BT’s 2024/25 outcomes present fibre positive factors amid slumping enterprise and client revenues. The UK telco is shrinking its worldwide footprint, refocusing on home enterprise development, and eyeing managed service growth – which is an efficient mannequin for many telcos, reckons Omdia.

In sum – what to know

Technique shift – regardless of sturdy fibre gross sales, and in-line efficiency, BT’s enterprise income dropped 4% because it retreats from international markets, slashes merchandise, and places squarer deal with UK gross sales.

Shrewd transfer – analysts reckon its pivot is wise, and is likely to be the mannequin for many of its friends: to give up chasing massive international offers, and double-down on native adjacencies like safety and managed apps.

Engine room – the nationwide SME market, principally forgotten about in early-adopter tech segments, is the one greatest alternative for telcos to organise souped-up AI-geared field shifting as a managed service.

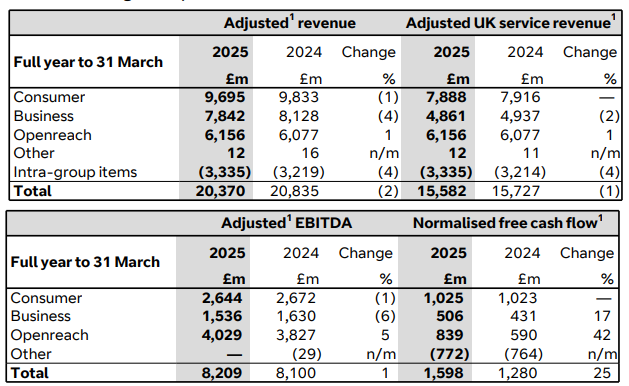

A fast have a look at BT’s full-year outcomes for 2024/25, from yesterday, vis-a-vis what they are saying in regards to the altering technique at a altering telco in a altering market – and particularly in regards to the enterprise technique at a nationwide (‘the nationwide’) telco, trying to reassert itself in its twitchy native market, in a troubled industrial sector, in a turbulent international economic system. Properly, the headline is that BT’s income is down two p.c, versus 2023/24, as notable drops in its enterprise and client items (4 p.c and one p.c) undercut good fibre gross sales.

Adjusted income slipped to £20.37 billion, from £20.835 for a similar interval a 12 months in the past. It blamed “worldwide gross sales and handsets”. However Openreach, its standalone fibre infrastructure enterprise, noticed income and revenue rally by one p.c and 5 p.c to £6.156 billion and £4.029 billion, which drove general revenue (EBITDA) and money stream greater – by one p.c and 25 p.c to £8.2 billion and £1.6 billion, respectively. It called-out “report demand” on the finish of the 12 months for fibre-to-the-premise (FTTP; “web provides above 500,000 for the primary time”).

However none of this was sufficient to compound its FTSE 100 exhibiting as “one of many worst performing shares”, sliding three p.c on the day (Might 22); nor to distract from the enterprise story, which rests on declines of 4 p.c and 6 p.c in income and revenue phrases (to £7.842 billion and £1.536 billion). In sum, BT takes 33 p.c of its complete income and 19 p.c of its complete revenue from enterprises – versus 41 p.c and 32 p.c, respectively from customers, and 26 p.c and 49 p.c from fibre infrastructure gross sales. (It is likely to be famous, right here, the latter are to broadband service suppliers within the UK, together with BT Group companies BT and EE, plus rivals like Sky and Vodafone).

The purpose is enterprise seems on a spreadsheet like extra work for much less cash. We are going to come again to it.

Simply on the outcomes: market watchers mirrored that the result’s broadly in keeping with expectation, and BT cited “sturdy price management”, which has already delivered £900 million of annualised price financial savings, and a “step-up in focus and transformation” as causes to be cheerful; it raised its full-year shareholder dividend by two p.c (to eight.16p per share). The corporate has additionally raised its fibre “construct goal” by 20 p.c to succeed in as much as 5 new million UK premises in 2025/26, to fulfill a acknowledged goal of 25 million properties by the tip of 2026.

It made hopeful noises about free money stream (£3 billion by 2030), in addition to its management staff – which is “in place to take our technique ahead”, it acknowledged. However what’s that technique, other than fibre rollout within the UK? As a result of one thing is up with its enterprise gross sales, and one thing is afoot with its enterprise technique. To recap: the enterprise is popping inwards, away from international in-market operations. In February, BT Enterprise introduced a take care of Pace Fibre Group to promote its Irish wholesale and enterprise unit. It’s eliminating its Italian footprint as properly.

