Introduction

In as we speak’s fast-paced enterprise panorama, organizations are more and more turning to AI-driven options to automate repetitive processes and improve effectivity. Accounts Payable (AP) automation, a crucial space in monetary administration, is not any exception. Conventional automation strategies typically fall quick when coping with advanced, dynamic duties requiring contextual understanding.

That is the place Massive Language Mannequin (LLM)-powered multi-agent techniques step in, combining the ability of AI with specialised process allocation to ship scalable, adaptive, and human-like options.

On this weblog, we’ll:

- Study the core elements and advantages of multi-agent designs in automating workflows.

- Elements of an AP system.

- Coding a multi-agent system to automate AP course of.

By the tip of this weblog, you’ll perceive the right way to code your personal AP agent in your personal bill use-case. However earlier than we soar forward, let’s perceive what are LLM based mostly AI brokers and a few issues about multi-agent techniques.

AI Brokers

Brokers are techniques or entities that carry out duties autonomously or semi-autonomously, typically by interacting with their surroundings or different techniques. They’re designed to sense, motive, and act in a manner that achieves a selected purpose or set of targets.

LLM-powered AI brokers use giant language fashions as their core to know, motive and generate texts. They excel at understanding context, adapting to numerous information, and dealing with advanced duties. They’re scalable and environment friendly, making them appropriate for automating repetitive duties like AP automation. Nevertheless LLMs can not deal with the whole lot. As brokers may be arbitrarily advanced, there are extra system elements resembling IO sanity, reminiscence and different specialised instruments which are wanted as a part of the system. Multi-Agent Techniques (MAS) come into image, orchestrating and distributing duties amongst specialised single-purpose brokers and instruments to boost dev-experience, effectivity and accuracy.

Multi-Agent Techniques (MAS): Leveraging Collaboration for Complicated Duties

A Multi-Agent System (MAS) works like a workforce of specialists, every with a selected function, collaborating towards a typical purpose. Powered by LLMs, brokers refine their outputs in real-time—as an illustration, one writes code whereas one other opinions it. This teamwork boosts accuracy and reduces biases by enabling cross-checks. Advantages of Multi-Agent Designs

Listed here are some benefits of utilizing MAS that can’t be simply replicated with different patterns

| Separation of Considerations | Brokers deal with particular duties, enhancing effectiveness and delivering specialised outcomes. |

| Modularity | MAS simplifies advanced issues into manageable duties, permitting straightforward troubleshooting and optimization. |

| Range of Views | Numerous brokers present distinct insights, enhancing output high quality and lowering bias. |

| Reusability | Developed brokers may be reconfigured for various purposes, creating a versatile ecosystem. |

Let’s now have a look at the structure and numerous elements that are the constructing blocks of a multi agent system.

Core Elements of Multi-Agent Techniques

The structure of MAS consists of a number of crucial elements to make sure that brokers work cohesively. Under are the important thing elements that makes up an MAS:

- Brokers: Every agent has a selected function, purpose, and set of directions. They work independently, leveraging LLMs for understanding, decision-making, and process execution.

- Connections: These pathways let brokers share info and keep aligned, making certain clean collaboration with minimal delays.

- Orchestration: This manages how brokers work together—whether or not sequentially, hierarchically, or bidirectionally—to optimize workflows and preserve duties on monitor.

- Human Interplay: People typically oversee MAS, stepping in to validate outcomes or make selections in tough conditions, including an additional layer of security and high quality.

- Instruments and Sources: Brokers use instruments like databases for validation or APIs to entry exterior information, boosting their effectivity and capabilities.

- LLM: The LLM acts because the system’s core, powering brokers with superior comprehension and tailor-made outputs based mostly on their roles.

Under you may see how all of the elements are interconnected:

There are a number of frameworks that allow us to successfully write code and setup Multi Agent Techniques. Now let’s talk about a couple of of those frameworks.

