Synthetic intelligence is reworking how 10 million QuickBooks prospects handle their funds. Companies utilizing QuickBooks‘ AI-powered options receives a commission 5 days sooner. They’re additionally 10% extra more likely to obtain full cost on overdue invoices. These capabilities free enterprise house owners from tedious bookkeeping duties, permitting them to deal with development and technique.

However it doesn’t cease at built-in AI. For those who’re seeking to minimize much more handbook work, specialised integrations like Nanonets may also help. It provides one other layer of AI-powered automation to your QuickBooks workflows, enabling you to automate info seize, approval routing, and bill posting.

The consequence? You get a contemporary monetary stack that when required a devoted back-office staff to handle. Now, enterprises can streamline complicated monetary operations, cut back handbook errors, and provides their groups extra time for strategic initiatives with out overhauling their current programs or retraining complete departments.

QuickBooks native AI: options defined

Intuit Help capabilities as an AI-powered monetary assistant in QuickBooks On-line, studying from your small business patterns to automate duties and supply insights. By a centralized enterprise feed, it screens your monetary knowledge and suggests actions to enhance your operations.

This is how Intuit Help and different native QuickBooks AI options work:

- Bill reminders: Create customized bill reminders that adapt to every consumer relationship. You may customise the tone and elegance of those communications whereas letting the AI decide optimum sending instances primarily based on cost patterns.

- Knowledge extraction: Convert photographs of receipts, invoices, and even handwritten notes into QuickBooks transactions. The AI extracts quantities, dates, and line objects and robotically populates the related fields for evaluation.

- Transaction categorization: When categorizing transactions, the AI gives explanations for its ideas, exhibiting you why it selected particular classes. This transparency helps you make knowledgeable selections about accepting or adjusting its suggestions.

- Enterprise feed and motion plans: The AI-driven enterprise feed screens your monetary knowledge and suggests particular actions. It will probably generate invoices from conversations and paperwork, warn you about cost points, and advocate steps to enhance your monetary operations.

- Proactive money circulation administration: The system analyzes your monetary patterns to foretell potential money circulation points earlier than they happen. It recommends cost strategies more likely to end in sooner assortment and may join you with lending choices when it identifies potential shortfalls.

- Matching and reconciliation: The AI robotically matches incoming transactions with current payments, invoices, or receipts in your system, serving to stop duplicates and streamlining the reconciliation course of.

Whereas Intuit Help streamlines many monetary workflows, complicated enterprise necessities usually demand further capabilities. For example, organizations processing lots of of non-standard invoices every day might have extra specialised doc processing instruments.

Excessive-volume transaction matching and receipt seize at scale may require purpose-built AI options to take care of accuracy and effectivity. You will have to mix QuickBooks’ native options with specialised AI instruments like Nanonets to construct a extra complete monetary automation technique.

How you can develop QuickBooks’ AI capabilities?

