Gross sales are sometimes received or misplaced at checkout, so giving prospects extra flexibility at that essential second could make a huge impact. Purchase now, pay later (BNPL) choices make it simpler for buyers to decide to bigger purchases with out placing additional danger on your enterprise.

As a service provider, you continue to receives a commission in full up entrance, whereas the BNPL supplier handles credit score checks and collects buyer funds.

On this put up, we’ll present an entire overview of what BNPL is, the way it may help your store, and several other methods to supply it by means of WooCommerce. By the top, you’ll be capable to confidently get began with the suitable BNPL supplier to scale back checkout friction and improve conversions.

Purchase now, pay later (BNPL) permits prospects to separate their purchases into smaller installments whereas retailers obtain full cost upfront.

The BNPL supplier handles the duties of underwriting prospects, coping with any credit score bureaus, and managing and accumulating funds so retailer house owners can give attention to their enterprise. And, if a buyer information a fraud-related dispute, BNPL lenders tackle the danger and any related prices.

Providing BNPL can enhance your common order worth, improve conversions, and easily present a greater expertise that results in happier prospects.

Let’s dive into different methods BNPL can profit your retailer, particularly when you promote high-value gadgets.

Consumers recognize selection. They pay utilizing a wide range of strategies and worth streamlined cost options that assist them do extra with much less. Listed here are 5 causes providing BNPL is a win-win:

1. You’ll be able to convert extra guests

In his guide Virtually Alchemy, advertising legend Dan Kennedy tells the story of a consumer who was promoting an merchandise for $29.95. Kennedy suggested him to promote it in two funds of $19.95. He bought twice as many models, although the acquisition worth was $10 greater.

The arduous information backs up this principle, with Afterpay retailers reporting an common 22% improve in cart conversions. You’ll promote extra merchandise if prospects could make versatile, interest-free funds as an alternative of paying all of sudden.

You’ll be able to provide an installment cost choice for orders with a number of merchandise, too — it’s not restricted to higher-value gadgets. Say a buyer desires to purchase a $200 product. Supply the choice of paying the entire up entrance or paying in 4 installments of $50. Fewer patrons may have second ideas in regards to the complete value if there’s an choice to pay month-to-month.

2. You’ll improve your margins

Versatile funds are an amazing various to conventional discounting. Patrons are capable of get extra of what they want by avoiding giant lump-sum funds. In flip, you’ll be capable to defend your margins on merchandise.

Right here’s an internet enterprise promoting a course with three choices for cost: a lump sum, 4 funds of $225, or ten funds of $99.

Not solely have they received 27% extra prospects since they started providing month-to-month funds, however 90% of their prospects who select to pay month-to-month select ten funds, although it prices $100 greater than the four-payment plan. Because of this 90% willingly pay extra in complete, simply to get a decrease month-to-month cost quantity for bigger purchases.

A latest research even discovered that Afterpay retailers see a mean 40% improve so as worth, plus extra repeat prospects.

3. You’ll be able to provide patrons extra selections

Providing a wide range of cost selections communicates that you simply need to make issues as straightforward as doable to your prospects. You’re attempting to satisfy them the place they’re with extra versatile cost choices.

Neil Patel reviews that 56% of shoppers anticipate a wide range of cost choices on a checkout web page. A lot of your buyers need the flexibility to pay in equal installments — and in instances of financial uncertainty, much more folks search for methods to pay flexibly.

The goodwill you’ll generate, even from non-buyers, can solely be a great factor for your enterprise and might result in constructive word-of-mouth suggestions, higher critiques, and higher buyer loyalty.

4. You’ll be able to scale back overhead and admin prices

Facilitating down funds and month-to-month cost plans your self invitations a number of irritating administrative issues, and probably deprives you of income if the shopper stops making funds earlier than finishing all of them.

Managing cost plans is a time-consuming, on a regular basis job. Bank cards can expire earlier than all of the funds have been made, requiring you to comply with up. It’s a must to remind prospects of upcoming funds. Facilitating product returns turns into extra sophisticated as a result of you will have to kind by means of cost historical past to grasp the correct refund to difficulty. You’ll spend time chasing late charges which might be almost inconceivable to get well.

