In case you’re contemplating beginning dropshipping, one of many questions that you could be be enthusiastic about is: “Is dropshipping authorized in my nation?”

The brief reply: Sure, dropshipping is authorized in most international locations.

However the guidelines will not be the identical in every single place.

Every nation has its personal legal guidelines about client safety, taxes, and importing merchandise.

For instance, what’s completely nice in the US would possibly require further paperwork in Germany or face excessive import taxes in Australia.

On this article, we’ll have a look at the highest 9 dropshipping markets and clarify a very powerful guidelines you must know in each.

Let’s get into it!

Overview desk

Earlier than we dive into the main points, this is a fast overview of how dropshipping is handled in 9 of the world’s hottest markets:

| Nation | Authorized standing | What to think about | Study extra? |

| United States | ✅ Authorized | FTC client safety, gross sales tax nexus, and product legal responsibility | Click on right here |

| United Kingdom | ✅ Authorized | EU transparency guidelines, VAT obligations, and bill necessities | Click on right here |

| Canada | ✅ Authorized | GST/HST tax, import duties, client safety | Click on right here |

| Australia | ✅ Authorized | 10% GST on imports, robust refund & guarantee legal guidelines | Click on right here |

| Germany | ✅ Authorized | EU client regulation, strict product compliance, VAT registration | Click on right here |

| France | ✅ Authorized | GST registration, import restrictions, and cost gateway guidelines | Click on right here |

| India | ✅ Authorized | Excessive import taxes, customs delays, and a fancy tax system | Click on right here |

| Singapore | ✅ Authorized | Shopper safety regulation, low tax atmosphere | Click on right here |

| United Arab Emirates (UAE) | ✅ Authorized | VAT since 2018, ecommerce license (free zone vs mainland) | Click on right here |

1. United States

Excellent news: dropshipping is totally authorized in the US.

The truth is, the US is likely one of the largest and most beginner-friendly markets for dropshippers.

However simply because it is authorized doesn’t suggest you possibly can ignore the principles.

If you wish to construct a enterprise that lasts, there are a couple of key issues you must perceive:

Shopper safety (FTC guidelines)

The Federal Commerce Fee (FTC) is the main company that protects patrons.

This implies:

Briefly: do not overpromise, and do not promote low-quality objects simply because they’re low-cost.

