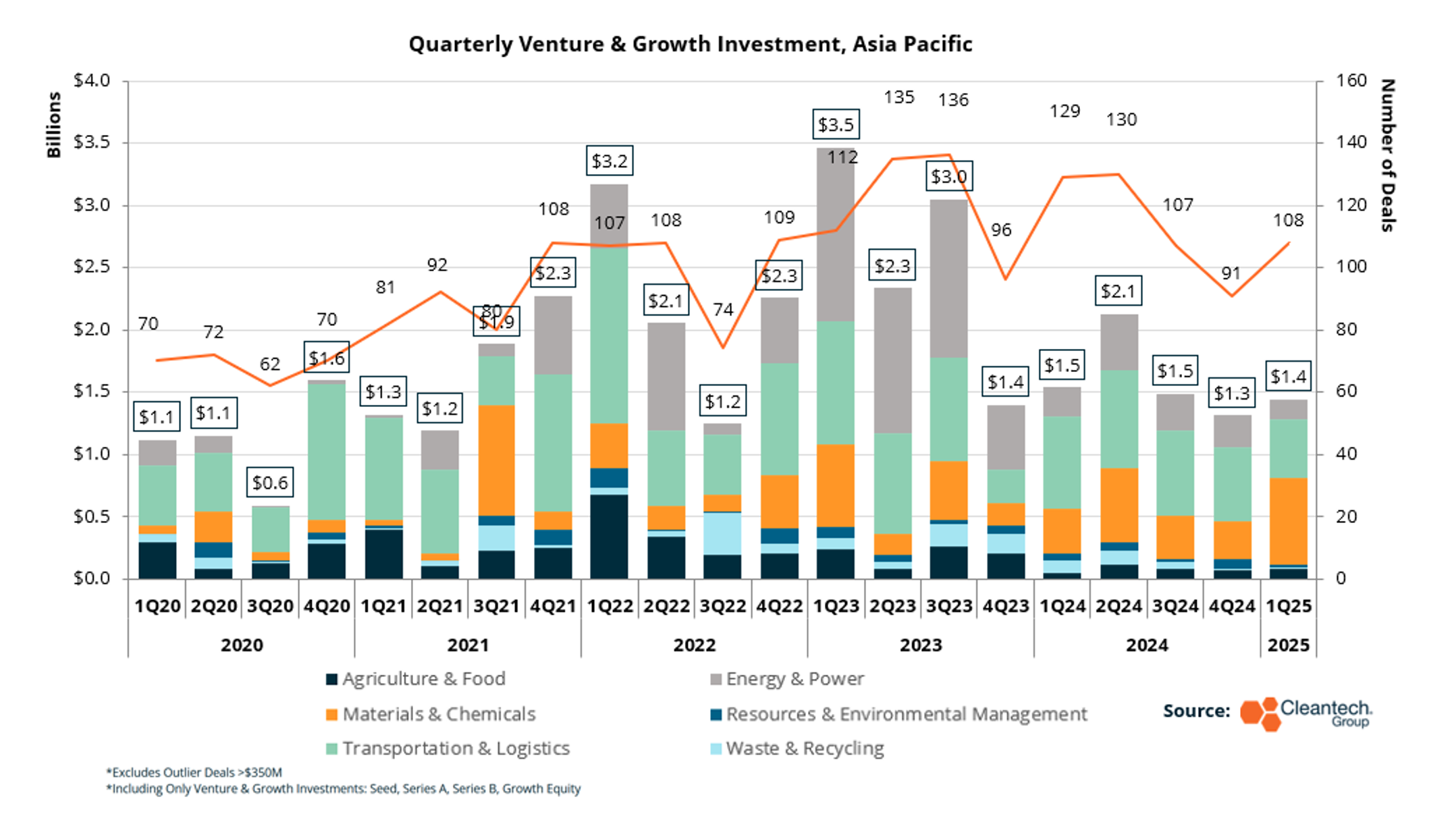

Only a few months in the past, we wrote in our year-end wrap-up e-newsletter on APAC exercise that, whereas funding numbers had come all the way down to earth following a extremely lively 2023, what was taking place beneath the floor was a development of the infrastructure essential to facilitate the subsequent waves of cleantech deployment (high-scale electrical mobility, knowledge facilities), and likewise a contest to personal innovation of the constituent elements within the new cleantech economic system (chips, semiconductors).

These tendencies have typically endured by this primary quarter of 2025, and certainly some have accelerated. Take notice particularly of the Supplies & Chemical substances business group, which skilled its most vital APAC quarter since 2021.

