Introduction: The Bill Chaos Drawback

Image a mid-sized firm dealing with 1,000–2,000 invoices each month—roughly 250–500 invoices per week. On the floor, this doesn’t sound unmanageable. However at a mean of 15–16 minutes per bill, that quantity rapidly snowballs into 200–400 employees hours each month spent on repetitive duties like knowledge entry, coding, and chasing approvals. In sensible phrases, that’s the equal of one to 2 full-time staff devoted solely to pushing paper as a substitute of including strategic worth.

Past the labor drain, the monetary impression is staggering. Research present that handbook bill processing prices between $15 and $20 per bill, relying on complexity and error charges (Resolve Pay; Conexiom). For a enterprise processing 1,500 invoices monthly—about 18,000 yearly—that interprets to $270,000–$360,000 per yr spent on AP processing alone. Automation can cut back this price to as little as $3 per bill, unlocking $180,000–$300,000 in annual financial savings.

Time-to-payment is equally regarding. Guide workflows stretch bill cycle instances to 10.9–17.4 days on common, whereas best-in-class automated processes can shrink that to only 2.8–4 days (GotBilled). The end result? Stronger vendor relationships, fewer late-payment penalties, and the power to seize early-payment reductions.

Then there’s accuracy. Guide methods see error charges of ~1.6% per bill, with errors like duplicate funds compounding over time. Clever automation reduces errors by as much as 80%, dramatically reducing the price of rework and compliance threat (Resolve Pay).

For finance leaders, these numbers spotlight a tough fact: handbook bill administration isn’t just inefficient—it’s a silent tax on development.

That is the place bill automation software program enters the image—reworking bill administration from a gradual, handbook burden right into a streamlined, clever course of. An automated bill processing system turns this chaos into readability.

What’s Bill Automation Software program?