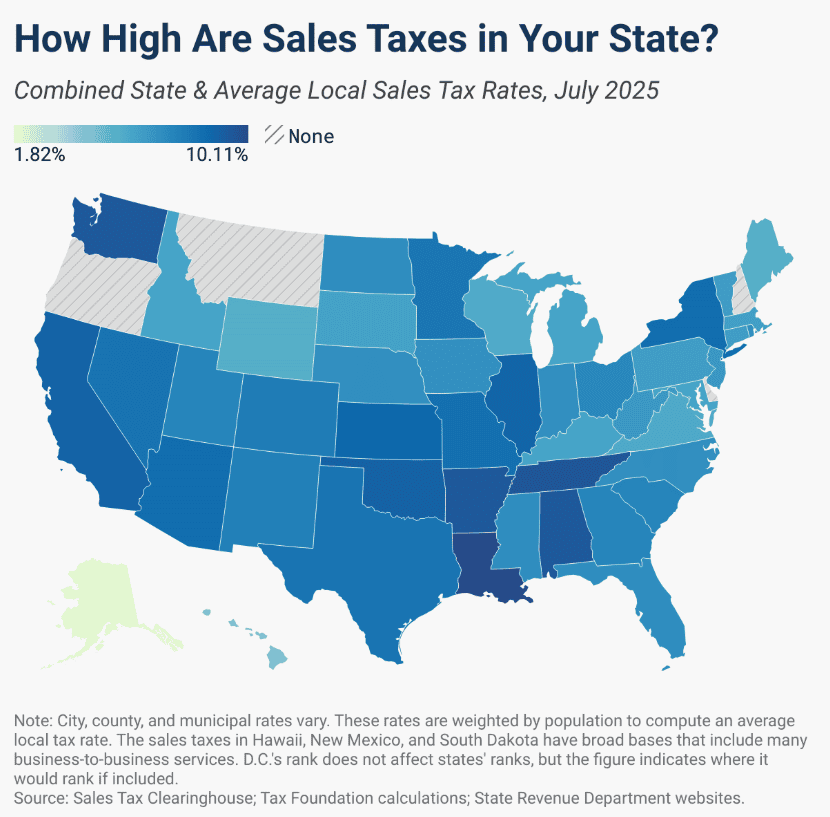

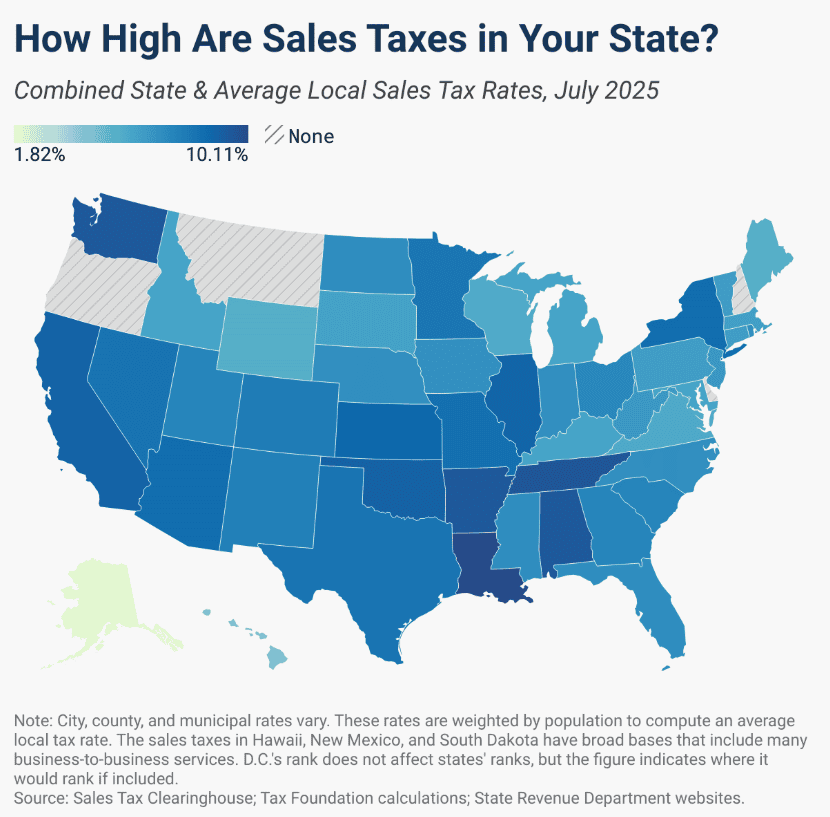

Gross sales tax (the difficult half)

The largest problem within the US is gross sales tax:

- Each state can resolve if you must acquire gross sales tax.

- In case you have a “nexus” (a authorized presence like an workplace, warehouse, and even a specific amount of gross sales in a state), you need to acquire gross sales tax from prospects there.

- Platforms like Shopify typically assist with automated tax assortment, however you need to nonetheless register appropriately:

For instance, in case you dwell in California and make a number of gross sales to prospects in Texas, you would possibly want to gather Texas gross sales tax, too, not simply California’s.

Tip: Have you ever already created your Shopify account? If not, join by clicking this hyperlink right here to get a free 3-day trial + 3 months for $1 every!

Product legal responsibility

If one thing goes fallacious with a product you offered (for instance, a charger that catches fireplace), the client can maintain you legally accountable.

That is why it is good to:

- Work solely with dependable suppliers.

- Keep away from dangerous classes like well being dietary supplements or electronics until you actually know the laws.

- Contemplate enterprise insurance coverage when you scale up.

Backside line: Dropshipping within the US is authorized and filled with alternative, however you must keep on prime of gross sales tax guidelines and be sure you’re promoting secure, official merchandise. In case you play by the principles, the US is likely one of the best locations to start out dropshipping.

2. United Kingdom

Sure, dropshipping is authorized within the UK.

However, as in most international locations, there are guidelines you must observe in case you do not need to run into bother.

The UK is a good dropshipping market as a result of folks typically store on-line, however the authorities takes client safety and taxes very significantly.

Shopper rights (very strict within the UK)

UK buyers are well-protected by regulation:

- Clients can cancel and return most on-line purchases inside 14 days for a full refund.

- You could inform prospects about transport occasions, return insurance policies, and refund choices.

- If a product arrives defective or not as described, you might be chargeable for fixing the issue, even when your provider is abroad.

