Individuals aged 60 and older misplaced a staggering $700 million to on-line scams in 2024, marking a pointy rise in fraud concentrating on seniors, in keeping with the Federal Commerce Fee.

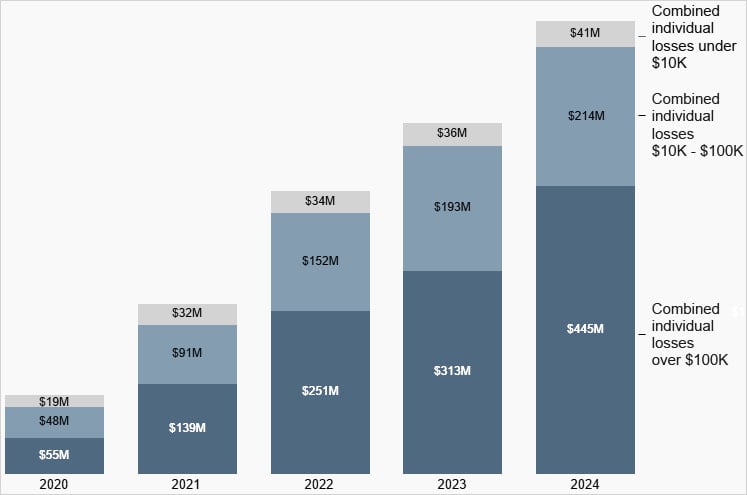

This determine, introduced within the company’s newest Shopper Safety Information Highlight, represents a rise over all three classes of loss in comparison with earlier years.

Most notably, the quantity of losses for many who misplaced over $100k recorded an eightfold bounce in comparison with 2020.

Beneath is an evaluation of the quantities:

- Losses above $100k: $445 million

- Losses between $10 and $100k: $214 million

- Losses below $10k: $41 million

In 2020, the whole losses had been $121M, so the 2024 determine of $700M represents a sixfold enhance.

In comparison with the earlier yr, 2023, the place $542M in losses for folks over 60 years of age had been logged, 2024 represented a notable enhance of about 30%.

Supply: FTC

Prevalent rip-off ways

The FTC highlighted frequent rip-off ways concentrating on older adults in 2024, involving impersonation, faux disaster situations, and telephone calls.

The victims had been told lies crafted to create urgency, like suspicious exercise on their banking accounts, their Social Safety numbers concerned in crimes, or malware an infection and hacks of their computer systems.

Scammers posed as authorities companies, together with the FTC, or companies like Microsoft and Amazon, providing to assist targets with an alleged situation.

“In one other layer of irony, these scammers usually fake to be the FTC, the nation’s shopper safety company, generally impersonating actual employees,” stories the FTC.

“Experiences present these scammers have told folks to switch cash out of their accounts, deposit money into Bitcoin ATMs, and even hand off stacks of money or gold to couriers – all issues the true FTC won’t ever do.”

The FTC famous that almost all of those scams begin on-line, however are sometimes additionally adopted by telephone calls made to accentuate stress and emotionally manipulate the victims whereas they’re in a weak, remoted state.

Older adults usually turn out to be targets of scammers as a result of their entry to bigger monetary reserves, belief or respect for authorities, and poor understanding of know-how.

The FTC says that in lots of instances, these folks lose their total life financial savings and even 401(okay)s, leaving them financially and emotionally devastated.

To remain secure from these scams, the company recommends by no means transferring cash or sharing monetary data with unknown callers or messengers. As a substitute, folks ought to grasp up and confirm by contacting the company or firm immediately, utilizing publicly accessible contact data.

Whereas the $445 million misplaced in 2024 by folks over the age of 60 is little doubt a big quantity, it pales compared to the whole quantity Individuals misplaced to fraud in 2024, which, in keeping with the FTC, was $12.5 billion.

This was a document quantity, constituting a 25% enhance over 2023, reflecting a steady rise in losses to scams ever for the reason that FTC began logging this information.