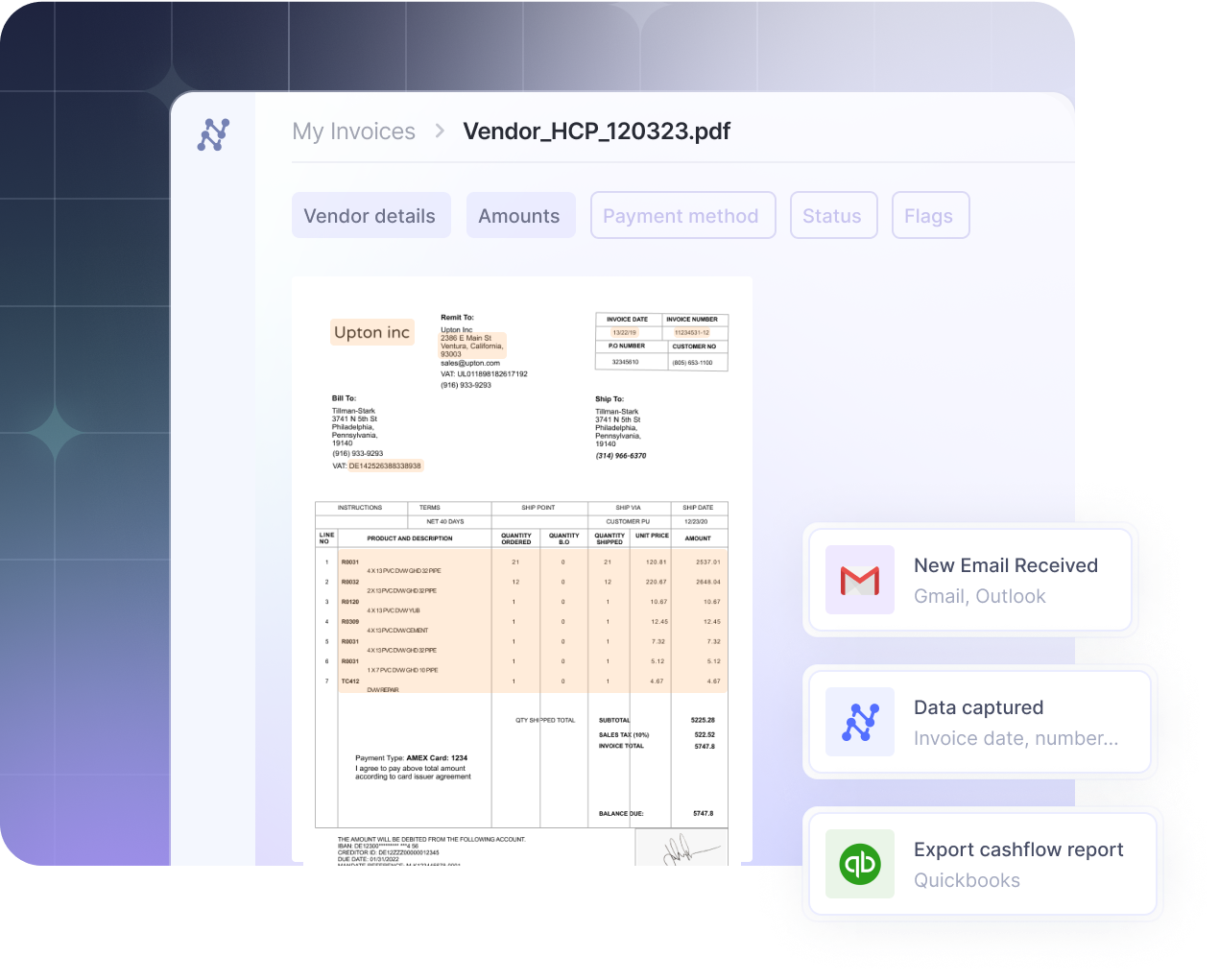

At its core, bill processing automation software program is designed to streamline the whole invoice-to-pay workflow. As a substitute of accounts payable (AP) groups manually coming into line objects, verifying buy orders, routing paperwork for approval, and scheduling funds, automation software program digitizes every step—from bill seize to validation, approval routing, and cost execution.

The inspiration of bill automation is knowledge seize — finished in seconds, not minutes —extracting key info comparable to vendor title, bill quantity, line objects, tax particulars, and cost phrases from paperwork. Early methods relied closely on optical character recognition (OCR), which converts scanned textual content into machine-readable codecs. However conventional OCR instruments are inflexible: they require pre-built templates for every bill format, and even minor adjustments (like a vendor updating their structure) can break extraction accuracy.

That is the place AI-first approaches—usually referred to as Clever Doc Processing (IDP)—essentially change the sport. In contrast to template-based OCR, AI-driven methods be taught patterns throughout invoices, adapt to new codecs dynamically, and constantly enhance with utilization. This permits them to deal with invoices from 1000’s of distributors with out requiring fixed template upkeep.

Why does this distinction matter? As a result of at scale, template fragility turns into a bottleneck. A mid-sized firm would possibly course of invoices from a whole bunch of suppliers, whereas enterprises handle tens of 1000’s. Every vendor could have a number of codecs, currencies, or tax codes. In template-based OCR methods, each variation wants handbook configuration. With AI-first platforms, invoices are captured precisely no matter format, enabling AP groups to spend time on exceptions and approvals as a substitute of fixing damaged templates. In contrast to outdated template-based OCR, these bill automation options guarantee accuracy at scale.

Merely put, bill automation software program—particularly when powered by AI-first seize—turns a fragmented, error-prone course of right into a seamless, touchless workflow, permitting companies to cut back prices, enhance accuracy, and scale operations with out scaling headcount.

However past effectivity, why does this matter a lot for companies in the present day? The reply lies within the very actual financial savings and aggressive benefits automation delivers.

Why Companies Want Bill Automation

Even in organizations which have digitized different finance capabilities, AP usually stays stubbornly handbook—with out an automated bill processing system to streamline workflows. As we noticed earlier, processing invoices manually consumes a whole bunch of employees hours, prices upwards of $15 per bill, and introduces error dangers that undermine accuracy and compliance. Add to that scattered invoices throughout inboxes and submitting cupboards, and the result’s poor money circulation visibility and lack of real-time management.

The ripple results are vital. Corporations miss out on early-payment reductions, take up late charges, battle with compliance, and pressure relationships with distributors. What must be a simple operational course of turns into a bottleneck that drains working capital and productiveness.

