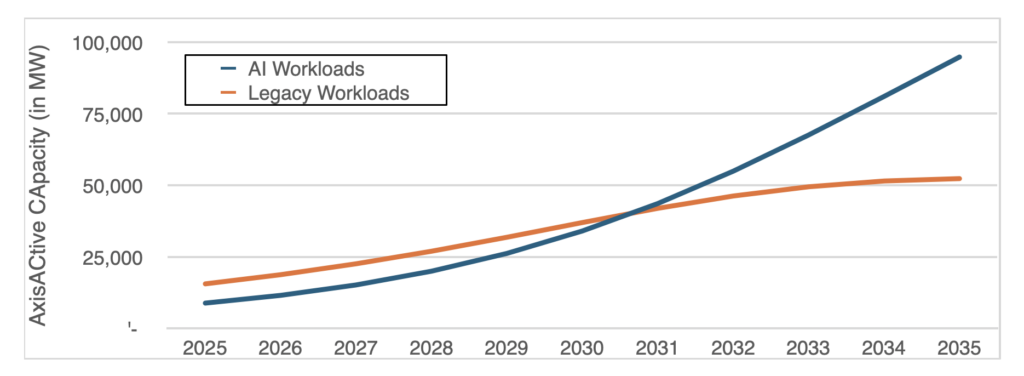

By 2035, world energetic knowledge middle IT capability is forecast to surge practically six-fold, from roughly 24 GW at present to round 147 GW, as a brand new ABI Analysis forecast exhibits. A staggering enlargement pushed largely by synthetic intelligence (AI) workloads, hyperscalers, and rising rack-level energy density. In comparison with earlier hypes, this tectonic shift must be front-of-mind for each telco strategist at present.

Lively capability by workload-type: world markets, 2025 to 2035 (Supply: ABI Analysis)

One ought to notice that that is development pushed by AI coaching, inference, and more and more dense workloads that require way more energy, way more cooling, and way more dependable connectivity than conventional functions ever did. Rack densities are rising, energy draw per web site is climbing, and latency tolerance is shrinking.

For telecom operators, this issues as a result of it modifications the place worth accumulates within the digital stack. Connectivity remains to be important – however it’s now not the scarce useful resource. Compute is, and energy is, and the power to colocate these two effectively is turning into the true bottleneck.

AI infra exposes telecom’s strategic awkwardness

Telecom has spent the final decade telling buyers it desires to maneuver “up the worth stack,” whereas behaving in ways in which recommend it’s deeply uncomfortable doing so. The AI-driven knowledge middle increase is exposing that contradiction.

AI workloads are latency-sensitive. They more and more want regional or metro-level compute. They profit from tight integration between community, edge services, and cloud platforms. On paper, this could play immediately into telco strengths: distributed belongings, native presence, spectrum, fiber, and enterprise relationships. However in observe they’re caught someplace within the center.

They’re too infrastructure-heavy to pivot rapidly like cloud-native gamers, and too culturally risk-averse to compete immediately with hyperscalers. In order that they default to partnerships which might be secure, incremental, and – crucially – value-limiting.

What’s fascinating is that the following wave of cloud development might not come solely from the same old hyperscaler trio. Smaller, AI-focused cloud suppliers are rising that care deeply about the place compute lives and the way it connects to customers. These gamers don’t essentially need to personal fiber, towers, or metro networks — however they do want them to work exceptionally effectively.

That creates a gap for telcos. To not change into cloud suppliers themselves, however to change into unavoidable infrastructure companions. The issue is that many operators nonetheless promote connectivity as if it had been the product, somewhat than as a part of a broader infrastructure functionality tied to compute, locality, and efficiency ensures.

Why energy and grid entry are the true bottlenecks

There’s a easy actuality behind the info middle development story. Information facilities don’t scale as a result of demand exists. They scale when energy and grid capability exist.

AI workloads at the moment are working into electrical energy constraints, significantly in Europe however more and more elsewhere. Tasks are being delayed or downsized not as a result of clients aren’t prepared, however as a result of the grid can not ship sufficient energy the place it’s wanted. This goes past technology. Transmission limits, substation capability, and gradual improve cycles have gotten actual blockers. Cooling solely makes the issue worse.

The problem isn’t energy within the summary. It’s grid entry. That makes this a bodily, regional drawback formed by allowing, municipal coordination, and lengthy planning timelines. In different phrases, that is an infrastructure drawback, not a cloud drawback.

Telecom operators ought to, in principle, have a bonus. They already handle bodily infrastructure, work with utilities and municipalities, and function metro and edge websites near constrained elements of the grid. Traditionally, these belongings had been optimized for protection and value. Going ahead, they might must be optimized for strategic optionality, the place energy, grid entry, and compute placement converge.

The choice is acquainted. Turning into a extremely environment friendly supply mechanism for another person’s AI infrastructure, related to knowledge facilities operators had no position in shaping and no leverage over as soon as they’re constructed. Because the business has realized greater than as soon as, that position hardly ever comes with premium margins.

Leo Gergs is principal analyst at ABI Analysis, main the agency’s enterprise connectivity and cloud and knowledge middle analysis. His work covers enterprise drivers, use instances, and supplier methods for applied sciences reminiscent of personal mobile, SD WAN, and Mounted Wi-fi Entry. He additionally analyzes key developments shaping the info middle market, together with the rise of neocloud suppliers, the rising significance of sovereign cloud fashions, and their implications for enterprise infrastructure, regulation, and workload placement.