T-Cellular, AT&T, and Verizon skilled a ‘noticeable’ decline in FWA obtain and add speeds throughout Q2 2025 and Q3 2025

In sum – what to know:

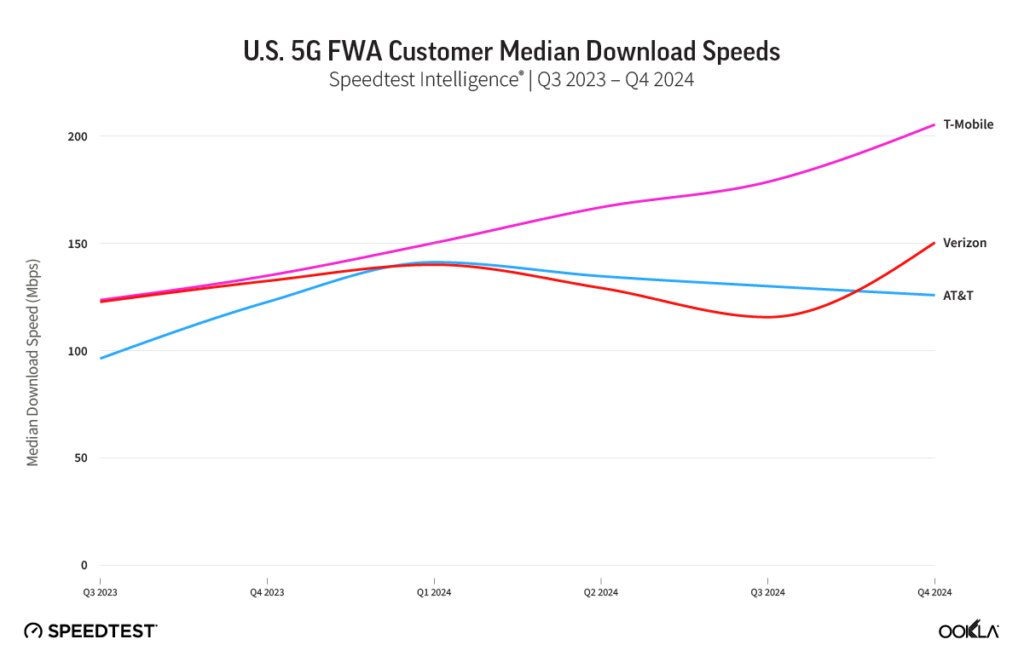

T-Mo reigns supreme – T-Cellular US delivered roughly double AT&T’s median obtain speeds in Q3 2025, whereas Verizon sits between the 2.

FWA efficiency stress – Foliage-related sign loss and presumably early indicators of community congestion are named as potential culprits behind velocity declines.

AT&T falls behind – The provider trails on velocity and latency — however good points are anticipated as new mid-band spectrum and website upgrades start to bolster its Web Air providing.

Ookla has launched its newest report detailing the state of mounted wi-fi entry (FWA) within the U.S., crowing T-Cellular because the “FWA velocity chief.” Based on the agency, the provider achieved a median obtain velocity of 209.06 Mbps for Q3 2025 — about double that of AT&T’s median obtain velocity of 104.63 Mbps in the identical quarter. Verizon’s median obtain velocity was 137.81.

Nonetheless, all three suppliers — T-Cellular, AT&T, and Verizon — skilled a “noticeable” decline in obtain and add speeds throughout Q2 2025 and Q3 2025. Ookla’s editorial director, Sue Marek, pointed to a potential “seasonal sample,” brought on by elevated foliage protection, which might influence Fastened Wi-fi Entry speeds.

“The sign loss usually happens through the spring and summer time months (Q2 and Q3) when deciduous timber are crammed with dense leaves that may weaken FWA indicators,” famous Marek, citing a equally timed decline in median add speeds for all three operators in Q2 and Q3 2024 and a decline in obtain speeds for AT&T and Verizon in Q2 and Q3 2024.

“It’s additionally potential that this can be an early indication that robust uptake in FWA is beginning to influence efficiency,” Marek added, explaining that community congestion is also responsible. “There have lengthy been issues from the funding neighborhood and others about site visitors from FWA subscribers inflicting congestion and impacting the efficiency of each cell and FWA clients as a result of the identical 5G spectrum is getting used to ship each providers.”

