In April 2025, electronics 3D printing agency Nano Dimension accomplished its long-anticipated acquisition of business 3D printer producer Desktop Steel (DM), 9 months after saying the $179.3 million deal. Shortly thereafter, Nano Dimension closed its $116 million takeover of Markforged, a Massachusetts-based FDM and binder jetting 3D printer OEM, first disclosed final September.

The offers adopted a protracted stretch of M&A uncertainty, marked by lawsuit filings and boardroom upheaval. For Julien Lederman, Nano Dimension’s new Chief Enterprise Officer (CBO), strategic change is crucial.

In a current dialogue with 3D Printing Business, he defined the rationale behind Nano Dimension’s new path. The up to date management group, now led by CEO Ofir Baharav, is prioritizing progress and shareholder return amid increasing market potential. Lederman cites the Prismark Printed Circuit Report as indicating that the focused addressable marketplace for the corporate’s electronics enterprise will method $12 billion by 2028.

“Nano Dimension has misplaced cash prior to now, and that should change,” emphasised the CBO. Nano Dimension reported a $86.4M working loss in FY’24, a 30.8% enchancment YoY from -$124.9M in FY’23. For the previous World Financial Discussion board government, profitability requires stricter fiscal self-discipline and a sharper funding focus. These ideas underpin the agency’s shift away from its earlier M&A-heavy technique.

Lederman supplied a standing replace on the Desktop Steel and Markforged acquisitions. He detailed plans to deal with Markforged’s excessive operational prices and defined how consolidation will influence worker headcount, whereas Desktop Steel goes by means of an unbiased strategic evaluation. Lederman additionally addressed Nano Dimension’s resolution to discontinue its Admatec, DeepCube, Fabrica, and Formatec product strains, which is predicted to assist unlock $20M in annualized financial savings.

![[INTERVIEW] Nano Dimension’s New Route: Unique Updates from Julien Lederman [INTERVIEW] Nano Dimension’s New Route: Unique Updates from Julien Lederman](https://3dprintingindustry.com/wp-content/uploads/2025/05/Julien-Lederman-Nano-Dimensions-CBO.-Photo-via-Nano-Dimension2.jpeg)

New Nano Dimension technique targets shareholder worth

Lederman joined Nano Dimension in 2021, as the corporate skilled a surge in capital funding. On $7M in income in 2020, the corporate raised roughly $1.5 billion by means of a collection of secondary choices on Nasdaq. “That’s lots of capital for an organization that was comparatively small,” defined Lederman, who was tasked with rising the enterprise by means of M&A, technique, and company improvement.

Following 2024’s boardroom shuffle that ousted then-CEO Yoav Stern, Lederman was appointed Interim CEO. This transfer got here amid a shift in doctrine on the Israel-headquartered 3D printer OEM. “The corporate wanted, and to some extent nonetheless wants, a metamorphosis,” added Lederman. His mandate spans post-merger integration, technique, communications, and different strategic initiatives aimed toward enhancing shareholder worth.

Lederman believes Nano Dimension’s management change adopted a transparent message from shareholders, lots of whom felt “Nano Dimension was not the place it wanted to be for a public firm.” Specifically, Lederman highlighted Nano’s inventory value. He famous that the corporate was buying and selling “at roughly a 50% low cost to money.” This mirrored a insecurity from traders who noticed Nano Dimension as “destroying worth.” This “goal actuality is a robust indication that change is required,” Lederman defined.

In consequence, Nano Dimension’s new management is charting a course targeted on monetary self-discipline and value discount. Lederman acknowledged that this technique would require “robust selections” that profit traders, prospects, and staff by “constructing an organization to final.” He added that whereas Nano Dimension goals to “preserve our place as the perfect capitalized firm within the business,” this requires avoiding a “short-term mindset,” which regularly results in fast money burn and compelled selections. The buildup of capital didn’t go unnoticed, attracting the eye of an activist investor.

Underneath the oversight of Yoav Stern, the earlier government group had a public feud with Murchinson Ltd., an activist shareholder that owns roughly 10% of Nano’s excellent shares. This fraught relationship got here to a head in 2023 when Murchinson led an unsuccessful hostile boardroom takeover, accusing the Stern-led administration of “underperformance and horrible company governance.” Lederman says Nano Dimension has now “taken a special tone with shareholders.”

