Vestiaire Collective sells secondhand luxuries far beneath retail, corresponding to Chanel tweed jackets for $1,500 and Fendi purses for $650. It simply grew to become the primary attire market to supply carbon credit as properly.

The Paris-based peer-to-peer reseller is translating the carbon emissions saved by clients’ secondhand purchases into credit to fund its purpose of a “100% round enterprise.”

“The ambition is to create a virtuous cycle, the place measurable environmental efficiency generates the monetary sources wanted to scale it additional,” in keeping with Vestiaire’s “Shaping a Round Future” 2025 report, launched Oct. 3 together with its credit program.

Carbon credit are usually related to high-emitting sectors corresponding to metal or delivery, however Vestiaire argues that trend belongs in that class too.

“For me, the thought of constructing income via influence work may be very crucial,” stated Vestiaire Collective Influence Director Hortense Pruvost.

That stated, critics warn that the carbon credit program is unintentionally encouraging overconsumption and even greenwashing.

Round trend

The style business creates between 2 and eight % of world carbon dioxide air pollution, relying on how one measures such issues.

Vestiaire Collective is pricing its credit at virtually $40 per metric ton of CO2 equal. It plans to supply 25,000 credit per yr via Inuk, a Paris agency that verifies carbon credit.

In Pruvost’s view, making Vestiaire’s round mannequin viable via credit will advance sustainability within the business. Shopping for pre-owned as a substitute of latest clothes gives 42 % decrease local weather and vitality impacts, in keeping with a 2023 research within the Journal of Round Financial system.

“We’re positively very combative about quick trend and throwaway trend normally,” Pruvost stated of its mission to supply high-end, long-lasting items. It lists objects from greater than 13,000 labels together with Chanel, Missoni, Versace and Zegna. Vestiaire not solely bans ultrafast manufacturers corresponding to Shein, but in addition greater than 60 mass-production mall manufacturers together with Abercrombie & Fitch, Hole, H&M and Zara.

Vestiaire operates in another way from different secondhand trend websites. Digital thrift store Vinted, now France’s high clothes retailer, has decrease overhead and cheaper items. The Lithuanian firm quadrupled its earnings in 2024. Luxurious San Francisco reseller The RealReal seems to be approaching a break-even level.

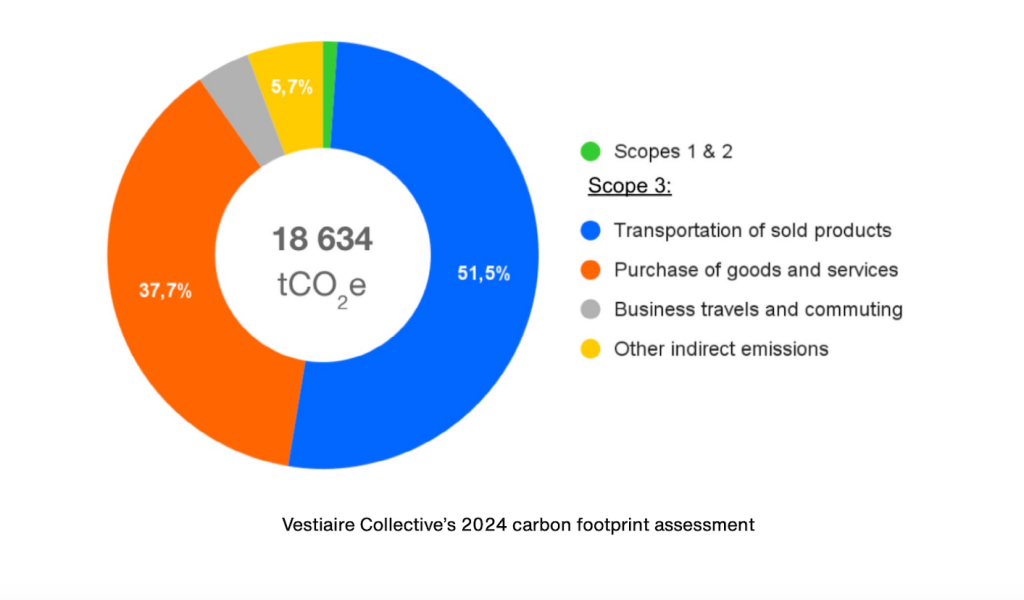

For Vestiaire, which has not reached profitability after 15 years, the carbon credit present crucial assist. Most of its emissions come from delivery merchandise, and the corporate creates no items. Nonetheless, for roughly one-third of gross sales, customers request authentication at a Vestiaire warehouse. Heading off knockoffs provides $17.56 per merchandise. Authentication applied sciences eat up the equal of 12 % of the corporate’s income, in keeping with Vestiaire.

That threatens the corporate’s efforts to advance circularity, in keeping with Pruvost. Synthetic intelligence instruments and digital product passports could provide future assist, and add prices, in opposition to more and more subtle counterfeiters, she added.

How the credit work

The carbon credit, obtainable on Inuk’s web site (French), are supposed to entice institutional patrons that want to assist a round financial system.

Vestiaire partnered with Inuk to develop a brand new methodology moderately than search a worldwide third-party certification physique corresponding to Verra or Gold Customary, in keeping with Pruvost.

New Jersey agency AmSpec validates Inuk’s strategies.

To reach at a conservative estimate of averted emissions for round flows of products, Inuk’s methodology thought of a secondhand “substitution price” of 85 %, a measure of the pre-loved purchases that exchange the necessity for brand spanking new objects. Inuk additionally thought of a “rebound impact” that will lead a secondhand shopper to purchase extra garments, along with the idea that used objects don’t final so long as new ones.

“This can be a very novel area,” stated Alena Raymond, senior principal life cycle evaluation practitioner at AmSpec. “There aren’t guidelines that match each program on the market, and so the strategy right here was to drag from present requirements and business finest practices throughout the area of quantifying averted emissions.”

The averted emissions program is particularly tailor-made to Vestiaire to encourage a round financial system, Raymond added. As well as, it follows a number of requirements from the Worldwide Requirements Group concerning lifecycle assessments, greenhouse-gas quantification and carbon footprinting.

A detailed parallel to Vestiaire’s program emerged in September, when London-based Bloom ESG launched credit for emissions averted by {hardware} recyclers.

Vestiaire’s credit sign the necessity for a round financial system to help broader financial decarbonization, in keeping with Sebastian Foot, founding companion of Bloom ESG. “Creating new incentives for round fashions that scale back quick trend and divert clothes from landfill ought to be embraced,” he stated.

Rewards or dangers?

Regardless of obvious good intentions, nevertheless, Vestiaire’s program dangers greenwashing, in keeping with Benja Baecks, an professional on world carbon markets with the nonprofit Carbon Market Watch in Brussels.

“These credit don’t signify real emission reductions; they’re merely monetizing present client habits,” she stated. “It sends the incorrect sign by suggesting that purchasing extra garments, albeit used ones, helps battle local weather change.”

Pruvost, however, sees a payoff in risking controversy. “I’m very assured in our strategy, however I’m additionally blissful to take the chance, as a result of for me it goes past the voluntary carbon market,” she stated. “It’s actually how we fund the round transition that all of us want to see occur.”