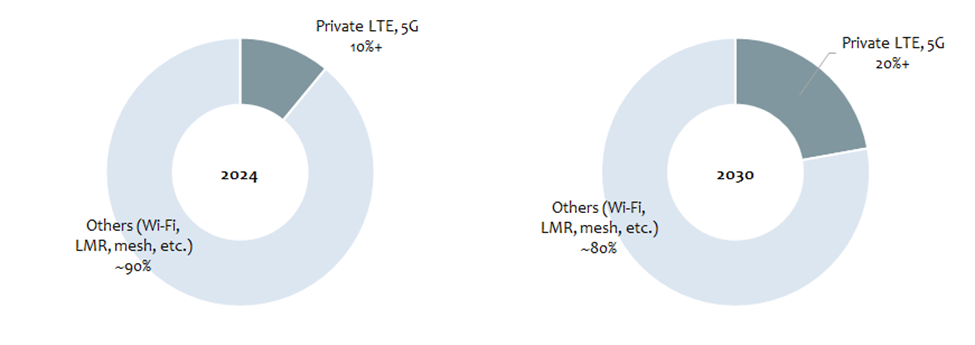

Cell Specialists predicts non-public 5G (and 4G) will double its market share of enterprise wi-fi by 2030 – versus Wi-Fi and mesh networks and so on. Progress is regular however fragmented, with industrial sectors seeing the strongest, if slower-than-expected, adoption.

In sum – what to know:

Double share – Non-public 4G/5G will rise from 10% to twenty% of enterprise gross sales in 5 years.

Business 4.0 – gross sales strongest in industrial, although fragmentation is slowing progress.

Lengthy tail – there’s a “deep sufficient pool of alternative for 25 years of progress”, says agency.

An replace on the non-public 5G market from analyst home Cell Specialists, and a fast one for the weekend: the non-public mobile will greater than double its share of the broader marketplace for enterprise wi-fi networking tools within the subsequent 5 years. That is the large takeaway – or an enormous one, at the very least – from a brand new report the agency has simply revealed, disseminated to press below the header, ‘non-public 5G marches towards wider adoption’.

Cell Specialists forecasts a “deep sufficient pool of alternative for 25 years of progress”.

Its press be aware doesn’t say a lot, really; there’s a 67-page report on the market, and it seems to be detailed (30 “charts and illustrations”; a five-year forecast for eight completely different verticals, and so on). It talked about challenges available in the market with fragmentation, notably between completely different enterprises in several verticals. “Whereas speedy progress was anticipated, the fact has been slower,” the agency acknowledged. “This isn’t a single market with a uniform set of necessities.”

It added: “As a substitute, it’s a assortment of area of interest purposes and vertical markets, every with distinctive integration necessities, units, and spectrum wants.” Which, in fact, most market watchers, and everybody immediately engaged within the self-discipline, is aware of very nicely. However an e mail inquiry yielded somewhat extra info; Cell Specialists issued a graphic to elucidate the double-share progress in non-public 4G and 5G over the following 5 years (see under).

Like others, the agency counts non-public 4G/5G in two classes: hard-core ‘industrial’ non-public mobile for “heavy” industries like mining, oil and fuel, manufacturing, ports, and railways; and ‘enterprise’ non-public mobile for so-called “carpeted” or ”mild” vertical sectors, corresponding to healthcare, schooling, retail, and venues. Mixed, their share will double when it comes to annual tools gross sales over 5 years – versus normal Wi-Fi, LMR (Land Cell Radio), and varied mesh and different applied sciences.

As per the graphic, these legacy enterprise networking applied sciences will account for 80 % of gross sales in 2030, down from 90 % at the moment; conversely, non-public mobile, of each kinds, will account for 20 %, up from 10 % at the moment. Which is a helpful body of reference for predicting the market. Kyung Mun, principal analyst at Cell Specialists, responded: “As you see, non-public LTE (4G) and 5G will coexist with Wi-Fi and different applied sciences for a really very long time.”

He added: “We’re seeing higher traction within the industrial non-public mobile section, the place business-critical purposes that require extensive protection and mobility favour LTE and 5G over Wi-Fi. The market is steadily rising, however not at an exponential tempo as many had hoped. There are macro and micro elements which have contributed to this, however market consciousness is rising (albeit at a tepid tempo) and differs by vertical segments.”

It doesn’t present any onerous figures, exterior of the paid report. The combined message – about “higher traction”, “regular” progress, and “tepid tempo” – shouldn’t be a shock. The worth of personal mobile seems very actual. (At writing, RCR Wi-fi has simply returned from a peak behind the scenes of the weekend tech setup on Portsmouth harbour, forward of the UK leg of the SailGP race, the place Ericsson’s non-public 5G is a “revelation” – says the occasion organiser.)

However enterprises – notably within the industrial sector, the place worth is arguably highest, and the place distributors’ early gross sales focus has been educated – are slow-moving entities, with long-term legacy property to sweat, and long-term future tech to get proper. So, to editorialise: what did we anticipate? In the long run, the forecast from Cell Specialists tells of part of the telecoms market exhibiting double digit progress – and 100% progress when it comes to market share.

Which sounds constructive. Certainly, Cell Specialists forecasts a “deep sufficient pool of alternative for 25 years of progress.”

Mun stated: “Enterprises are coping with an rising workload, together with [with] AI, that requires high-performance, dependable, and safe networks. There may be deep demand for higher connectivity available in the market… We see nice examples of [industrial] corporations reaching a improbable ROI on non-public LTE networks. With a necessity for dependable connectivity with extensive protection and mobility assist, this market has a deep sufficient pool of alternative for 25 years of progress.”

Cell Specialists stated it has a brand new device referred to as the ‘Readiness Wheel’ to gauge the maturity of assorted know-how and enterprise elements for the market to scale up. The agency has utilized it to the manufacturing, vitality, utilities, logistics, transportation, mining, and authorities sectors in its report – to “make the longer term path of every market crystal clear”, it stated. The report is obtainable right here.