Chopping corners: A brand new report has reignited the talk over how a lot tax the world’s largest expertise corporations pay, revealing that the so-called “Silicon Six” – Amazon, Apple, Alphabet, Meta, Microsoft, and Netflix – have paid almost $278 billion much less in company earnings tax over the previous decade than could be anticipated if their income have been taxed on the common statutory fee for US corporations.

The evaluation, performed by the Truthful Tax Basis (FTF), scrutinizes the monetary information and tax methods of those digital giants, whose mixed market capitalization now exceeds $12.9 trillion, making them collectively extra useful than the complete FTSE 100 and Euro Stoxx 50 indices.

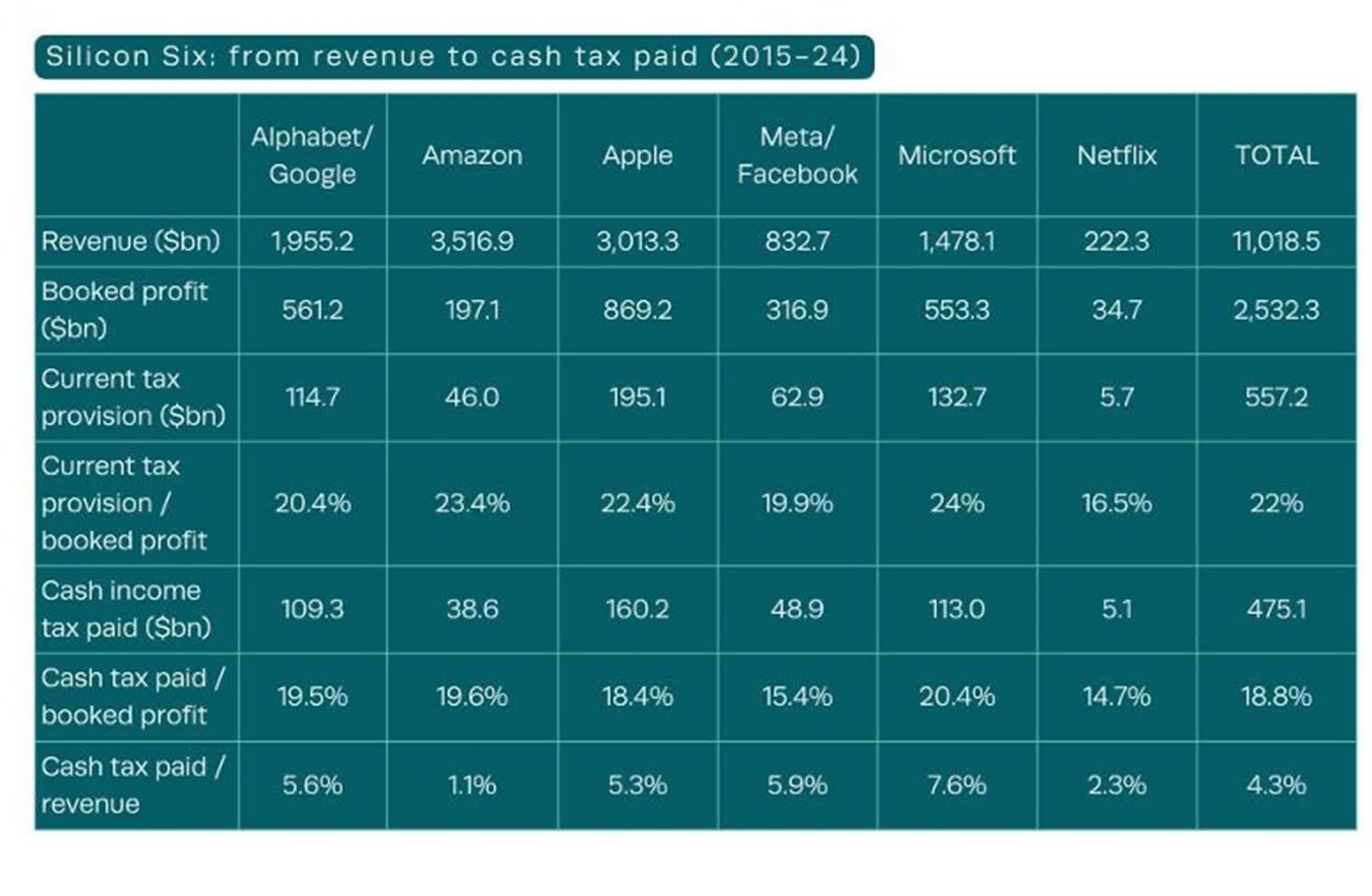

In accordance with the FTF, the Silicon Six generated $11 trillion in income and $2.5 trillion in income over the past ten years. Regardless of these staggering figures, their common efficient company tax fee was simply 18.8 p.c, properly under the U.S. common of 29.7 p.c throughout the identical interval and the worldwide common of 27 p.c.

If one-off repatriation tax funds associated to historic tax avoidance are excluded, their efficient fee drops additional to 16.1 p.c. The report additionally highlights that these corporations have inflated their reported tax funds by $82 billion by together with tax contingencies – quantities put aside for potential future tax liabilities that they don’t count on to pay.

Paul Monaghan, chief govt of the Truthful Tax Basis, argues that tax avoidance stays “hardwired” into these companies’ enterprise fashions. He factors to aggressive tax practices, similar to reserving income in low-tax jurisdictions and leveraging tax breaks just like the US International-Derived Intangible Revenue (FDII) deduction, which permits corporations to pay as little as 13 p.c tax on sure abroad income.

The FDII has been significantly profitable: in 2024 alone, it yielded $12 billion in tax reduction for the Silicon Six, and over the previous three years, the profit has totaled $30 billion. For Meta, Alphabet, and Netflix, the deduction diminished their efficient tax charges by 5 proportion factors every final 12 months.