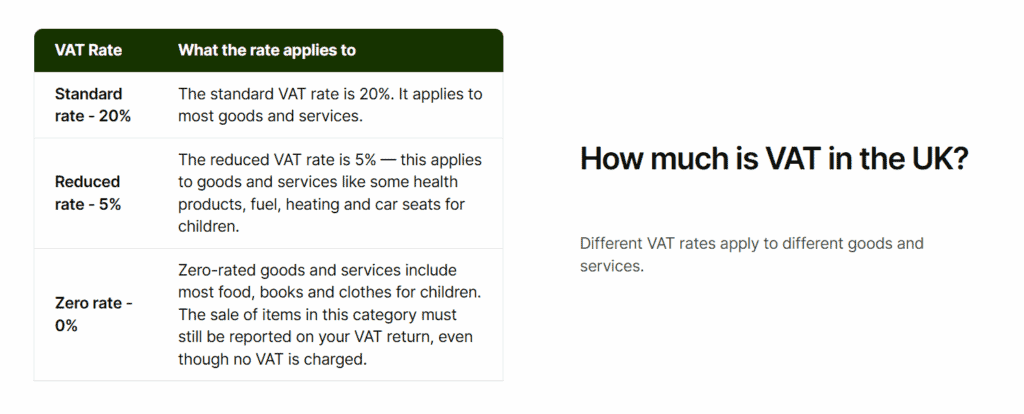

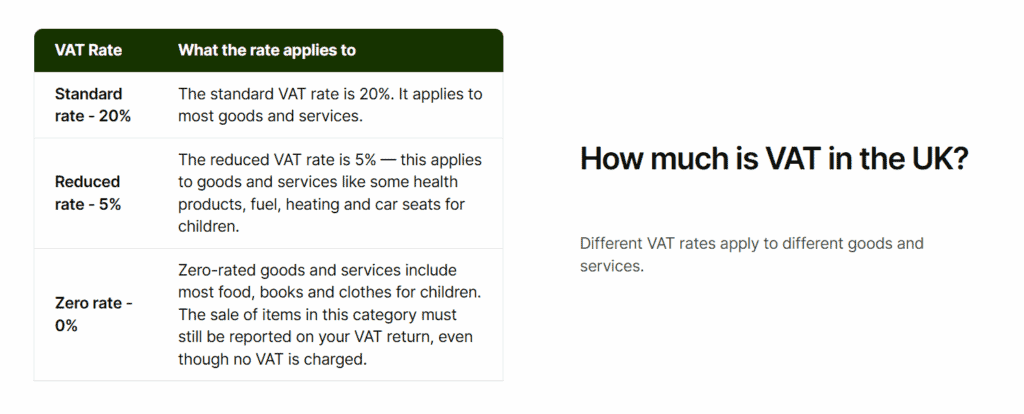

VAT (Worth Added Tax)

That is just like gross sales tax within the US:

- If your online business makes greater than £90,000 per yr in gross sales, you need to register for VAT.

- VAT is normally 20% and should be added to your product costs in case you’re registered.

Submit-Brexit Customs

Since Brexit, promoting from suppliers outdoors the UK (particularly from the EU) comes with further steps:

- Clients could have to pay import duties or VAT on deliveries from overseas.

- To maintain patrons glad, many UK dropshippers use native UK suppliers for sooner, smoother transport.

Backside line: Dropshipping within the UK is 100% authorized, however you need to respect robust client safety legal guidelines and be prepared for VAT and customs guidelines.

3. Canada

Sure, dropshipping is authorized in Canada.

It is really a well-liked enterprise mannequin there, however like within the US and UK, you must play by the principles.

Shopper safety

Canada has robust client safety legal guidelines, they usually apply to on-line sellers too:

- Merchandise should be secure and precisely described.

- Clients have the precise to refunds or replacements if the product is flawed or deceptive.

- You’re chargeable for dealing with complaints.