However devoted BNPL options handle all these items. As soon as a client completes a purchase order, you’re paid for the complete transaction inside days. The purchase now, pay later supplier companies the account and takes on the danger, from chargebacks to fraud.

Finally, the method is seamless for each you and your buyer, and also you don’t must shoulder any of the danger.

6. You’ll attain extra prospects

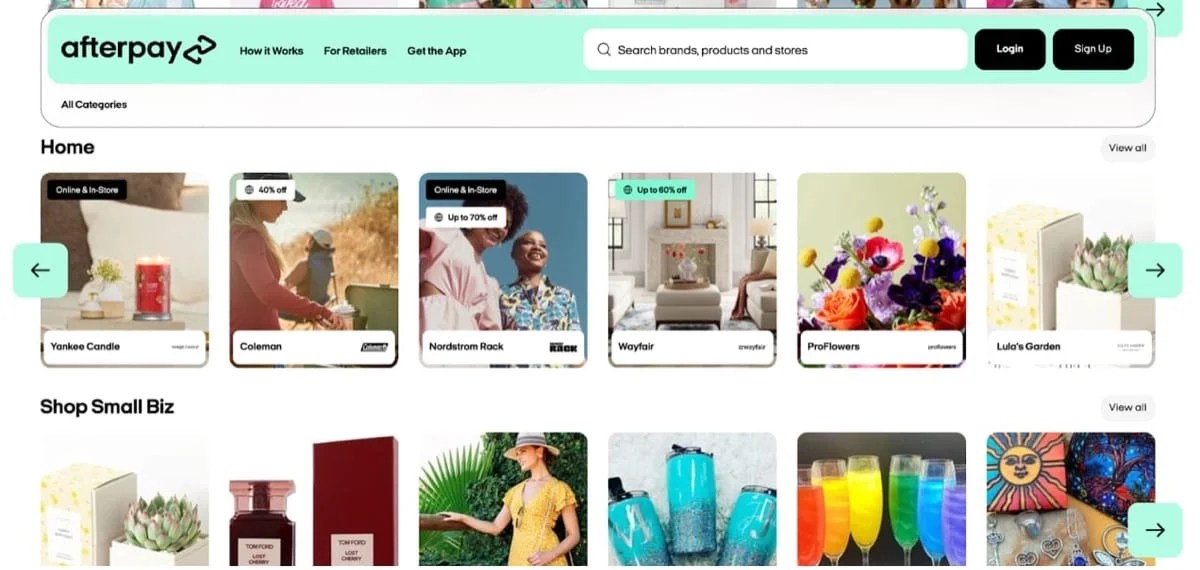

Affirm, Afterpay, and Klarna have directories the place prospects can discover trusted shops providing a BNPL plan. Every supplier has hundreds of thousands of customers and almost limitless potential for sending highly-valuable visitors to your retailer.

Klarna additionally presents a performance-based media combine that locations your enterprise in entrance of high-intent buyers throughout a number of channels — from consciousness to conversion — leveraging wealthy shopper insights and point-of-purchase attribution throughout Klarna surfaces.

BNPL choices are particularly engaging to youthful prospects who could have decrease credit score scores, no bank card, or no capacity to pay for giant purchases in a single cost. In truth, Afterpay’s community of 20 million world prospects is made up of 73% Gen Z and millennial customers.

In response to Afterpay, retailers discover that 30% of Afterpay buyers are new to their model, making it an effective way to succeed in and win new prospects.

As all the time, WooCommerce permits for unimaginable flexibility with regards to BNPL choices. Shops can combine with Affirm, Afterpay, and Klarna utilizing three main strategies:

- Standalone extensions: All three BNPL suppliers — Affirm, Afterpay, and Klarna — provide particular person extensions you can set up from the WooCommerce market. This can be a nice method to go if you wish to add to an current cost stack.

- WooPayments: With WooPayments, you may provide BNPL choices to your prospects along with credit score and debit playing cards, digital wallets like Apple Pay, Faucet to Pay (for in-store purchases), and extra. There’s no want for added extensions or switching between tabs. Plus, current WooPayments customers profit from a streamlined approval course of.