AT&T performs catch-up — however enhancements anticipated

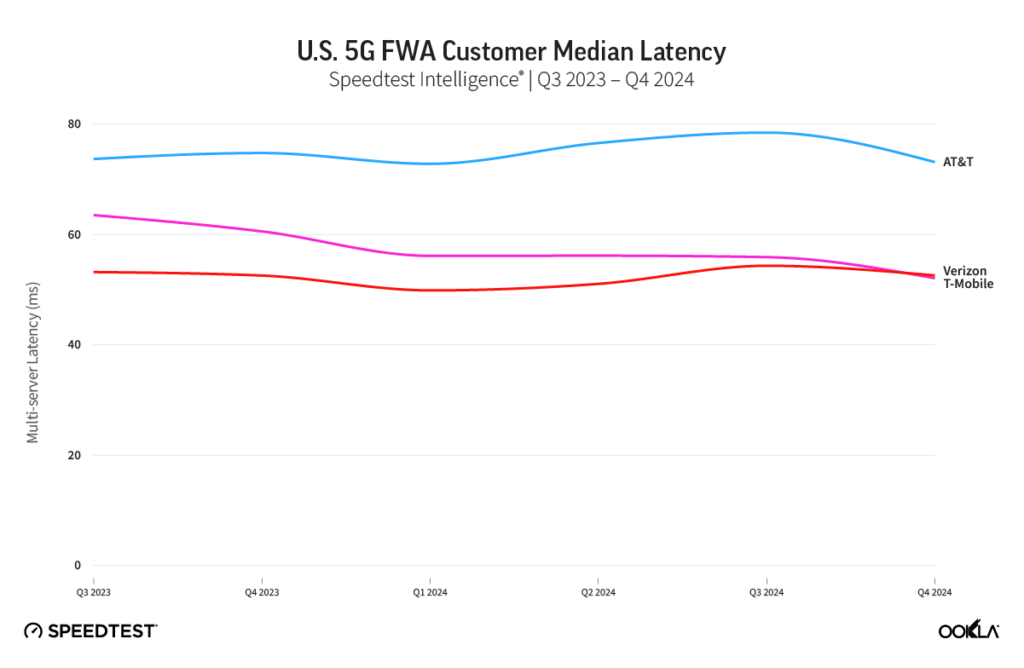

AT&T — the most recent entrant into FWA — continues to lag on latency. In Q3, the provider’s median latency was 67 milliseconds (ms) in comparison with Verizon at 54 ms and T-Cellular at 50 ms. On a optimistic word, it seems that its latency is enhancing each quarter from a excessive of 78 ms in Q3 2024.

Ookla expects additional good points for AT&T Web Air within the coming months because the provider integrates newly acquired 600 MHz and three.45 GHz spectrum from EchoStar. Collectively, the licenses cowl 400 U.S. markets, Marek stated. Whereas the deal shouldn’t be anticipated to shut till mid-2026, AT&T disclosed in mid-November that it has already outfitted 23,000 cell websites with gear able to supporting the three.45 GHz band, permitting each cell and FWA clients to learn sooner.

In September, AT&T SVP and Community CTO Yigal Elbaz informed RCR Wi-fi Information that FWA stays an necessary complement to the corporate’s fiber-first broadband technique, quite than a alternative for it. AT&T plans to make use of its newly acquired mid-band spectrum to “comparatively shortly” speed up FWA deployment in areas the place fiber shouldn’t be but out there.

Wanting past AT&T, Verizon and T-Cellular have each not too long ago raised their long-term FWA targets, aiming to achieve 8 million to 9 million subscribers and 12 million subscribers, respectively, by 2028.

In Q3 2025, the large three added a mixed 1.04 million new subscribers, bringing the overall variety of Fastened Wi-fi Entry clients to 14.7 million. “We anticipate U.S. operators to aggressively pursue the FWA market within the coming 12 months and we’ll proceed to watch the FWA buyer expertise as these operators broaden their choices,” stated Marek.