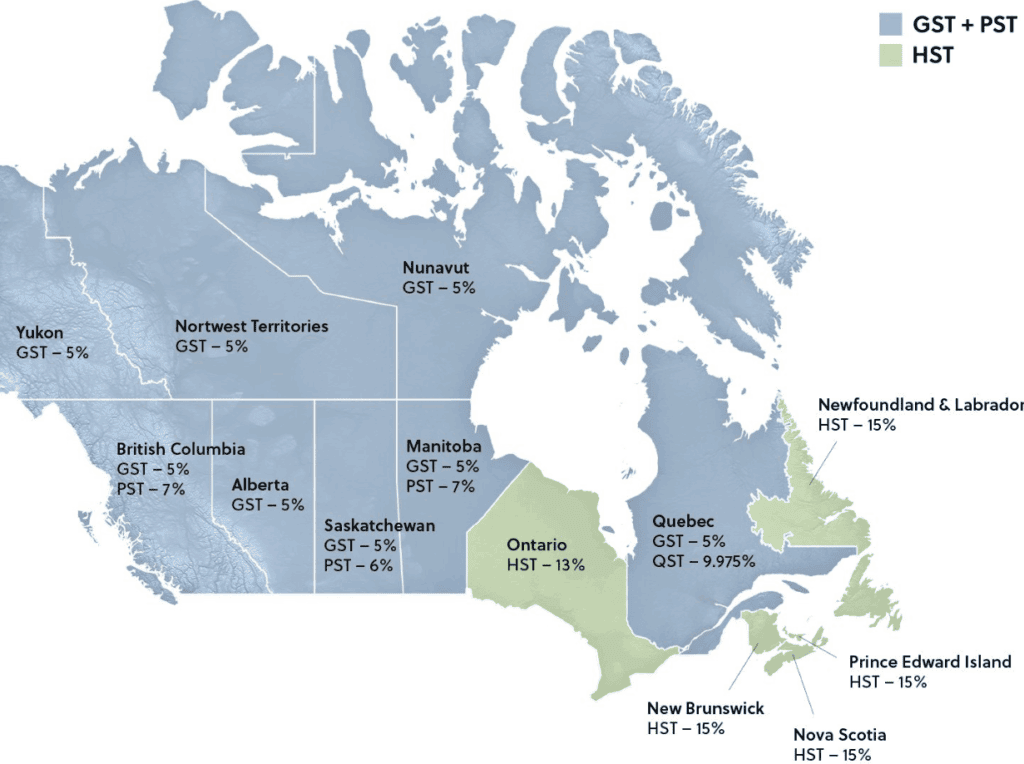

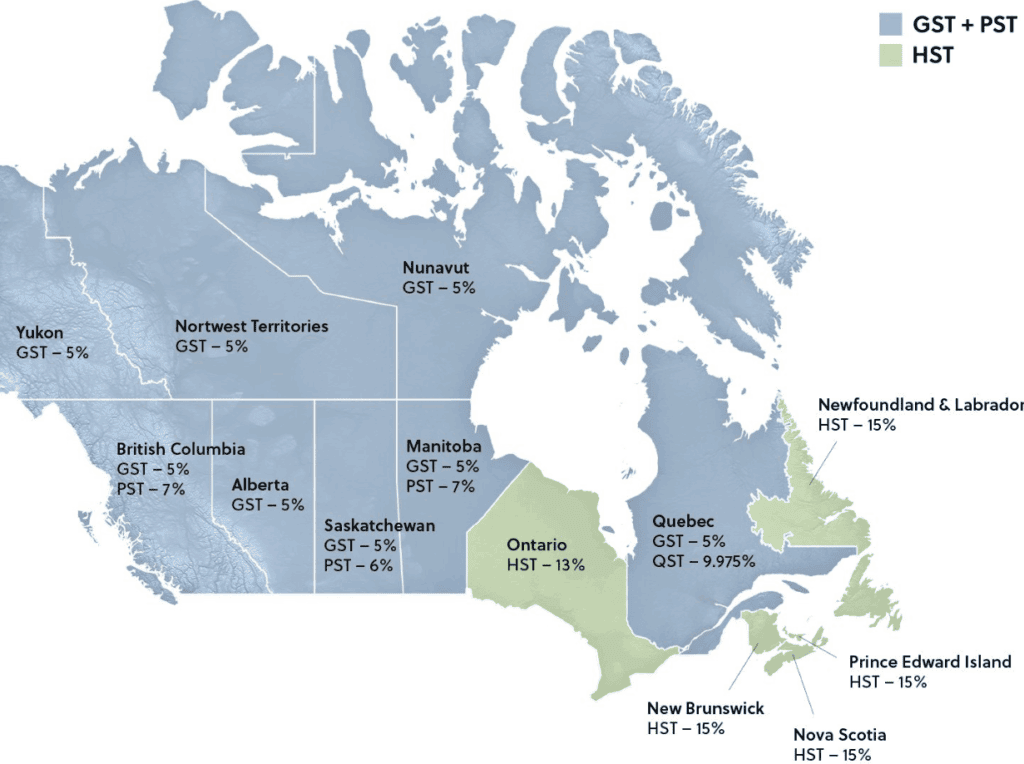

GST/HST (Gross sales tax in Canada)

Taxes in Canada work a bit of otherwise in comparison with the US:

- Canada makes use of GST (Items and Providers Tax) at 5%, plus HST (Harmonized Gross sales Tax) in sure provinces.

- In case your gross sales are greater than CAD $30,000 per yr, you need to register for GST/HST and cost it on gross sales.

- Under that quantity, you needn’t register, however many critical sellers do anyway to look skilled and declare tax credit.

Customs and import duties

That is the place some Canadian dropshippers run into issues:

- In case your provider ships from outdoors Canada (like China or the US), the client might need to pay customs duties or import taxes when the bundle arrives.

- Lengthy transport occasions from abroad suppliers may also frustrate Canadian prospects.

The answer?

Some dropshippers work with Canadian suppliers to maintain supply quick and keep away from customs surprises.

Backside line: Dropshipping in Canada is authorized and worthwhile, however you must deal with GST/HST appropriately and watch out with transport from abroad. In order for you glad Canadian prospects, hold supply occasions brief and make your return coverage easy.

4. Australia

Sure, dropshipping is authorized in Australia.

The truth is, it is a well-developed ecommerce market with loads of alternatives.

However if you wish to succeed right here, you must perceive how taxes and client rights work, as a result of Australia is thought for having a few of the strongest purchaser safety legal guidelines on the earth.

