From international private-5G deployments at Vodafone Enterprise to nationwide spectrum coverage gridlock at Vodafone Concept, plus the looming exit of Nokia, the non-public 5G market appears to be like each extra mature and extra fragile than it ever has. The numbers are bettering, if not quick sufficient; the messaging and mindset nonetheless want work.

Simply to proceed the dialog from yesterday – as a result of RCR has slept on it, and thinks there’s extra to say. So listed below are some fast bullets (edit: lengthy ones), inferred or imagined from the dual ‘Vodafone’ commentaries about non-public 5G on the UPTIME discussion board yesterday (February 12). Word, these could be price wanting up – about Vodafone Enterprise right here and Vodafone Concept right here – in case you are simply becoming a member of us. Word as properly, that (put up edit) the abstract under misses one thing: that the non-public 5G market thinks it is able to scale, ultimately.

This was evident at UPTIME within the commentary from Vodafone Enterprise, as reported yesterday. The important thing quote was: “We’d like options which might be enterprise-friendly, initially, and that don’t must be constructed from the bottom up each time – like a tailor-made costume. It’s irritating the place Vodafone, Telefonica, Verizon all combat over the one large deal that comes up in a rustic every quarter – as a result of it might be higher for us to win 500-more offers annually between us.” It was additionally evident within the nominal non-public 5G goal, bandied about, maybe random, referenced under, of 500,000 deployments.

Possibly that is the most important takeaway; however there’s tons within the trivia, as properly – as follows…

1 | Vodafone Enterprise has its home in some type of order.

