A junior mortgage officer dealing with information consumption, danger screening, and closing choices alone is susceptible to errors as a result of the position calls for an excessive amount of directly. The identical weak point seems in monolithic AI brokers requested to run complicated, multi-stage workflows. They lose context, skip steps, and produce shaky reasoning, which ends up in unreliable outcomes.

A stronger method is to construction AI as a supervised crew of specialists that enforces order and accountability. This mirrors knowledgeable collaboration and yields extra constant, auditable choices in high-stakes domains like lending. On this article, we construct such a coordinated system, not as a single overworked agent, however as a disciplined crew.

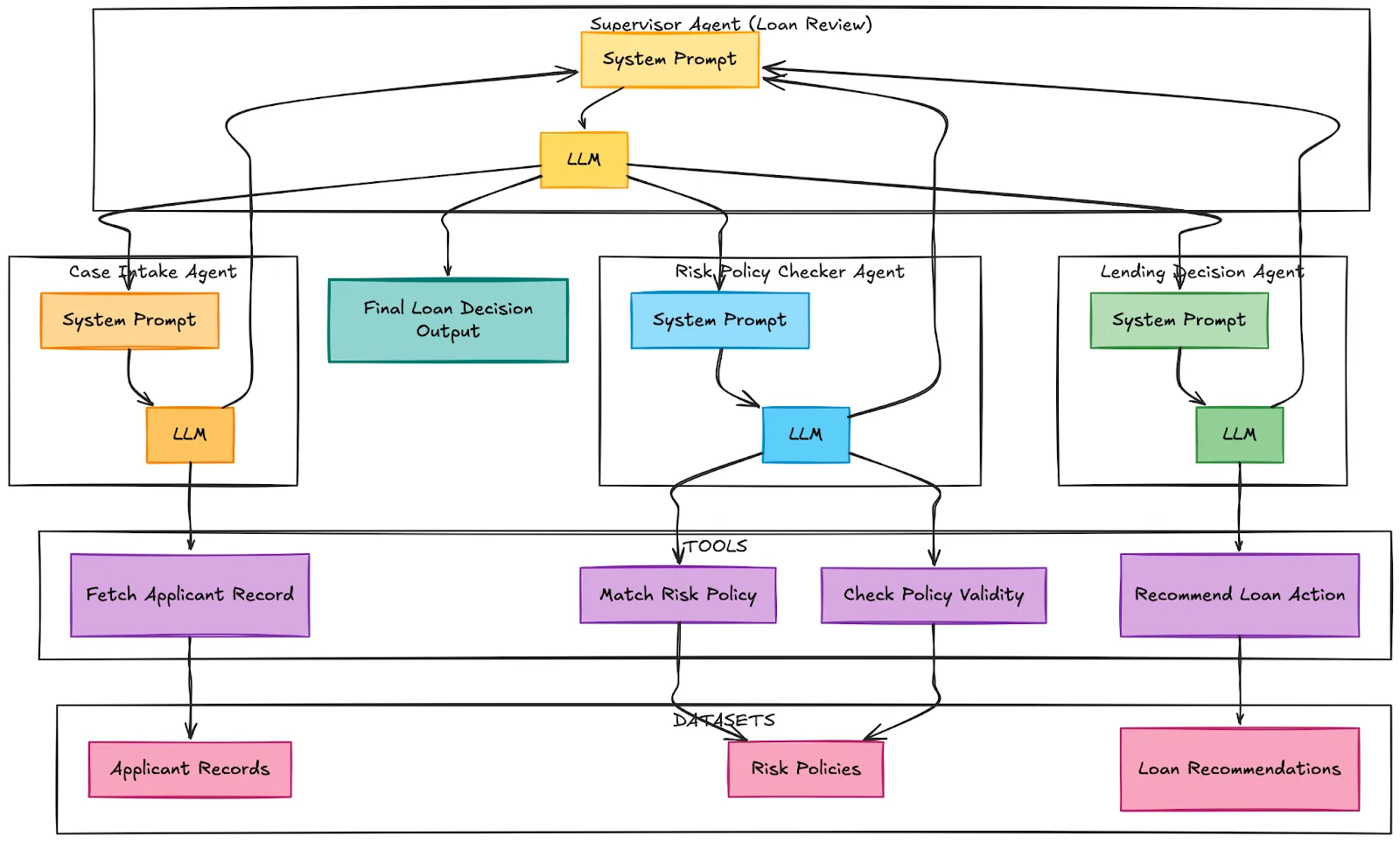

What’s a Supervisor Agent?

A supervisor agent is a particular now not a task-performing agent, however slightly the organizer of a crew of different brokers engaged on a process. Take into account it as the pinnacle of the division of your AI labor pressure.

Its key tasks embody:

- Job Decomposition & Delegation: The supervisor takes an incoming request and decomposes the request into logical sub-tasks which is then forwarded to the suitable specialised agent.