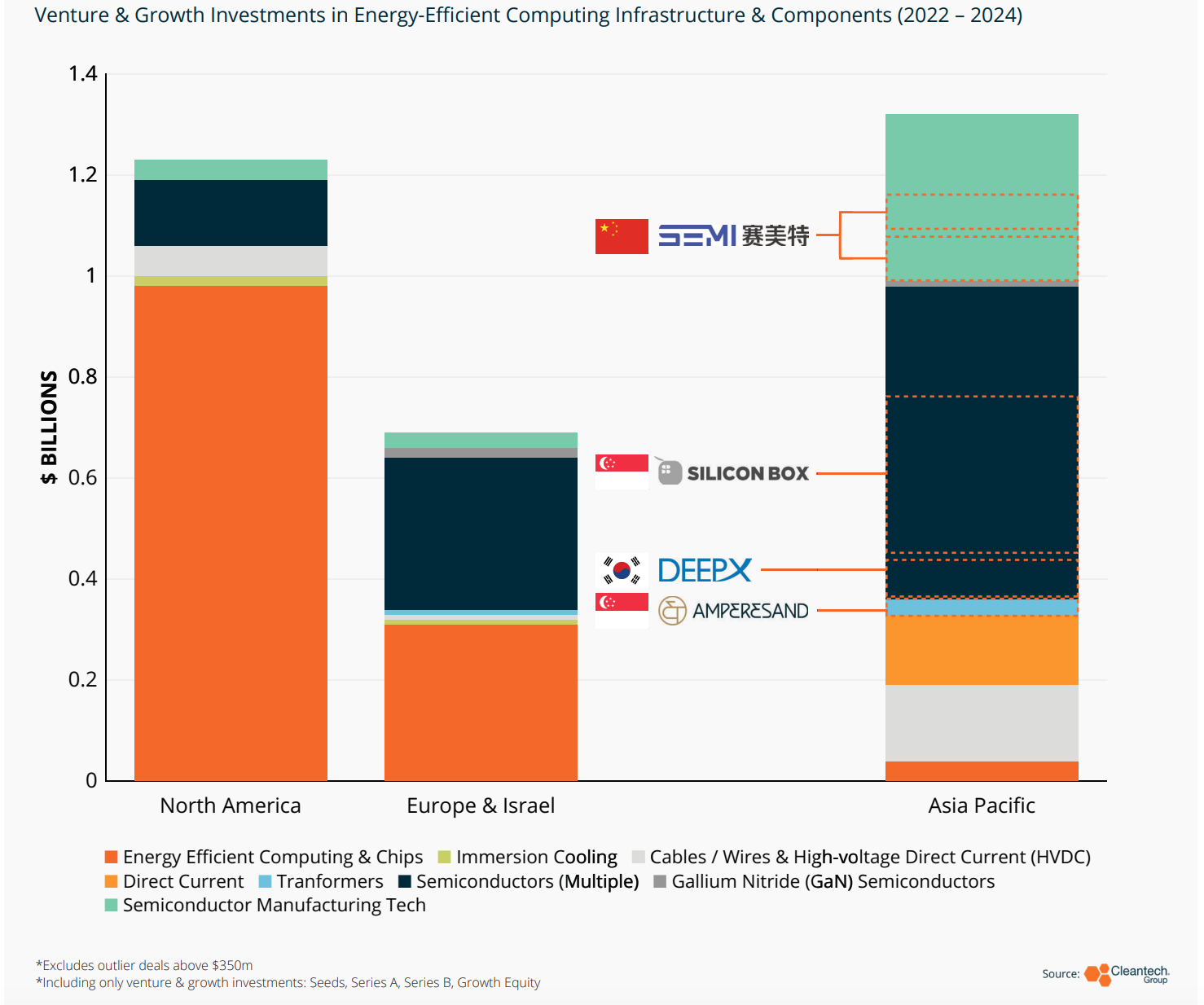

We noticed in our 2025 APAC Cleantech 25 report (free obtain right here) that Asia-Pacific was nonetheless catching up in delivering AI merchandise for cleantech-specific purposes, however certainly was competing on a world scale to innovate within the applied sciences that underpin AI infrastructure. Not solely was innovation in APAC garnering extra funding than world opponents, on mixture, we additionally famous the presence of corporations like Firmus Applied sciences and Amperesand on our APAC Cleantech 25 as a sign that the ecosystem was additionally perceiving these corporations as high-quality and positioned for development.