Bill automation flips this equation. By digitizing seize, validation, and approval workflows, organizations dramatically cut back cycle instances, minimize prices, and enhance accuracy. Extra importantly, automation frees finance groups from repetitive knowledge entry, permitting them to concentrate on evaluation, planning, and provider technique.

The advantages are clear:

- Price financial savings: Automation reduces bill prices by greater than 80%, unlocking six-figure financial savings yearly for mid-sized companies.

- Pace: Cycle instances fall from weeks to just some days, serving to firms keep away from late charges and seize early-payment reductions.

- Accuracy: Error charges drop dramatically, slicing duplicate funds and handbook rework.

- Capability: Finance groups unlock the equal of 1–2 FTEs yearly to concentrate on higher-value duties.

📌 Case Examine: Asian Paints + Nanonets

One in all Asia’s largest paint producers adopted an automated bill processing answer to sort out this burden. With Nanonets, they minimize bill processing time from 5 minutes to ~30 seconds per doc—a 90% discount. By automating extraction and routing into SAP, the corporate saved 192 hours monthly (~10 FTE days) and positioned itself to handle 22,000+ distributors with minimal handbook intervention.

👉 Learn the complete case examine

📌 Case Examine: SaltPay + Nanonets

SaltPay, a fast-growing funds supplier, manages over 100,000 distributors. Guide processing was slowing down development. By integrating Nanonets with SAP, SaltPay achieved near-100% accuracy in knowledge seize and realized 99% time financial savings in comparison with handbook workflows. Finance groups shifted from bill coding to provider administration and strategic finance tasks, strengthening each throughput and vendor relationships.

👉 Learn the complete case examine

Briefly: automation transforms AP from a expensive legal responsibility right into a strategic enabler of money circulation visibility, compliance, and provider belief.

Should-Have Options of the Finest Bill Automation Software program

When you perceive why bill automation is essential, the subsequent query is apparent: what options separate the most effective platforms from the remainder? Not all options ship true automation; some nonetheless rely closely on templates, handbook intervention, or clunky integrations. The proper software program ought to mix intelligence, flexibility, and scalability to suit your enterprise in the present day—and develop with you tomorrow.

These are the non-negotiable options each bill automation answer ought to present:

1. AI-First Information Seize

On the coronary heart of bill automation lies correct knowledge extraction. Legacy OCR methods require templates for every bill structure, making them fragile and maintenance-heavy. A small change in a vendor’s format can break extraction and flood AP groups with exceptions. In contrast, AI-first methods be taught bill layouts with out templates. They adapt to new codecs dynamically, making certain excessive accuracy throughout 1000’s of distributors and doc sorts (Wikipedia). That is essential for scaling with out creating new back-office burdens.

2. Enterprise Rule Validations

Capturing knowledge is simply step one. Finest-in-class methods apply enterprise rule validations mechanically, making certain invoices adjust to organizational and regulatory necessities earlier than they ever hit approval queues. Examples embrace:

- 3-way matching (bill vs. buy order vs. items receipt).

- Vendor compliance checks, comparable to validating provider financial institution particulars in opposition to grasp data.

- Duplicate detection, flagging invoices with the identical quantity or quantity already processed.

- Tax and VAT compliance, mechanically verifying charges and jurisdiction-specific guidelines.

- Threshold alerts, flagging invoices above a set quantity for added approval.These guidelines not solely cut back exceptions but additionally safeguard in opposition to fraud and compliance dangers.

3. Versatile Approval Workflows

AP processes are not often linear. Invoices may have a number of reviewers throughout departments, particular dealing with based mostly on worth, or emergency escalation when deadlines loom. Search for platforms with configurable approval workflows that may:

- Route invoices mechanically by vendor, division, or spend class.

- Apply role-based and conditional approvals (e.g., invoices >$10K routed to the CFO).

- Escalate overdue approvals to backup reviewers.

- Permit cellular approvals, enabling busy executives to approve on the go.

- Assist delegation when an approver is out of workplace.By automating these workflows, firms eradicate bottlenecks, cut back back-and-forth emails, and maintain cost cycles on monitor.