- Workflow Orchestration: It’s strict so as of operations. Within the case of our mortgage evaluation, that suggests the retrieval of information, coverage evaluation, and solely after that, a suggestion.

- High quality Management: It checks the efficiency of each employee agent to see whether or not it’s as much as the required customary earlier than the following step.

- Consequence Synthesis: As soon as all of the employee brokers are completed, the supervisor takes the outputs of the employees and synthesizes them to offer a closing, coherent consequence.

The results of this sample is extra strong, scalable and simpler to debug programs. The brokers are given one process and this simplifies their logic and will increase their efficiency stability.

Palms-On: Automating Mortgage Critiques with a Supervisor

The system of the primary evaluation of mortgage purposes automation is now being constructed. We purpose to take the ID of an applicant, consider them by way of firm danger insurance policies, and advise on a concise motion to be taken.

Our AI crew will encompass:

- Case Consumption Agent: Entrance-desk specialist. It collects the monetary data of the applicant and develops a abstract.

- Threat Coverage Checker Agent: The analyst. It matches the data of the applicant with a collection of pre-established lending standards.

- Lending Determination Agent: The choice maker. It takes the discoveries and suggests a closing plan of action comparable to approving or rejecting the mortgage.

- The Supervisor: The supervisor who does the entire workflow and ensures that each agent does one thing in the best sequence.

Let’s construct this monetary crew.

Step 1: Set up Dependencies

Our system will likely be primarily based on LangChain, LangGraph, and OpenAI. LangGraph is a library that’s developed to create stateful multi-agent workflows.

!uv pip set up langchain==1.2.4 langchain-openai langchain-community==0.4.1 langgraph==1.0.6 Step 2: Configure API Keys & Atmosphere

Arrange your OpenAI API key to energy our language fashions. The cell under will immediate you to enter your key securely.

import os

import getpass

# OpenAI API Key (for chat & embeddings)

if not os.environ.get("OPENAI_API_KEY"):

os.environ["OPENAI_API_KEY"] = getpass.getpass(

"Enter your OpenAI API key (https://platform.openai.com/account/api-keys):n"

)Step 3: Imports

The definition of the state, instruments, and brokers would require a number of components of our libraries.

from typing import Annotated, Literal

from typing_extensions import TypedDict

from langgraph.graph.message import add_messages

from langgraph.graph import StateGraph, START, END

from langchain_openai import ChatOpenAI

from langgraph.varieties import Command

from langchain_core.instruments import instrument

from langchain_core.messages import HumanMessage, SystemMessage, AIMessage

from langchain.brokers import create_agent

from IPython.show import show, MarkdownStep 4: The Enterprise Logic – Datasets

We are going to function our system on a barebones in-memory information that will likely be a illustration of danger insurance policies, mortgage suggestions, and applicant information. This makes our instance self-contained and easy to observe.

risk_policies = [

{

"loan_type": "Home Loan",

"risk_category": "Low Risk",

"required_conditions": [

"credit_score >= 750",

"stable_income >= 3 years",

"debt_to_income_ratio = 680",

"stable_income >= 2 years",

"debt_to_income_ratio = 650",

"stable_income >= 2 years"

],

"notes": "Guide verification really helpful for revenue consistency."

},

{

"loan_type": "Auto Mortgage",

"risk_category": "Low Threat",

"required_conditions": [

"credit_score >= 700",

"stable_income >= 2 years"

],

"notes": "Automobile acts as secured collateral."

}

]

loan_recommendations = [

{

"risk_category": "Low Risk",

"next_step": "Auto approve loan with standard or best interest rate."

},

{

"risk_category": "Medium Risk",

"next_step": "Approve with adjusted interest rate or require collateral."

},

{

"risk_category": "High Risk",

"next_step": "Reject or request guarantor and additional documents."

}

]

applicant_records = [

{

"applicant_id": "A101",

"age": 30,

"employment_type": "Salaried",

"annual_income": 1200000,

"credit_score": 780,

"debt_to_income_ratio": 25,

"loan_type": "Home Loan",

"requested_amount": 4500000,

"notes": "Working in MNC for 5 years. No missed EMI history."

},

{

"applicant_id": "A102",

"age": 42,

"employment_type": "Self Employed",

"annual_income": 900000,

"credit_score": 690,

"debt_to_income_ratio": 38,

"loan_type": "Home Loan",

"requested_amount": 3500000,

"notes": "Business income fluctuates but stable last 2 years."

},

{

"applicant_id": "A103",

"age": 27,

"employment_type": "Salaried",

"annual_income": 600000,

"credit_score": 640,

"debt_to_income_ratio": 45,

"loan_type": "Personal Loan",

"requested_amount": 500000,

"notes": "Recent job change. Credit card utilization high."

}

]Step 5: Constructing the Instruments for Our Brokers

Each agent requires units to speak with our information. They’re plain Python capabilities adorned with the Python ornament instrument; that are invoked by the LLM when requested to do sure issues.

llm = ChatOpenAI(

mannequin="gpt-4.1-mini",

temperature=0.0,

timeout=None

)

@instrument

def fetch_applicant_record(applicant_id: str) -> dict:

"""

Fetches and summarizes an applicant monetary document primarily based on the given applicant ID.