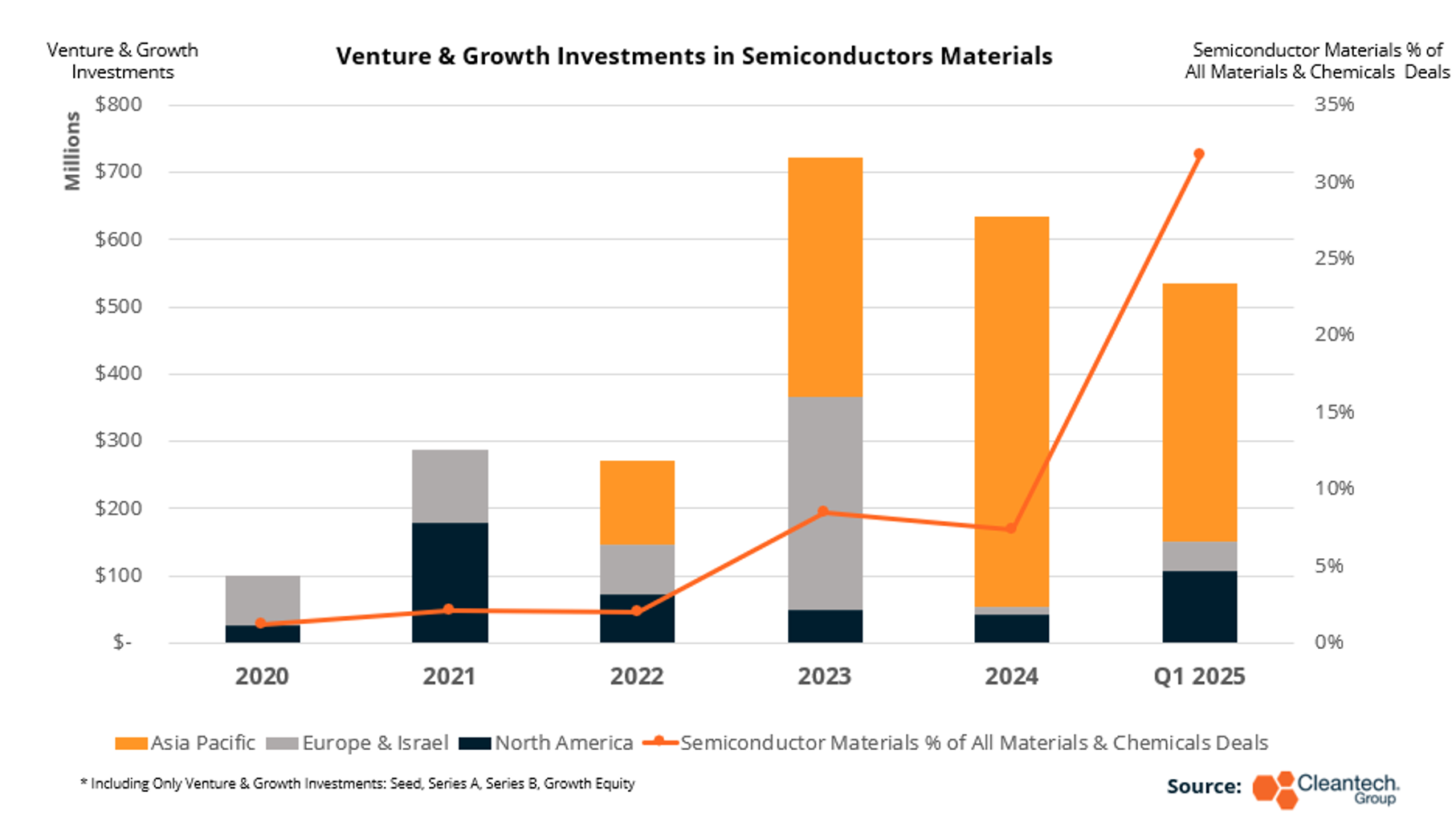

A lot of the APAC innovation exercise within the space has been on the furthest upstream degree of semiconductor supplies. Firms within the area, particularly China, are looking for to cut back single factors of failure of their provide chain that may be affected by commerce restrictions – even earlier than the newest spherical of U.S. tariffs, we witnessed Chinese language semiconductor innovators elevating the suitable funds to deal with the upcoming alternative.

This has an observable impact on the worldwide context – not solely had been semiconductors the important thing underpinning know-how section within the Supplies and Chemical substances class in Q1, this area was as soon as once more primarily comprised of APAC-based innovators.

This previous quarter was one in all important exercise for Chinese language innovators targeted on each supplies and manufacturing know-how for semiconductors. A couple of notable examples:

- InventChip, a silicon carbide system producer raised a $137.5M Progress Fairness spherical in January. InventChip’s silicon carbide merchandise are utilized in inverters for photo voltaic and wind and in electrical autos (DC-DC conversion, charging). Earlier funding rounds have taken in funding from main Chinese language automotive OEMs and suppliers, together with XPeng, Xiaomi, and CATL.

_ - Omnisun, a provider of substrate supplies for photomasks, raised a $101.7M Collection B spherical, simply lower than a 12 months off a $77M Collection A final January. Omnisun, a 20-year-old firm, claims to be the one Chinese language firm creating and promoting these supplies, that are a crucial enter to built-in circuits and printed circuit boards, in addition to show applied sciences.

