Monetary establishments funneled $8.9 trillion into corporations driving deforestation final 12 months, in response to the brand new “Forest 500” report from International Cover. Regardless of a decade of rising ambition, fewer monetary establishments have public deforestation insurance policies than in earlier years, the report discovered, a setback that researchers warn undermines world local weather and nature targets.

The report assessed 150 monetary establishments funding 500 corporations with the most important affect on deforestation by high-risk commodities, together with soy, beef, palm oil and timber.

Solely 40 % have a public deforestation coverage in place, down from 45 % in 2023.

“This troubling shift is in distinction to the pattern over the earlier decade, when monetary establishments more and more set deforestation insurance policies,” mentioned Pei Chi Wong, strategic finance engagement lead at International Cover.

Coverage failures

Between 2023 and 2024, three monetary establishments eradicated their deforestation insurance policies altogether and 7 “failed to enhance in keeping with finest apply,” that means their insurance policies now not obtain passing grades.

The previous group contains Ameriprise Monetary and Fifth Third Bancorp within the U.S., and Germany’s DZ Financial institution.

Then again, 11 establishments — together with Allianz, Lloyds Financial institution and Financial institution Rakyat Indonesia — printed new deforestation commitments.

The evaluation additionally spotlights monetary heavyweights reminiscent of Vanguard, BlackRock and JPMorgan Chase, which collectively offered greater than $1.6 trillion to corporations on the Forest 500 listing in 2024. Many of those corporations have vital hyperlinks to deforestation and related human rights abuses.

Even establishments with sturdy insurance policies proceed financing high-risk shoppers, the report discovered. Dutch financial institution ING, for example, has complete insurance policies on six commodities and publishes outcomes of its engagement with shoppers — but nonetheless offered over $6.6 billion to company “laggards” that lack any public deforestation dedication.

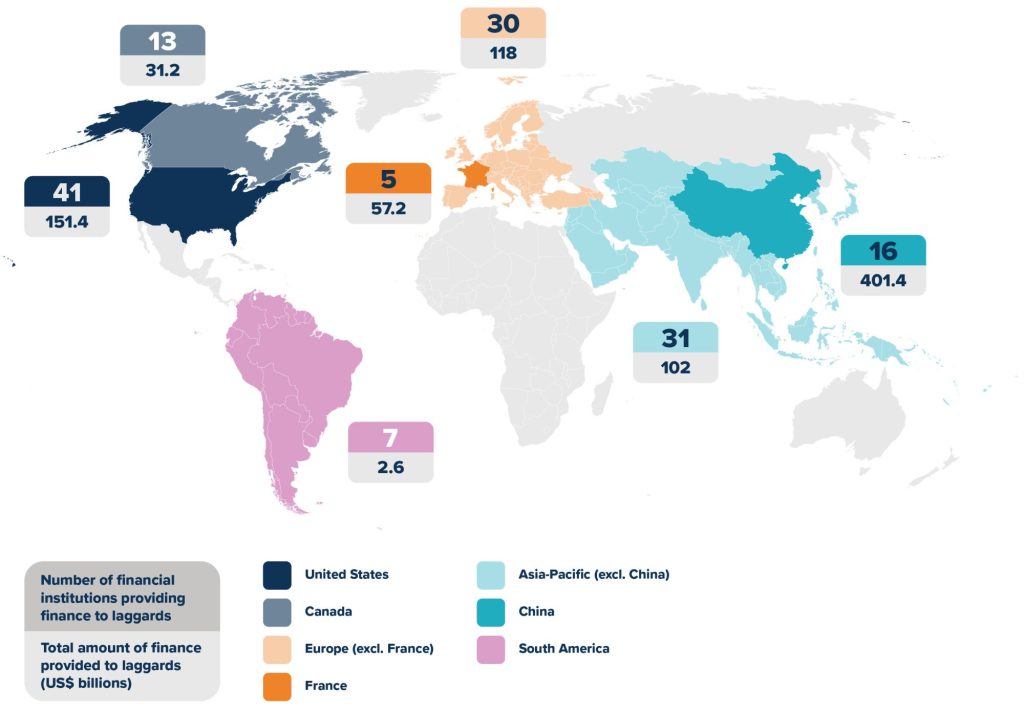

In complete, the 150 establishments analyzed within the report offered $864 billion to laggards final 12 months. By far the most important quantity, $401 billion, got here from establishments in China.

Sources of finance for deforestation

Supply: “Forest 500 — Finance report: Deforestation is a nasty funding,” International Cover

‘A solvable disaster’

“Deforestation is a solvable disaster,” Wong instructed Trellis. “It’s a good entry level for monetary establishments to navigate wider nature-related dangers because it has essentially the most superior steerage, information and metrics within the nature area.”

In the intervening time, he added, no laws requires monetary establishments to conduct due diligence for deforestation dangers.

One potential catalyst is the EU Deforestation Regulation (EUDR), which takes impact later this 12 months. The legislation would require corporations buying and selling within the bloc to show their merchandise are usually not linked to deforestation.

“The EUDR has put deforestation on the agenda,” Wong mentioned, “however for the laws to make a major impression, strong rules in different jurisdictions are additionally wanted to create a degree enjoying subject.”

Monetary establishments have the leverage to drive systemic change throughout commodity provide chains. With the world’s forests vanishing at alarming charges, the clock is ticking.