“[BT] Enterprise [has] continued to refocus on the UK,” it stated. In the meantime, BT blamed the income droop in its enterprise unit on worldwide buying and selling (“principally”). And but its rationalisation crosses into its enterprise portfolio, as properly; the corporate has decreased the variety of merchandise it sells by 20 p.c, apparently – from 263 to 203. All of it’s being accomplished within the title of “modernisation”. So what provides? The punchiest response got here from Camille Mendler, analysis director for telco B2B at analyst home Omdia. “The killer stat is that nine-percent drop in worldwide [sales] – and, typically, its need to promote extra to smaller home companies in a consolidating UK market.”

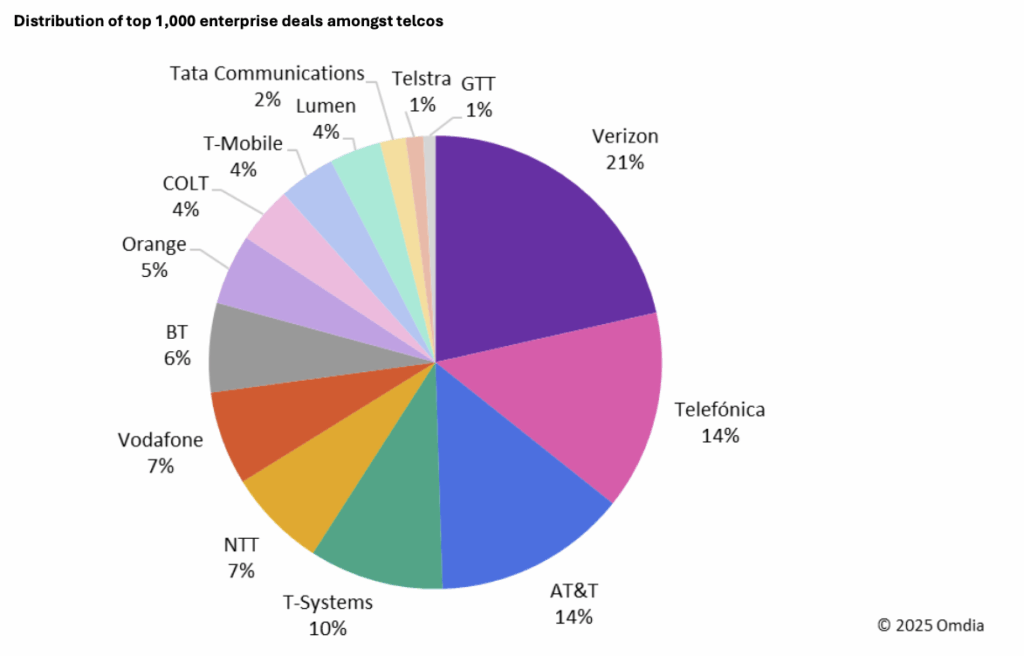

She stepped again, and defined: “BT’s ongoing worldwide losses spotlight an essential lesson: telcos should go massive or go dwelling. There’s a trillion-dollar development alternative in telco B2B however for 99 p.c of operators, it doesn’t lie with multinational enterprises. It’s time to exit dangerous enterprise and deal with rational adjacencies past connectivity. BT captured solely a six p.c share of the highest 1,000 international enterprise offers amongst its service supplier friends… Good worldwide alliances with know-how and go-to-market companions now supply the one sustainable path ahead.”

On the latter, BT pointed to offers with Equinix and Google Cloud in assist of its creating International Cloth proposition, which stitches collectively native metro-edge cloud-and-network providers for enterprises to ‘store’ for sooner compute providers through native operators and information centre companions. It covers over 30 Equinix data-centres, as of January. The association with Google Cloud is in regards to the cloud outfit’s Cloud WAN product, billed in BT’s monetary commentary as a “planet-scale community”. Which appears to be the gist for multinationals: a community service (NaaS) exterior of the UK, which rides on non-traditional telco infrastructure from cloud suppliers of various stripes.

However Mendler’s feedback are fascinating, extra broadly. She equipped a breakdown of those enterprise offers (the highest 1,000; see beneath), which says Verizon (Verizon Enterprise) has the lion’s share of them – one in 5 (21 p.c). Telefónica (Telefónica Tech?) and AT&T each take 14 p.c (about one in seven) every; T-Techniques, the IT SI unit hooked up to Deutsche Telekom, takes one in 10. The enterprise-integrator divisions at each different tier-one telco – together with BT and Vodafone within the UK, and Orange in France, plus others – are preventing for the leftover scraps.