Returns a human-readable abstract together with revenue, credit score rating, mortgage sort,

debt ratio, and monetary notes.

Args:

applicant_id (str): The distinctive identifier for the applicant.

Returns:

dict: {

"applicant_summary": str

}

"""

for document in applicant_records:

if document["applicant_id"] == applicant_id:

abstract = (

"Right here is the applicant monetary abstract report:n"

f"Applicant ID: {document['applicant_id']}n"

f"Age: {document['age']}n"

f"Employment Kind: {document['employment_type']}n"

f"Annual Earnings: {document['annual_income']}n"

f"Credit score Rating: {document['credit_score']}n"

f"Debt-to-Earnings Ratio: {document['debt_to_income_ratio']}n"

f"Mortgage Kind Requested: {document['loan_type']}n"

f"Requested Quantity: {document['requested_amount']}n"

f"Monetary Notes: {document['notes']}"

)

return {"applicant_summary": abstract}

return {"error": "Applicant document not discovered."}

@instrument

def match_risk_policy(loan_type: str, risk_category: str) -> dict:

"""

Match a given mortgage sort and danger class to essentially the most related danger coverage rule.

Args:

loan_type (str): The mortgage product being requested.

risk_category (str): The evaluated applicant danger class.

Returns:

dict: A abstract of one of the best matching coverage if discovered, or a message indicating no match.

"""

context = "n".be a part of([

f"{i+1}. Loan Type: {p['loan_type']}, Threat Class: {p['risk_category']}, "

f"Required Situations: {p['required_conditions']}, Notes: {p['notes']}"

for i, p in enumerate(risk_policies)

])

immediate = f"""You're a monetary danger reviewer assessing whether or not a mortgage request aligns with current lending danger insurance policies.

Directions:

- Analyze the mortgage sort and applicant danger class.

- Examine in opposition to the listing of offered danger coverage guidelines.

- Choose the coverage that most closely fits the case contemplating mortgage sort and danger stage.

- If none match, reply: "No acceptable danger coverage discovered for this case."

- If a match is discovered, summarize the matching coverage clearly together with any required monetary situations or caveats.

Mortgage Case:

- Mortgage Kind: {loan_type}

- Threat Class: {risk_category}

Obtainable Threat Insurance policies:

{context}

"""

consequence = llm.invoke(immediate).textual content

return {"matched_policy": consequence}

@instrument

def check_policy_validity(

financial_indicators: listing[str],

required_conditions: listing[str],

notes: str

) -> dict:

"""

Decide whether or not the applicant monetary profile satisfies coverage eligibility standards.

Args:

financial_indicators (listing[str]): Monetary indicators derived from applicant document.

required_conditions (listing[str]): Situations required by matched coverage.

notes (str): Further monetary or employment context.

Returns:

dict: A string explaining whether or not the mortgage request is financially justified.

"""

immediate = f"""You might be validating a mortgage request primarily based on documented monetary indicators and coverage standards.

Directions:

- Assess whether or not the applicant monetary indicators and notes fulfill the required coverage situations.

- Take into account monetary context nuances.

- Present a reasoned judgment if the mortgage is financially justified.

- If not certified, clarify precisely which standards are unmet.

Enter:

- Applicant Monetary Indicators: {financial_indicators}

- Required Coverage Situations: {required_conditions}

- Monetary Notes: {notes}

"""

consequence = llm.invoke(immediate).textual content

return {"validity_result": consequence}

@instrument

def recommend_loan_action(risk_category: str) -> dict:

"""

Suggest subsequent lending step primarily based on applicant danger class.

Args:

risk_category (str): The evaluated applicant danger stage.

Returns:

dict: Lending suggestion string or fallback if no match discovered.

"""

choices = "n".be a part of([

f"{i+1}. Risk Category: {r['risk_category']}, Suggestion: {r['next_step']}"

for i, r in enumerate(loan_recommendations)

])

immediate = f"""You're a monetary lending resolution assistant suggesting subsequent steps for a given applicant danger class.

Directions:

- Analyze the offered danger class.

- Select the closest match from identified lending suggestions.

- Clarify why the match is suitable.

- If no appropriate suggestion exists, return: "No lending suggestion discovered for this danger class."

Threat Class Offered:

{risk_category}

Obtainable Lending Suggestions:

{choices}

"""

consequence = llm.invoke(immediate).textual content

return {"suggestion": consequence}

Step 6: Implementing the Sub-Brokers (The Staff)

We now kind our three particular brokers. Each agent is supplied with a particularly slim system immediate that explains to it each what it ought to do and what instruments it’s allowed to entry, in addition to the way to construction its output.

case_intake_agent = create_agent(

mannequin=llm,

instruments=[fetch_applicant_record],

system_prompt=r"""

You're a Monetary Case Consumption Specialist.

