In sum – what to know

Enterprise drives development – indoor enterprise networks are engine of small cell development.

Regular, not flashy – secure 9.4% CAGR forecast to 2030; no hype, simply regular growth.

Hybrid leads demand – hybrid private-public enterprise networks high funding drivers.

RCR was at Small Cells World Summit in London for a few hours at present (June 3), and left with a bunch of session recordings, together with a wise market overview courtesy of a late-morning scene-setter from Caroline Gabriel, analyst and content material director with Small Cells Discussion board (SCF). So right here’s a tough replay – for anybody who didn’t make it all the way down to Somerstown, to a fairly austere theatre venue subsequent to the British Library, the place SCF is internet hosting 400-odd trade sorts for 2 days, and telling a great story (which RCR readers know very nicely). It goes like this…

There isn’t any hype, right here, and no hockey-sticks – stated Gabriel to a theatre viewers. This can be a severe expertise for severe individuals with severe functions. Neglect about your shopper nonsense – and neglect, as nicely, to a level about macro rollouts (stated Nokia in an earlier presentation). Sure, there’s a key function for small cells in broad community densification, for cell community operators (MNOs) to satisfy mandates and guarantees (and merger contingencies) on new SA protection, and to shut digital divides in rural climes. However the actual motion is with enterprises, of varied stripes.

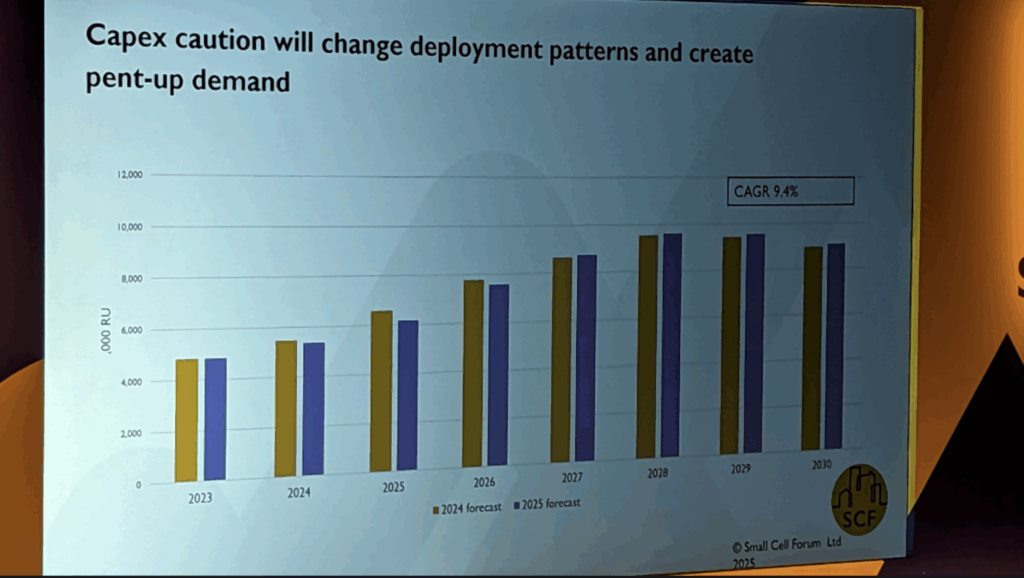

In different phrases, the story of small cells, mid-2025, is generally about non-public enterprises and public companies. That is the place the expansion is, and there may be sufficient of it – and sufficient promise in it – that SCF has raised its compound annual (CAGR) gross sales forecast marginally, she stated – from 8.4 p.c to a 9.2 p.c (9.4 p.c, within the slide) development within the interval to 2030. It’s a unit measure, she suggested – for radio deployments, together with DAS shipments, fairly than revenues (which will likely be obtainable in the summertime, apparently, when SCF publishes its full market forecasts).

It isn’t the sort of price or uplift (“comparatively modest”) that makes a vendor ecosystem wealthy, or quickly-rich anyway, however it’s regular and useful enterprise, she prompt – and nailed-on if the ecosystem can additional cut back complexity and price. It’s also useful enterprise for presidency companies, native authorities, and significant industries, variously deploying small cells to gentle up their hybrid, shared, and personal networks – in accordance with earlier displays (which can or might not even be written up). “We’re on monitor. The trade is stabilizing; it is a bit more predictable,” stated Gabriel.