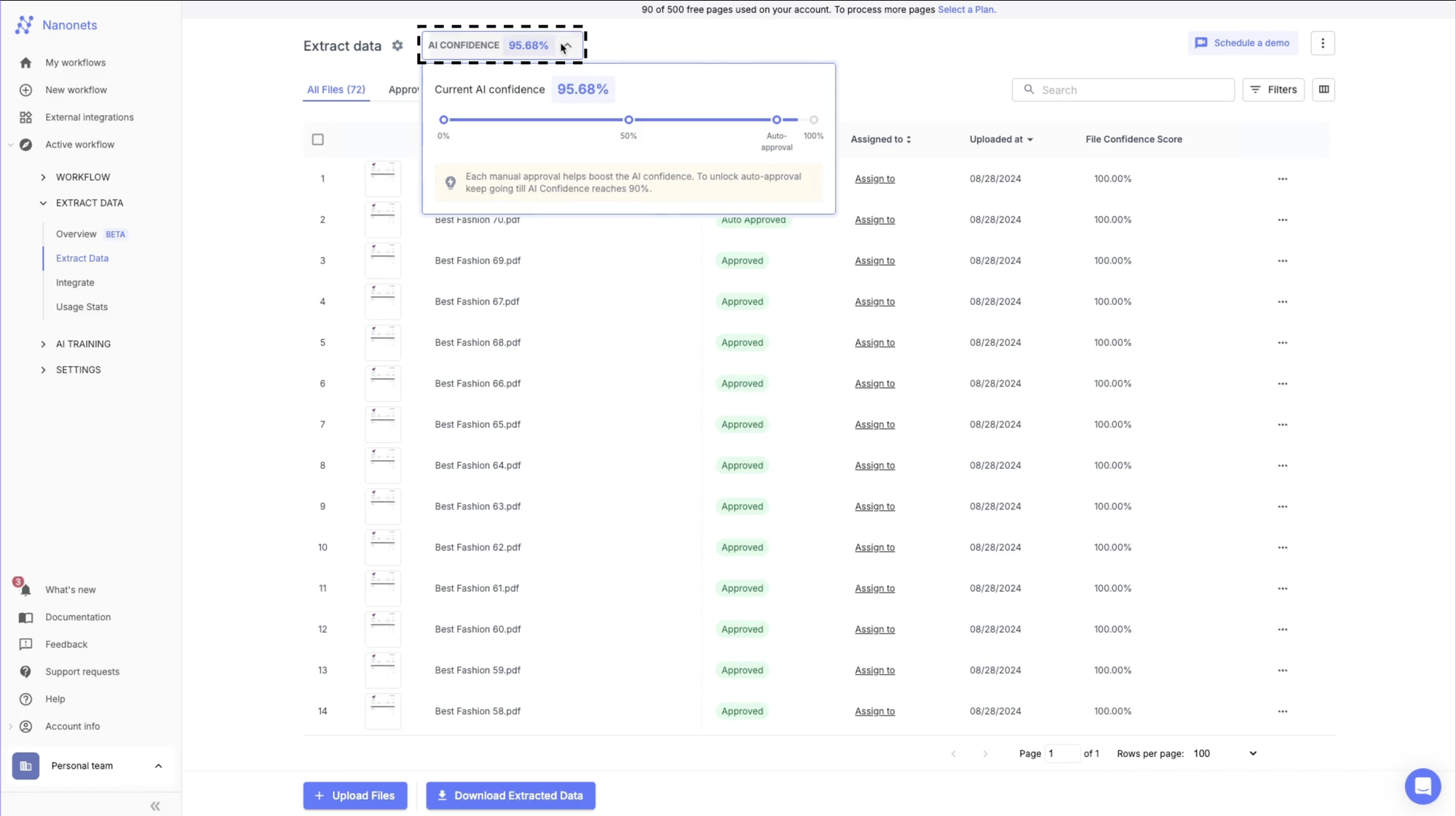

Nanonets is an clever doc processing platform that integrates straight with QuickBooks. This mix enhances its AI options, significantly for complicated doc processing and approval workflows. You’d be capable to deal with paperwork in any format or language, with the AI studying and enhancing because it processes extra of your particular doc varieties.

Let me present you ways Nanonets may also help develop your QuickBooks AI capabilities:

1. Automated doc processing

Getting invoices and buy orders into your accounting system is commonly the primary bottleneck. Many companies waste hours manually downloading attachments from emails, sorting via completely different codecs, and typing knowledge into QuickBooks.

Nanonets solves this via automated doc consumption channels:

- Ahead invoices straight from electronic mail

- Join your ERP system for automated import

- Add paperwork via the net interface

- Monitor particular folders for brand new paperwork

The system processes these paperwork utilizing AI-powered OCR to:

- Extract key fields like bill numbers and quantities

- Seize line merchandise particulars robotically

- Convert dates into standardized codecs

- Current knowledge in each kind and tabular views

For instance, when a vendor emails an bill, merely ahead it to your devoted Nanonets electronic mail deal with. You may see the identical within the GIF above. The system robotically processes the doc and extracts the information, turning what was a 5-minute handbook job right into a 30-second automated workflow. For a enterprise processing 100 invoices month-to-month, this might save over hours of handbook knowledge entry time.

2. Clever PO matching

Buy order matching is often a tedious course of the place AP groups manually cross-reference invoices in opposition to POs and receiving reviews. This usually results in cost delays, duplicate funds, or overpayments when discrepancies go unnoticed.

Nanonets automates this verification course of via clever three-way matching:

- Mechanically pulls matching PO knowledge from QuickBooks

- Validates bill totals in opposition to PO quantities

- Matches particular person line objects for amount and value

- Verifies vendor particulars in opposition to QuickBooks data

- Flags any discrepancies for evaluation

The system performs particular validations and clearly flags points when:

- Bill quantities do not match PO values (e.g., $2,106 bill vs $3,138 PO)

- Line merchandise portions differ from ordered portions

- Delivery portions do not match ordered portions

- Costs have modified from the unique PO

For instance, when processing an bill, the system robotically pulls the corresponding PO from QuickBooks and compares every line merchandise. If an bill exhibits a amount of two items whereas the PO specified 1 unit, it instantly flags this discrepancy. The AP staff can then evaluation simply these flagged objects as a substitute of manually evaluating each element, turning what was usually a 15-20 minute verification course of into a fast 2-minute exception evaluation.