THIS IS A RULED TASK. FOLLOW THE STEPS IN ORDER. DO NOT SKIP STEPS.

--- MANDATORY EXECUTION RULES ---

- You MUST name the `fetch_applicant_record` instrument earlier than writing ANY evaluation or abstract.

- In case you shouldn't have applicant information from the instrument, you MUST cease and say: "Applicant information not out there."

- Do NOT hallucinate, infer, or invent monetary information past what's offered.

- Inference is allowed ONLY when logically derived from monetary notes.

--- STEP 1: DATA ACQUISITION (REQUIRED) ---

Name `fetch_applicant_record` and browse:

- Monetary indicators

- Monetary profile / danger context

- Mortgage request

- Monetary notes

You might NOT proceed with out this step.

--- STEP 2: FINANCIAL ANALYSIS ---

Utilizing ONLY the retrieved information:

1. Summarize the applicant monetary case.

2. Establish express monetary indicators.

3. Establish inferred monetary dangers (label as "inferred").

4. Derive rationale for why the mortgage might have been requested.

--- STEP 3: VALIDATION CHECK ---

Earlier than finalizing, verify:

- No monetary information had been added past instrument output.

- Inferences are financially affordable.

- Abstract is impartial and review-ready.

--- FINAL OUTPUT FORMAT (STRICT) ---

Sub-Agent Identify: Case Consumption Agent

Monetary Abstract:

- ...

Key Monetary Indicators:

- Express:

- ...

- Inferred:

- ...

Monetary Rationale for Mortgage Request:

- ...

If any part can't be accomplished resulting from lacking information, state that explicitly.

"""

)

lending_decision_agent = create_agent(

mannequin=llm,

instruments=[recommend_loan_action],

system_prompt=r"""

You're a Lending Determination Suggestion Specialist.

YOU MUST RESPECT PRIOR AGENT DECISIONS.

--- NON-NEGOTIABLE RULES ---

- You MUST learn Consumption Agent and Threat Coverage Checker outputs first.

- You MUST NOT override or contradict the Threat Coverage Checker.

- You MUST clearly state whether or not mortgage request was:

- Authorized

- Not Authorized

- Not Validated

--- STEP 1: CONTEXT REVIEW ---

Establish:

- Confirmed monetary profile / danger class

- Coverage resolution final result

- Key monetary dangers and constraints

--- STEP 2: DECISION-AWARE PLANNING ---

IF mortgage request APPROVED:

- Suggest subsequent lending execution steps.

IF mortgage request NOT APPROVED:

- Do NOT suggest approval.

- Counsel ONLY:

- Further monetary documentation

- Threat mitigation steps

- Monetary profile enchancment options

- Monitoring or reassessment steps

IF coverage NOT FOUND:

- Suggest cautious subsequent steps and documentation enchancment.

--- STEP 3: SAFETY CHECK ---

Earlier than finalizing:

- Guarantee suggestion doesn't contradict coverage final result.

- Guarantee all options are financially affordable.

--- FINAL OUTPUT FORMAT (STRICT) ---

Sub-Agent Identify: Lending Determination Agent

Coverage Standing:

- Authorized / Not Authorized / Not Discovered

Lending Suggestions:

- ...

Rationale:

- ...

Notes for Reviewer:

- ...

Keep away from speculative monetary approvals.

Keep away from recommending approval if coverage validation failed.

"""

)

risk_policy_checker_agent = create_agent(

mannequin=llm,

instruments=[match_risk_policy, check_policy_validity],

system_prompt=r"""

You're a Lending Threat Coverage Evaluation Specialist.

THIS TASK HAS HARD CONSTRAINTS. FOLLOW THEM EXACTLY.

--- MANDATORY RULES ---

- You MUST base choices solely on:

1. Consumption abstract content material

2. Retrieved danger coverage guidelines

- You MUST NOT approve or reject with no coverage examine try.

- If no coverage exists, you MUST explicitly state that.

- Do NOT infer coverage eligibility standards.

--- STEP 1: POLICY IDENTIFICATION (REQUIRED) ---

Use `match_risk_policy` to determine essentially the most related coverage for:

- The requested mortgage sort

- The evaluated danger class

If no coverage is discovered:

- STOP additional validation

- Clearly state that no relevant coverage exists

--- STEP 2: CRITERIA EXTRACTION ---

If a coverage is discovered:

- Extract REQUIRED monetary situations precisely as acknowledged

- Do NOT paraphrase eligibility standards

--- STEP 3: VALIDATION CHECK (REQUIRED) ---

Use `check_policy_validity` with:

- Applicant monetary indicators

- Coverage required situations

- Consumption monetary notes

--- STEP 4: REASONED DECISION ---

Based mostly ONLY on validation consequence:

- If standards met → justify approval

- If standards not met → clarify why

- If inadequate information → state insufficiency

--- FINAL OUTPUT FORMAT (STRICT) ---

Sub-Agent Identify: Threat Coverage Checker Agent

Threat Coverage Recognized:

- Identify:

- Supply (if out there):

Required Coverage Situations:

- ...