- The Stripe extension: For those who’re already utilizing Stripe in your retailer, you may seamlessly add BNPL choices by means of the official Stripe for WooCommerce extension.

All three of those strategies will allow you to supply BNPL in your retailer — the most suitable choice is dependent upon the way you need to handle your total cost stack.

Affirm, Afterpay, and Klarna are all glorious BNPL suppliers. So how do you select between them? And does it make sense to make use of multiple?

Finally, this may rely on the wants of your enterprise, your world attain, and the preferences of your viewers. You may also use multiple BNPL supplier if that is smart for your enterprise.

In some instances, retailers could select to supply a number of BNPL choices relying on areas served and cost preferences.

Right here’s a desk that summarizes among the key variations between the three suppliers:

| Affirm | Afterpay | Klarna | |

| Regional availability | U.S., Canada, U.Okay. | U.S., Canada, U.Okay., Australia, New Zealand | Out there globally in 26 markets, together with the U.S., Canada, Mexico, the U.Okay., most of Europe, Australia, New Zealand |

| Fee strategies | Pay in 30, Pay in 4, and month-to-month installments as much as 36 months, for carts of $35 to $30,000 | Pay in 4, month-to-month installments | Pay in 30 days, Pay in 3 or 4, Financing, and Pay in Full |

| Help choices for retailers | A devoted service provider assist, a Shopper Success Supervisor for bigger companies, a self-service service provider portal, a knowledgebase | A devoted Technical Service provider Providers lead, a Associate Advertising and marketing lead, an Account Supervisor, 24/7 entry to technical assist | Onboarding help, a devoted service provider portal, 24/7 assist for technical and operational queries |

| Help choices for patrons | 24/7 assist by means of a wide range of channels, a self-serve buyer assist heart, an in-app and net assist | A assist heart, a assist ticketing system | 24/7 assist through dwell chat or cellphone |

| Finest for | Shops with high-value merchandise or excessive AOV, and prospects planning main life purchases | An AOV of as much as $3,000 (for Pay-in-4), buy totals of between $100 and $10,000 (for Pay Month-to-month), a target market made up of scholars | Companies of all sizes and verticals on the lookout for all-in-one cost methodology |

Now, let’s dive a bit additional into every answer.