Frameworks for Constructing Multi-Agent Techniques with LLMs

To successfully handle and deploy MAS, a number of frameworks have emerged, every with its distinctive method to orchestrating LLM-powered brokers. In beneath desk we will see the three hottest frameworks and the way they’re completely different.

| Standards | LangGraph | AutoGen | CrewAI |

|---|---|---|---|

| Ease of Utilization | Reasonable complexity; requires understanding of graph idea | Consumer-friendly; conversational method simplifies interplay | Simple setup; designed for manufacturing use |

| Multi-Agent Help | Helps each single and multi-agent techniques | Sturdy multi-agent capabilities with versatile interactions | Excels in structured role-based agent design |

| Device Protection | Integrates with a variety of instruments through LangChain | Helps numerous instruments together with code execution | Provides customizable instruments and integration choices |

| Reminiscence Help | Superior reminiscence options for contextual consciousness | Versatile reminiscence administration choices | Helps a number of reminiscence sorts (short-term, long-term) |

| Structured Output | Sturdy assist for structured outputs | Good structured output capabilities | Strong assist for structured outputs |

| Ideally suited Use Case | Greatest for advanced process interdependencies | Nice for dynamic, customizable agent interactions | Appropriate for well-defined duties with clear roles |

Now that we have now a excessive stage information about completely different multi-agent techniques frameworks, we’ll be selecting crewai for implementing our personal AP automation system as a result of it’s simple to make use of and simple to setup.

Accounts Payable (AP) Automation

We’ll deal with constructing an AP system on this part. However earlier than that allow’s additionally perceive what AP automation is and why it’s wanted.

Overview of AP Automation

AP automation simplifies managing invoices, funds, and provider relationships by utilizing AI to deal with repetitive duties like information entry and validation. AI in accounts payable accelerates processes, reduces errors, and ensures compliance with detailed data. By streamlining workflows, it saves time, cuts prices, and strengthens vendor relationships, turning Accounts Payable into a better, extra environment friendly course of.

