improvement,” stated Hickok. “We’ve got to get finance flowing into the carbon markets to scale, to construct out the aptitude within the business.”

The place carbon initiatives should blaze their very own path

To make sure, carbon elimination presents distinctive challenges. For one, nature-based carbon elimination operates on nature’s timelines: It might probably take 5 to 10 years earlier than a challenge persistently delivers a stream of carbon elimination credit. That’s barely longer than typical return timelines from a wind or photo voltaic farm, making affected person capital and long-term offtakes much more vital for the carbon sector.

Though consumers and traders keen to take a protracted view with carbon offtakes are nonetheless briefly provide, that dedication additionally makes carbon initiatives notably impactful to native communities, providing “long-term employment and a transformative view of enterprise fashions for implementation companions,” stated Ben Gatley, Local weather Impression Companions’ head of business challenge improvement. Because of this, “they’ll make fairly totally different selections round how they run their group.”

Local weather Impression Companions estimates that over the funding timeframe farmers concerned with the Panna challenge will double their incomes from fruit tree yields and carbon funds.

Subsequent step: standardizing finance

The following step to scale the carbon elimination business is to standardize finance buildings, in line with Vertefeuille. “All challenge finance into massive infrastructure initiatives seems to be and smells the identical. It took a very long time to get there,” she stated. Getting there took apply to determine repeatable playbooks.

“The primary movers in renewables had their selection of initiatives previous to the rise in demand that restricted choices afterward,” stated Hickok. “This is identical outlook for carbon.”

[Join more than 5,000 professionals at Trellis Impact 25 — the center of gravity for doers and leaders focused on action and results, Oct. 28-30, San Jose.]