A brand new evaluation from the $80 trillion-backed investor community FAIRR warns that a lot of the world’s largest protein producers are dangerously unprepared for the escalating risk of water shortage, inserting international meals safety and investor returns in danger.

The analysis briefing, Water Insecurity within the Agri-Meals Worth Chain, reveals that just about two-thirds of the businesses assessed in FAIRR’s Coller Protein Producer Index are failing to handle water-related dangers successfully. The Index evaluates 60 of the world’s largest publicly listed meat, dairy and aquaculture firms in opposition to sustainability themes linked to the UN Sustainable Growth Objectives.

The evaluation additionally provides steps that enterprise leaders can take now to protect water provides — from mapping their full water footprint to setting basin-specific targets and standardizing how progress is measured. These actions, FAIRR says, are crucial to safeguarding long-term water provides as demand and stresses surge within the coming years.

“We’re transferring in direction of a way forward for water insecurity, significantly with the rise in depth of droughts in numerous components of the world,” Simi Thambi, local weather and nature economist at FAIRR and co-author of the report, instructed Trellis in an interview. “It’s turning into a risk to enterprise fashions, and but it’s not explored that a lot.”

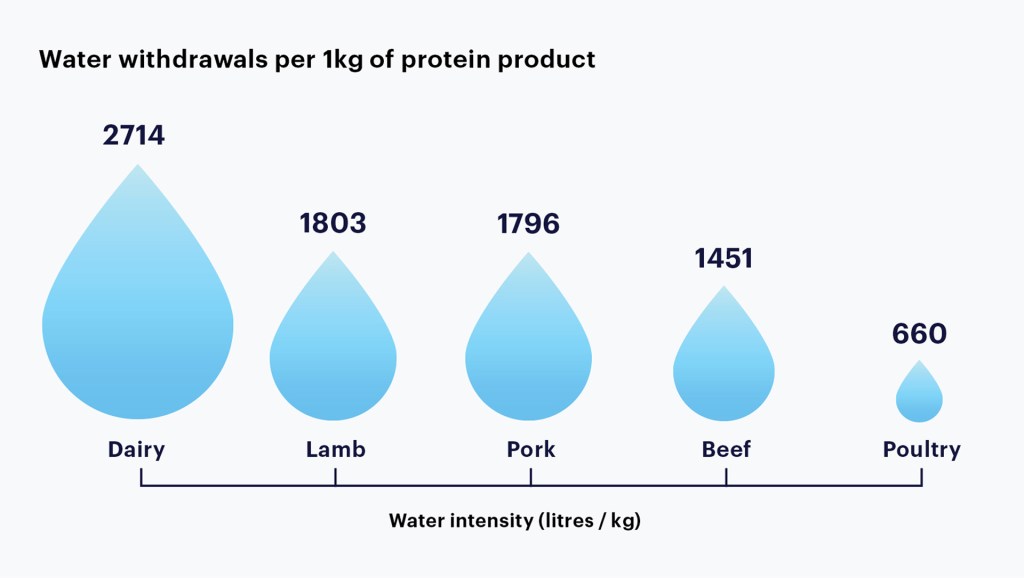

Supply: FAIRR

Hint your water footprint past the manufacturing unit gate

For a lot of firms, the most important water dangers lie not in direct operations however in feed and provide chains. But FAIRR discovered that 84 p.c of livestock corporations fail to reveal the place their feed crops come from — even when sourced from drought-prone areas reminiscent of northern China, India and the U.S. Midwest.

Just one, Texas-based egg and dairy producer Important Farms, disclosed all feed sources from water-stressed areas.

Others are probably under-reporting their publicity. Thailand’s Charoen Pokphand Meals, as an example, estimates its corn provide chain makes use of almost 29,000 cubic meters of water per $1 million in gross sales — roughly 10 instances larger than friends that depend solely direct operations. That distinction highlights how a lot threat can stay hidden upstream.

“Provide chain disclosures of water utilization and threat are crucial as a result of that’s the place a number of these water-intensive actions are concentrated,” Thambi mentioned. “It’s not adequate to reveal solely direct operations as a result of it doesn’t seize the total image.”

Set basin-specific targets

Solely 10 firms in FAIRR’s 2024 Protein Producer Index have set targets to chop water withdrawals, and most focus narrowly on effectivity moderately than absolute reductions.

In contrast, New Zealand dairy firm Fonterra has dedicated to decreasing withdrawals by 30 p.c by 2030 at high-stress websites, whereas Charoen Pokphand has already achieved a 30-percent per-unit discount domestically and is now increasing targets to abroad operations and suppliers.

The report additionally recommends tying these absolute discount targets to government pay. Such a transfer may very well be worthwhile for buyers: BlackRock analysis cited within the report discovered that high-efficiency water customers achieved higher returns than friends.

Standardize metrics

Even when firms disclose water knowledge, comparability stays poor. FAIRR urges corporations to report water depth per unit gross sales and hyperlink it to the supply (groundwater, floor or rainfall) and stress stage of every basin.

This is able to enable buyers to benchmark threat and direct capital in direction of firms decreasing withdrawals the place it issues most.

The takeaway

International freshwater demand is projected to outstrip provide by 40 p.c inside 5 years. For the trillion-dollar livestock sector, the selection is obvious: construct water-resilient enterprise fashions now, or face stranded property and shrinking provide chains later.

“Simply as large tech — and particularly synthetic intelligence — faces scrutiny over water use, a handful of extremely dependent agri-food firms maintain outsized affect in constructing water resilience,” FAIRR analysis supervisor and report co-author Henry Throp mentioned in a press release. “It’s crucial that we perceive the monetary implications of water insecurity — and the worth that may be generated in constructing resilience.”