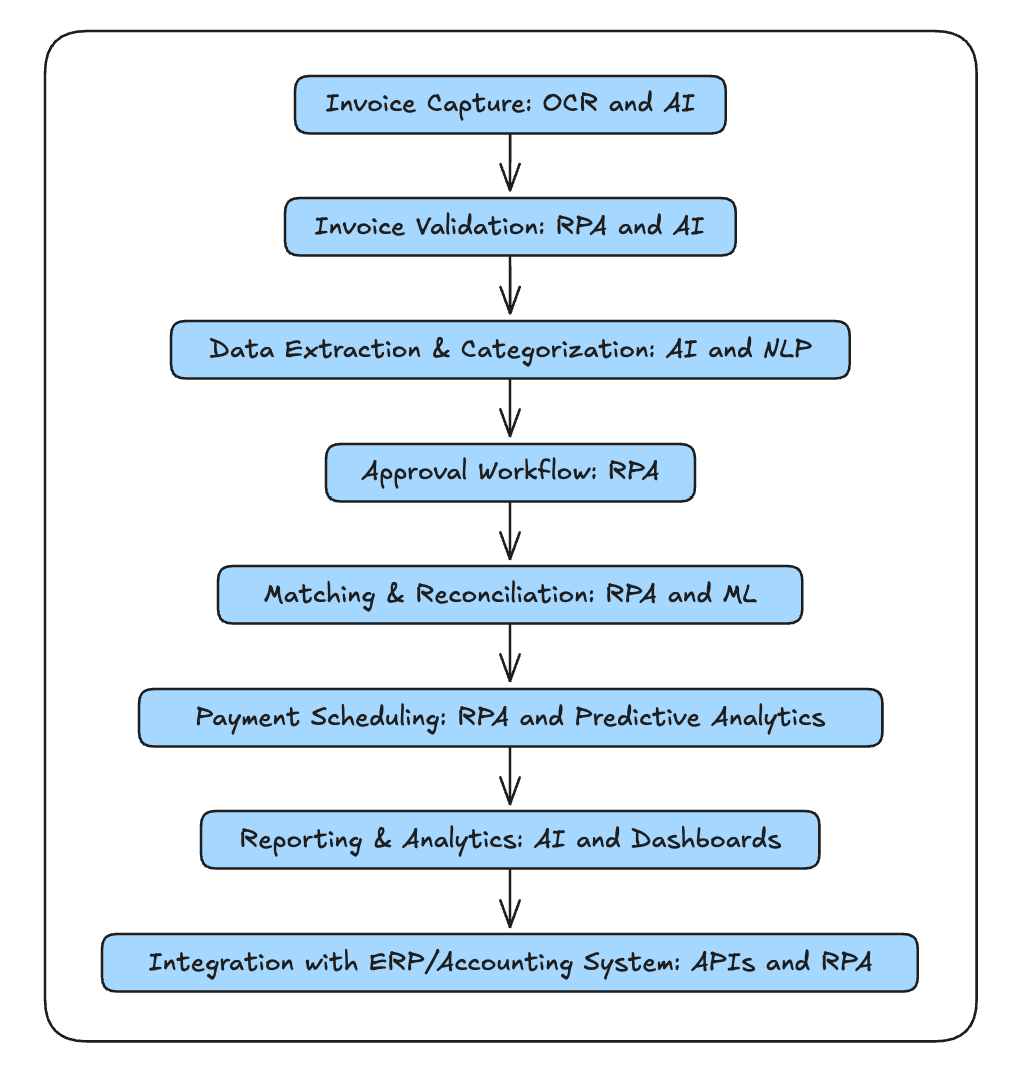

Typical Steps in AP

- Bill Seize: Use OCR or AI-based instruments to digitize and seize bill information.

- Bill Validation: Robotically confirm bill particulars (e.g., quantities, vendor particulars) utilizing set guidelines or matching in opposition to Buy Orders (POs).

- Knowledge Extraction & Categorization: Extract particular information fields (vendor identify, bill quantity, quantity) and categorize bills to related accounts.

- Approval Workflow: Route invoices to the proper approvers, with customizable approval guidelines based mostly on vendor or quantity.

- Matching & Reconciliation: Automate 2-way or 3-way matching (bill, PO, and receipt) to examine for discrepancies.

- Fee Scheduling: Schedule and course of funds based mostly on fee phrases, early fee reductions, or different monetary insurance policies.

- Reporting & Analytics: Generate real-time experiences for money circulation, excellent payables, and vendor efficiency.

- Integration with ERP/Accounting System: Sync with ERP or accounting software program for seamless monetary data administration.

Implementing AP Automation

As we have learnt what’s a multi-agent system and what’s AP, it is time to implement our learnings.

Listed here are the brokers that we’ll be creating and orchestrating utilizing crew.ai –