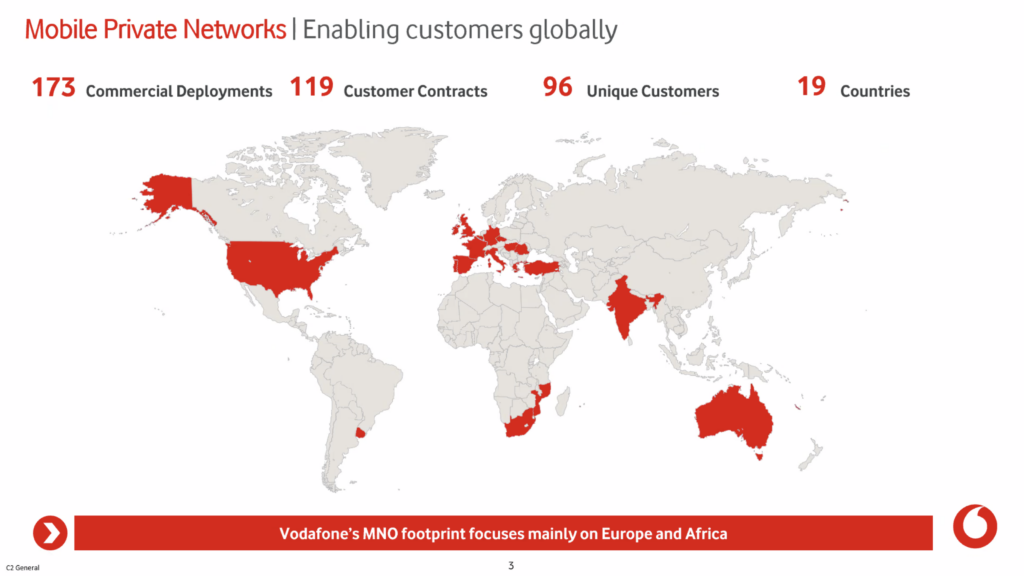

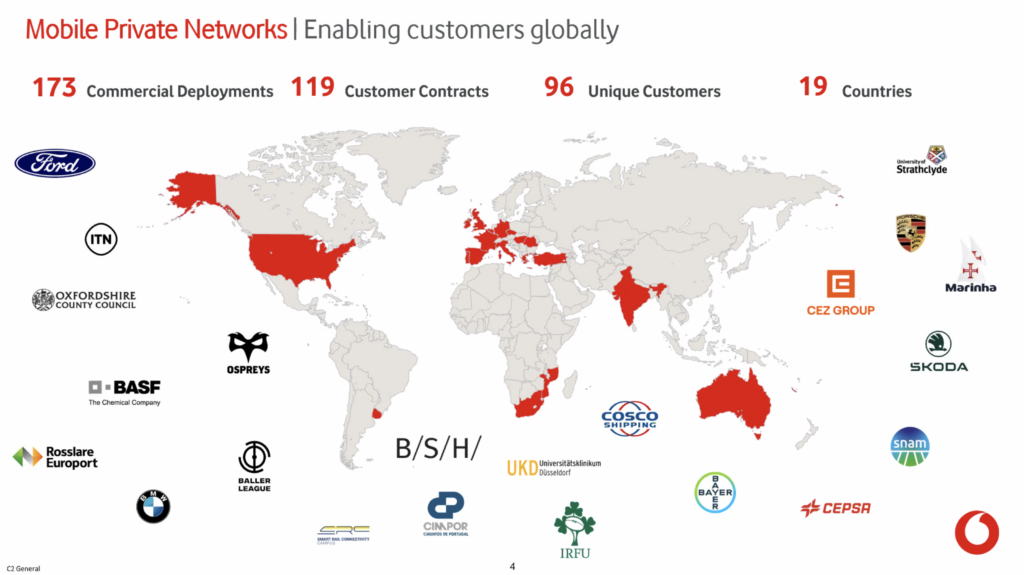

That is the apparent takeaway from these classes – and the top-line message from Massimiliano Mesenasco’s presentation at UPTIME. Virtually 200 (173) non-public 5G deployments with nearly 100 (96) clients in nearly 20 (19) nations appears to be like like an honest half-time scorecard – relative to the tempo of the sport, the situation of its rivals, the 5G rollout extra broadly, and the concept that Nokia’s exit forces a break within the play. On the final level, it could be famous that every one / practically-all of Vodafone’s 173-count is for campus-edge tasks – and so that is the market we’re discussing, which Nokia is quitting. Sure, a piece of Vodafone’s deployments (about 40 %) comprise community slices and hybrid programs, however the remainder (nearly 60 %) are all-edge affairs – and all of them are geared in the direction of campus environments of 1 kind or one other.

2 | Vodafone Enterprise wants to speak about it – and lead.

Vodafone has not communicated its successes very properly. Not lots of the large tier-one cell operators have – Deutsche Telekom hasn’t, Orange hasn’t, Telefónica hasn’t; T-Cell hasn’t, AT&T actually hasn’t. China Cell turned up at Industrial Wi-fi Discussion board on the finish of 2025, and stated a few phrases; there’s stuff taking place in Japan, too, however it not often carries. Actually, the one operator that has its story down – and has advised it moderately properly, for a few years – is Verizon (Enterprise). Maybe this displays on RCR, which has been overlaying this market – nearer than anybody – for a decade at the very least. Besides it doesn’t, as a result of RCR has badgered and bothered, and never heard again – and given up the chase. Which is bizarre, as a result of Vodafone (Enterprise / IoT) has talked properly about IoT for ages, and personal 5G is a sub-plot there (see under).

Maybe Vodafone is simply higher with analysts – which place it excessive of their critiques (per Mesenasco’s UPTIME slides). However then, the analysts haven’t communicated the Vodafone story, both – or else (sure of) their critiques are sus. The purpose is, Vodafone ought to / might take inventory throughout its half-time staff discuss, and emerge from the tunnel once more like an business chief – if it needs to. Definitely, the sector wants one other provider champ to feed all of the ballers within the channels. It actually does whether it is to make a correct sport of personal 5G – and ship 500,000 programs (the brand new goal quantity for international deployments doing the rounds at UPTIME) right into a broader mass enterprise market.

3 | Vodafone Concept (or India) doesn’t have its home so as.

That is much less a criticism of 1 firm as of nationwide coverage. However the comparability between India-based Vodafone Concept, on an early panel at UPTIME, and UK-headquartered Vodafone Group, with a session of its personal, is telling. The world map the latter confirmed goes a way (about 30 %) past its international working territories – to the place regulators have liberalised spectrum for possession and utilization by home enterprises, for activation and administration by non-domestic suppliers. Which is, partially, why US-based Verizon Enterprise seems to be crushing it – as a result of it’s choosing up main contracts in markets the place it has no networks or airtime, together with in Vodafone’s heartlands within the UK and Germany. Vodafone’s presentation at UPTIME labored as a riposte to the notion that Verizon is stealing one-way, from underneath its nostril.

However Vodafone Concept is working in a distinct market. Varied factions – some large enterprises, largely large integrators and distributors – have lobbied the Indian authorities to open the airwaves for devoted native utilization with non-public 5G programs. However the operator neighborhood, a blended bag of public/non-public set-ups, has pushed again, and the opposition has fizzled out. Both method, the implication from Vodafone Concept at UPTIME that enterprises could be blamed for the issues with non-public 5G (integration, consultancy) is unfair, and in addition ungallant. The accepted line as of late, borrowed from IoT, is that non-public 5G is a staff sport and speculative pursuit – and that the onus, plainly, is on the seller ecosystem to debate, clear up, design, construct, and handle (as requested). Any failures are on them.