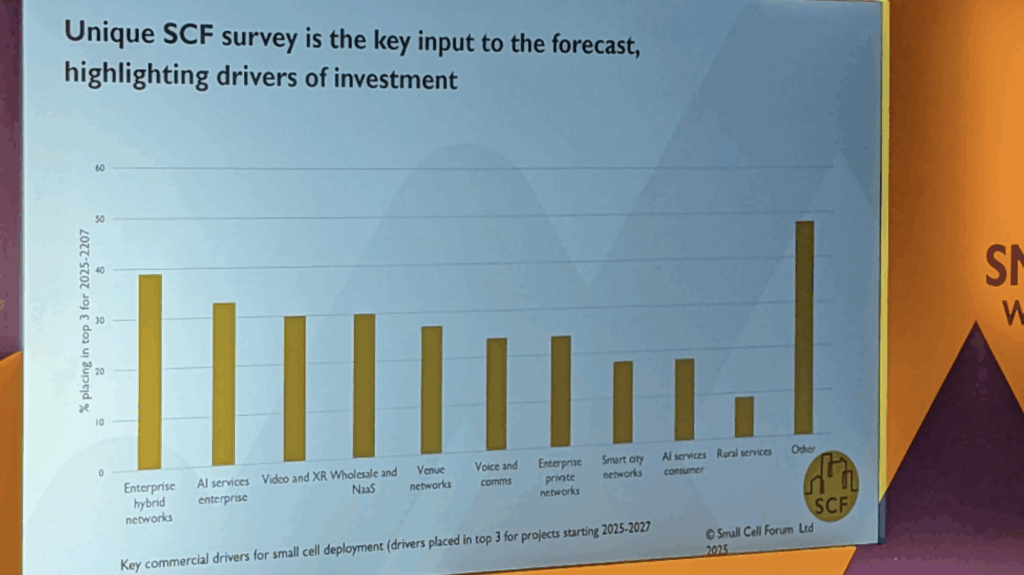

The SCF forecast is predicated, partially, on an annual ballot of 90-odd corporations from throughout the small cell ecosystem, on each side of the provision line. Gabriel offered a slide, based mostly on their responses, about ‘drivers of funding’. She stated: “By a way the largest [driver] is enterprise networks, and notably enterprise hybrid networks – the place non-public or indoor networks work together with the general public community. These contain an MNO, sometimes, however different stakeholders as nicely.” Judging by the slide, virtually two in 5 respondents place hybrid networks amongst their high three ‘drivers’.

About one in 4 additionally/or place non-public networks in there. Taken collectively, these outcomes recommend correct demand. In any other case, modish enterprise AI companies (her characterisation, successfully; “AI may be very a lot in entrance of thoughts in the meanwhile”, she stated) and video and ‘prolonged actuality’ are driving curiosity in small-cell networks – the survey says. ‘Venue networks’ is one other standard reply, it appears – extra so than good cities, rural companies, or shopper AI, anyway. However then, the graph reveals an extended tail of ‘different’ funding instances (cited by virtually half of respondents).

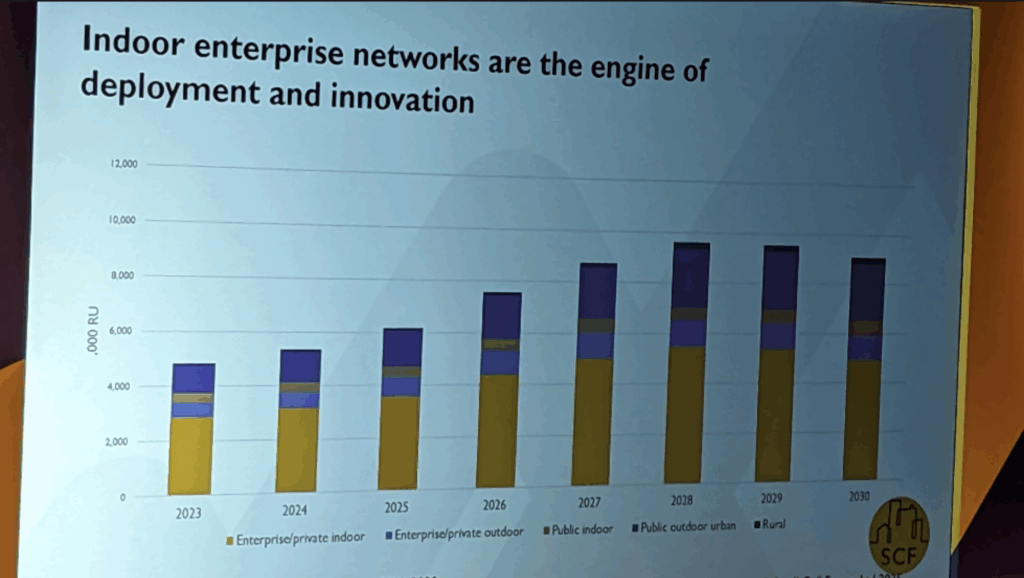

“The engine of deployment is indoor enterprise networks,” stated Gabriel, with one other slide which bucketed-together all of the methods enterprises would possibly leverage small-cell infrastructure to get higher indoor capability, velocity, reliability, high quality. Private and non-private outside setups, additionally supporting purposes to drive investments, are “pretty small classes”, by comparability. The painpoints are the place the pinchpoints are, which is indoors – the place the persons are. In unit gross sales, something-less than 4 million (3.75 million?) out of something-more than six million will go on indoor non-public networks in 2025.

That’s what the slide says – and indoor non-public networks will likely be host to greater than half of small cell deployments into 2030, it appears, even when gross sales begin to decline on the finish of the last decade. The opposite main host setup for small cells is public outside macro networks, rising steadily by way of the remainder of the interval – to attach something-more than two million items by 2030 (versus about 4.5 million on indoor non-public networks), out of something-more than 8.5 million. “It reveals there may be lots of development potential,” she stated. “We left the hockey sticks behind way back.”

And she or he adopted with a quote that most likely summed up the speak, and the occasion. “The engine for scale and innovation – in expertise and enterprise fashions – is undoubtedly the enterprise market, because it actually all the time has been. As a result of the necessity for these in-building programs stays so necessary, and more and more necessary for enterprises to grow to be extra digital and spend money on a wide selection of various purposes… This can be a market of gradual regular growth – of individuals constructing on the experiences of some pioneers, and driving a market to the size it completely requires.”

There was different great things in there, too: about limitations to entry, regularly falling away (notably, web site and spectrum entry); deployment and funding fashions, slowly diversifying (provided / managed fairly evenly by integrators, distributors, operators); shared infrastructure (DAS is right here to remain, however neutral-host programs are the long run – they are saying); and in addition utilization of latest spectrum (with high-density high-band mmWave FR2 frequencies tipped to host as much as 40 p.c of latest radio items by 2030 – if to not assist 40 p.c of networks). However we’ve a deadline, and should put a pin in it (perhaps we are going to observe up).