Shopper protections (Australian Shopper Legislation)

The Australian Shopper Legislation (ACL) could be very strict:

- Clients have the precise to refunds, repairs, or replacements if the product is defective or not as described.

- You could clearly state your transport occasions and return insurance policies.

- Even when your provider is abroad, you might be chargeable for fixing the problem.

For instance, if a buyer buys headphones out of your retailer they usually cease working after per week, you need to present a refund or substitute, even when your provider is in China.

GST (Items and Providers Tax)

Taxes are one other necessary level:

- Australia fees a ten% Items and Providers Tax (GST) on most items offered to Australian prospects.

- If your online business makes greater than AUD $75,000 per yr, you need to register for GST and cost it in your gross sales.

Backside line: Dropshipping in Australia is authorized, however you need to respect strict client safety legal guidelines and deal with GST appropriately. In case you’re trustworthy about supply occasions and work with dependable suppliers (ideally native Australian suppliers), it may be a really worthwhile market.

5. Germany

Sure, dropshipping is authorized in Germany.

However Germany has a few of the strictest client safety and tax guidelines in Europe.

German prospects count on professionalism, transparency, and high-quality service.

Shopper safety (very robust in Germany)

Germany follows EU client safety legal guidelines, however typically enforces them extra strictly than different international locations:

- Clients have a 14-day proper of withdrawal, which implies they will return most merchandise inside 14 days for a full refund.

- You could show your return coverage, firm particulars, and call info in your web site:

- Merchandise should meet EU product security requirements (particularly for electronics, toys, and well being merchandise).

For instance, in case you promote a youngsters’s toy with out the right CE certification, you would face authorized fines.

Discover native suppliers: 6 Greatest Dropshipping Suppliers in Germany (Free & Paid)

VAT (Worth Added Tax)

This is what you must know:

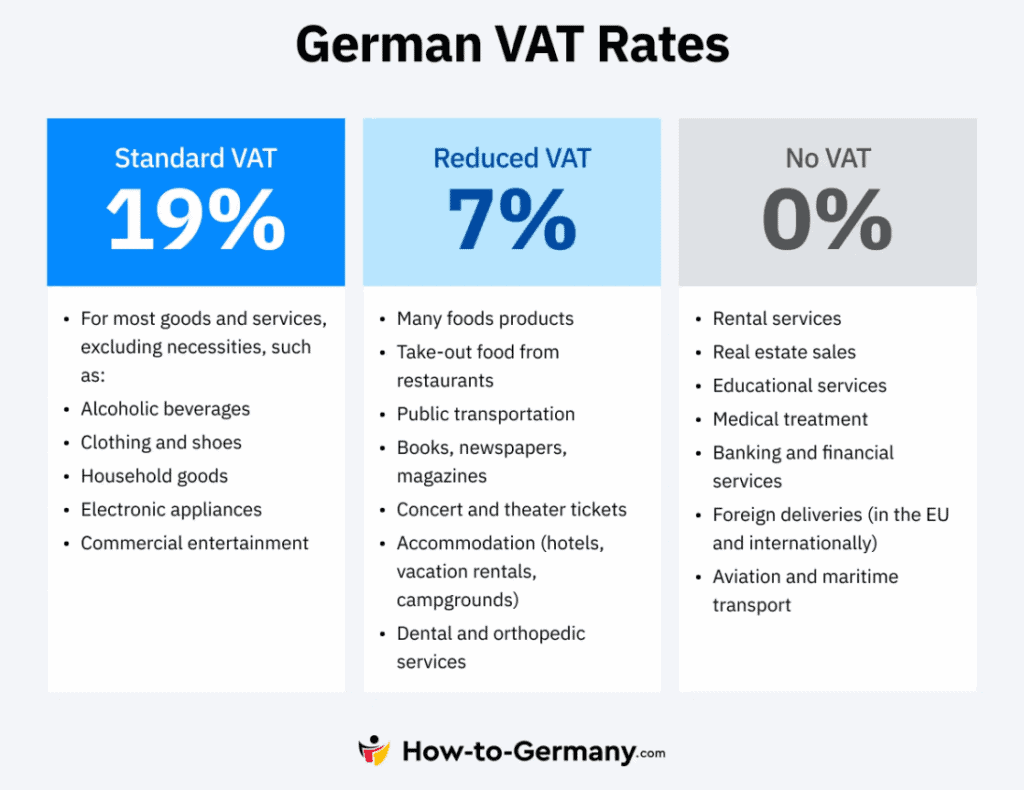

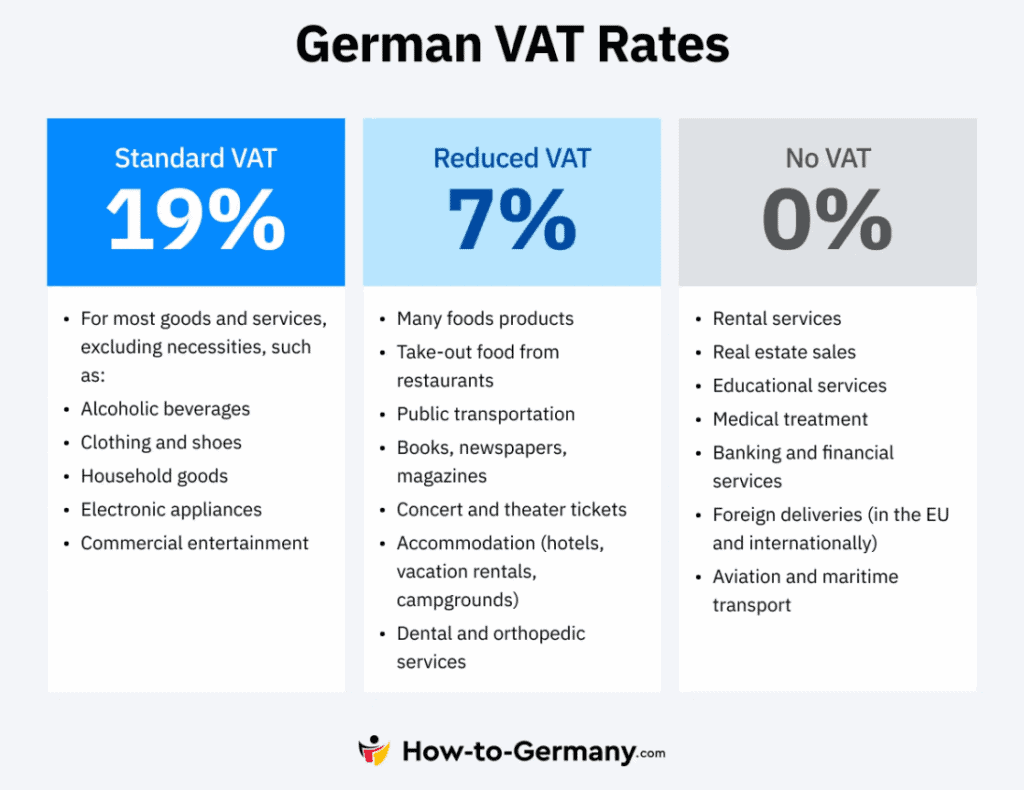

- In case you promote to German prospects, you might have to cost 19% VAT (the usual fee).

- As soon as your gross sales cross the EU threshold (€10,000 yearly for cross-border gross sales), you need to register for VAT within the EU One-Cease-Store (OSS) system.

- Even in case you’re not primarily based in Germany, promoting to German prospects can nonetheless set off VAT obligations.

Enterprise registration and transparency

German regulation requires on-line sellers to be very clear:

- You could present an Impressum (a authorized discover web page with your online business deal with and call particulars):

- Clients ought to know who they’re shopping for from; nameless dropshipping shops will not be allowed.

- Failure to conform may end up in “Abmahnungen” (authorized warnings) from opponents or client safety teams, which could be costly.

Backside line: Dropshipping in Germany is authorized, however not straightforward. You may have to register for VAT, observe strict EU product and security legal guidelines, and be absolutely clear with your online business particulars. In case you do it proper, Germany is usually a very worthwhile market with loyal, repeat prospects, however in case you minimize corners, you will run into authorized bother quick.

6. France

Sure, dropshipping is authorized in France.

However, identical to in Germany, France has robust client safety legal guidelines and really particular necessities for on-line sellers.

Shopper safety

French regulation, and EU regulation basically, is designed to guard patrons:

- Clients have a 14-day interval to return most merchandise for a full refund.

- You could inform prospects about supply occasions, return rights, and who they’re shopping for from.

- If an merchandise is flawed, arrives late, or is not what you described, you might be chargeable for refunds or replacements.

For instance, in case your retailer says transport takes 7 days however the product arrives in 30 days, the client can demand a refund and even report you to client authorities.

Discover native suppliers: 7 Greatest Dropshipping Suppliers in France (Free & Paid)

VAT (Worth Added Tax)

In France:

- The usual VAT fee is 20%.

- In case you’re promoting from outdoors France however to French prospects, when you cross the EU-wide gross sales threshold (€10,000), you need to register for the One-Cease-Store (OSS) VAT system.

- Invoices should embody VAT particulars if you’re registered; French authorities pay shut consideration to this.

Authorized web site necessities

Your retailer ought to have:

- Mentions légales (authorized discover web page). This contains your online business identify, deal with, registration particulars, and call info.

- Phrases & Situations (Situations Générales de Vente). Explains the way you deal with gross sales, returns, and refunds.