3. Automated QuickBooks export

After bill processing and validation, finance groups usually face one other time-consuming job: manually creating payments in QuickBooks. This course of usually entails switching between programs, re-entering knowledge, and attaching paperwork. It opens up alternatives for errors and duplicates.

Nanonets streamlines this via direct QuickBooks integration:

- Select between account-based or item-based payments

- Create direct expense entries

- Choose particular AP accounts for posting

- Map bill fields to QuickBooks fields

- Deal with stock merchandise monitoring

The system gives versatile export controls:

- Export upon approval or after particular validations

- Cut up exports by web page or complete doc

- Embody attachments robotically

- Sync vendor lists in real-time

- Observe export standing and errors

For example, when an bill is accredited, Nanonets robotically creates a invoice in QuickBooks with all the proper categorizations, line objects, and attachments. The system even maps stock objects accurately, updating portions and prices. Invoices can circulation robotically into QuickBooks in seconds, with validation checks guaranteeing accuracy at each step.

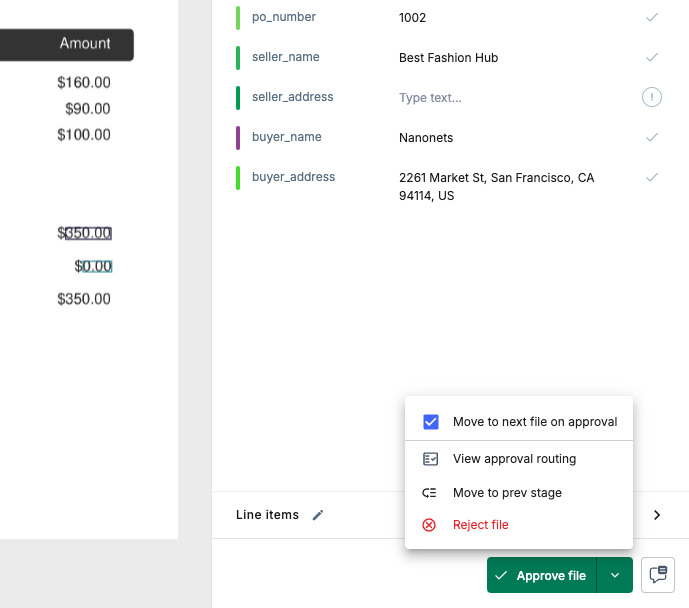

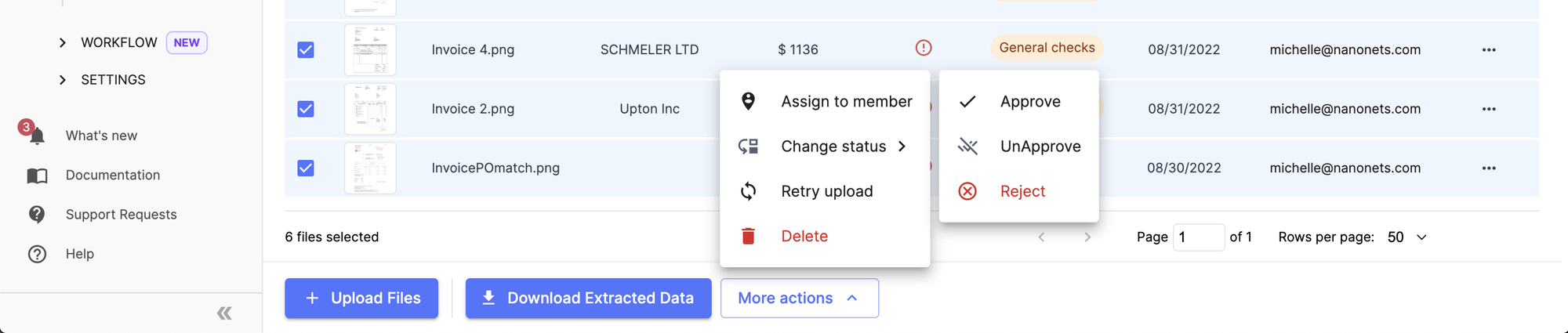

4. Seamless approval circulation

Companies usually battle with bill approvals getting caught in electronic mail chains or misplaced in paper trails. With out a structured workflow, monitoring who must approve what and when turns into a guessing recreation, resulting in cost delays and vendor frustration.