The FTF’s report ranks Amazon as having the “worst tax conduct,” citing its profit-shifting practices, similar to reserving a good portion of its UK earnings in Luxembourg, a low-tax jurisdiction. Nevertheless, Amazon’s common company tax fee over the last decade was 19.6 p.c, greater than Netflix (14.7 p.c), Meta (15.4 p.c), and Apple (18.4 p.c). Microsoft paid the best fee at 20.4 p.c.

Regardless of almost half of their income being generated abroad, solely 36 p.c of income have been booked outdoors america, and simply 30 p.c of present tax provisions have been reported as international, suggesting that a lot of their worldwide earnings is topic to decrease tax charges attributable to profit-shifting and decrease margins.

The report additionally attracts consideration to the rising hole between the taxes these corporations truly pay and what’s reported of their monetary statements. Over the last decade, the distinction between headline tax charges and money taxes paid reached $277.8 billion, whereas the hole between reported tax provisions and money taxes paid was $82.1 billion.

The FTF notes that the Silicon Six’s reported unsure tax positions – basically, claims for tax advantages that won’t stand up to scrutiny – have greater than tripled up to now ten years, now totaling $82.5 billion. These positions and an extra $10.1 billion in potential curiosity and penalties could additional inflate the businesses’ reported tax costs, giving a deceptive impression of their precise contributions.

In response to the report, Amazon, Meta, and Netflix representatives emphasised their compliance with present tax legal guidelines and rules. Amazon highlighted its important investments in jobs and infrastructure, arguing that these, mixed with low-profit margins, naturally lead to a decrease money tax fee. Meta and Netflix equally said that they comply with all related tax guidelines in each nation the place they function.

The affect of the Silicon Six extends past their monetary may. In 2024, they spent $115 million lobbying governments in america and the European Union, underscoring their substantial political clout. On the similar time, their tax methods are drawing rising scrutiny from policymakers worldwide, prompting a patchwork of responses similar to digital providers taxes in nations just like the UK, France, Austria, and Turkey. Whereas not very best, these unilateral measures are seen as vital steps within the absence of a worldwide consensus on tips on how to tax digital multinationals pretty.