After concluding the Markforged acquisition, Nano Dimension has reported full-year (FY) 2024 income of $57.8 million, a 2.6% improve from $56.3 million in FY 2023.

Fourth-quarter (This autumn) income reached $14.6 million, up 0.8% Y/Y from $14.5 million in This autumn 2023. On a sequential foundation, income was down by 1.9% from $14.9M in Q3’24. Gross revenue for the 12 months declined to $25.0 million, down 1.8% Y/Y, whereas This autumn gross revenue was $4.9 million, a 31% lower from $7.0 million in This autumn 2023.

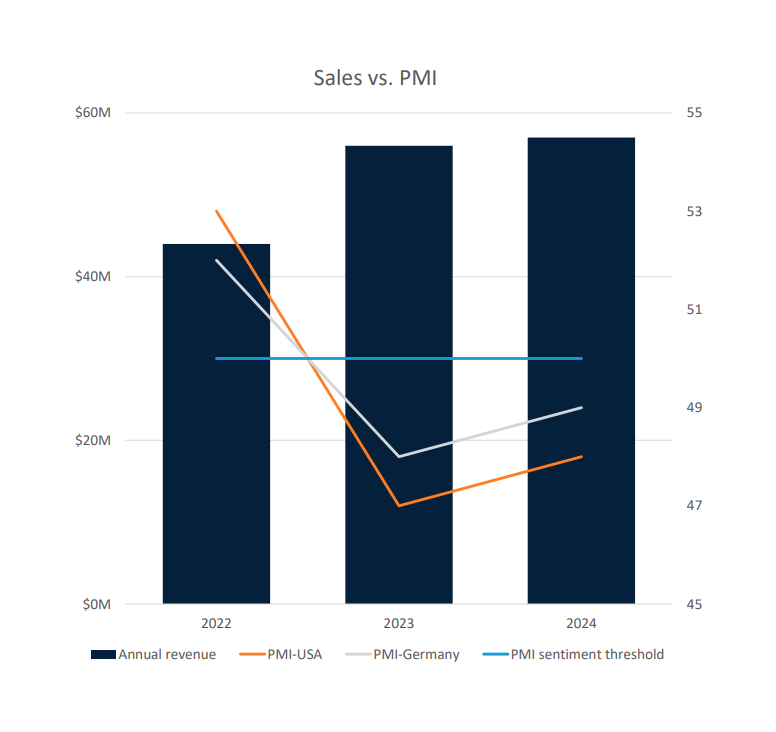

Alongside these outcomes, the corporate applied structural adjustments, together with a narrower product focus, a $20 million discount in annual working bills, and a 52% improve in income per worker. This was pushed by capital self-discipline and long-term profitability targets, regardless of a Buying Managers Index (PMI) under 50.

“We’re shifting from chaos to self-discipline,” mentioned CFO Assaf Zipori. He defined that value reductions stemmed from a centered technique and improved structural alignment, leading to “previously a bloated value construction now materially lowered.”

Aggressive growth to centered execution

Quite a bit can change in a 12 months, and Nano Dimension’s trajectory is a transparent instance of that. The shift from then-CEO Yoav Stern to Ofir Baharav introduced greater than only a change in management; it signaled a broader transformation in tone, priorities, and route.

Throughout the This autumn 2023 earnings name, Stern introduced a enterprise centered on speedy development and consolidation. He described 2023 as “a unbelievable 12 months for Nano Dimension,” citing a 29% income improve and improved gross margins.

Assured within the firm’s important money place, he outlined a technique primarily based on acquisitions, saying, “If we find yourself with $10 million, 12 million money burn a 12 months, with $1 billion in money, which goes for use for acquisitions and for R&D, we’re in a superb, wonderful form.

Stern’s message was forward-looking and bold. He highlighted prospects resembling NASA and the U.S. Division of Protection and emphasised Nano’s position in what he known as a enterprise area, moderately than standard trade. Software program growth and AM innovation featured closely in his narrative.

