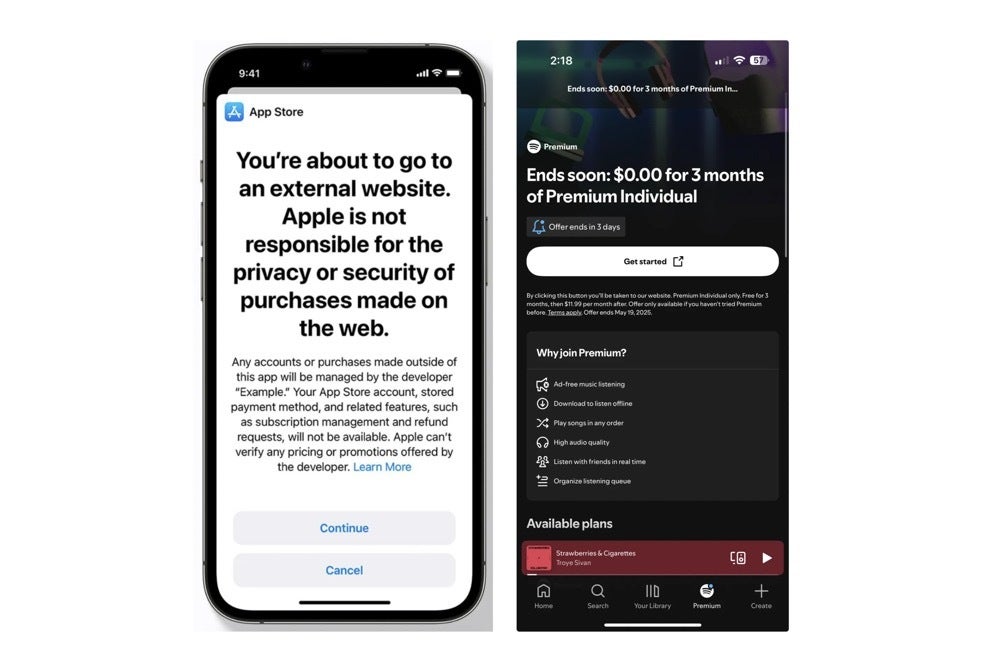

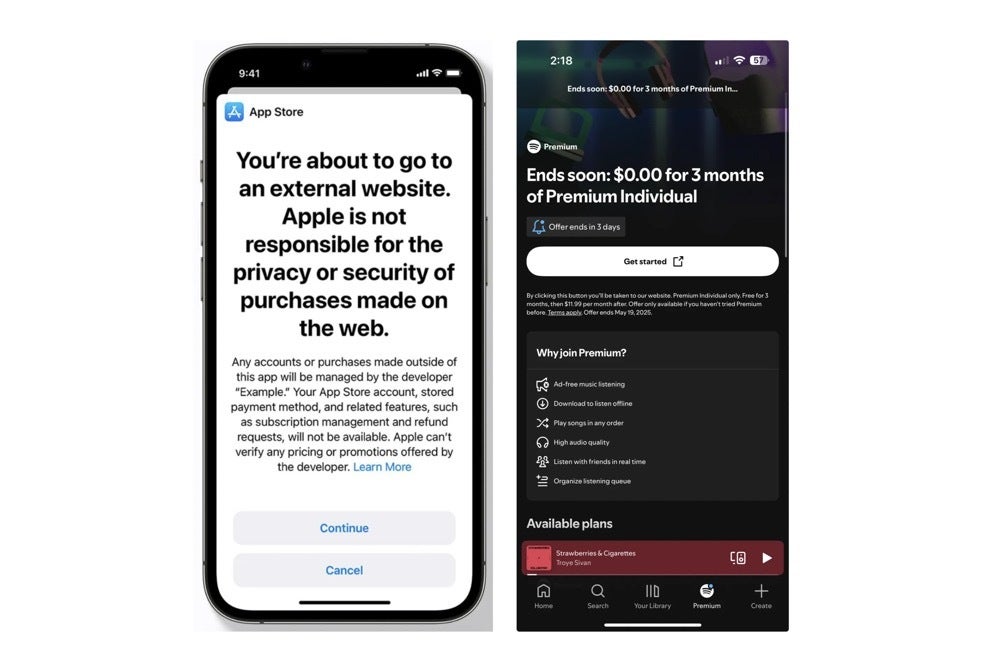

Apple’s previous App Retailer warning when customers tried to navigate to an exterior hyperlink within the US versus Spotify’s new exterior retailer web page. | Picture credit score — Mark Gurman/Bloomberg

In-app buy troubles

At first look, this would possibly seem to be a small change, but it surely hits Apple proper the place it hurts. Nearly all of the App Retailer’s cash comes from in-app purchases, particularly in video games. If builders begin sending customers elsewhere to pay, Apple loses each cash and management. Gurman factors out that whereas this solely impacts the U.S. for now, it might shortly unfold to different international locations the place regulators are watching intently.The stress can also be constructing from contained in the ecosystem. Many builders who constructed their success on the App Retailer at the moment are large enough to push again. Their foremost criticism? Apple’s charges are too excessive for what they’re getting. Different cost companies like Stripe or PayPal cost round 3 p.c, which makes Apple’s 15 to 30 p.c lower really feel steep by comparability.

AI delays and rising iPhone costs

And it is not nearly funds. Apple can also be behind in one other key space: synthetic intelligence. Gurman says the corporate continues to be making an attempt to catch as much as rivals like Google and OpenAI relating to generative AI. Apple Intelligence, its large push into the area, continues to be lacking in motion. Siri hasn’t seen main upgrades, and customers are beginning to discover. For an organization that prides itself on premium experiences, falling behind in AI is an issue.

Put all that collectively (authorized challenges, AI delays, and developer pushback) and Apple’s grip on the digital companies area appears to be like quite a bit weaker than it used to. And that comes at a time when the corporate can also be anticipated to lift iPhone costs, probably as quickly as this 12 months. Asking builders to pay extra whereas charging clients extra is a tricky steadiness to strike.

What can Apple do at this level?

So what can Apple do from right here? Gurman expects the corporate to maintain combating the U.S. ruling in greater courts, hoping to delay or reverse the choice. However authorized fights take time, and builders are already beginning to discover different choices. Exterior of court docket, Apple could must take a extra versatile method to maintain builders onboard.

That might imply reducing fee charges, providing higher instruments and assist, and even selling Apple’s personal cost system because the safer, extra personal possibility. If builders are allowed to supply exterior cost strategies, Apple should make the case that sticking with its system continues to be price it.

It’s even potential Apple might need to compete with different cost companies by itself platform — a state of affairs that will have been laborious to think about just some years in the past. For an organization identified for management and consistency, opening the door to third-party cost choices might be a significant shift.

As Gurman places it, the platform wars are altering. Apple used to have complete management over how apps had been bought and the way folks paid. Now that mannequin is being challenged from each route. Builders need extra freedom, customers need extra alternative, and regulators need extra competitors.

Apple’s subsequent steps will assist outline what the App Retailer appears to be like like over the subsequent decade. If it chooses to evolve, it might keep its affect in a altering market. If it digs in too laborious, it dangers pushing builders away and dropping floor to platforms which can be sooner to adapt.

What occurs subsequent gained’t simply have an effect on Apple, however really reshape all the app economic system. And for the primary time in a very long time, Apple is probably not the one setting the principles.