- Privateness Coverage. Required for dealing with buyer knowledge underneath GDPR (EU privateness regulation).

Backside line: Dropshipping in France is authorized and worthwhile, however you should be very clear and observe EU tax and client legal guidelines.

7. India

Sure, dropshipping is authorized in India.

However in comparison with locations just like the US or UK, operating a dropshipping enterprise right here could be extra difficult.

Shopper safety

India has robust client safety legal guidelines:

- You should be trustworthy in your product descriptions and pricing.

- If a product is flawed, broken, or not delivered, you might be chargeable for refunds or replacements.

- Hidden prices (like shock import duties) can result in disputes and even penalties.

Discover native suppliers: The 11 Greatest Dropshipping Suppliers in India (Free & Paid)

GST (Items and Providers Tax)

Taxes are a bit complicated in India:

- You could register for GST in case your annual turnover exceeds INR 20 lakh (about USD $24,000).

- Even in case you make much less, registering for GST is usually required to work with marketplaces like Amazon India or Flipkart.

- GST charges rely on the product class (anyplace from 5% to twenty-eight%), however they’re presently engaged on reforming the system to make it less complicated:

Fee gateways

One other problem is cost processing:

- Platforms like Shopify Funds and PayPal (generally utilized by dropshippers overseas) are restricted in India.

- You might want to make use of various cost gateways to simply accept funds from Indian prospects.

- Worldwide funds could be harder attributable to Reserve Financial institution of India (RBI) laws.

Backside line: Dropshipping in India is authorized, however extra complicated than in Western international locations.

8. Singapore

Sure, dropshipping is authorized in Singapore.

The truth is, Singapore is called one of the crucial business-friendly locations on the earth.

The principles listed here are simple, taxes are comparatively low, and the federal government helps ecommerce progress.

That stated, there are nonetheless a couple of issues you must know:

Shopper safety

Singapore has clear client safety legal guidelines underneath the Shopper Safety (Truthful Buying and selling) Act (CPFTA):

- You should be trustworthy in your product descriptions and never make false claims.

- Clients have the precise to refunds or replacements if a product is flawed or not delivered as promised.

- You’re chargeable for resolving disputes, even when your provider is abroad.

Discover native suppliers: Dropshipping in Singapore: The place to Discover Suppliers? (2025)

GST taxes

Taxes in Singapore are comparatively easy in comparison with different international locations:

- The Items and Providers Tax (GST) is presently 9%.

- In case your annual income is greater than SGD $1 million, you need to register for GST and cost it to prospects.

- In case you earn lower than that, GST registration is elective. Most new dropshippers will not hit this threshold instantly, making Singapore enticing for beginning small.

Backside line: Dropshipping in Singapore is 100% authorized, with a business-friendly atmosphere and low limitations to entry.

9. UAE

Sure, dropshipping is authorized within the UAE, and it has turn out to be one of many fastest-growing ecommerce hubs within the Center East.

However not like some international locations the place you can begin promoting on-line with little or no setup, the UAE has particular guidelines about enterprise licensing and taxes that you must observe.

Shopper safety

The UAE’s client safety legal guidelines have gotten stricter as ecommerce grows:

- You could present correct product descriptions.

- Clients have the precise to refunds if objects are faulty or not delivered.

- You, as the vendor, are chargeable for resolving complaints, not your provider.

VAT (Worth Added Tax)

The UAE launched VAT in 2018, and it applies to ecommerce companies too:

- The VAT fee is 5%.

- In case your annual income is above AED 375,000, you need to register for VAT.

- Even in case you’re beneath the edge, registering voluntarily can generally be helpful to look skilled and reclaim VAT on bills.

Licensing necessities

One of many largest variations within the UAE is that you simply normally want a license to run an internet enterprise:

- If you wish to function legally, it is best to apply for an ecommerce license.