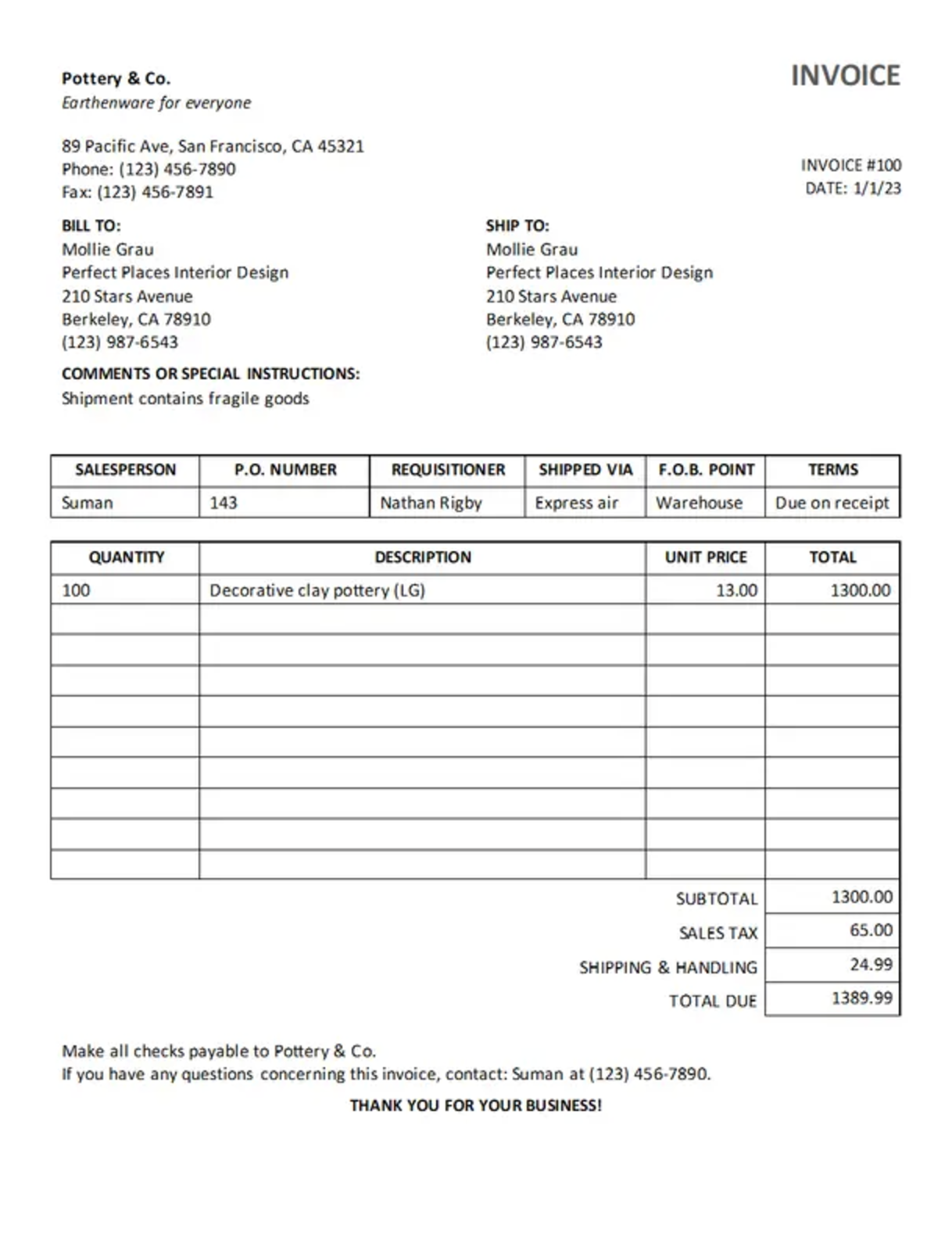

- Bill Knowledge Extraction Agent: Extracts key bill particulars (vendor identify, quantity, due date) utilizing multimodal functionality of GPT-4o for OCR and information parsing.

- Validation Agent: Ensures accuracy by verifying extracted information, checking for matching particulars, and flagging discrepancies.

- Fee Processing Agent: Prepares fee requests, validates them, and initiates fee execution.

This setup delegates duties effectively, with every agent specializing in a selected step, enhancing reliability and total workflow efficiency.

Right here’s a visualisation of how the circulation will seem like.

Code:

First we’ll begin by putting in the Crew ai package deal. Set up the ‘crewai’ and ‘crewai_tools’ packages utilizing pip.

!pip set up crewai crewai_toolsSubsequent we’ll import needed lessons and modules from the ‘crewai’ and ‘crewai_tools’ packages.

from crewai import Agent, Crew, Course of, Process

from crewai.venture import CrewBase, agent, crew, process

from crewai_tools import VisionToolSubsequent, import the ‘os’ module for interacting with the working system. Set the OpenAI API key and mannequin identify as surroundings variables. Outline the URL of the picture to be processed.

import os

os.environ["OPENAI_API_KEY"] = "YOUR OPEN AI API KEY"

os.environ["OPENAI_MODEL_NAME"] = 'gpt-4o-mini'

image_url="https://cdn.create.microsoft.com/catalog-assets/en-us/fc843d45-e3c4-49d5-8cc6-8ad50ef1c2cd/thumbnails/616/simple-sales-invoice-modern-simple-1-1-f54b9a4c7ad8.webp"Import the VisionTool class from crewai_tools. This instrument makes use of multimodal performance of GPT-4 to course of the bill picture.

from crewai_tools import VisionTool

vision_tool = VisionTool()Now we’ll be creating the brokers that we want for our process.

- Outline three brokers for the bill processing workflow:

- image_text_extractor: Extracts textual content from the bill picture.

- invoice_data_analyst: Validates the extracted information with consumer outlined guidelines and approves or rejects the bill.