The IoT market is aware of this (see under). Verizon Enterprise talks very properly about it. Past new vendor partnerships, Vodafone Enterprise didn’t say a lot about ecosystem constructing at UPTIME, however it ought to – as mentioned above, and because it does already within the IoT house. Equally, Vodafone Concept’s defence of operators and dismissal of integrators at UPTIME – that integrators lack telco know-how (like that’s the deal breaker) and capital flexibility to have the ability to design and bankroll large enterprise tasks – doesn’t scan. As a result of integrators in progressive non-public 5G markets maintain the IT/OT keys – and progressive operators like Verizon and Vodafone will, right here and there, rent them as boots-on-the-ground. Integrators even have ties with the perfect distributors to fund enterprise service offers on their very own.

So most of these things has been resolved elsewhere, and operators should recognise that – within the international non-public 5G market – they don’t seem to be all the time a starter, and should earn the proper to play. Which largely comes right down to service consultancy, drawback fixing, and ecosystem administration – and, possibly someplace down the road, to public/non-public roaming companies. We have to wrap this one up, however Mesenasco’s ultimate feedback say all of it: “Look, I feel the numbers (173 deployments) will not be almost sufficient. I imagine that the business generally, us included, wasted at the very least a few years, significantly in Europe, as a result of we weren’t humble sufficient. As a result of 4 or 5 years again, most of our playbooks have been about very fancy use instances and tremendous shiny Trade 4.0 eventualities.”

4. Non-public 5G is (formally) a part of the (non-public) IoT household.

And properly, hallelujah – as a result of RCR Wi-fi has stated this for years. And so it felt essential and useful that Vodafone Concept stated the identical at UPTIME: “Non-public 5G and IoT go hand in hand. That’s the proper solution to see the product [set] from an enterprise standpoint.” A few of the logic for that is defined above – IoT for sensing, AI for sense-making, and 5G (and Wi-Fi and many others) to hitch the dots; components of the identical collective options and collaborative gross sales. Besides that, once more, we would learn between the strains, and counsel a wide-area telco-view of IoT is the incorrect grasp. As a result of the private-5G correlation isn’t (primarily / initially) with public IoT, however non-public IoT; they mix to watch and observe property in factories and warehouses, and never on roads.

The general public piece issues, after all – for stitching collectively non-public and public domains as items transfer by supply-chains, by manufacturing, storage, distribution, and sale. However on web site IT/OT integration at gadget stage, mapping to system stage, comes first. Extra importantly, it’s about mindset: IoT distributors have had their very own darkish nights of the soul, over a few years; however they’re brighter, happier, and completely acquainted in industrial setups – and so they know what it takes to design options inside an ecosystem, moderately than simply to promote tech. Once more, see the quote from Mesenasco above, and the longer model within the writeup.

5. Yellow-bellied Nokia is nowhere – and in addition in every single place.

That is pushing it, and (rival) components of the market will flinch at it, however it additionally just-about true: that this has been Nokia’s sport, till now. Not solely; a variety of smaller specialists have additionally been influential. However of family names – together with Verizon and Vodafone, as mentioned right here; plus additionally Ericsson, as its nearest competitor – Nokia has run the sphere. And but – disgrace, disgrace – its mum or dad has hooked it, and (shortly) it gained’t reappear after the break in the identical equipment. Because it stands, and as reported, Nokia is in search of a purchaser for its daring campus-edge division – which has, in the meantime, been gagged. (See remark on the high about the true topic right here – if you wish to cut up hairs about what’s on the block.)

Besides, with out a lot point out, Nokia was all throughout Vodafone’s presentation at UPTIME – and far of the occasion. Sure, Mesenasco stated Vodafone is doubling its roster of vendor companions for its managed service – from two (Nokia and HPE) to 4, to in all probability embody Ericsson (TBC; however “one is apparent”) and presumably Celona (or related; whole guess, however described as “much less apparent”, and logical based mostly additionally on discuss on the finish in regards to the business needing to pitch-up to the SME market with easier options). And no, the shake-up has nothing to do with Nokia’s pending exit from the house. “The enlargement of our vendor pool for our managed MPN providing was within the roadmap earlier than Nokia’s announcement,” he stated. However Nokia stays one in every of solely two (with HPE, additionally) for heavy-lift bespoke industrial drops.

And the client slide at the beginning – emblazoned with BASF, Bayer, BMW, CEPSA, CEZ Group, Ford, Porsche, Rosslare Europort, Skoda, Snam, amongst industrial giants, plus sports activities, broadcast, and schooling teams – is stacked with Nokia customers. Plus, once more, all the great IoT-style language round integration, consultancy, and collaboration has been conspicuous in Nokia’s channels for years – with savvy industrial integrators, large and small, and with clued-up cell operators like Verizon and Vodafone (plus Orange and Telefónica, truly), as properly. It’s unclear the place Nokia’s private-5G unit will find yourself, however, for its daring imaginative and prescient and courageous work, its sale nonetheless appears to be like like an odd selection.

It’d make enterprise sense, on paper, however the brand new AI inference story brings the sting again into play (as Verizon Enterprise has began to articulate, already, as others ought to clarify), and makes new-Nokia look rooster.