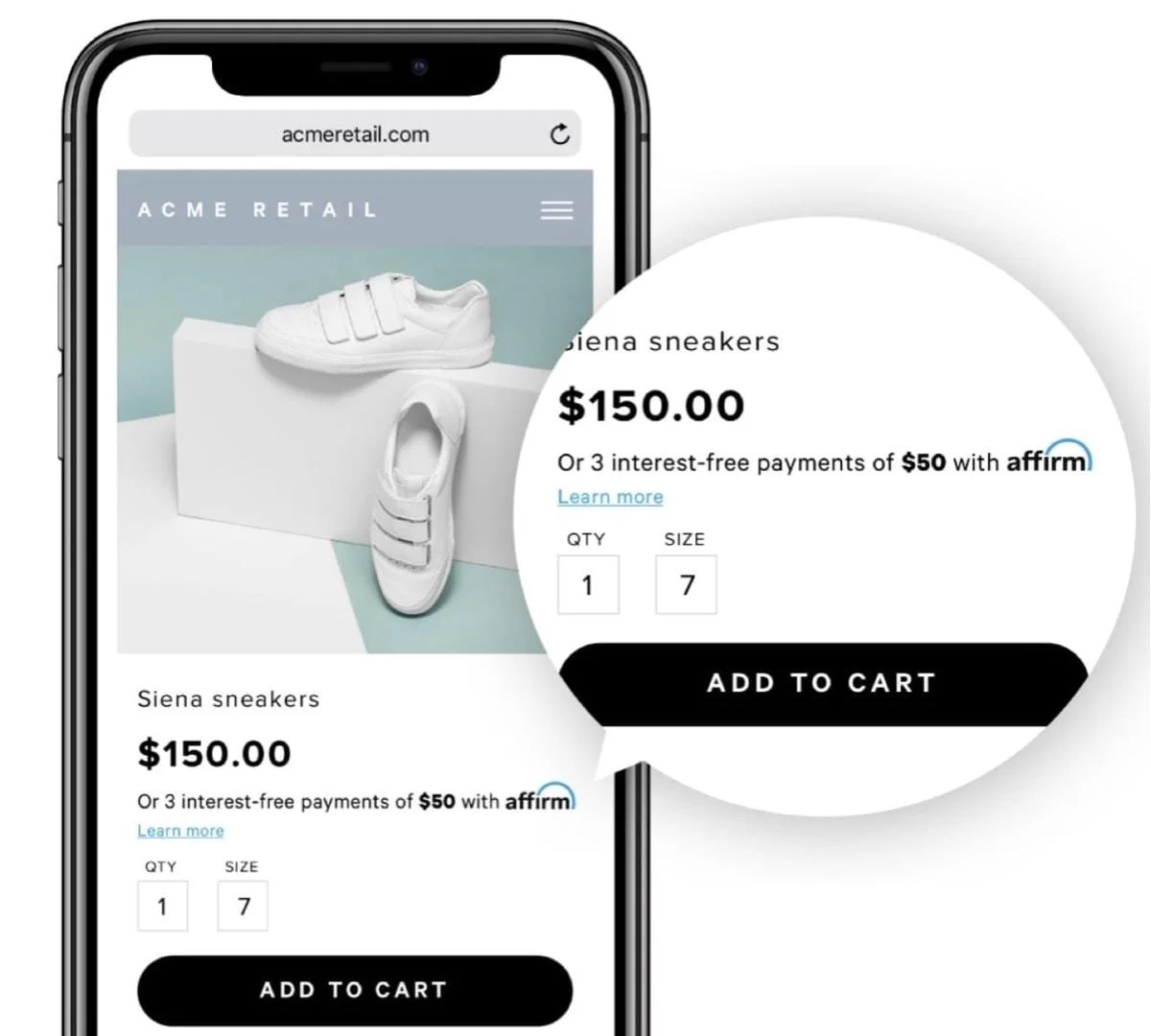

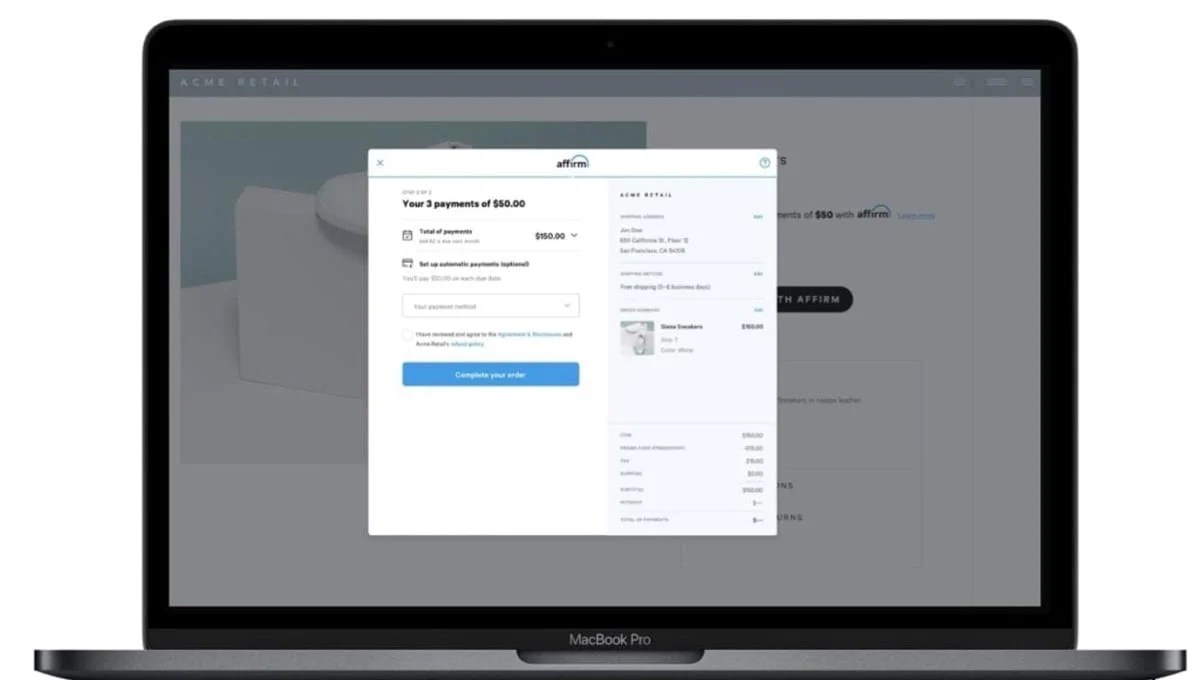

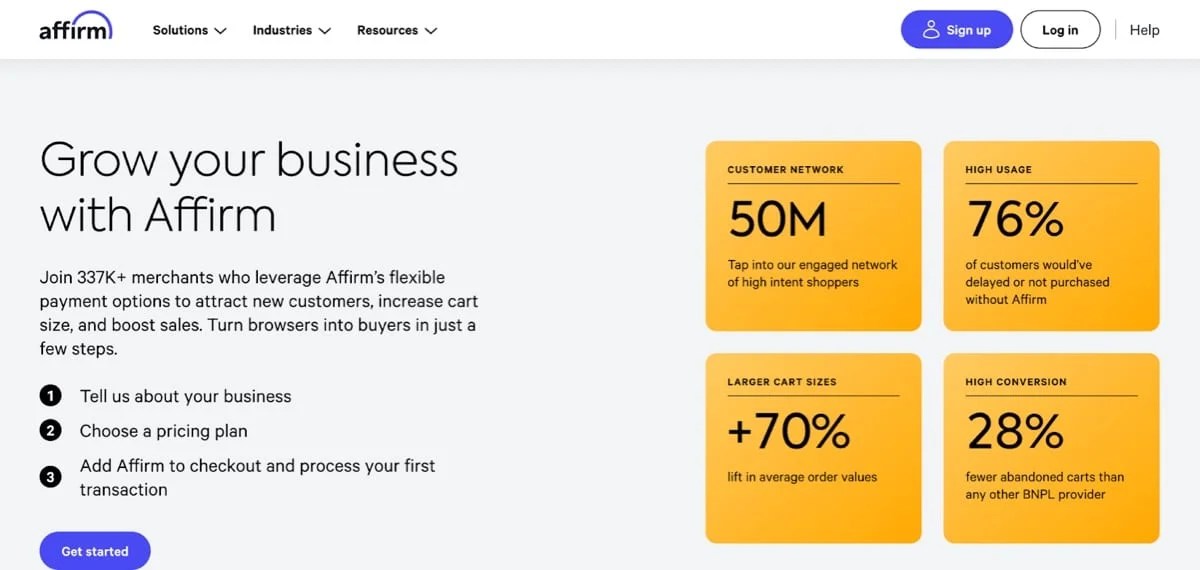

Affirm

Affirm is a purchase now, pay later answer that enables prospects to buy gadgets instantly and pay for them over time in fastened, clear installments.* Retail companions receives a commission for the acquisition upfront, identical to a bank card transaction, with no reimbursement danger. By providing Affirm at checkout, certified buyers have extra cost flexibility and better buying energy, which might improve gross sales, increase common order worth, and construct buyer belief.

*Topic to eligibility. See lending phrases at affirm.com/disclosures.

Fast stats:

- Retailers that provide Affirm report an over 70% carry in common cart sizes.

- Retailers have seen a 20% common improve in conversion charges after providing Affirm.

- Affirm has a highly-engaged community, with 94% of transactions coming from repeat prospects.

What units Affirm aside:

- No late charges or hidden prices: Affirm by no means expenses prospects late charges, prepayment charges, or every other hidden service charges. The acquisition quantity that buyers see at checkout is what they’ll pay.

- Superior underwriting: Affirm makes use of a proprietary, AI- and machine learning-powered underwriting mannequin that assesses a buyer’s capacity to repay in actual time. This enables for a extra nuanced credit score determination than a easy “one-size-fits-all” method and results in extra buyer approvals with out arduous credit score checks.