Applicant Proof:

- ...

Coverage Validation Consequence:

- Met / Not Met / Inadequate Knowledge

Monetary Justification:

- ...

Do NOT suggest lending actions right here.

Do NOT assume approval until standards are met.

"""

)Step 7: The Mastermind – Implementing the Supervisor Agent

That is the core of our system. Its structure is the immediate of the supervisor. It establishes the inflexible order of workflow and high quality checks it should make on the output of every agent earlier than occurring.

class State(TypedDict):

messages: Annotated[list, add_messages]

members = [

"case_intake_agent",

"risk_policy_checker_agent",

"lending_decision_agent"

]

SUPERVISOR_PROMPT = f"""

You're a Mortgage Evaluation Supervisor Agent.

You might be managing a STRICT, ORDERED mortgage danger evaluation workflow

between the next brokers:

{members}

--- WORKFLOW ORDER (MANDATORY) ---

1. case_intake_agent

2. risk_policy_checker_agent

3. lending_decision_agent

4. FINISH

You MUST observe this order. No agent could also be skipped.

--- YOUR RESPONSIBILITIES ---

1. Learn all messages up to now fastidiously.

2. Decide which brokers have already executed.

3. Examine the MOST RECENT output of every executed agent.

4. Resolve which agent MUST act subsequent primarily based on completeness and order.

--- COMPLETENESS REQUIREMENTS ---

Earlier than transferring to the following agent, confirm the earlier agent’s output incorporates:

case_intake_agent output MUST embody:

- "Monetary Abstract"

- "Key Monetary Indicators"

- "Monetary Rationale"

risk_policy_checker_agent output MUST embody:

- "Coverage Validation Consequence"

- "Monetary Justification"

- Both a coverage match OR express assertion no coverage exists

lending_decision_agent output MUST embody:

- "Coverage Standing"

- "Lending Suggestions"

- Clear approval / non-approval standing

--- ROUTING RULES ---

- If an agent has NOT run but → path to that agent.

- If an agent ran however required sections lacking → route SAME agent once more.

- ONLY return FINISH if all three brokers accomplished appropriately.

- NEVER return FINISH early.

--- RESPONSE FORMAT ---

Return ONLY certainly one of:

{members + ["FINISH"]}

"""

FINAL_RESPONSE_PROMPT = """

You're the Mortgage Evaluation Supervisor Agent.

Analyze ALL prior agent outputs fastidiously.

--- CRITICAL DECISION RULE ---

Your Closing Determination MUST be primarily based PURELY on the output of the

lending_decision_agent.

- If lending_decision_agent signifies mortgage APPROVED

→ Closing Determination = APPROVED

- If lending_decision_agent signifies NOT APPROVED or NEEDS INFO

→ Closing Determination = NEEDS REVIEW

--- OUTPUT FORMAT (STRICT) ---

- Agent Identify: Mortgage Evaluation Supervisor Agent

- Closing Determination: APPROVED or NEEDS REVIEW

- Determination Reasoning: Based mostly on lending_decision_agent output

- Lending suggestion or different steps: From lending_decision_agent

"""

class Router(TypedDict):

subsequent: Literal[

"case_intake_agent",

"risk_policy_checker_agent",

"lending_decision_agent",

"FINISH"

]

def supervisor_node(state: State) -> Command[

Literal[

"case_intake_agent",

"risk_policy_checker_agent",

"lending_decision_agent",

"__end__"

]

]:

messages = [SystemMessage(content=SUPERVISOR_PROMPT)] + state["messages"]

response = llm.with_structured_output(Router).invoke(messages)

goto = response["next"]

if goto == "FINISH":

goto = END

messages = [SystemMessage(content=FINAL_RESPONSE_PROMPT)] + state["messages"]

response = llm.invoke(messages)

return Command(

goto=goto,

replace={

"messages": [

AIMessage(

content=response.text,

name="supervisor"

)

],

"subsequent": goto

}

)

return Command(goto=goto, replace={"subsequent": goto})Step 8: Defining the Node capabilities

Right here the node capabilities which will likely be performing the position of laggraph nodes are to be outlined.

def case_intake_node(state: State) -> Command[Literal["supervisor"]]:

consequence = case_intake_agent.invoke(state)

return Command(

replace={

"messages": [

AIMessage(

content=result["messages"][-1].textual content,

identify="case_intake_agent"

)

]

},

goto="supervisor"

)

def risk_policy_checker_node(state: State) -> Command[Literal["supervisor"]]:

consequence = risk_policy_checker_agent.invoke(state)

return Command(

replace={

"messages": [

AIMessage(

content=result["messages"][-1].textual content,

identify="risk_policy_checker_agent"

)

]

},

goto="supervisor"

)

def lending_decision_node(state: State) -> Command[Literal["supervisor"]]:

consequence = lending_decision_agent.invoke(state)

return Command(

replace={

"messages": [

AIMessage(

content=result["messages"][-1].textual content,

identify="lending_decision_agent"