This relationship has smoothed since December 2024, when Nano Dimension’s Administrators have been changed with Murchinson-backed candidates. In line with Lederman, this new-look management group is collaborating carefully with its shareholders, relatively than “making an attempt to villainize or overly critique them.” He explicitly acknowledged that the corporate is working to keep away from “the general public points that have been on show prior to now,” between Murchinson and Stern. “We’re a public firm,” Lederman careworn. “[Increasing shareholder value] is our best accountability.”

Wanting forward, Nano Dimension is prioritizing consolidation over contemporary M&A dealmaking. “Buying is simple, however integrating could be very troublesome. That’s the place both the worth creation occurs, or the dangerous deal occurs,” Lederman defined. Due to this fact, the present focus lies in managing the addition of Desktop Steel and Markforged.

Nevertheless, Lederman clarified that “this doesn’t imply we’ll by no means do an acquisition once more.” As a substitute, Nano Dimension will observe a strategic method that’s conscious of the 2 new acquisitions and the way they match into the broader firm.

He supplied a frank evaluation of the difficulties forward. “You’re bringing probably three organizations collectively: totally different cultures, operations, expertise stacks, management groups.” Past the expertise or price ticket, Lederman believes the cultural and organizational parts are important. “It’s not simply concerning the tech, but in addition whether or not these organizations match collectively properly. That was definitely factored in after we did this.”

Replace on Desktop Steel and Markforged acquisitions

Though the acquisition has been accomplished, Desktop Steel’s future at Nano Dimension stays unsure. Instantly after confirming the deal, Baharav referred to as the mix a “important alternative” and shared his pleasure at providing “main prospects extra modern applied sciences.”

Nevertheless, following its acquisition, the multi-technology 3D printer producer initiated a technique evaluate whereas working as an unbiased subsidiary of Nano Dimension. This ongoing course of is exploring all choices, together with potential restructuring. Desktop Steel’s monetary place raises urgent issues. The corporate possesses restricted liquidity and substantial liabilities. This contains $115M in excellent convertible notes, issued earlier than the acquisition. Desktop Steel reportedly lacks the liquidity to repurchase the notes, as required by the indenture, or to fulfill its different obligations. Nano Dimension supplied restricted financing to deal with short-term liquidity wants and assist its strategic evaluate, however has not but dedicated further capital.

Lederman famous that Desktop Steel affords “some nice applied sciences,” an overlapping buyer base, and a shared give attention to industrial improvement. Nevertheless, he careworn that the macro setting has shifted dramatically for the reason that July 2024 settlement, significantly following the election of Donald Trump because the forty fifth U.S. President. In the end, extra readability is predicted following the completion of Desktop Steel’s inside evaluate, which is being performed independently from Nano Dimension, the dad or mum firm. “There are alternatives sooner or later, but it surely’s too early to say what that appears like,” Lederman added.

The longer term seems safer for Markforged. Lederman highlighted the synergy between Nano Dimension’s legacy in electronics and Markforged’s energy in mechanical industrial parts. He believes “definitely, there may be an enlargement with our functions.”

Nano Dimension has additionally highlighted the worth of Markforged’s cloud-based AI inspection and monitoring software program, Blacksmith. In a press launch, the corporate referred to as this “a leap ahead in AI-enhanced manufacturing,” emphasizing that Markforged addresses “important” repeatability challenges. Lederman echoed this sentiment. He acknowledged that Nano Dimension is “enthusiastic about their portfolio usually, significantly their software program providing.” He added that Markforged’s software program portfolio “may change into a strategic asset.”

Whereas Lederman acknowledged Markforged’s excessive operational prices, he expressed confidence in tackling the difficulty. He outlined his plan to align bills, significantly administration and normal administrative prices, with “regular expense ratio benchmarks.”

Nano Dimension may also work to interrupt down organisational silos and guarantee efficiencies, “particularly in how we serve Markforged prospects.”