- Most flexibility in phrases: Affirm presents the broadest vary of reimbursement choices within the trade, from the usual interest-free “Pay in 4” choice to longer month-to-month installment plans as much as 36 months or extra for high-value purchases.

- A give attention to greater AOV: Whereas appropriate for smaller carts, Affirm’s mannequin is especially efficient for retailers that promote higher-priced items, as longer-term financing makes costly gadgets extra accessible.

Finest for:

- Excessive-value merchandise like furnishings, dwelling items, electronics, health gear, journey packages, luxurious style, and auto components/companies.

- Shops with a excessive common order worth (AOV).

- Funds-conscious customers who need to unfold their funds out over time with out the danger of compounding curiosity or hidden charges.

- Prospects planning main life purchases (e.g., furnishing a brand new dwelling, shopping for an engagement ring, and so forth.).

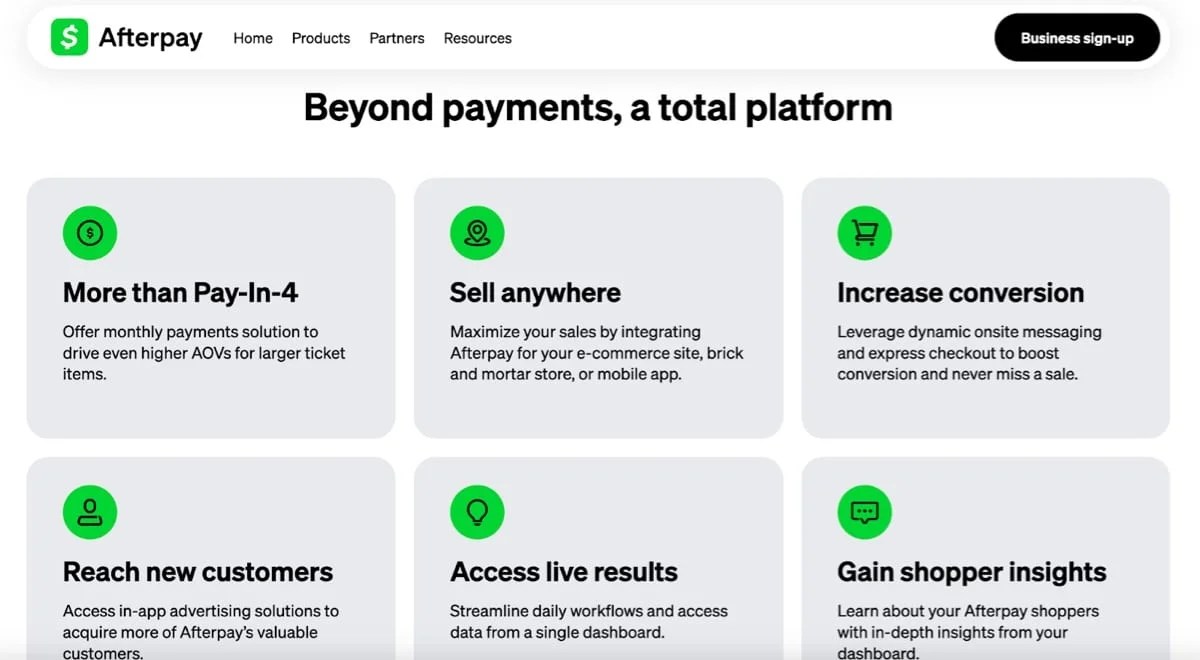

Afterpay

With Money App Afterpay, retailers can faucet into 57M+ incremental month-to-month lively prospects. Let buyers pay in 4 installments or pay month-to-month, whereas driving incremental gross sales and progress for your enterprise. Money App Afterpay is trusted by greater than 425K high manufacturers globally.

Fast stats:

- 95% of Afterpay installments are paid on time and 98% don’t incur a late payment.

- Afterpay has greater than 57 million month-to-month lively customers.

- Practically 50% of Afterpay customers’ annual spending is with Afterpay.

- 97% of Afterpay prospects by no means contact assist with issues.

