The usage of synthetic intelligence (AI) in monetary markets has grown quickly, with massive language fashions (LLMs) more and more utilized to fairness evaluation, portfolio administration, and inventory choice. BlackRock analysis group proposed AlphaAgents for funding analysis. The AlphaAgents framework leverages the ability of multi-agent programs to enhance funding outcomes, scale back cognitive bias, and improve the decision-making course of in fairness portfolio development.

The Want for Multi-Agent Methods in Fairness Analysis

Fairness portfolio administration historically depends on human analysts who synthesize huge, numerous datasets—monetary statements, information stories, market indicators, and extra—to make considered inventory choices. This course of is inclined to cognitive and behavioral biases, resembling loss aversion and overconfidence, that are well-documented in behavioral finance literature.

LLMs can course of massive volumes of unstructured information quickly, extracting actionable insights from sources like regulatory disclosures, earnings calls, and analyst scores. Nonetheless, even highly effective fashions face challenges:

- Hallucination: Producing plausible-yet-inaccurate info.

- Restricted area focus: Singular brokers might overlook contrasting views or fail to think about the interaction of market sentiment, basic evaluation, and valuation.

- Cognitive bias mitigation: Decreasing human-like biases in automated decision-making.

Multi-agent LLM frameworks purpose to deal with these pitfalls via collaborative reasoning, debate, and consensus-building.

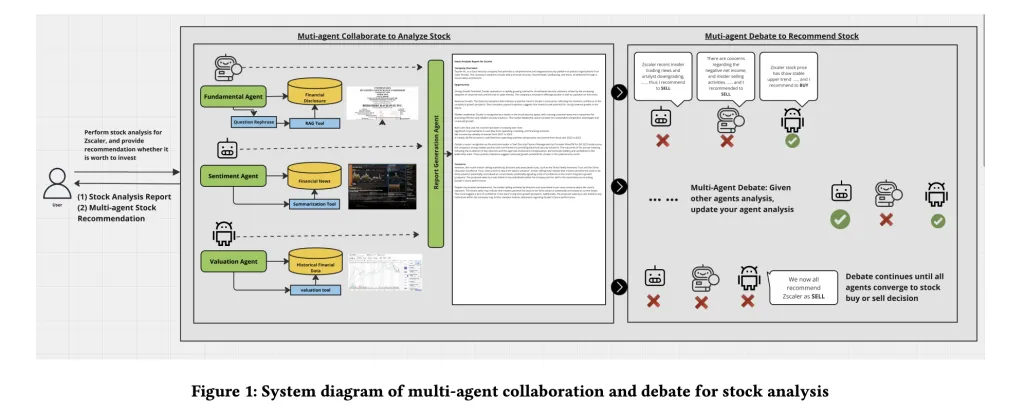

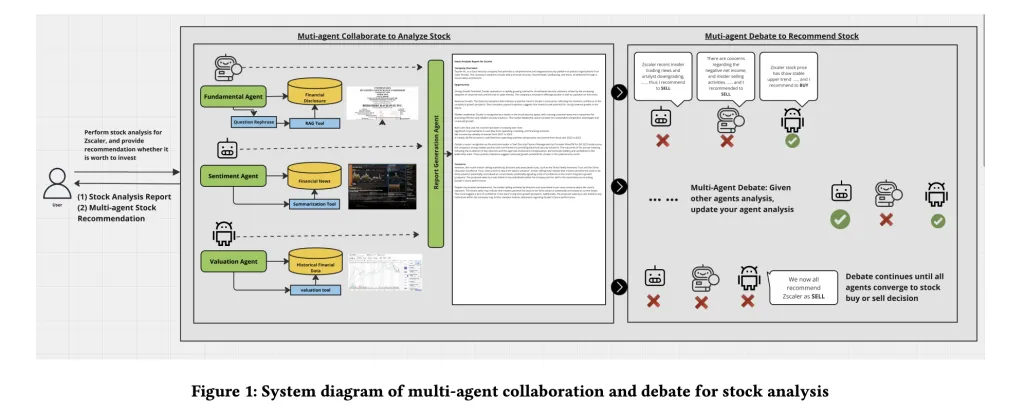

AlphaAgents Framework: System Structure

AlphaAgents is a modular framework designed for fairness inventory choice, that includes three core specialised brokers, every representing a definite analytical self-discipline:

1. Elementary Agent

- Operate: Automates qualitative and quantitative evaluation of firm fundamentals utilizing 10-Ok/10-Q filings, sector traits, and monetary statements.