Moreover, Lederman revealed a plan to “drive operational enhancements in each different area.” Specifically, it will embrace “consolidation on the administration degree” to create a “flatter organisation that may innovate and execute extra successfully.” He revealed that Nano Dimension is within the strategy of conducting manufacturing rationalization, with a give attention to long-term competitiveness, progress potential, and shareholder return on funding.

Is Nano Dimension planning redundancies following its acquisitions of Desktop Steel and Markforged? Lederman acknowledged that no plan has been introduced regarding headcount, however acknowledged that “some consolidation” is predicted. “We’re actively reviewing structural necessities,” Lederman added. “We additionally look forward to finding an array of organizational synergies, and we’ll adapt the group accordingly.”

Additive manufacturing electronics poised for progress

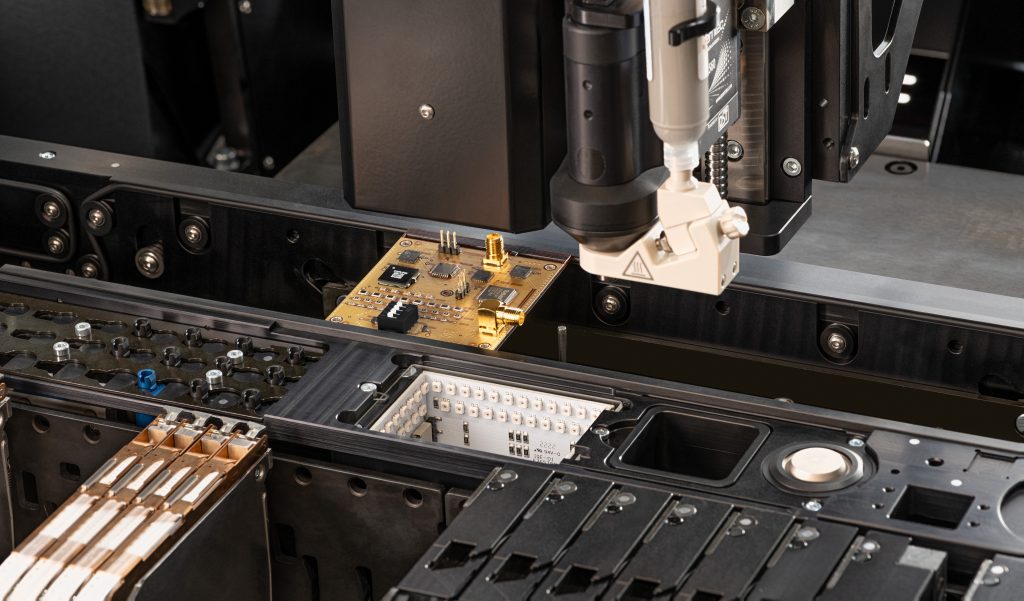

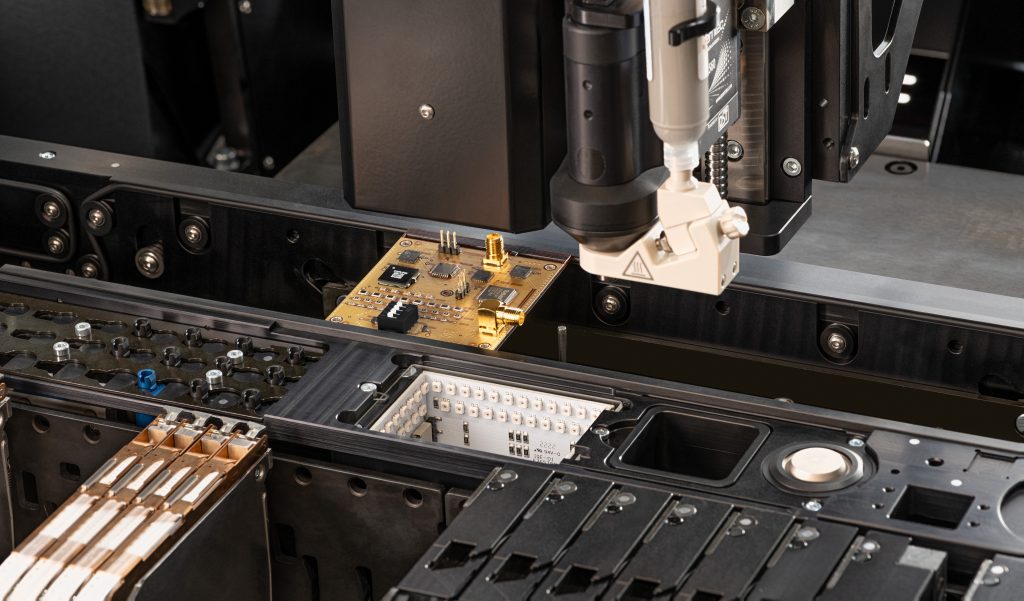

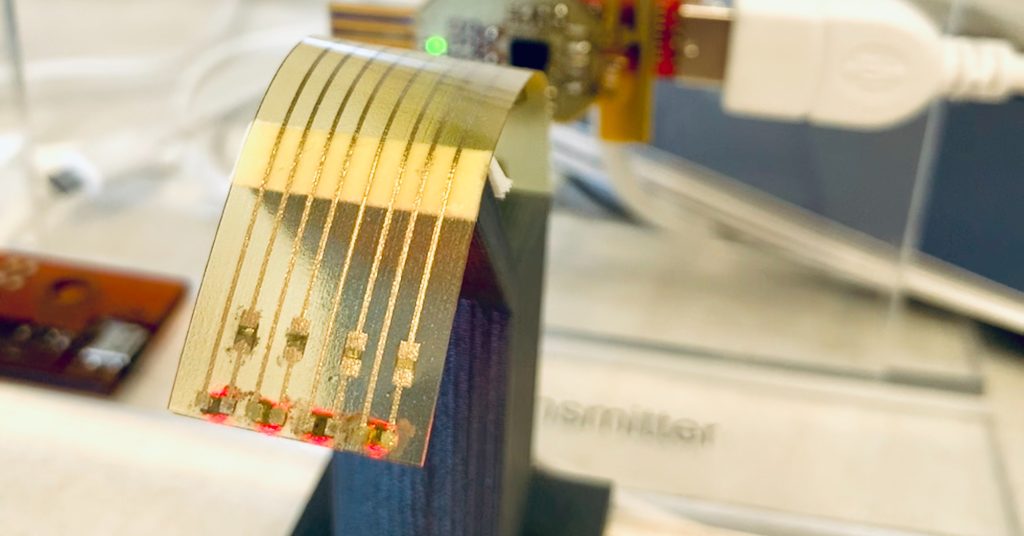

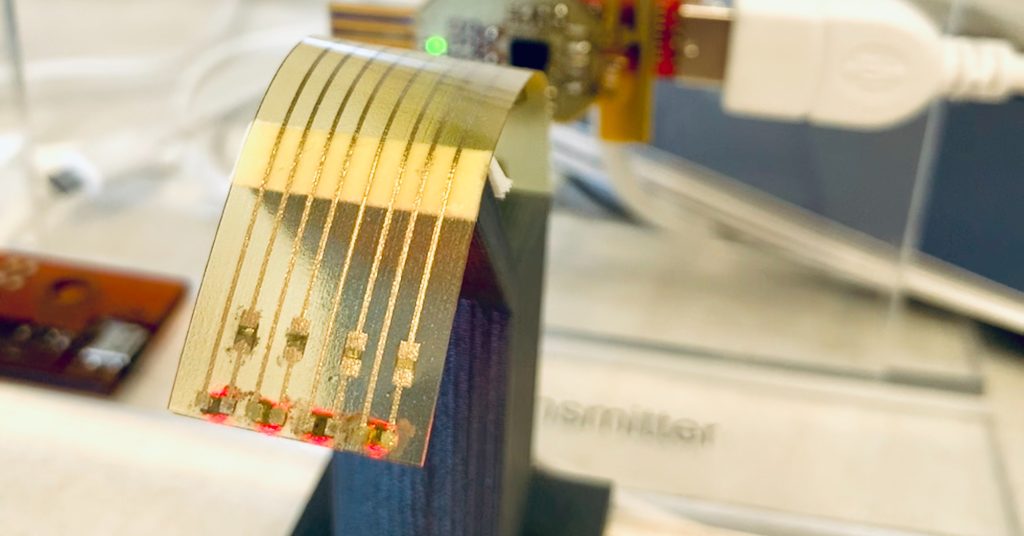

Amid the addition of two new 3D printing expertise portfolios, Nano Dimension’s dedication to Additive Manufacturing Electronics (AME) stays agency. “It’s core to our differentiation,” Lederman stated. “We consider now we have the perfect printers on this house.”