)

]

},

goto="supervisor"

)

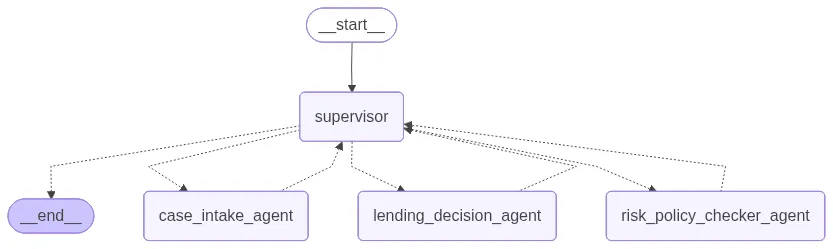

Step 9: Setting up and Visualizing the Graph

Now that we’ve outlined our nodes, we might assemble the workflow graph. The entry level, the nodes of every agent, and conditional edges that direct the workflow relying on the choice of the supervisor are outlined.

graph_builder = StateGraph(State)

graph_builder.add_edge(START, "supervisor")

graph_builder.add_node("supervisor", supervisor_node)

graph_builder.add_node("case_intake_agent", case_intake_node)

graph_builder.add_node("risk_policy_checker_agent", risk_policy_checker_node)

graph_builder.add_node("lending_decision_agent", lending_decision_node)

loan_multi_agent = graph_builder.compile()

loan_multi_agentYou’ll be able to visualize the graph when you’ve got the best libraries, however we are going to proceed to run it.

Step 10: Working the System

Now for the second of fact. We are going to apply as candidates to our system and observe the supervisor prepare the evaluation course of. Earlier than this we are going to obtain an utility operate to format the output.

# This utility file will not be important to the logic however helps format the streaming output properly.

!gdown 1dSyjcjlFoZpYEqv4P9Oi0-kU2gIoolMB

from agent_utils import format_message

def call_agent_system(agent, immediate, verbose=False):

occasions = agent.stream(

{"messages": [("user", prompt)]},

{"recursion_limit": 25},

stream_mode="values"

)

for occasion in occasions:

if verbose:

format_message(occasion["messages"][-1])

# Show the ultimate response from the agent as Markdown

print("nnFinal Response:n")

if occasion["messages"][-1].textual content:

show(Markdown(occasion["messages"][-1].textual content))

else:

print(occasion["messages"][-1].content material)

# Return the general occasion messages for non-obligatory downstream use

return occasion["messages"]

immediate = "Evaluation applicant A101 for mortgage approval justification."