- payment_processor: Processes the fee whether it is permitted.

image_text_extractor = Agent(

function="Picture Textual content Extraction Specialist",

backstory="You might be an skilled in textual content extraction, specializing in utilizing AI to course of and analyze textual content material from pictures, particularly from PDF information that are invoices that must be paid. Be sure you use the instruments offered.",

purpose= "Extract and analyze textual content from pictures effectively utilizing AI-powered instruments. It is best to get the textual content from {image_url}",

allow_delegation=False,

verbose=True,

instruments=[vision_tool],

max_iter=1

)

invoice_data_analyst = Agent(

function="Bill Knowledge Validation Analyst",

purpose="Validate the information extracted from the bill. In case the circumstances should not met, you must return the error message.",

backstory="You are a meticulous analyst with a eager eye for element. You are recognized in your potential to learn by the bill information and validate the information based mostly on the circumstances offered.",

max_iter=1,

allow_delegation=False,

verbose=True,

)

payment_processor = Agent(

function="Fee Processing Specialist",

purpose="Course of the fee for the bill if the fee is permitted.",

backstory="You are a fee processing specialist who's answerable for processing the fee for the bill if the fee is permitted.",

max_iter=1,

allow_delegation=False,

verbose=True,

)Defining Brokers, that are the personas within the multi-agent system

Now we’ll be defining the duties that these brokers will probably be performing.

Outline three duties which our brokers will carry out:

- text_extraction_task: This process assigns the ‘image_text_extractor’ agent to extract textual content from the offered picture.

