Metallic additive manufacturing (AM) is predicted to achieve a market worth of $13 billion by 2035, practically tripling in measurement over the subsequent decade, in accordance with a brand new report from IDTechEx. The report, Metallic Additive Manufacturing 2025–2035: Applied sciences, Gamers, and Market Outlook, outlines how metallic AM is shifting from prototyping and tooling to end-use manufacturing in sectors resembling aerospace, automotive, and common manufacturing.

IDTechEx, an unbiased analysis agency targeted on rising applied sciences since 1999, identifies three key traits at the moment shaping the metallic AM market: the dominance of laser powder mattress fusion (LPBF), regional acceleration in China, and the financial uncertainty pushed by tariff insurance policies.

Laser Powder Mattress Fusion Retains Market Management Attributable to Versatility and Maturity

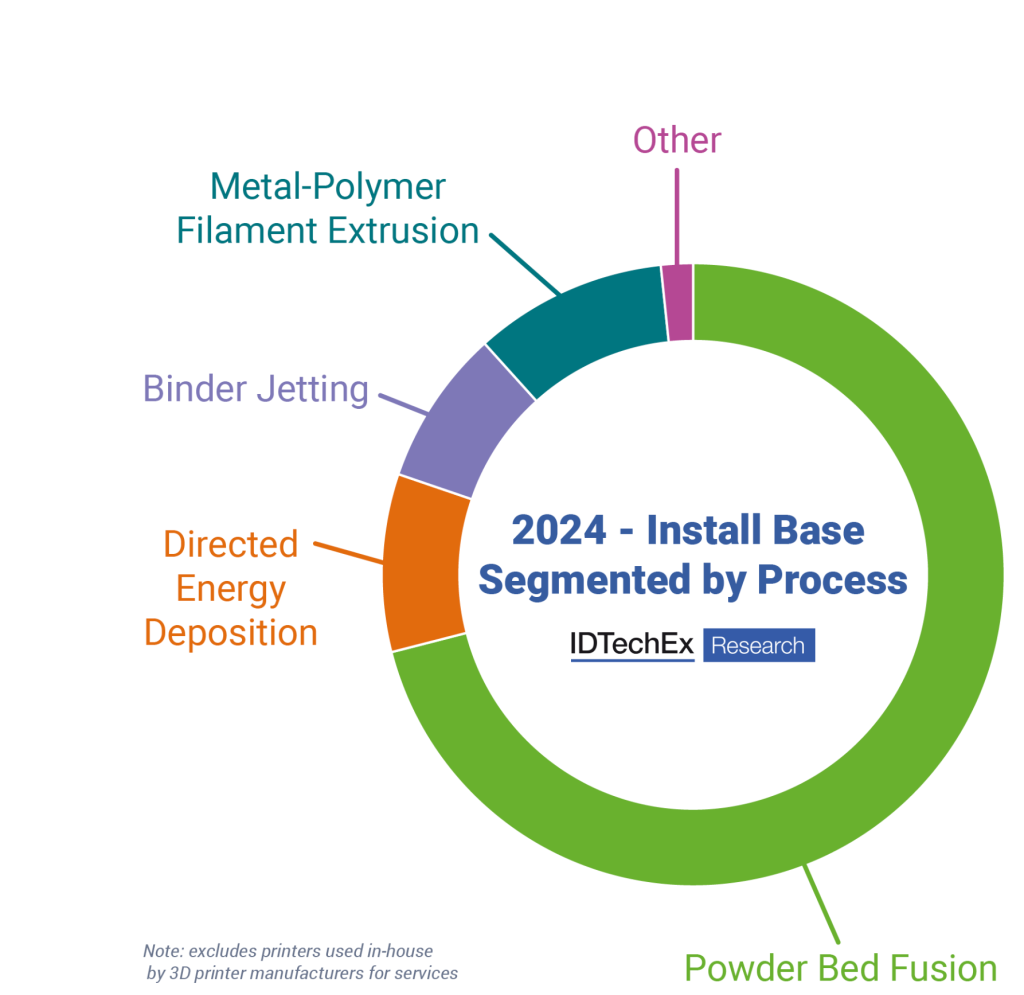

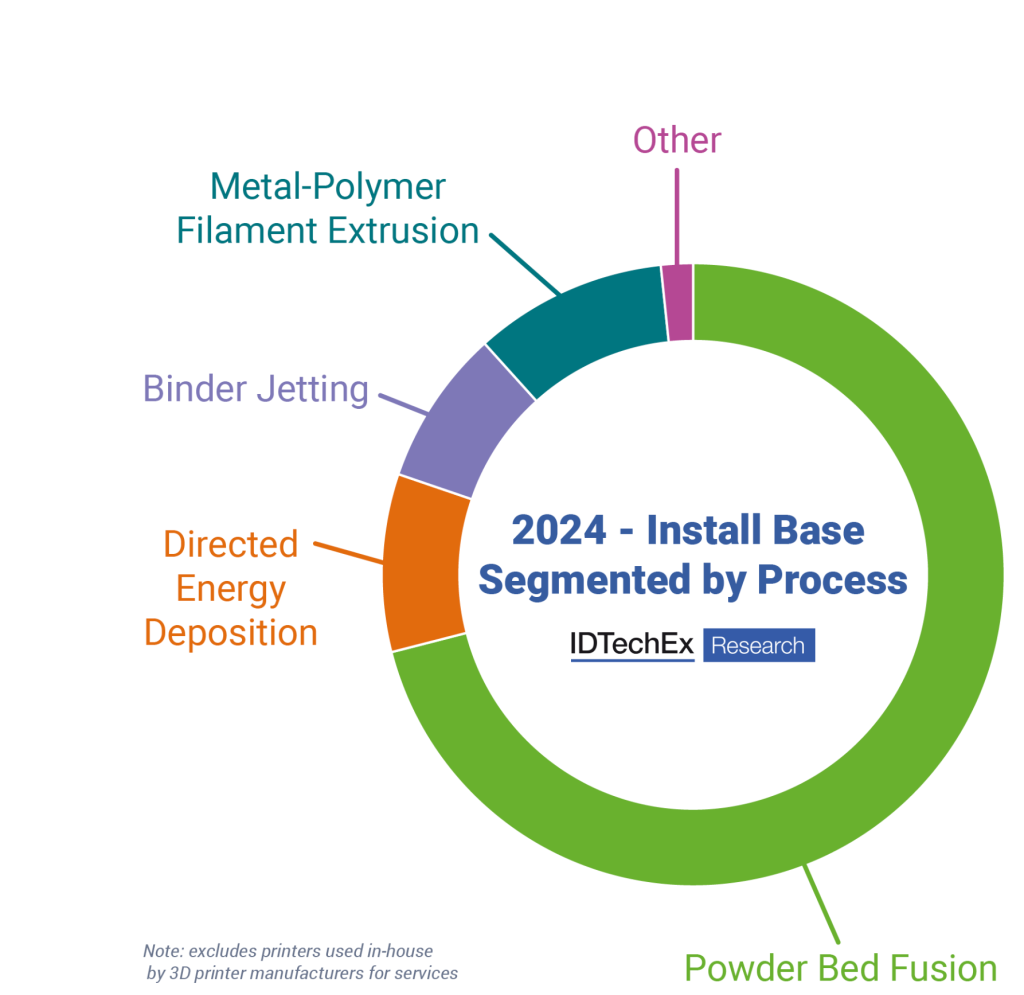

Regardless of rising curiosity in different applied sciences like metallic binder jetting (MBJ) and metal-polymer filament extrusion (MPFE), LPBF continues to dominate metallic AM in each income and adoption. LPBF, which makes use of lasers to fuse metallic powder into components layer by layer, is probably the most commercially mature metallic 3D printing methodology. It’s backed by intensive operational expertise from each gear producers and industrial customers.

MBJ and MPFE have been anticipated to problem LPBF because of their simplified workflows and potential value benefits. Nonetheless, IDTechEx studies that end-users are nonetheless grappling with technical and financial limitations in these newer strategies. For instance, MBJ is restricted by sintering constraints, making it appropriate just for particular geometries and half sizes, whereas MPFE is usually confined to prototyping, jigs, and fixtures because of materials and energy limitations.