4. ERP & Accounting Integrations in Bill Processing Automation Software program

Automation solely delivers full worth if it connects seamlessly to your finance stack. Main platforms provide native integrations with ERP and accounting methods comparable to QuickBooks, NetSuite, SAP, and Oracle. This ensures that bill knowledge, approvals, and cost standing circulation mechanically into your system of report—eradicating duplicate entry and lowering reconciliation complications.

5. Analytics & Reporting

Prime-tier platforms transcend processing to ship visibility and management. Dashboards ought to monitor KPIs comparable to:

- Common cycle time per bill.

- Exception charges and bottlenecks.

- Spend by vendor or class.

- Share of invoices captured and authorized touchlessly.These insights assist CFOs and controllers optimize working capital, determine course of inefficiencies, and negotiate higher vendor phrases.

6. Safety & Compliance

Invoices include delicate monetary knowledge, making safety non-negotiable. Finest-in-class options adhere to requirements like SOC 2, GDPR, and SOX, provide role-based entry controls, and supply full audit trails. Compliance isn’t nearly avoiding fines—it builds belief with auditors, regulators, and suppliers.

7. Scalability & Consumer Expertise

Lastly, the platform ought to develop with your corporation. Meaning dealing with quantity spikes gracefully (assume quarter-end bill surges), supporting multi-entity or international buildings, and sustaining excessive accuracy at the same time as complexity will increase. Simply as essential: a clear, intuitive interface. If AP employees discover the system clunky, adoption will lag and the worth of automation will erode. A robust person expertise ensures groups embrace the device as a substitute of working round it.

The proper options guarantee automation scales with you, however options alone don’t inform the complete story. Let’s take a look at the distributors main the cost.

Finest Bill Automation Software program in 2025

Understanding the must-have options is one factor; discovering the best answer is one other. The marketplace for bill automation has exploded, with dozens of distributors promising velocity, accuracy, and integration. However not each platform delivers the identical worth. Some excel at end-to-end AP automation, whereas others concentrate on area of interest strengths like AI-first seize or small enterprise simplicity.

That can assist you navigate the choices, we’ve grouped the main bill processing automation software program into 4 classes—every suited to a special enterprise profile:

- Finish-to-Finish AP Automation for firms in search of complete management from bill to cost.

- Small Enterprise Instruments for companies that need affordability and ease of use.

- Enterprise ERP Options for big organizations needing deep system integration.

- AI-First Extraction Engines for companies trying to modernize seize with out overhauling their ERP stack.

Within the sections that comply with, we’ll break down every vendor by goal use case, key options, pricing, professionals and cons, integrations, and ideally suited buyer profile.

📊 Automated Bill Processing Software program Panorama at a Look

| Class | Distributors | Strengths |

|---|---|---|

| Finish-to-Finish AP Automation | Tipalti, Stampli | Full AP suite + vendor/ERP integration |

| Small Enterprise Pleasant | QuickBooks Invoice Pay, Melio | Low-friction, cost-effective automation |

| Enterprise ERP Workflows | SAP Concur, Coupa | Deep enterprise management, spend visibility |

| AI-First Bill Seize | Nanonets, Rossum | Template-free, clever extraction layers |

Now let’s take a better take a look at every of those options to see how they examine in follow.

a. Finest for Finish-to-Finish AP Automation

Distributors: Tipalti, Stampli

Tipalti

- Goal use case: Companies needing full-spectrum AP—from bill seize to international payouts—particularly the place compliance and scalability matter.

- Key options: AI-driven bill seize; 2-/3-way matching; provider self-onboarding and tax compliance (KPMG-engine); international mass funds; real-time reconciliation; spend visibility instruments. Rossum.ai Coupa

- Pricing: SaaS plans beginning at ~$129/month; enterprise pricing on request. Analysis.com

- Execs: Automates international payables, integrates broadly, sturdy controls.

- Cons: Could also be overkill for small groups; complexity is usually a barrier.

- Integrations: NetSuite, QuickBooks, Acumatica, Dynamics, Sage, SAP Enterprise One, Xero. Tipalti

- Perfect buyer: Mid-market to enterprise companies managing high-volume, cross-border payables.

Stampli

- Goal use case: Groups needing fast AP workflow upgrades that don’t disrupt current ERPs, with heavy emphasis on collaboration and AI help.

