Is the carbon market rising from its years-long stoop?

A sequence of latest findings suggests it’s. Purchaser confidence, which had been severely dented by exposés of flawed tasks, seems to be returning as market high quality inches upward.

The latest information comes from a survey of companies in 30 nations carried out by SE Advisory Providers, the consulting arm of vitality know-how firm Schneider Electrical. Requested about buying plans between now and 2030, greater than half of respondents stated they anticipated to extend engagement with carbon markets — 29 % reasonably and 26 % considerably.

The shift is pushed partly by the unfold of latest emissions discount rules, significantly in Asia, that enable firms to make use of credit to hit targets. “These early movers are constructing the inventories, relationships and capabilities they are going to want when voluntary turns into obligatory,” the report authors famous.

Shopping for higher

Consumers, significantly these new to the market, are additionally utilizing new high quality indicators. The Schneider report discovered that 55 % of respondents regarded for the Core Carbon Ideas, a high quality label developed by the Integrity Council for the Voluntary Carbon Market that rubber-stamped its first methodologies in summer time 2024. Though the council’s selections aren’t a assure of high quality — a number of of its first approvals have been questioned by unbiased consultants — the label is taken into account a related a part of a due diligence course of nonetheless.

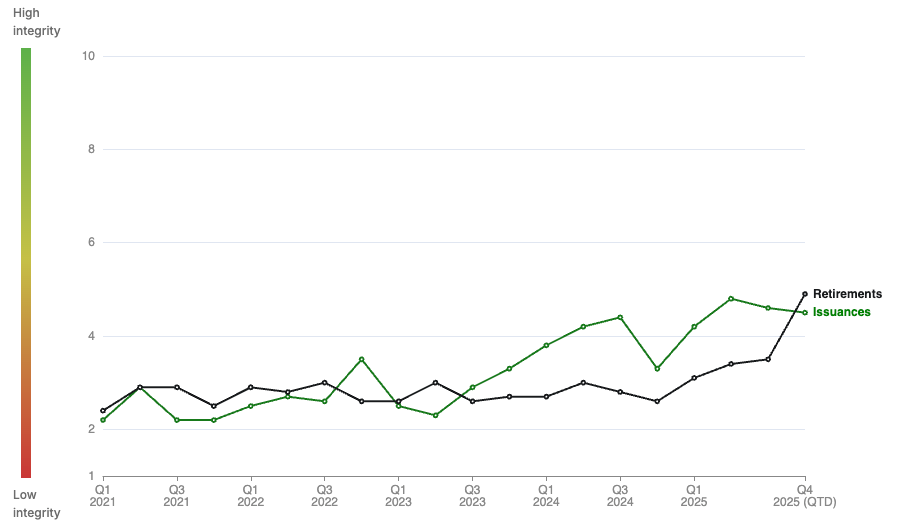

Purchaser demand for high quality appears to be slowly shaping the market. The integrity of credit issued and retired has been trending steadily upwards since 2021, as measured on a 10-point scale utilized by Calyx International, an unbiased rater of credit score tasks.

Carbon credit score high quality developments

An analogous uptick was seen by the finance intelligence supplier MSCI, which charges carbon tasks from AAA to CCC. The corporate’s second annual report on market integrity, revealed in September, famous that 35 % of credit retired within the first half of this yr have been rated BBB or above, in contrast with 25 % in 2022.

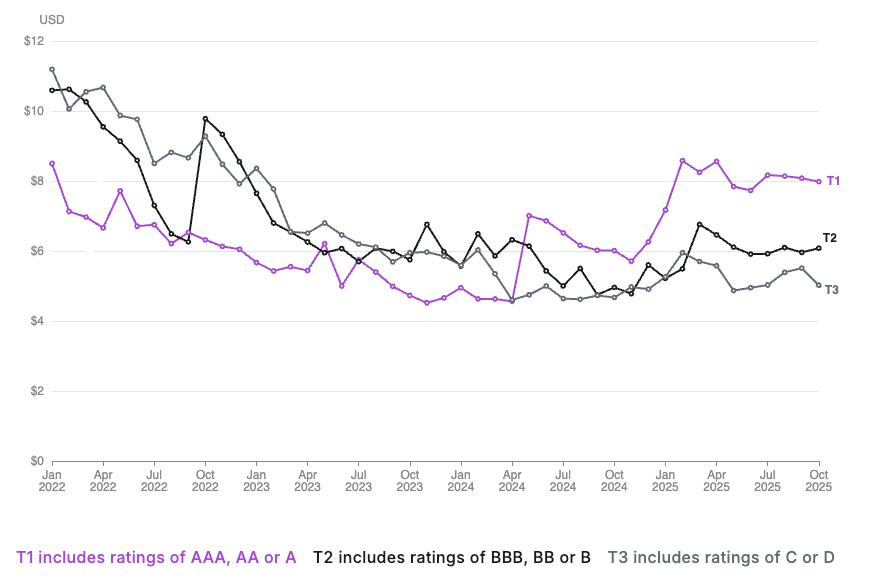

Greater-quality credit are additionally commanding larger costs, in response to an index maintained by Calyx and ClearBlue Markets that provides instruments to assist firms navigate carbon markets.

Costs for carbon credit in numerous high quality tiers

MSCI information aligns with this: Credit within the firm’s high-integrity index traded at greater than 4 instances the value of these in its low-integrity index, in contrast with a two-fold distinction in 2024.

‘Intractable’ issues

Nonetheless, probably the most talked-about publication in current months most likely isn’t any of the above. It’s a overview of the educational literature on carbon credit, by Joseph Romm on the College of Pennsylvania, which concluded that many well-liked offset varieties have “intractable” high quality issues.

Many within the trade stated Romm’s paper flagged recognized issues which might be being addressed by the integrity council and different organizations. Others — together with the Guardian, one of many fiercest critics of carbon markets — cited it as yet-more proof that carbon credit can’t be trusted. The carbon market could also be evolving, however its capacity to divide opinions stays unchanged.