- Instruments: RAG (Retrieval-Augmented Technology) for report evaluation, direct information extraction from filings, and domain-specific immediate engineering.

2. Sentiment Agent

- Operate: Analyzes monetary information, analyst scores, govt modifications, and insider buying and selling disclosures to gauge market sentiment’s affect on inventory costs.

- Instruments: LLM-based summarization and reflection-enhanced prompting, driving knowledgeable suggestions and sentiment classification.

3. Valuation Agent

- Operate: Evaluates historic inventory costs and volumes to find out valuation, calculate annualized returns/volatility, and assess pricing traits.

- Instruments: Computational analytics for volatility and return calculations, aided by mathematical software constraints for rigor.

Every agent operates on information particularly sanctioned for his or her designated function, minimizing cross-domain contamination.

Position Prompting and Agent Workflow

AlphaAgents employs “function prompting,” rigorously crafting agent directions aligned with monetary area experience. For instance, the valuation agent is prompted to deal with long-term worth and quantity traits, whereas the sentiment agent synthesizes news-driven market reactions.

Coordination is managed by a bunch chat assistant (constructed on Microsoft AutoGen), which ensures equitable participation and consolidates agent outputs. In instances of divergent evaluation or suggestion, a “multi-agent debate” mechanism (round-robin model) permits brokers to share views and iterate towards consensus—a course of designed to cut back hallucination and improve explainability.

Incorporating Threat Tolerance

AlphaAgents introduces agent-specific threat tolerance modeling by way of immediate engineering, mimicking actual investor profiles—risk-neutral versus risk-averse. For example:

- Threat-Averse Brokers: Slim inventory choices, emphasizing low volatility and monetary stability.

- Threat-Impartial Brokers: Broader picks, balancing upside potential with measured warning.

This permits tailor-made portfolio development reflective of various funding mandates—a novel side not broadly embedded in earlier multi-agent monetary programs.

Analysis and Backtesting

1. Retrieval-Augmented Technology (RAG) Metrics

AlphaAgents leverages Arize Phoenix to guage the faithfulness and relevance of agent outputs, utilizing retrieval metrics for brokers counting on RAG and summarization (e.g., basic and sentiment brokers).

2. Portfolio Again-testing

The crucial downstream analysis includes backtesting agent-driven portfolios in opposition to a benchmark over a four-month window.

Portfolios constructed embody:

- Valuation agent portfolio

- Elementary agent portfolio

- Sentiment agent portfolio (the place enough information protection)

- Coordinated multi-agent portfolio

Efficiency metrics:

- Cumulative return

- Threat-adjusted return (Sharpe Ratio)

- Rolling Sharpe ratio for dynamic threat evaluation

Findings reveal:

- Threat-Impartial State of affairs: Multi-agent collaboration outperforms single-agent approaches and the market benchmark, synergizing short-term sentiment/valuation and long-term basic views.

- Threat-Averse State of affairs: All agent-driven portfolios are extra conservative, lagging the benchmark attributable to tech sector rallies and decrease volatility exposures. The multi-agent strategy, nevertheless, achieves decrease drawdowns and higher threat mitigation.

Key Insights and Sensible Implications

- Multi-agent LLM frameworks convey strong, explainable reasoning to inventory choice, with modularity for scaling and integration of latest agent varieties (e.g., technical evaluation, macroeconomic brokers).

- The controversy mechanism echoes real-world funding committee workflows, reconciling differing views for clear choice trails—a crucial characteristic for institutional adoption.

- AlphaAgents serves not just for portfolio development however as a modular enter for superior optimization engines (Imply-Variance, Black-Litterman), increasing use instances in trendy asset administration.

- Human-in-the-loop transparency: All agent dialogue logs can be found for overview, providing override and audit capabilities crucial for institutional belief.

Conclusion

AlphaAgents represents a compelling development in agentic portfolio administration: collaborative multi-agent LLMs, modular structure, risk-aware reasoning, and rigorous analysis. Whereas present scope facilities on inventory choice, the potential for automated, explainable, and scalable portfolio administration is evident—positioning multi-agent frameworks as foundational elements in future monetary AI programs.

Take a look at the Paper. Be happy to take a look at our GitHub Web page for Tutorials, Codes and Notebooks. Additionally, be happy to comply with us on Twitter and don’t overlook to hitch our 100k+ ML SubReddit and Subscribe to our E-newsletter.