LPBF’s energy lies in its capacity to scale throughout a variety of functions. Relying on machine configuration—resembling construct quantity or variety of lasers—LPBF methods are used for producing small injection molds and enormous aerospace parts alike. This vary of use circumstances reinforces LPBF’s place because the main know-how within the metallic AM sector.

Home Progress in China Redefines International Market Share

Metallic AM in China is increasing quickly, supported by a home ecosystem that prefers cost-competitive native producers. Firms resembling Xi’an Shiny Laser Applied sciences (BLT), HBD, and EPlus3D have considerably elevated their market presence over the previous decade, supplying Chinese language companies throughout sectors together with aerospace and automotive.

These producers have grown with out closely counting on exports. Whereas worldwide consideration to Chinese language metallic AM remained low till current years, home demand has allowed companies like BLT to scale constantly. Double-digit annual development charges have enabled a number of of those firms to open workplaces in Europe and North America, establishing new distribution partnerships and repair networks.

Worth stays a key promoting level. Metallic AM methods require excessive upfront capital, and the affordability of Chinese language-built machines is a main issue for worldwide prospects evaluating suppliers. Nonetheless, IDTechEx notes that escalating commerce tensions and the introduction of latest tariffs may complicate abroad growth plans for Chinese language companies. Even so, the size of China’s inside market is predicted to maintain ongoing improvement within the area.

Tariff Pressures Generate Blended Indicators for Funding in Additive Manufacturing

Tariff insurance policies designed to advertise home manufacturing in the USA are producing conflicting results for the metallic AM trade. On one aspect, tariffs have prompted renewed curiosity in reshoring and native manufacturing. This shift may favor metallic AM applied sciences that allow decentralized manufacturing and fast lead occasions.

Nonetheless, uncertainty surrounding tariffs has already triggered a pullback in capital spending throughout a number of industries. Firms are delaying investments in new manufacturing services, and lots of are scaling again analysis and improvement budgets. These developments have an effect on the willingness of companies to undertake rising manufacturing applied sciences like metallic AM, notably for functions that require substantial upfront validation and certification.

IDTechEx studies that within the second half of 2024, financial uncertainty contributed to a slowdown in metallic AM development. The report means that this development may proceed relying on how commerce and industrial coverage evolve in 2025.

Market Projections Segmented by Expertise and Materials Class

The report gives detailed forecasts for metallic AM {hardware}, supplies, and put in base development via 2035. Projections are damaged down into ten metallic printing processes and 9 classes of metallic supplies, providing granular perception into market dynamics. Forecast knowledge is supplemented with comparative benchmarks for every know-how and utility case research.

Materials demand can be anticipated to rise as metallic AM transitions to production-scale use. The report highlights rising necessities for powder uniformity, course of stability, and repeatable half high quality—components vital for certification in aerospace and different high-regulation sectors.

Profiles of main firms are primarily based on direct interviews and market efficiency monitoring. These embody producers of LPBF methods, suppliers of MBJ applied sciences, and builders of metallic feedstocks. The evaluation additionally outlines aggressive methods and regional positioning.

Entry to Full Analysis and Trade Insights

The total Metallic Additive Manufacturing 2025–2035 report is on the market at www.IDTechEx.com/MetalAM, the place pattern pages and extra knowledge are additionally provided.

IDTechEx’s broader 3D printing analysis portfolio contains protection of polymers, ceramics, electronics, and large-scale functions resembling development and biomedical gadgets. To view the total library of additive manufacturing market research, go to www.IDTechEx.com/Analysis/3D.

Prepared to find who received the 2024 3D Printing Trade Awards?

Subscribe to the 3D Printing Trade publication to remain up to date with the most recent information and insights.

Take the 3DPI Reader Survey — form the way forward for AM reporting in underneath 5 minutes.

Featured picture exhibits the quilt of Metallic Additive Manufacturing 2025–2035. Picture through IDTechEx.