- Key options: AI assistant (“Billy the Bot”), seamless QuickBooks integration, 2-/3-way PO matching, vendor portal, unified communication, built-in funds. Analysis.com Concur

- Pricing: Bundled licensing tied to bill quantity and person roles; connector charges could apply. Tipalti

- Execs: Deploys quick; reduces friction in change administration.

- Cons: Connector charges and bundled pricing could also be opaque for small groups.

- Integrations: QuickBooks, NetSuite, Xero, Sage Intacct, Microsoft Dynamics, SAP, Oracle, and workflow instruments (Slack, Groups). Software program Join

- Perfect buyer: Mid-market finance groups wanting AP automation with out ERP rip-and-replace.

b. Finest for Small Companies

Distributors: QuickBooks Invoice Pay, Melio

QuickBooks Invoice Pay

- Goal use case: SMBs embedded inside the QuickBooks ecosystem in search of fundamental but dependable invoice cost automation.

- Key options: Bill seize by way of scan or e-mail, batch funds, 3-way matching, approval workflows, provider self-service portals, ACH/credit score/wire choices, vendor/VAT verification. Tipalti

- Pricing: Native to QuickBooks subscriptions; out there as an add-on.

- Execs: Low friction, aligned with bookkeeping workflows.

- Cons: Restricted superior workflow or AP analytics past Small Enterprise wants.

- Integrations: Constructed-in with QuickBooks On-line/Superior.

- Perfect buyer: Small companies utilizing QuickBooks with light-to-moderate AP quantity.

Melio

- Goal use case: Very small companies needing intuitive payables and receivables in a single, budgeting simplicity with flexibility on charges.

- Key options: Seamless QuickBooks On-line sync; no month-to-month charges (solely transaction-based); prolonged pay phrases; easy vendor onboarding; encrypted knowledge and compliance. Capterra SAP Concur Software program Recommendation

- Pricing: Free for normal use; charges apply for expedited or credit-based funds.

- Execs: Pleasant UX, reasonably priced, prolonged liquidity choices.

- Cons: Restricted P2P or procurement options.

- Integrations: QuickBooks On-line and API-driven.

- Perfect buyer: Micro-businesses or solo operators in search of pay-on-demand flexibility.

c. Finest for Enterprise ERP Workflows

Distributors: SAP Concur, Coupa

SAP Concur

- Goal use case: Giant and international enterprises combining journey, expense, and bill administration below one compliant ecosystem.

- Key options: Automated bill seize (paper, e-mail, fax) with ML/OCR; cellular expense/receipt matching; real-time spend visibility; AI fraud detection and coverage enforcement (Joule AI Copilot); complete analytics. Concur Software program Join

- Pricing: Customized pricing (~$9/person/month baseline, with quotes scaling up); giant footprints probably in five-figure SaaS budgets. Tipalti

- Execs: Deep protection throughout T&E, invoicing, compliance; highly effective analytics.

- Cons: Steeper studying curve, clunky UX; costly setup and scaling. Rho Software program Recommendation

- Integrations: NetSuite, SAP ERP, Oracle, Microsoft, QuickBooks, HR methods, reporting instruments. Software program Join

- Perfect buyer: International enterprises needing end-to-end spend visibility and governance.

Coupa

- Goal use case: Enterprises searching for superior bill/PO capabilities, AI validation, vendor collaboration, and wealthy spend administration.

- Key options: AI-powered bill validation; 2- and 3-way matching; e-invoicing; provider self-service; multi-currency/multi-country dealing with; optimized cost scheduling; cellular entry; dashboards. ProcureDesk Rossum.ai

- Pricing: Quote-based, usually in ~$90K/yr mid-tier vary (median ~ $93K/yr). Vendr Analysis.com

- Execs: Sturdy AI and fraud instruments; unified spend visibility; scalable.

- Cons: Excessive price; provider adoption could require additional change administration. Capterra

- Integrations: Deep ERP connectors with SAP, Oracle, plus APIs for customized use. ProcureDesk

- Perfect buyer: Giant, matrixed organizations needing full-suite spend intelligence.

d. Finest for AI-First Bill Extraction

Distributors: Nanonets, Rossum

Nanonets

- Goal use case: Companies in search of a nimble, AI-native seize layer that may inject automation into current methods.