_ - A smaller spherical, however one probably indicative of the route of precedence in Chinese language semiconductors, is the $6.9M Progress Fairness spherical in Teyan Semiconductor. Teyan produces gear for semiconductor packaging (system-in-packaging, chiplets), printing, and laser processing companies. Hold a watch out for a motivated drive to enhance semiconductor packaging know-how in China. As world gamers transfer past transistor scaling to packaging innovation in chips to pursue effectivity and energy use discount, this can be one of many key alternatives for Chinese language semiconductor producers to develop a efficiency and price benefit on the similar time that demand is rising, and commerce is complicating.

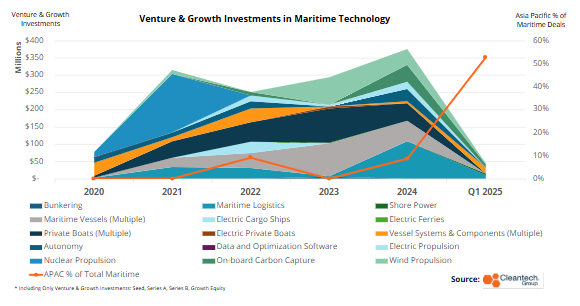

Q1 of 2025 introduced an surprising shock within the type of excessive APAC funding exercise in maritime cleantech. This, at a time when the maritime sectors in cleantech noticed a landmark 2024 that concerned solely marginal APAC exercise, raises a query of whether or not the pattern is catching in Asia or whether or not the worldwide pattern is receding.

A part of the reply to that query is that Q1 was a sluggish quarter for world funding in maritime innovation (simply 12% of what it was all of 2024). Even so, the $23M in investments in APAC-based maritime innovators in Q1 is in comparison with solely $32M within the area in all of final 12 months – and that $23M determine is for corporations squarely categorized as maritime innovation (see the instance of Energy-X under who has a number of purposes).

- Lyen Marine (China) presents pitch-controllable propellors for ships in addition to a set of analytics instruments for fleet optimization, stating gasoline financial savings potential from use of their propellor and analytics instruments. The corporate raised a $13.6M Collection A in February.

_ - The accelerating significance of the digital layer in maritime cleantech is coming by clearly in each the Lyen deal and likewise with Korean Seadronix. Seadronix describes itself as a “port-to-port” AI platform. Its software program is ready to convey a various feed of information from a number of sensor sorts into analytics and optimization instruments for ships, for ports, and one that may be mixed for each. Seadronix raised a $10.4M Collection B spherical in March.

_ - Not mirrored within the maritime numbers are a $38M spherical to Energy-X. Energy-X manufactures liquid-cooled lithium iron phosphate (LFP) batteries for stationary grid and industrial constructing storage, but in addition presents marine batteries. Energy-X is now pioneering an revolutionary “Ocean Grid” providing comprised of battery-carrying ships that may cost with off-peak renewables and discharge at factors of excessive demand. The rendering under is of the 240MWh “Energy Ark” ship, set to sail in 2027 – one of many said use circumstances can be “connecting” an offshore wind set up with town of Yokohama.

Rendering of a Energy-X “Energy Ark”

In recent times, Asia-Pacific has been the central venue for each scale deployment and innovation EV charging strategies. Within the first quarter of 2025, investments in EV charging dipped globally, but in addition noticed the APAC share of these offers dip as properly. The open query will now be whether or not the leaders in EV charging (suppose Nio or BYD) are too well-established for brand new gamers to proceed discovering provide gaps (notice that final quarter we recognized a number of area of interest gaps that innovators in APAC had been experimenting with).

Nonetheless, the pattern of innovation localized fashions for EV charging to accommodate nuances in utilization patterns continued to develop. It is usually clear from this previous quarter’s deal exercise that managing pressure on grids is a rising precedence for every geography that continues to develop EV possession. On this previous quarter’s offers, we are able to see three distinct applied sciences in three completely different international locations as examples:

- Jolt (Australia) presents EV charging cost and membership options for each particular person EV drivers but in addition fleets and experience sharing. Jolt secured $135M in structured debt from the Canada Infrastructure Financial institution in February to finance enlargement into Canada.

_ - On the earlier-stage aspect of offers, India-based DeCharge raised a $2.5M Seed spherical to fund the expansion of its 7kw charging unit and decentralized charging software program. The DeCharge helps homeowners of buildings and parking areas provide charging options at an inexpensive worth.

_ - Kwetta (New Zealand) is a 2025 APAC Cleantech 25 awardee. The corporate’s “Grid Unlock” resolution deploys DC fast-charging depots with subtle energy electronics to keep away from expensive grid upgrades. Kwetta raised a $10.5M Collection A in January.

A Kwetta Charging Depot