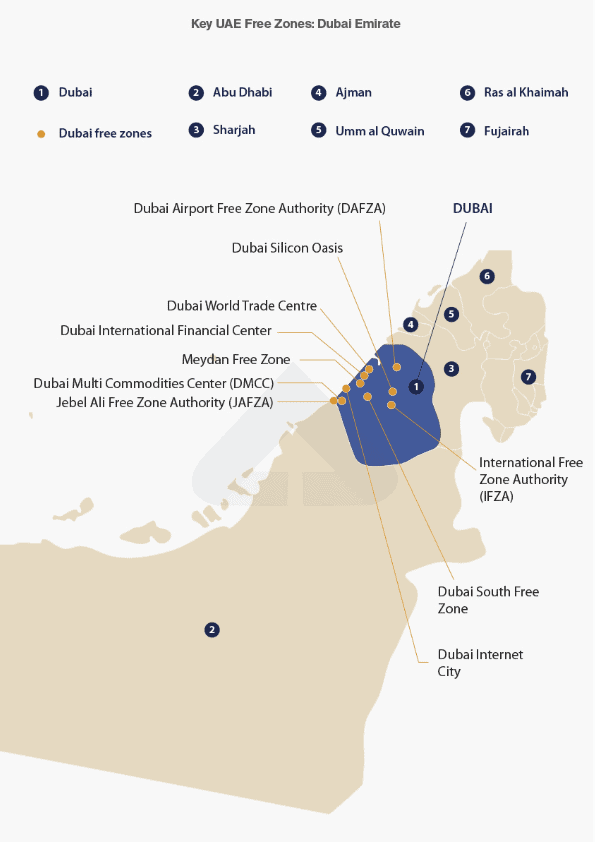

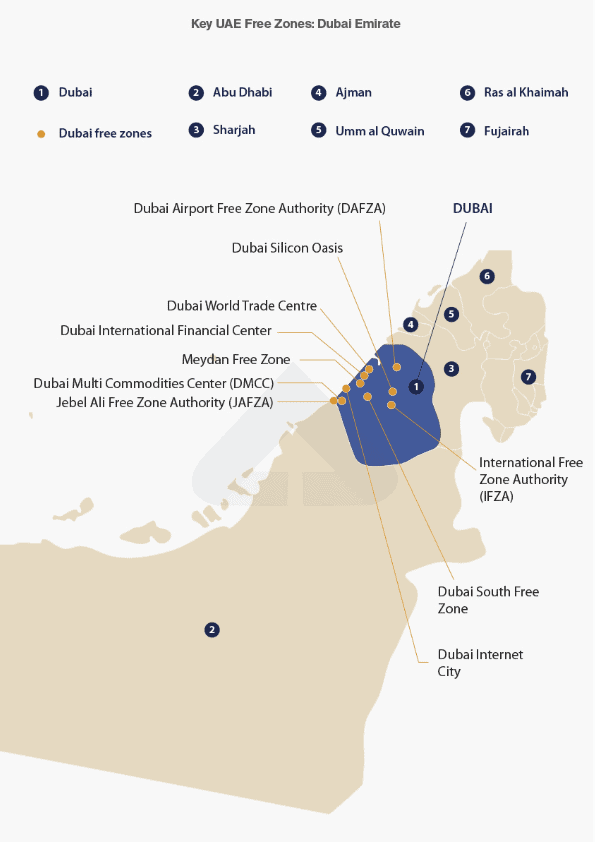

- Licenses could be obtained in two methods:

- Mainland license. Permits you to promote immediately within the UAE market.

- Free zone license. Cheaper and simpler, however could restrict the way you commerce domestically until you’re employed with a distributor.

- The licensing price can differ, however many entrepreneurs select free zones as a result of they’re extra versatile and business-friendly.

Backside line: Dropshipping within the UAE is authorized, however you want an ecommerce license and will have to register for VAT as your online business grows.

Is there any nation the place dropshipping isn’t authorized?

The easy reply isn’t any; there is no such thing as a nation that has fully banned dropshipping.

The enterprise mannequin itself is authorized worldwide.

Nonetheless, in some international locations, the limitations are so excessive that it will possibly appear virtually unimaginable to run a dropshipping retailer legally.

A couple of examples are:

- Nigeria and different components of Africa. Whereas dropshipping is not unlawful, many entrepreneurs battle with unreliable cost gateways, weak logistics networks, and strict international change guidelines. This makes scaling very exhausting in comparison with Western markets.

- Turkey. The Turkish authorities has strict guidelines round import licensing and customs clearance. Lengthy transport delays, excessive import taxes, and continually altering laws can frustrate each sellers and patrons.

- Russia. Dropshipping is technically authorized, however sanctions, cost restrictions (like PayPal being restricted), and customs challenges make ecommerce extraordinarily tough.

- Argentina. Excessive inflation, strict forex controls, and heavy import taxes make it powerful for dropshippers to remain worthwhile. Even when your retailer is authorized, getting merchandise delivered easily is a large problem.

- Saudi Arabia. Just like the UAE, you want an official license to function an internet enterprise.

Conclusion

So, is dropshipping authorized in your nation?

The reply is sort of definitely sure.

However as you have seen, the expertise could be very totally different relying on the place you reside or the place you need to promote.

In locations just like the US, UK, or Singapore, dropshipping is comparatively simple in case you deal with taxes and client rights correctly.

However in international locations similar to Nigeria, Turkey, or Argentina, the additional challenges with funds, imports, or licenses could make it really feel prefer it’s unlawful.

Have an important remainder of your day!

Wish to be taught extra about dropshipping?

Prepared to maneuver your dropshipping retailer to the following degree? Take a look at the articles beneath:

Plus, do not forget to take a look at our in-depth information on the way to begin dropshipping right here!