- Key options: Template-free AI OCR customization, QuickBooks integration, extremely correct discipline extraction, low cost-per-invoice (as little as $1.42), fraud mitigation, compliance. SelectHub

- Pricing: Sometimes decrease per-invoice charges; ideally suited for scaling with out replatforming.

- Execs: Quick ROI; versatile deployment; accuracy features.

- Cons: Requires pairing with workflows or ERP to finish automation.

- Integrations: QuickBooks; API for deeper ERP connectivity. Nanonets

- Perfect buyer: Mid-sized companies needing smarter seize with out full suite dedication.

Rossum

- Goal use case: Organizations that have already got AP workflows however want extra resilient, AI-based bill knowledge seize capabilities.

- Key options: AI-driven doc understanding, customizable templates, validation guidelines, cloud extraction, real-time dashboards. Concur

- Pricing: Quote-based.

- Execs: Finest-in-class seize; simple integration with current DMS/ERP.

- Cons: Restricted end-to-end AP capabilities; have to be layered into current stack.

- Integrations: API-friendly for doc methods and ERPs.

- Perfect buyer: Groups wanting best-in-class seize rather than brittle OCR methods.

6. The right way to Select the Proper Bill Automation Software program

With so many choices available on the market, the query isn’t whether or not to automate invoices—it’s which platform most closely fits your corporation wants. Selecting the best answer requires balancing scale, complexity, and organizational priorities. Right here’s a step-by-step framework to information analysis.

Step 1: Assess Bill Quantity and Workflow Complexity

The scale of your AP workload is the one most essential determinant. An organization processing 200 invoices monthly has very completely different wants than one dealing with 20,000+ invoices globally. Take into account not simply quantity, but additionally workflow complexity: multi-entity buildings, international distributors, tax/VAT guidelines, or multi-level approval chains.

Step 2: Map to Vendor Classes

Map your workload to the best bill automation answer (as summarized within the earlier part):

- Small Enterprise Instruments → Perfect in the event you course of fewer than 500 invoices/month and wish low-cost simplicity.

- AI-First or Mid-Market Suites → Finest match for companies dealing with 1,000–2,000 invoices/month and needing workflow automation with ERP integration.

- Enterprise ERP/International Suites → Vital for organizations processing 10,000+ invoices/month, with advanced compliance and multi-entity necessities.

Step 3: Take into account Persona-Primarily based Priorities

Totally different stakeholders weigh various factors:

- CFO → Money visibility, compliance, auditability, ROI.

- Head of Operations → Effectivity, scalability, course of resilience.

- AP Supervisor → Usability, accuracy, ease of onboarding employees.

A profitable selection satisfies all three lenses, not only one.

Step 4: Apply a Fast Analysis Guidelines

Earlier than issuing RFPs or scheduling demos, use this five-point filter:

- Quantity match: Can it deal with your present and future bill load?

- Integrations: Does it natively connect with your ERP/accounting system?

- Approval workflows: Are they configurable to your construction?

- Compliance & safety: Does it meet SOC 2, GDPR, SOX, and audit necessities?

- Price range alignment: Is pricing clear, and does ROI justify the spend?

Briefly: selecting bill automation software program is about match, not flash. By mapping your bill quantity, aligning with vendor classes, contemplating persona-driven wants, and making use of a structured guidelines, you’ll be able to confidently slim the sphere to a shortlist that may ship impression in the present day and scale tomorrow.

Conclusion: Automating At the moment, Future-Proofing Finance

Bill automation is now not nearly lowering knowledge entry. The expertise is evolving quickly, and the subsequent wave of innovation is ready to redefine how accounts payable capabilities inside fashionable finance organizations.

Rising Developments to Watch

- Touchless AP → The holy grail is a totally automated, “straight-through” course of the place invoices transfer from seize to validation, approval, and cost with zero human intervention. Early adopters already report vital cycle time reductions, and the expectation is that touchless AP will change into the usual quite than the exception.

- Predictive Analytics → With historic bill knowledge feeding into AI fashions, companies will achieve the power to forecast spend, anticipate money circulation necessities, and determine anomalies earlier than they change into issues. This shifts AP from a reactive perform to a forward-looking companion in monetary technique.