Nanonets constructions your approval course of via:

- Customizable approval workflows primarily based on quantity, vendor, or division

- Computerized reviewer task

- Actual-time validation alerts

- Full audit path monitoring

The system automates communication by:

- Sending electronic mail alerts for pending approvals

- Notifying reviewers about validation failures

- Enabling feedback and staff tagging

- Monitoring all communication in a single place

- Sustaining dialog historical past for audit functions

Say when an bill fails PO matching, Nanonets robotically routes it to the suitable reviewer with all related particulars and comparability knowledge highlighted. Reviewers can remark, tag staff members, and monitor modifications inside the one interface. You will not have to fret about scattered approval processes anymore.

5. Touchless knowledge enhancements

Making ready bill and buy order knowledge for export can require greater than easy extraction. Groups usually have to standardize codecs, apply enterprise guidelines, and guarantee all important fields are appropriate earlier than pushing data into QuickBooks. With out automation, this step turns into a repetitive handbook checkpoint that slows down your workflow and will increase the danger of errors.

Nanonets addresses this with versatile knowledge actions and enhancement steps:

- Mechanically codecs dates into ISO requirements

- Cleans and converts financial fields to match accounting necessities

- Performs customized lookups, resembling verifying PO numbers in QuickBooks earlier than export

- Creates conditional logic for subject validation, resembling flagging lacking required values or checking for duplicates

- Helps user-defined scripts for complicated enterprise guidelines

For instance, should you obtain invoices from worldwide distributors with different date codecs and currencies, Nanonets can convert dates and quantities into your most popular QuickBooks format as a part of the workflow. If an bill doesn’t match an current PO, the system flags it for evaluation robotically. These enhancements save handbook effort and guarantee knowledge integrity throughout your monetary data.

Every of those steps might be adjusted primarily based in your particular necessities. The system continues to study out of your paperwork and processes, enhancing accuracy over time via machine studying. Finance groups can deal with reviewing exceptions and strategic evaluation whereas the AI handles routine processing.

Actual-world advantages and success tales

Combining QuickBooks’ native AI with specialised doc processing instruments delivers tangible enhancements to monetary operations. Organizations implementing this built-in method report vital reductions in handbook knowledge entry, fewer errors of their monetary knowledge, sooner processing cycles, and the flexibility to scale operations with out proportionally growing headcount.

These effectivity positive aspects translate on to bottom-line advantages: decrease processing prices, higher money circulation administration, and extra time for strategic monetary actions.

Listed here are examples of how completely different companies have carried out this method and the outcomes they’ve achieved:

1. Completely happy Jewelers: 90% discount in doc processing time

Completely happy Jewelers, a family-owned enterprise with a number of jewellery shops throughout California, Chicago, and New York, struggled with bill administration as they expanded.

🗨️

After implementing Nanonets with their current QuickBooks system, Completely happy Jewelers automated their doc consumption via electronic mail integration and bill classification. The system captured key info like vendor identify, bill quantity, date, and due date whereas robotically organizing paperwork by vendor. This implementation allowed their finance staff to course of 50% extra invoices on the identical time with out further workers.

2. Professional Companions Wealth: 40% time financial savings over conventional OCR

Professional Companions Wealth, an accounting and wealth administration agency headquartered in Missouri, confronted challenges with their current doc processing system. Regardless of utilizing automation software program, their staff spent vital time correcting bill knowledge entries manually. Their straight-through processing fee was very low, with almost each bill requiring evaluation or modifying.

🗨️

“Nanonets is the long-term resolution for corporations seeking to develop. We’re seeing a serious distinction in accuracy, as Nanonets gives >95% accuracy which has helped minimize down our processing time by ~50%.” ~ Kale Flaspohler, Monetary Advisor at Professional Companions Wealth

After implementing Nanonets with QuickBooks, Professional Companions Wealth achieved:

- 95% knowledge extraction accuracy (up from 80% with their earlier device)

- Over 80% straight-through processing fee

- 40% time financial savings in comparison with conventional OCR instruments

- The power to scale their enterprise by taking up new shoppers

On account of these enhancements, Professional Companions Wealth shifted from manually validating each bill to primarily performing spot checks.

Closing ideas

The mixture of QuickBooks’ native AI capabilities and specialised doc processing instruments creates a strong monetary administration ecosystem that works for companies of all sizes.

Whether or not you are combating excessive bill volumes like Completely happy Jewelers or want better accuracy like Professional Companions Wealth, this built-in method delivers measurable enhancements in effectivity and accuracy.

Able to see how AI-enhanced QuickBooks might rework your monetary workflows? Schedule a demo with us to discover a personalized resolution tailor-made to your particular enterprise necessities.