Nano Dimension has introduced its determination to discontinue ‘non-core product teams’ Admatec, DeepCube, Fabrica, and Formatec.

The merchandise, which specialize in 3D printed ceramics, micro additive manufacturing and deep learning-based synthetic intelligence, got here from a sequence of acquisitions made by Nano between 2021 and 2022, lengthy earlier than the corporate turned embroiled in subsequent M&A drama with Desktop Metallic, which reached its conclusion final month (or maybe not?) with a transaction valued at $179.3 million.

In keeping with a letter from Nano Dimension’s newly appointed CEO Ofir Bahara following the publication of the corporate’s 2024 monetary outcomes, the strikes, collectively with broader organisational efficiencies, have enabled the corporate to scale back annualised working bills of its core enterprise by over $20 million and ship a 52% improve in income per worker from $147,000 to $223,000.

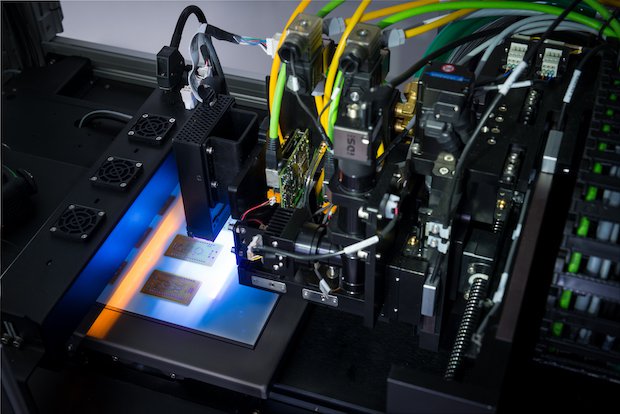

The letter describes the “onerous look” the corporate had taken at its portfolio, which Bahara stated included scrutinising “extreme G&A, together with unwarranted administration overhead”, breaking down silos, significantly in gross sales and advertising and marketing, and realignment of the organisation “across the buyer”. The conclusion, per the letter, is “much less hierarchy, extra execution, and a flatter, sooner organisation higher outfitted to innovate and ship.” The corporate is now stated to be focusing its efforts on two core product teams: Additively Manufactured Electronics (AME) and surface-mount know-how (SMT).

Bahara additionally offered additional touch upon Nano’s Desktop Metallic and Markforged acquisitions. Whereas the corporate continues to be within the early levels of its assessment of Markforged, which closed in a deal value $116 million final week, the letter highlighted Desktop Metallic’s restricted liquidity and vital liabilities, together with however not restricted to $115 million principal quantity of excellent convertible notes.

Bahara stated, “Desktop Metallic doesn’t at present have liquidity or a financing dedication enough to fund the repurchase of the notes required by the indenture or fulfill its different materials liabilities. Following our acquisition, we offered restricted financing to Desktop Metallic to assist it tackle short-term liquidity wants and run a course of to guage its strategic alternate options. No assurances might be given as to the result or timing of Desktop Metallic’s strategic assessment course of or our consideration of whether or not or in what quantity to offer extra financing.”

The assertion reinforces claims made final week that Nano is exploring ‘all strategic alternate options’ to handle Desktop Metallic’s liabilities and liquidity wants, which may result in its divestiture, simply weeks after its acquisition was accomplished.

Nano Dimension plans says it plans to host a strategic replace in June 2025.