- AI-Led Fraud Detection → Fraudulent invoices, duplicate submissions, and suspicious vendor exercise stay a persistent threat. Rising platforms are embedding machine studying to flag these anomalies in actual time, lowering monetary leakage and strengthening compliance.

- RPA + AI Synergy → Robotic course of automation (RPA) has been efficient in dealing with repetitive bill workflows, however when paired with AI, the outcomes are transformative. Research present a possible 65–75% discount in human intervention, driving each velocity and accuracy (GoBeyond.AI, Ramp, Nanonets).

Strategic Impression on Finance

As automation matures, accounts payable will now not be seen as a price heart. As a substitute, it can change into a finance intelligence hub—a supply of real-time insights into money circulation, vendor threat, and dealing capital traits. The most important shift is cultural: AP groups transfer from chasing invoices to influencing strategic finance selections, from liquidity planning to provider negotiations.

Key Takeaways

- Price financial savings: Mid-market companies can unlock 200+ hours and save $180K–$300K yearly.

- Compliance & accuracy: Automation reduces error charges by as much as 80% and strengthens audit readiness.

- Future traits: Touchless AP, predictive analytics, and AI-driven fraud detection are shifting from experimental to plain.

- Strategic development: Bill automation is the bridge from back-office effectivity to finance-led decision-making.

Closing Thought: Bill automation is now not a “nice-to-have”—it’s an operational necessity. Corporations that undertake AI-first platforms in the present day place themselves not solely to chop prices, however to construct the finance perform of the long run. The query isn’t if you need to undertake automated bill processing software program, however how rapidly you will get began.

Steadily Requested Questions on Bill Automation

1. What’s bill automation and the way does it differ from handbook processing?

Bill automation (or automated bill processing software program) makes use of AI to seize, validate, route, and pay invoices—slicing prices, rushing up cycle instances, and lowering errors. In contrast to handbook processing, which depends on knowledge entry and spreadsheets, automation gives touchless workflows that scale with your corporation.

2. How does AI-first bill seize outperform conventional OCR?

AI-first seize doesn’t require inflexible templates. It learns bill patterns dynamically, adapts to structure adjustments, and maintains accuracy throughout 1000’s of vendor codecs. Conventional OCR usually fails when distributors replace codecs—resulting in exceptions and handbook fixes.

3. Can bill automation deal with a number of currencies and tax methods?

Sure. Most bill automation options assist multi-currency processing and native tax/VAT guidelines, making them efficient for international operations. This ensures compliance and accuracy throughout jurisdictions whereas minimizing errors from handbook entry.

4. What sort of time and price ROI can mid-sized companies anticipate?

For firms processing 1,000–2,000 invoices/month, automation can unlock 200–400 employees hours month-to-month, minimize prices from $15–20 per bill all the way down to ~$3, and unlock $180K–$300K in annual financial savings.

5. How lengthy does implementation sometimes take?

Implementation is dependent upon complexity and integrations, however most companies go stay in just a few weeks to some months. Many platforms embrace vendor assist and pre-built connectors to speed up rollout.

6. Will my staff nonetheless want handbook oversight after automating invoices?

Sure. Automation handles nearly all of invoices, however exceptions—comparable to disputes, lacking POs, or uncommon spend—nonetheless require human evaluate. This implies AP groups spend much less time on knowledge entry and extra time on technique.

7. What dimension of enterprise advantages most from bill automation?

All enterprise sizes profit. Small companies achieve effectivity and error discount, mid-sized firms see the quickest ROI (200+ hours and six-figure financial savings yearly), and huge enterprises achieve international compliance, scalability, and spend visibility.

8. How does automation enhance vendor relationships?

By lowering delays and errors, automation ensures sooner, extra correct funds. Provider portals and higher visibility enhance communication, whereas well timed funds strengthen belief and permit companies to seize early-payment reductions.

![Finest Bill Automation Software program 2025 [Updated] Finest Bill Automation Software program 2025 [Updated]](https://i1.wp.com/nanonets.com/blog/content/images/size/w1200/2023/12/64422be64ad1932155065294_644137b8f7c8a928c5f3f68a_Frame-201000001506.png?w=696&resize=696,0&ssl=1)