What units Afterpay aside:

- Its reputation with Millennials and Gen Z: Roughly 50% of Millennials and Gen Z contemplate Afterpay to be essentially the most trusted BNPL model.

- A sophisticated underwriting mannequin: Money App’s proprietary underwriting mannequin is powered by first-party information from prospects’ cash motion, resembling paycheck deposits and peer-to-peer funds. It’s considerably more practical at predicting constructive outcomes and lowering danger, significantly for youthful customers who are sometimes underbanked and underserved by conventional monetary establishments.

- A loyal buyer base: There are a number of factors alongside the acquisition journey the place Afterpay ensures that prospects perceive the worth proposition and their reimbursement schedules. That belief interprets into unmatched purchaser loyalty, with essentially the most frequent prospects buying with Afterpay 24 instances per 12 months.

Finest for:

- Retailers with a mean order worth of as much as $3,000 (for Pay-in-4).

- Shops with common buy totals of between $100 and $10,000 (for Pay Month-to-month).

- A target market made up of scholars — Afterpay was named the very best BNPL answer for college kids.

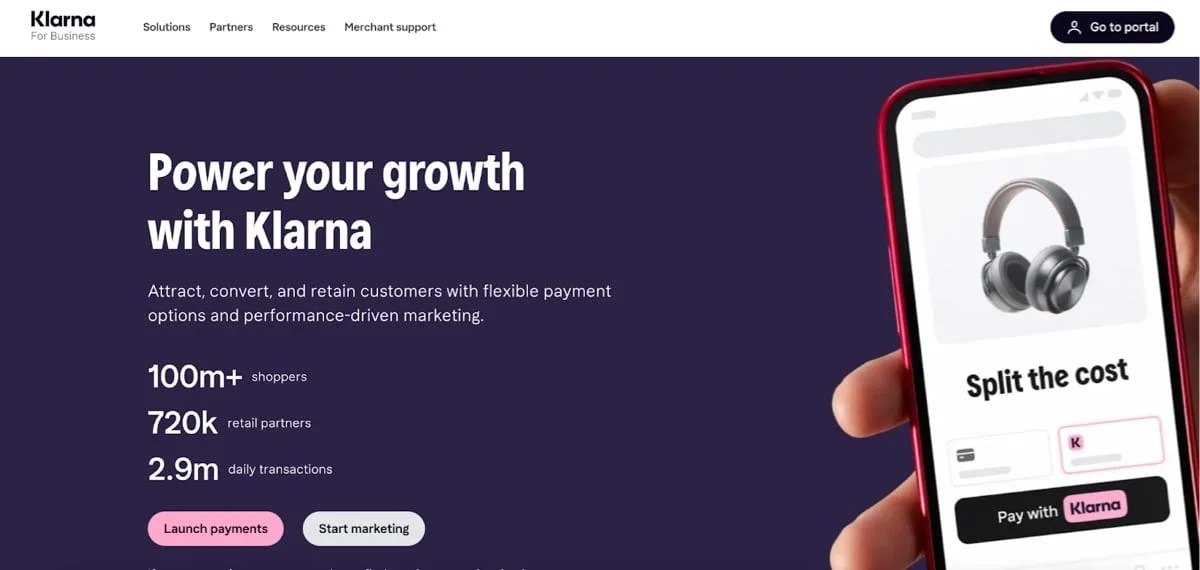

Klarna

Klarna offers a unified platform for funds, checkout, and post-purchase experiences. Its infrastructure powers a commerce community designed to enhance effectivity and conversion throughout the acquisition journey.

Fast stats:

- Klarna companions see 20% greater checkout conversion charges and 46% greater repeat buy frequency.

- Versatile choices with Klarna improve common order worth by 40%.

What units Klarna aside:

- The power to drive extra gross sales: Klarna will increase conversions by providing versatile, trusted cost selections that align with buyer expectations.

- A seamless and safe on-line buying expertise: Klarna retailers report a 46% improve in buy frequency, pushed by the belief and comfort that comes with a high quality, easy checkout.

- The power to succeed in new buyers: Faucet into Klarna’s world community of greater than 114 million high-intent buyers. In-app placements, campaigns, and advertising instruments improve service provider visibility and discovery throughout key markets.