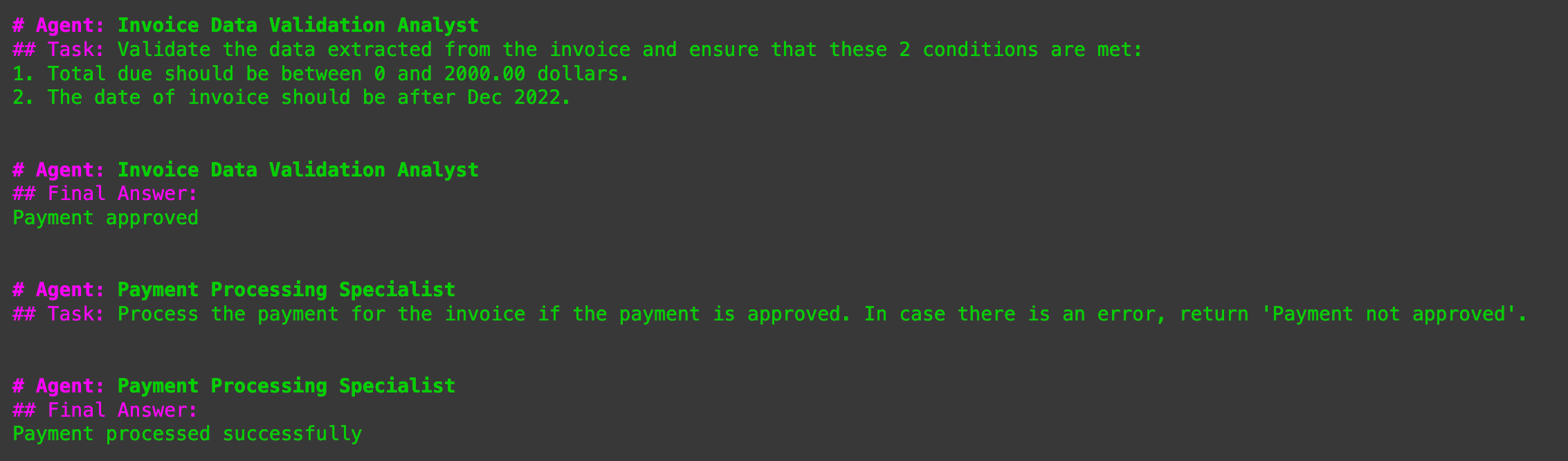

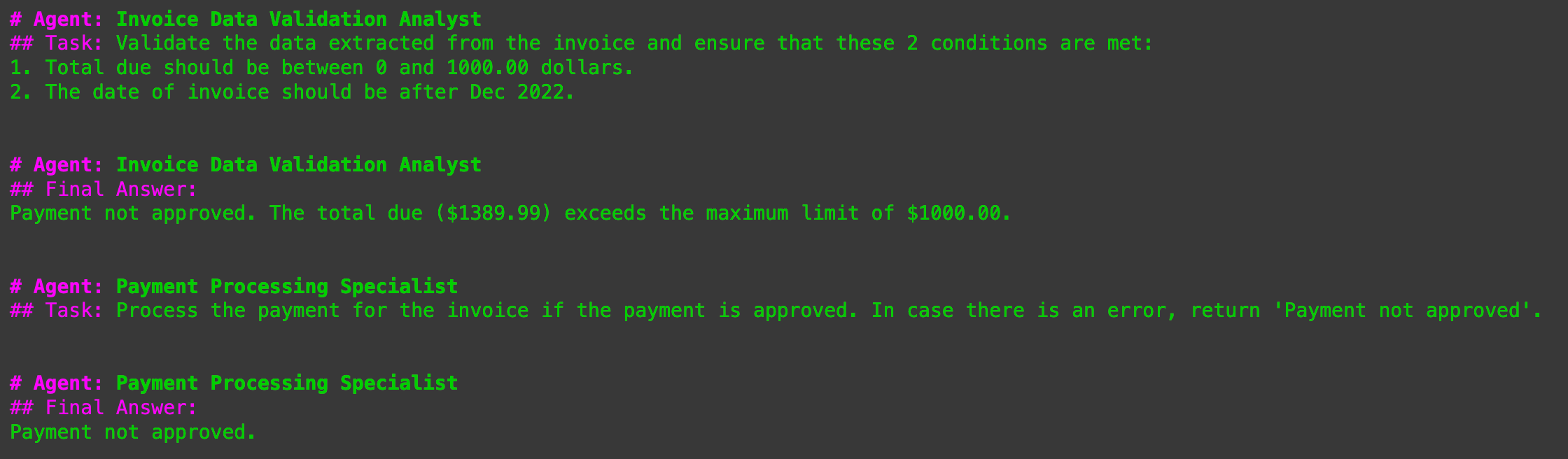

- invoice_data_validation_task: This process assigns the “invoice_data_analyst” agent to validate and approve the bill for fee based mostly on guidelines outlined by the consumer.

- payment_processing_task: This process assigns a “payment_processor” agent to course of the fee whether it is validated and permitted.

text_extraction_task = Process(

agent=image_text_extractor,

description=(

"Extract textual content from the offered picture file. Make sure that the extracted textual content is correct and full, "

"and prepared for any additional evaluation or processing duties. The picture file offered could comprise numerous textual content parts, "

"so it is essential to seize all readable textual content. The picture file is an bill, and we have to extract the information from it to course of the fee."

),

expected_output="A string containing the complete textual content extracted from the picture."

)

# We will outline the circumstances which we wish the agent to validate for fee processing.

# Presently I've created 2 circumstances which needs to be met within the bill earlier than it is paid.

invoice_data_validation_task = Process(

agent=invoice_data_analyst,

description=(

"Validate the information extracted from the bill and be sure that these 2 circumstances are met:n"

"1. Whole due needs to be between 0 and 2000.00 {dollars}.n"

"2. The date of bill needs to be after Dec 2022."

),

expected_output=(

"If each circumstances are met, return 'Fee permitted'.n"

"Else, return 'Fee not permitted' adopted by the error string based on the unmet situation, which may be eithern"

)

)

payment_processing_task = Process(

agent=payment_processor,

description=(

"Course of the fee for the bill if the fee is permitted. In case there may be an error, return 'Fee not permitted'."

),

expected_output="A affirmation message indicating that the fee has been processed efficiently: 'Fee processed efficiently'."

)Duties carried out by every agent

As soon as we have now created brokers and the duties that these brokers will probably be performing, we’ll initialise our Crew, consisting of the brokers and the duties that we have to full. The method will probably be sequential, i.e every process will probably be accomplished within the order they’re set.