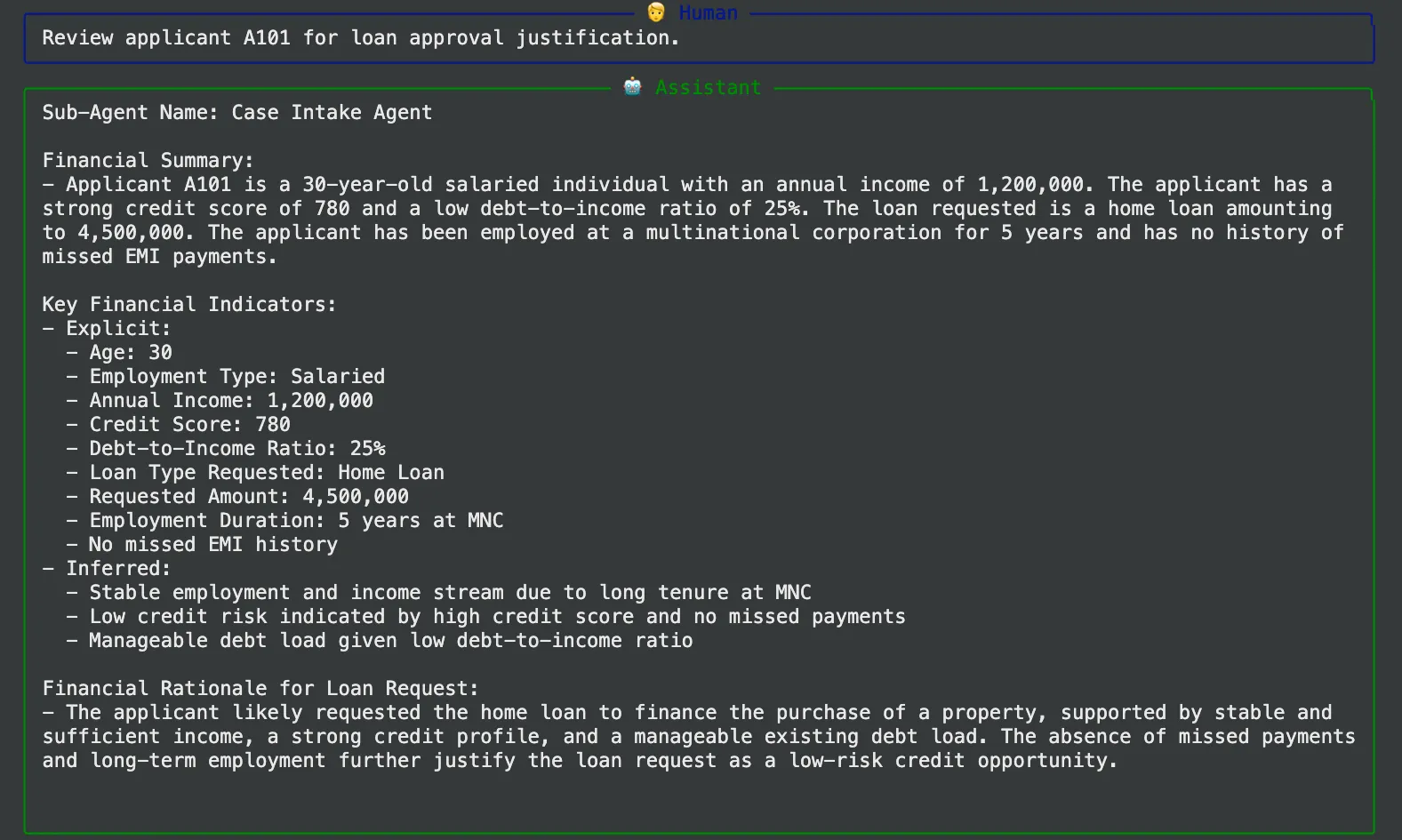

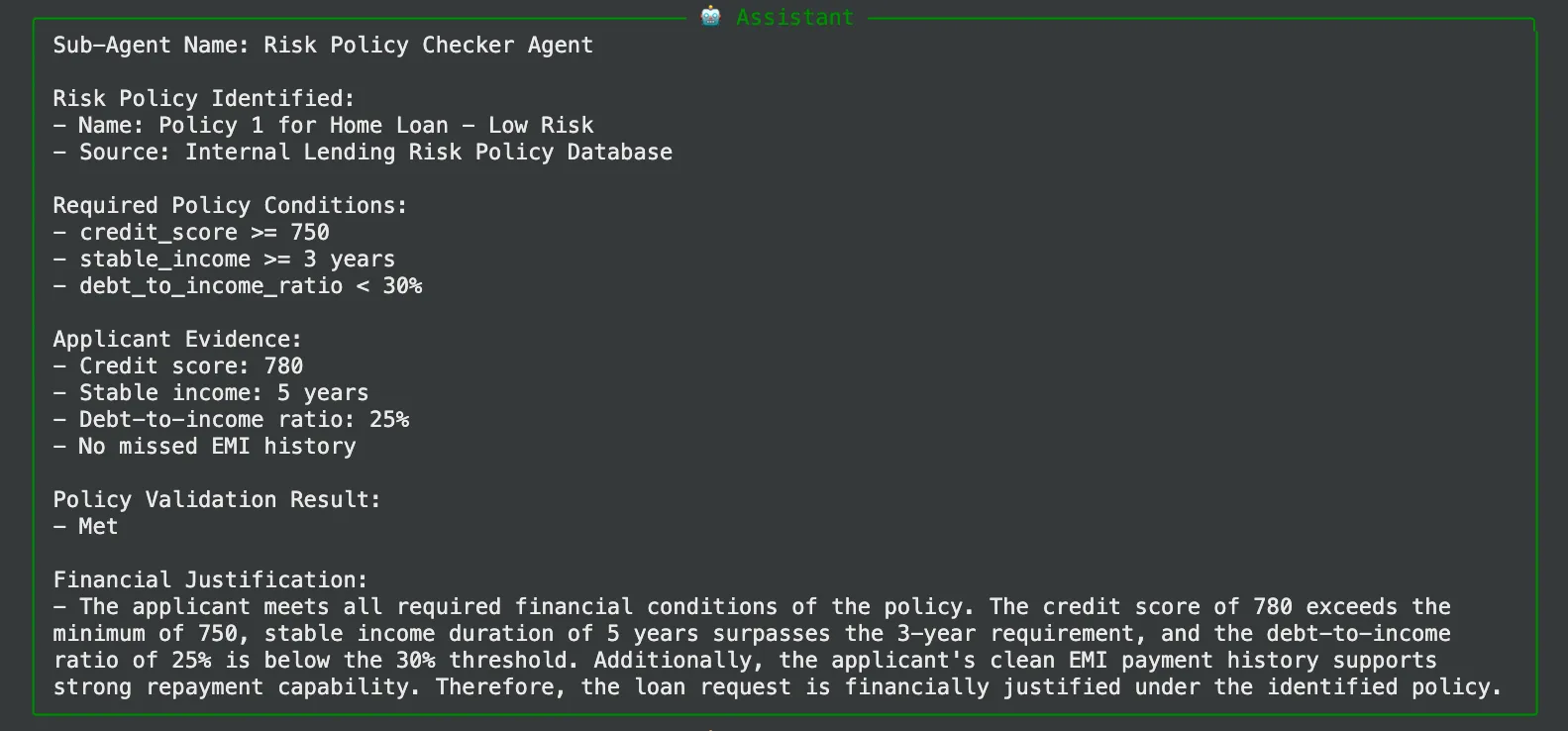

