Oracle’s media investments illustrate how AI leaders are vertically integrating to regulate each compute provide and demand

Think about this: Oracle’s Larry Ellison invests in Paramount Photos and courts TikTok. At first look, it appears to be like like a billionaire interest. As soon as aligned with Oracle’s multibillion-dollar AI infrastructure ambitions, nonetheless, the technique appears to be like like a deliberate try to generate demand vertically.

Oracle is constructing large AI knowledge facilities with budgets rumored to exceed $100 billion.

Media manufacturing and social platforms akin to TikTok are compute-hungry and data-rich. They generate continuous, high-volume workloads.

Ellison is subsequently not simply shopping for content material. He’s engineering demand for his personal infrastructure.

By controlling each the availability of compute and the demand for it, Ellison goals to create a self-reinforcing system that shields him from the commodity entice that plagues pure infrastructure suppliers. This logic represents the spearpoint of how the AI economic system is diverging from the atmosphere most companies inhabit.

From this angle, we will see why capital markets are behaving so unusually and why many investments might look a lot much less worthwhile in actuality than they do on paper.

Two diverging economies

The AI economic system vs. the legacy economic system

Does it really feel like each enterprise headline now options billions? Knowledge facilities, chip fabs, mannequin coaching runs, vitality crops flood the literature. Instantly $10 billion sounds small, and $100 billion is the brand new critical.This isn’t the world that almost all companies inhabit.

We’re watching two economies diverge:

- The AI Financial system: Outlined by capital expenditures at a scale that used to belong solely to governments. The numbers are tens to tons of of billions. Corporations like Nvidia, Microsoft, Meta, and Oracle are repriced not by their money flows at present, however by their potential to take a seat on the heart of a remodeled manufacturing operate. Their inventory costs replicate perception that each unit of capital deployed into AI will ship extra output than the previous economic system ever might.

- The Conventional Financial system: Manufacturing, retail, companies, and even mature tech. These corporations face compressed valuations, tight capital constraints, and personal fairness scrutiny over each greenback. They aren’t simply cyclical laggards. They’re being repriced as their future productiveness is discounted towards the opportunity of AI disruption.

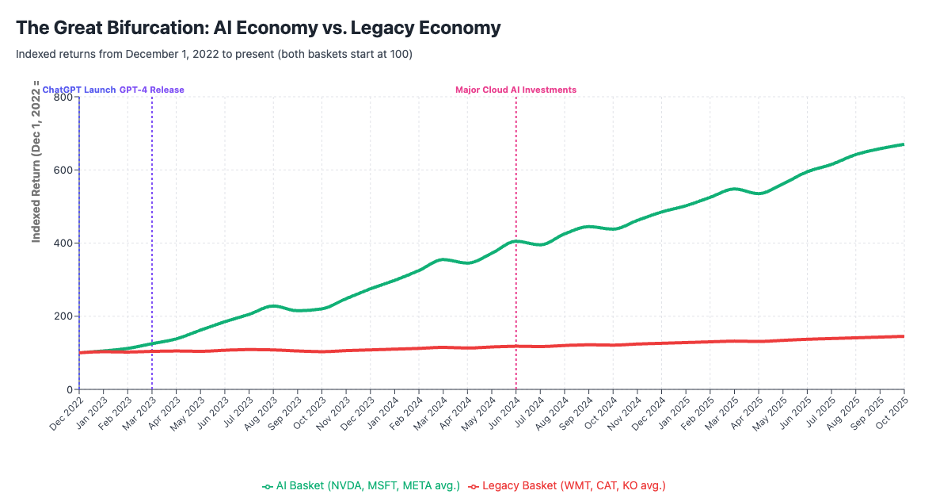

From December 2022 onward, the efficiency hole has grown steadily wider. An “AI basket” of Nvidia, Microsoft, and Meta surged practically sevenfold from its base, whereas a “Legacy basket” of Walmart, Caterpillar, and Coca-Cola barely moved above its place to begin.

In distinction, the legacy names present a flat line. Their returns have been steady, modest, and largely disconnected from AI hype cycles. This quiet trajectory displays their function in mature industries that stay insulated from AI-driven revaluations.