# Notice: If any modifications are made within the brokers and/or duties, we have to re-run this cell for modifications to take impact.

crew = Crew(

brokers=[image_text_extractor, invoice_data_analyst, payment_processor],

duties=[text_extraction_task, invoice_data_validation_task, payment_processing_task],

course of=Course of.sequential,

verbose=True

)

Lastly, we’ll be operating our crew and storing the outcome within the “outcome” variable. Additionally we’ll be passing the bill picture url, which we have to course of.

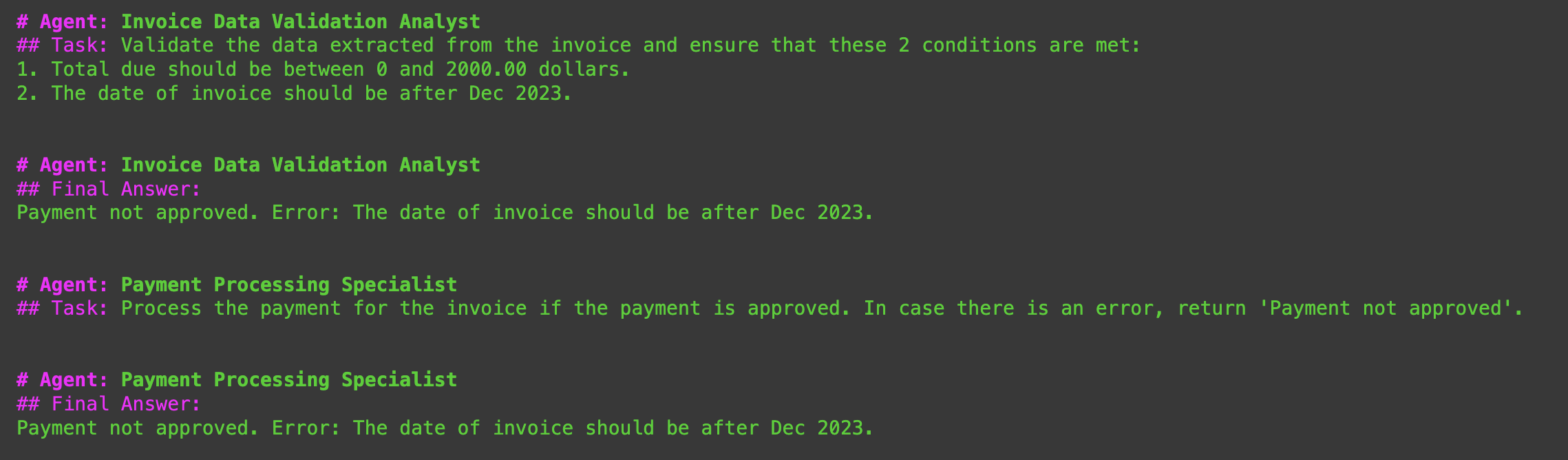

outcome = crew.kickoff(inputs={"image_url": image_url})Listed here are some pattern outputs for various eventualities/circumstances for bill validation:

If you wish to attempt the above instance, right here’s a Colab pocket book for a similar. Simply set your OpenAI API and experiment with the circulation your self!

Sounds easy? There are a couple of challenges that we have missed whereas constructing this small proof of idea.

Challenges of Implementing AI in AP Automation

- Integration with Present Techniques: Integrating AI with current ERP techniques can create information silos and disrupt workflows if not achieved correctly.

- Worker Resistance: Adapting to automation could face pushback; coaching and clear communication are key to easing the transition.

- Knowledge High quality: AI will depend on clear, constant information. Poor information high quality results in errors, making supply accuracy important.

- Preliminary Funding: Whereas cost-effective long-term, the upfront funding in software program, coaching, and integration may be important.

Nanonets is an enterprise-grade instrument designed to remove all of the hassles for you and supply a seamless expertise, effortlessly managing the complexities of accounts payable. Click on beneath to schedule a free demo with Nanonets’ Automation Consultants.

Conclusion

In abstract, LLM-powered multi-agent techniques present a scalable and clever answer for automating duties like Accounts Payable, combining specialised roles and superior comprehension to streamline workflows.

We have realized the paradigms behind multi-agent techniques, and learnt the right way to code a easy crew.ai software to streamline invoices. Rising the elements within the system needs to be as straightforward as producing extra brokers and duties, and orchestrating with the proper course of.