Quick ahead to the This autumn 2024 earnings name, Baharav’s tone was extra grounded. He described 2024 as “a 12 months of transformation,” formed by execution and monetary fundamentals. The corporate exited non-core models together with Admatec, DeepCube, Formatec, and Fabrica as highlighted in a letter to shareholders by activist investor Murchinson. This transfer helped Nano scale back working prices by $20 million, and concentrate on profitability.

That shift was echoed by CFO Assaf Zipori, who mentioned, “Effectivity issues. We’ve got already made massive adjustments and we don’t plan to cease.” The crew highlighted a significant improve in income per worker (from $147,000 to $223,000) because of structural enhancements moderately than employees growth. In contrast to Stern’s summary imaginative and prescient, Baharav emphasised tangible, measurable outcomes.

Each leaders acknowledged the significance of software program, however with contrasting approaches. Stern mentioned its potential to reshape the trade, whereas Baharav centered on Markforged’s platform as a near-term asset inside a centered funding technique.

Taken collectively, the calls replicate an organization shifting from aggressive growth to centered execution, shifting its precedence from scale to sustainability.

Replace on Desktop Steel and Markforged

Alongside its inner overhaul, Nano Dimension has begun reviewing its acquisitions, significantly Desktop Steel and Markforged. Each are below strategic evaluation to find out how they match into the corporate’s long-term imaginative and prescient.

Markforged is seen as a powerful asset for its software program and broad put in base, whereas Desktop Steel raises monetary issues. CFO Assaf Zipori defined that the acquisition was accomplished below court docket order, with Nano paying practically $180 million to Desktop Steel shareholders. The corporate has since supplied restricted secured financing to assist short-term obligations however has not dedicated to any further funding.

Zipori addressed the state of affairs straight, calling Desktop Steel “the elephant within the room.” He famous that the corporate faces important monetary liabilities, together with $115 million in excellent convertible notes, all incurred previous to the acquisition. He reiterated that any additional involvement would rely on clear strategic match.

Internally, management mentioned web site visits revealed new cost-saving alternatives and methods to align operations. These observations knowledgeable choices to consolidate roles and streamline choices. In accordance with administration, this cultural reset aimed not solely to enhance margins however to unlock innovation by decreasing organizational friction.

By simplifying construction and holding groups accountable to profitability metrics, Nano believes it’s now higher outfitted to ship complicated, high-performance components throughout key sectors.

Steering for FY 2025

Although the corporate didn’t subject formal steerage for FY 2025, it shared preliminary figures. Q1 2025 income is anticipated to succeed in $14.4 million, up 8% from the prior 12 months. Money and money equivalents stood at round $840 million as of March 31, 2025, excluding contributions from Q2 acquisitions.

Management emphasised that future investments, together with additional involvement with Desktop Steel, might be evaluated primarily based on their alignment with Nano Dimension’s concentrate on margin enchancment and shareholder worth. Administration expects to have readability on Desktop Steel’s strategic overview by the top of June.

Wanting forward, the corporate plans to strengthen its presence in 4 core markets: aerospace and protection, automotive, electronics, and medical. These sectors align with Nano Dimension’s core capabilities and the rising demand for complicated, high-performance components.

Bringing the decision to an in depth, executives famous that with transformation underway and strategic priorities now clarified, FY 2025 is anticipated to be outlined by disciplined execution and measurable outcomes.

What 3D printing tendencies do you have to be careful for in 2025?

How is the way forward for 3D printing shaping up?

To remain updated with the most recent 3D printing information, don’t overlook to subscribe to the 3D Printing Business e-newsletter or comply with us on Twitter, or like our web page on Fb.

When you’re right here, why not subscribe to our Youtube channel? That includes dialogue, debriefs, video shorts, and webinar replays.

Featured picture reveals gross sales development in a difficult macro atmosphere. Picture through Nano Dimension.