The result’s a bifurcation in markets: two economies transferring on totally different curves. The AI economic system instructions premium multiples and capital inflows, whereas the legacy economic system continues to ship regular however unspectacular progress.

Constructing oil refineries to promote MP3s

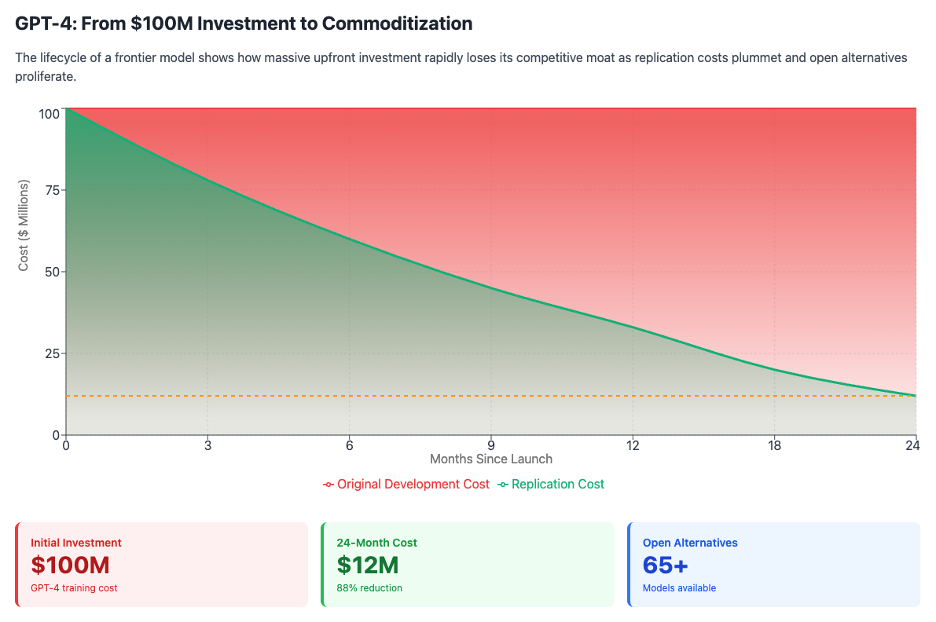

Why would anybody commit $50 billion or $100 billion to AI infrastructure when the output (fashions and inference) is quickly commoditized? That is the paradox on the core of the AI economic system.

Huge mounted prices embrace knowledge facilities, GPUs, vitality, cooling, networking, mannequin coaching, dataset acquisition, and software program engineering.

Speedy diffusion and near-zero marginal price then observe. As soon as a mannequin structure is revealed, others replicate it. Open-source releases speed up cloning and fine-tuning. Competing fashions turn into cheaper to coach as infrastructure improves.

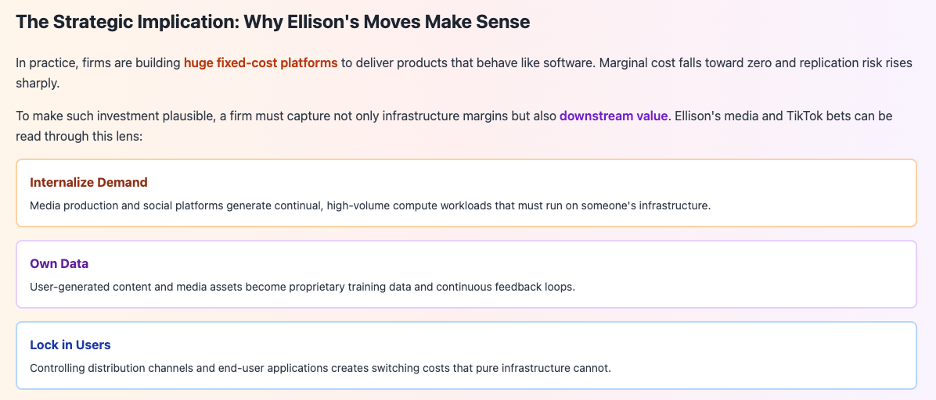

In observe, companies are constructing big fixed-cost platforms to ship merchandise that behave like software program. Marginal price falls towards zero and replication threat rises sharply.