It can take some unpicking – which RCR will do, because it places squarer deal with networking and computing assets on this mad story in regards to the unusual economics of commercial AI, and the way it’s served up. However some footnotes: Omdia’s overview of the telco neighborhood’s top-1,000 offers relies on the worth of their current contracts with enterprises. The typical worth is about $23 million, says Mendler. “There are normally a number of billion greenback mega offers yearly,” she says. The offers embrace each multi-national and nationwide contracts; the latter are usually massive public sector offers.

BT notes in its outcomes that it has simply renewed its Emergency Companies Community (ESN) setup within the UK, for instance. Certainly, the Omdia information is vastly useful. Most telcos don’t present a lot in the best way of an enterprise breakdown; solely 60 p.c report any B2B numbers in any respect, says Mendler – “and sometimes don’t escape enterprise and wholesale”. However what are we to think about BT’s technique – to close down in-market worldwide gross sales, to go after big-sized parochial enterprise issues within the UK, when the likes of Verizon Enterprise seem like hoovering-up at dwelling and overseas?

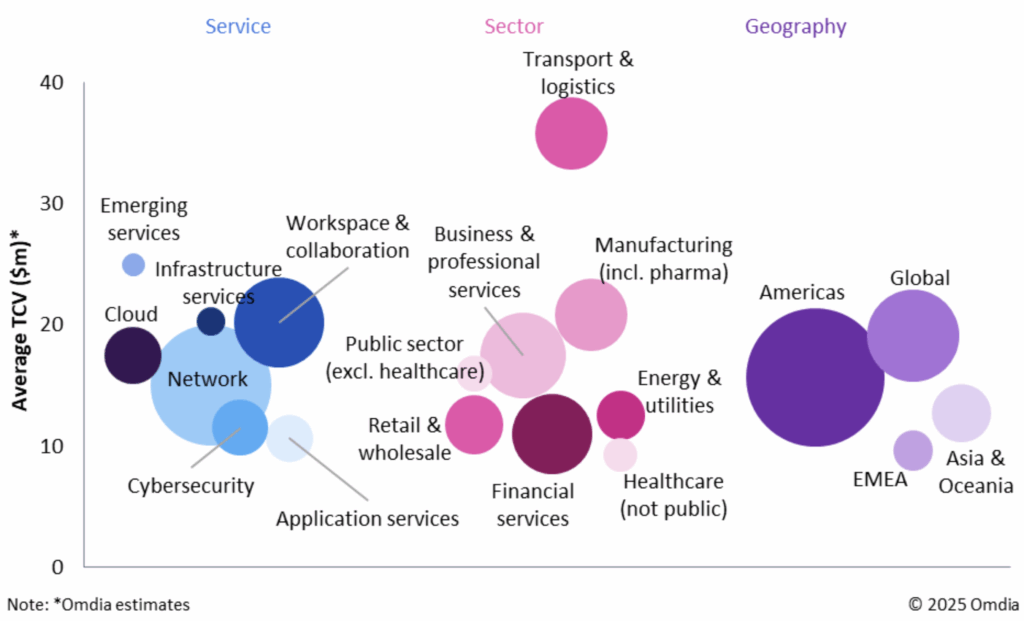

Mendler displays: “Everybody has had a tough time with this a part of the enterprise, even the service suppliers that seem like cornering the market.” And multi-national gigs would possibly nearly be perceived as self-importance tasks – the message goes. “The chance is with SMEs,” she says. “That’s the place telcos like BT can cross-sell managed digital and bodily safety, collaboration, managed apps; the digital pockets, past safety, is up for grabs, as an example.” Fascinating, and what RCR has stated all alongside – that the SME market is the place operators would possibly simply convey some type of souped-up multi-layered box-shifting to bear to ship non-public 5G networks and public 5G slices to the good engine room of Trade 4.0.

After all, this can be a restricted view, and Mendler has one other graphic, to indicate the place the bundling of instruments and purposes into managed providers offers will develop. She goes on: “Suppose: mid-market companies with round 200-2,000 workers, which have rising sophistication however few inner abilities, the place the IT needs to outsource administration of all digital infrastructure. Suppose: public sector, the place a former incumbent like BT is very trusted for sovereign cloud, digital id, public security, slicing providers, and so forth. What BT is doing is right: it should deal with a narrower set of development alternatives as an alternative of enjoying enterprise mannequin bingo.”

Very fascinating; we’ll choose up once more with Mendler, hopefully.