Ericsson’s enterprise phase noticed blended Q2 outcomes, with falling gross sales however enhancing profitability. Progress in wi-fi connectivity and key 5G wins partly offset weaker Vonage efficiency amid cautious buyer funding.

In sum – what to know:

Decrease gross sales – Enterprise gross sales fell 6% (adjusted), led by a 9% drop at Vonage, although enterprise wi-fi confirmed natural progress.

Higher earnings – Profitability improved, with adjusted EBITA loss narrowing from SEK 1.2bn to SEK 0.5bn as a consequence of value reductions.

New contracts – Main 5G wins and new product developments, together with edge AI and ZTNA, level to strong pipeline momentum.

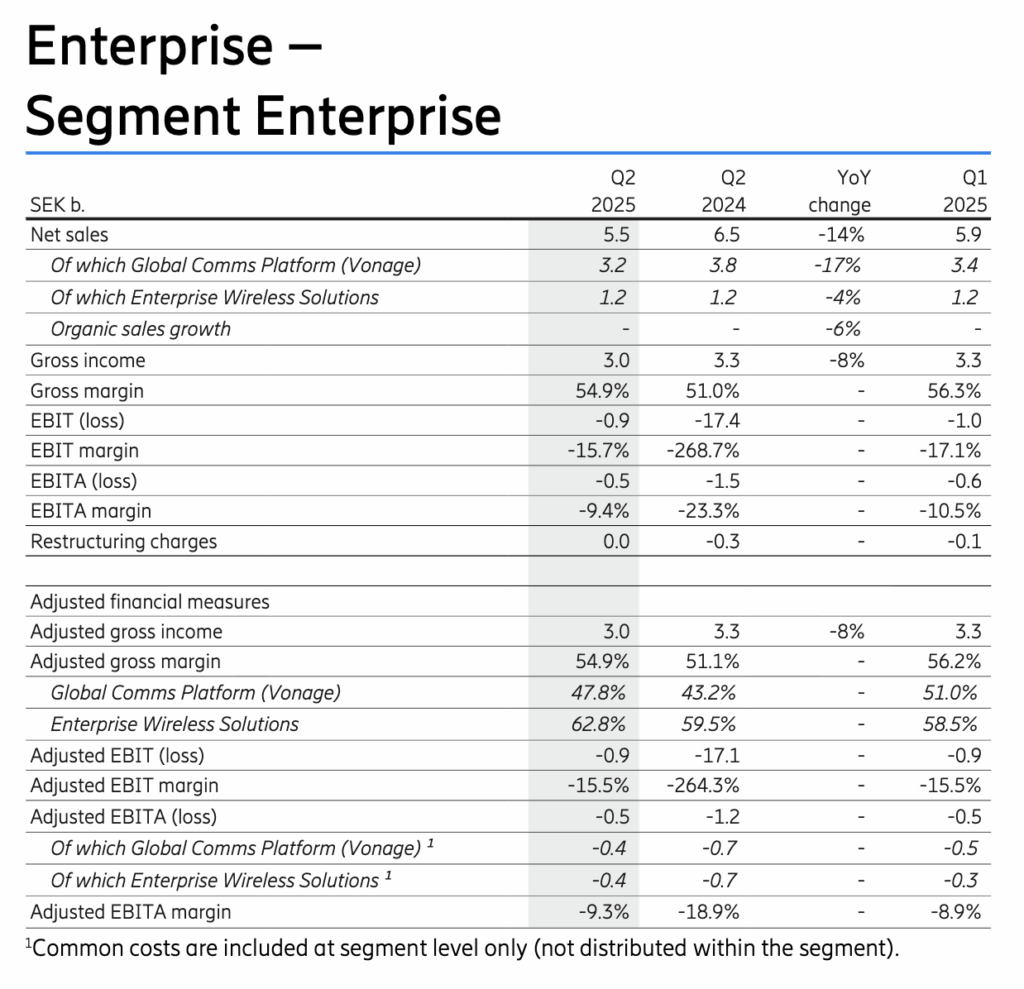

A fast snapshot and abstract of Ericsson’s efficiency within the enterprise sector within the second quarter, to be thought of with its full outcomes, lined right here. The Swedish vendor claimed “steady progress” and ‘pipeline momentum’ for enterprise connectivity, whilst adjusted gross sales slipped six % on the year-ago quarter (and 14 % as reported internet gross sales figures), from SEK 6.5 billion to SEK 5.5 billion, and adjusted preliminary earnings (EBITA), the chief profitability metric, confirmed a lack of SEK 0.5 billion. However within the spherical, efficiency regarded first rate.

The unit’s adjusted EBITA confirmed an enchancment within the quarter, from a lack of SEK 1.2 billion in the identical interval in 2024. This was all the way down to diminished operational bills in each its ‘enterprise wi-fi options’ enterprise, chargeable for its personal networks and wi-fi wide-area community (WWAN) options, and its ‘world communications platform’ enterprise, which accounts for its Vonage exploits. The 2, collectively, symbolize the mainstays (about 80 %, nominally) of Ericsson’s enterprise enterprise phase. (The remaining contains ‘applied sciences and new companies’.)

The general decline in enterprise gross sales mirrored a “extra cautious buyer funding atmosphere”. It was principally all the way down to the latter, it appears. Web gross sales for the Vonage operation fell 17 % year-on-year as a consequence of diminished actions in some nations – from SEK 3.8 billion to SEK 3.2 billion within the interval (adjusted to 9 %). Enterprise wi-fi gross sales had been down 4 % on a reported foundation – however returned the identical worth as a 12 months in the past (SEK 1.2 billion; which is a 5 % leap as an natural foundation). Natural progress for its enterprise wi-fi unit, principally from larger WWAN gross sales, rallied within the interval, and “partly offset” the remainder of the phase.

By comparability, adjusted internet gross sales in its greater cell networks segments – protecting networks themselves and cloud software program and providers – each elevated within the interval, by three % and one % (to SEK 35.7 billion and SEK 14.4 billion, respectively). These twin items invariably comprise the lion’s share of its revenues (about 89 %; SEK 50.1 billion out of SEK 56.1 billion). Börje Ekholm, president and chief government at Ericsson, defined the group’s efficiency when it comes to progress within the US, stability in Europe, and good trade gross sales of mounted wi-fi entry (FWA) options.

However the agency’s enterprise gross sales look regular, too. Asa Tamsons, in command of its enterprise wi-fi options division, pointed to large (public) personal 5G wins within the quarter, with Newmont Company (for distant dozer management) and the metropolis of Istres (for a digital camera community). Each deployments had been not possible, or simply too costly, with Wi-Fi, she stated. As properly, Tamsons highlighted Ericsson’s work within the quarter to increase its NetCloud SASE with clientless zero-trust community entry (ZTNA) performance (a “gamechanger for IT groups”, she stated), and to tie-up with Supermicro on new edge AI capabilities (in “industries like retail, factories, and healthcare”).

She said: “I’m extra assured than ever in our imaginative and prescient for enterprise connectivity. Our momentum isn’t nearly numbers – it’s about actual transformation for purchasers worldwide… I’m inspired by the momentum in our pipeline for steady progress, strengthening our place as a number one associate for enterprises searching for 5G and superior wi-fi options. We’re delivering real-world outcomes sooner than ever… By summer time, I see us persevering with to unlock alternatives to scale impression, deepen partnerships, and proceed redefining what’s attainable when enterprises embrace next-generation connectivity.”