Applied sciences to take away carbon from the environment have progressed quickly. Sadly, early-stage funding has not saved tempo.

In 2022, non-profit Terraset got down to shut this hole utilizing philanthropic {dollars}. It has since deployed a number of million {dollars} buying sturdy carbon elimination from greater than a dozen tasks that sometimes goal to seize and retailer carbon for millennia. Its newest initiative is a revolving fund created to provide different carbon elimination patrons a pathway to assist early-stage tasks with out taking up early-stage threat.

Terraset launched its revolving fund in Might with a seven-figure anchor grant from the Schmidt Household Basis. Earlier this month, the non-profit introduced the first spherical of pre-purchases from the fund. As soon as undertaking builders ship the verified credit to Terraset, the non-profit will resell to different patrons and return the sale proceeds to the fund to pay for brand spanking new pre-purchases.

Buying carbon elimination from Terraset’s revolving fund is like shifting cash into an earlier stage of undertaking improvement, the place it may be extra catalytic, says Adam Fraser, Terraset’s CEO. “Company patrons might take a look at this as a means of buying credit in the identical means they may buy by way of any platform or direct procurement … however we are going to plow that cash again in to assist earlier, riskier tasks.”

The facility of pre-purchase

To remain on monitor with Paris-aligned local weather outcomes, we’ll possible want to drag some 7 to 9 billion tons of carbon dioxide out of the environment yearly by mid-century, in accordance with the Intergovernmental Panel on Local weather Change. Offtake agreements — commitments to buy credit sooner or later — are among the finest instruments for constructing the carbon elimination business, as they supply a powerful demand sign to the market. However few offtakes embrace upfront funds. That leaves undertaking builders scrambling for capital to construct their amenities and develop operations to satisfy the offtake.

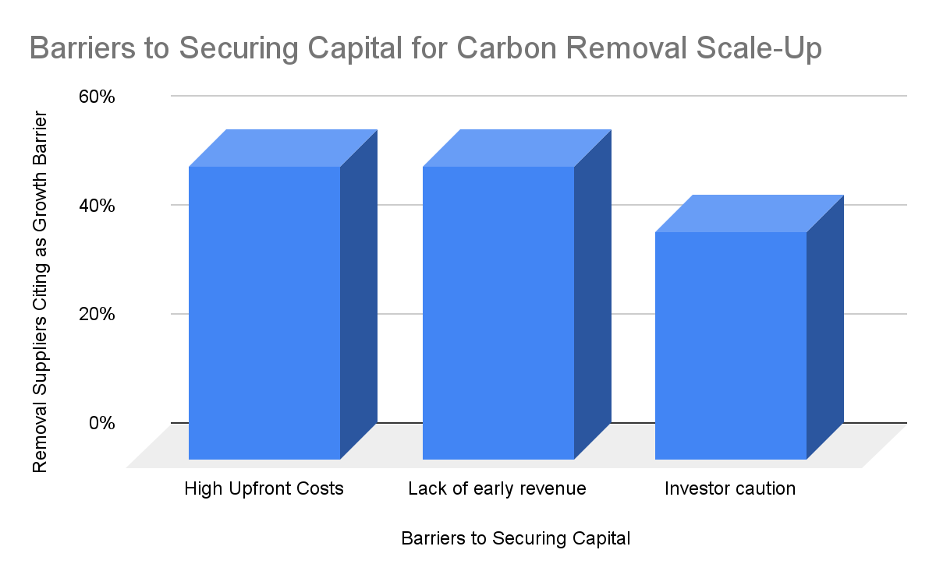

However with out a playbook for industrial operation of most carbon elimination pathways, low-cost capital to cowl early improvement stays scarce. It’s a chicken-and-egg downside: as extra tasks efficiently make it to the end line, and ship verified carbon elimination credit, buyers will acquire confidence and the price of capital will come down. However till then, the dearth of early-stage capital stays a serious blocker to scale, in accordance with an business survey Terraset printed earlier this 12 months.

The price curves of many elimination pathways exacerbate the issue, as tasks have excessive setup prices and take a number of years to provide verified carbon credit.

Supply: Terraset survey of carbon elimination suppliers, 2025

Regardless of the necessity for early-stage funding, Terraset’s conversations with company patrons made clear that almost all aren’t able to tackle the danger of placing down cash earlier than credit are prepared for supply.

Within the revolving fund, philanthropic capital offers bridge funding for scaling early-stage tasks, primarily shifting company purchases earlier within the course of with out asking end-buyers to tackle the early-stage pre-purchase threat.

Mission due diligence

Carbon elimination corporations can apply to the fund by way of the Terraset web site. Terraset conducts due diligence primarily based on its high quality rubric, and leans on the experience of its carbon council advisory board and different exterior advisors to supply funding suggestions to administration and the board.

The primary purchases from the revolving fund come from 5 corporations: Eion, CarbonRun, UNDO, Andes and Attraction Industrial. The businesses use a spread of elimination pathways, together with enhanced rock weathering and bio-oil.

“We’re capital-constrained,” stated Fraser. “There are corporations which have handed our due diligence with flying colours, however we simply don’t have capital to buy from all of them.”

Terraset expects credit score deliveries from the revolving fund all through 2026 and 2027. Then it’s going to start re-selling credit to company patrons trying to embrace sturdy carbon elimination of their local weather methods and internet zero roadmaps.

Lengthy-term plans

Fraser isn’t positive what the fund’s long-term monetary efficiency might be, and he’s open to a spread of outcomes. If Terraset is ready to re-sell the carbon credit at its pre-purchase value, that can create an evergreen fund the non-profit can deploy a number of instances, growing the variety of catalytic prepayments it may possibly present.

If Terraset is unable to recoup its upfront funds, Fraser — who will communicate on a panel at VERGE, in October — continues to be optimistic the fund could have a catalytic influence on the elimination business. “Let’s say we solely bought 50 % of the cash again,” he stated. “It’s nonetheless going considerably additional than if we do a one-and-done buy and that’s the tip of the highway.”