- Upfront cost with full safety: As a licensed financial institution, Klarna assumes each credit score and fraud danger so retailers are paid up entrance, each time, with full cost ensures and strong fraud safety.

- Progress past checkout: Klarna extends its commerce community past funds by serving to retailers affect buyers earlier than they attain checkout, with performance-driven placements and point-of-purchase attribution throughout Klarna surfaces.

Finest for:

Klarna works properly for a variety of retailers and helps each high and low AOV transactions. Klarna is especially well-liked with Gen Z and Millennial audiences, so it may very well be a good selection if these generations are a key a part of your goal demographic.

Prepared to extend conversions and common order values whereas offering a useful useful resource to prospects? There are a couple of other ways to begin providing purchase now, pay later choices in your retailer:

Standalone extensions

As we talked about earlier on, Affirm, Afterpay, and Klarna every present their very own extensions, out there from the WooCommerce Market. Keep in mind, you should utilize greater than one by one.

As soon as your chosen extensions are put in, you may arrange BNPL inside the cost settings in your WooCommerce dashboard. For provider-specific directions, go to the WooCommerce Documentation hub and seek for the extension you’d like to make use of.

WooPayments

With the WooPayments BNPL integration, you may view all orders and transactions from a single dashboard — no extra leaping between home windows! And also you don’t want to put in and handle an additional extension.

For those who don’t already use WooPayments, there’s by no means been a greater time to begin. Not solely will you profit from the BNPL companies mentioned right here, however you’ll be capable to:

- Maintain all your transactions in a single place.

- Supply contactless funds, digital wallets like Apple Pay and Google Pay, and Faucet to Pay.

- Sync order info and stock updates between your on-line and offline gross sales.

- Settle for 135+ currencies.

- Combine with instruments for subscriptions, memberships, and extra.

As soon as the WooPayments extension is put in and activated, you may allow BNPL choices immediately out of your dashboard, alongside playing cards, wallets, and different cost strategies.

Evaluation the official WooPayments documentation for quick set up and directions for getting began.

Stripe

For those who’re utilizing Stripe, you may activate BNPL by means of your current Stripe extension settings in your WooCommerce dashboard. Learn the official documentation from Stripe and the WooCommerce extension for full particulars about utilizing BNPL.

Purchase now, pay later offers prospects extra flexibility at checkout and drives stronger outcomes for shops. Providers like Affirm, Afterpay, and Klarna let buyers unfold out funds with out delaying their buy, which results in greater order values and fewer deserted carts.

Are you interested by BNPL? Study extra about the way it can profit your retailer.

Able to dive in? Activate BNPL utilizing WooPayments, Stripe, or an extension from Affirm, Afterpay, or Klarna.

Is BNPL dangerous for retailers?

Purchase now, pay later suppliers deal with buyer approval and pay retailers the complete buy quantity up entrance so it doesn’t impression cost circulate. In addition they assume accountability for fraud and reimbursement issues, so the method is risk-free for retailers and offers almost limitless upside potential.

Do you want any particular instruments to supply purchase now, pay later with WooCommerce?

Retailers utilizing WooPayments or Stripe have already got entry to BNPL options from Affirm, Afterpay, and Klarna. You’ll be able to activate a number of of those suppliers in your dashboard and get rolling instantly.

For those who don’t use WooPayments or Stripe, you’ll want to put in an extension like these supplied immediately from Affirm, Afterpay, and Klarna. Each may have particular registration and activation directions. Different cost gateways might also assist integrations with these suppliers in sure areas, and this will change over time.

Are there limits to BNPL?

Sure, the flexibility to supply BNPL options in your website is topic to service provider approval and prospects’ capacity to make purchases utilizing BNPL is topic to their very own approval and limits. There are most order values for every platform, in addition to limitations primarily based on geography, forex, cost historical past, and extra.

Vanessa has spent her profession writing useful issues for folks throughout the tech house. Exterior of labor, she enjoys coaching for triathlon, rotating by means of hobbies, and exploring new locations each city and pure. She has two fluffy cats, maintains a couple of succulents, and has far too many books on her TBR shelf.