To make such funding believable, a agency should seize not solely infrastructure margins but in addition downstream worth. Ellison’s media and TikTok bets may be learn by means of this lens. He’s attempting to internalize demand, personal knowledge, and lock in customers to his stack.

Eventualities: What occurs subsequent

The AI economic system continues to be younger, and its trajectory is much from settled. What appears to be like like explosive progress at present might harden into steady utility-like returns, collapse into commodity pricing, or evolve into one thing completely new. The desk beneath outlines 5 potential paths ahead, every with a distinct mechanism, instance, and set of return implications. Collectively, they seize the strategic uncertainty that traders and executives should navigate as they place bets on this quickly shifting panorama.

| Situation | Mechanism | Instance or Hypothetical | Return Implication |

| 1. Oligopoly and utility returns | Only some gamers survive, scale protects them | A handful of companies management AI compute globally, just like cloud suppliers | Returns stabilize within the vary of 8 to 12 p.c actual ROI. Worthwhile however not spectacular. |

| 2. Full commoditization | Core fashions turn into open-source and standardized. Margins collapse. | Mannequin suppliers compete on price, worth shifts to purposes | Infrastructure returns decline sharply. Most traders lose capital. |

| 3. Regulatory lock-in | Mental property, licensing, and security guidelines increase obstacles to entry | Governments mandate audits or prohibit mannequin distribution | Choose companies earn outsized returns underneath safety, however threat stays excessive. |

| 4. Vertical integration wins | Corporations mix provide, knowledge, and demand in a single stack | Ellison’s Oracle to Paramount to TikTok technique succeeds | Returns come much less from mannequin edges and extra from ecosystem management. |

| 5. Paradigm shift reset | New architectures (quantum, neuromorphic, organic) displace at present’s fashions | Markets reset each decade, wiping out prior leaders | Excessive churn, destruction of capital, and occasional speculative winners. |

Illustrative instance (Situation 4): Suppose Oracle’s media and TikTok strikes let it amortize $50 billion of infrastructure price by charging “inside compute” utilization to its media division whereas additionally promoting surplus capability externally. Even when exterior margins decline, the inner load is locked and margin shift is feasible.

Underneath hybrid situations, probably the most resilient companies shall be those who not solely construct quicker fashions but in addition personal knowledge, lock in customers, and seize consumption straight.

Actionable playbook for executives and traders

For AI and infrastructure aspirants

- Design your personal demand. Construct or purchase companies whose workloads your infrastructure will serve. Ellison didn’t simply construct knowledge facilities. He purchased content material and distribution to feed them.

- Embed downstream worth seize. Don’t solely hire compute. Take a minimize of enterprise outcomes akin to margin share in purposes your compute allows.

- Time issues, and so does protection. You’ll have solely 12 to 24 months of premium margin earlier than competitors catches up. Plan your obstacles early, particularly in knowledge, person expertise, and workflows.

- Hedge innovation threat. Allocate reserve capital for radical shifts akin to quantum that would out of date your present structure.

For conventional (legacy economic system) companies

- Don’t dismiss AI as irrelevant. Your valuation might already be discounting structural obsolescence. Face it consciously reasonably than ready for capital to “normalize.”

- Companion or embed as an alternative of competing straight. Use AI platforms as leverage. Don’t try to win infrastructure races. Goal to turn into the most effective AI-powered model of your enterprise.

- Discover area moats. In your trade, determine knowledge or workflow exclusivities that generalized AI can’t simply replicate (for instance healthcare outcomes or provide chain idiosyncrasies).

- Speed up pilot to scale cycles. The window of differentiation is shrinking. Pilots that final 18 months will already be out of date. Use modular and fast iterations.

Why Ellison’s strikes matter

Ellison’s Oracle plus Paramount plus TikTok technique is a microcosm of the logic that can outline winners within the AI age. These combos internalize demand, produce knowledge, lock in workloads, and blur the road between provide and demand.

If profitable, such companies shall be much less weak to margin collapse from commoditization as a result of they don’t seem to be simply compute distributors. They’re full-stack ecosystems.

If markets reward this technique, Ellison’s uncommon media bets might appear to be foresight. If not, they could seem as extravagant diversions. Both method, watching whether or not he can maintain that vertical system gives a stay case research in how radical capital is being reallocated in actual time.