Lederman sees no direct rivals to Nano Dimension throughout the 3D printing sector. Whereas firms like BotFactory additionally 3D print PCBs (printed circuit boards), he famous they aim “easier functions.” As a substitute, he views the actual competitors as typical PCB and electronics producers. Nano Dimension’s technique is to not compete with different disruptors, however to exchange legacy processes with sooner, extra versatile additive manufacturing processes.

When requested about scalability, Lederman famous that a lot of the additive manufacturing sector nonetheless facilities on prototyping. The identical holds for Nano Dimension, which stays “within the early a part of that curve” for high-mix, low-volume manufacturing. He believes the one solution to “actually advance” 3D printing is to maneuver past prototyping and into industrial-scale manufacturing.

That shift is already underway. By means of its Swiss subsidiary Essemtec, Nano has established a foothold in high-mix, low-volume functions. Essemtec focuses on digital meeting gear and provides parts for high-value sectors akin to aerospace and automotive. In line with Lederman, it has already scaled to producing 1000’s of end-use elements, utilized in the whole lot from spaceships to automobiles.

To keep up its give attention to AME, Nano Dimension introduced plans to discontinue Admatec, Formatec, Fabrica, and DeepCube, merchandise it described as “non-core.” Acquired between 2021 and 2022, these companies focus on ceramic 3D printing, micro additive manufacturing, and deep studying AI software program.

Lederman defined that the choice stemmed from the product teams “not fairly assembly our ROI aims for our shareholders.” Shuttering these operations is predicted to assist lower over $20M in annualized working bills and increase income per worker by 52%, from $147,000 to $223,000.

The way forward for 3D printing at Nano Dimension

For the way forward for Nano Dimension, Lederman painted a transparent strategic ambition marked by “progress, profitability, and focus.” Like many 3D printer OEMs, Nano Dimension stays unprofitable. Nevertheless, Lederman is assured this will change.

“The secret is excessive margin with decrease OpEx,” he stated, contrasting the business’s tendency towards low-margin merchandise supported by unsustainably excessive operational prices. It’s a simple system, however one which requires self-discipline.

Lederman referred to as for a give attention to markets the place Nano Dimension is usually a “market chief” and preserve pricing energy. It will be sure that the corporate will not be disrupted by low-cost rivals, “as a result of we give attention to services the place now we have a aggressive benefit.”

Nano Dimension’s new CBO needs to place the corporate as a number one “enabler of future developments.” He drew parallels with Corning Glass, which was important within the improvement of the iPhone. “The unique iPhone wouldn’t have occurred with out Corning,” Lederman defined. “We wish to be like that expertise, enabling the longer term to occur.”

As Nano Dimension strikes ahead, its management is betting on focus, fiscal self-discipline, and deep technological integration to show the web page on previous turbulence. With a redoubled give attention to AME, the corporate is focusing on monetary progress and profitability to spice up shareholder return. If profitable, this might shift Nano Dimension from a capital-heavy disruptor to a leaner enabler of the following technology of producing.

Take the 3DPI Reader Survey — form the way forward for AM reporting in beneath 5 minutes.

Who received the 2024 3D Printing Business Awards?

Subscribe to the 3D Printing Business e-newsletter to maintain up with the newest 3D printing information.

You may as well observe us on LinkedIn, and subscribe to the 3D Printing Business Youtube channel to entry extra unique content material.

Featured picture reveals Julien Lederman, Nano Dimension’s CBO. Photograph by way of Nano Dimension

![[INTERVIEW] Nano Dimension’s New Route: Unique Updates from Julien Lederman [INTERVIEW] Nano Dimension’s New Route: Unique Updates from Julien Lederman](https://i2.wp.com/3dprintingindustry.com/wp-content/uploads/2025/05/Julien-Lederman-Nano-Dimensions-CBO.-Photo-via-Nano-Dimension2.jpeg?w=696&resize=696,0&ssl=1)