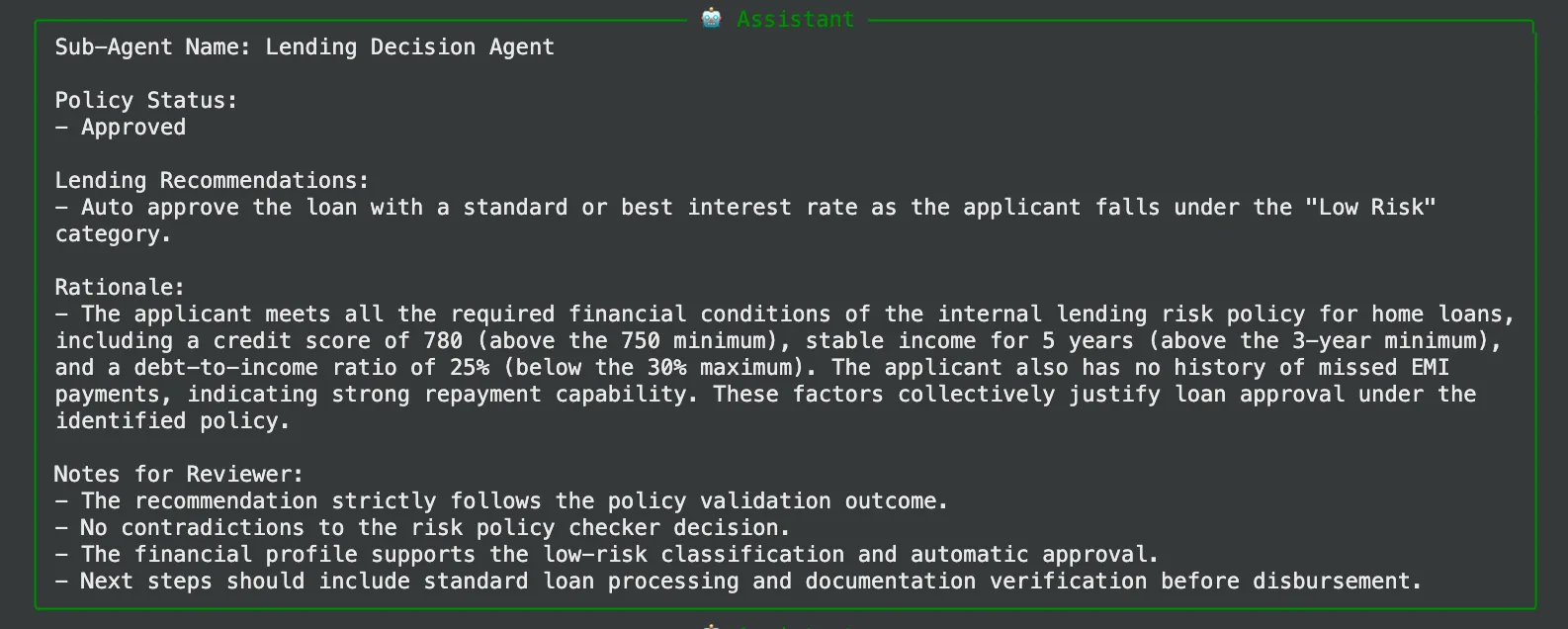

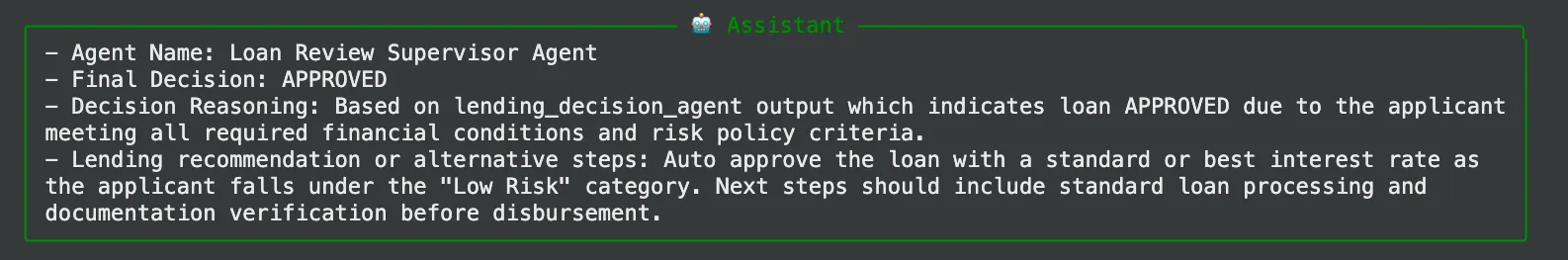

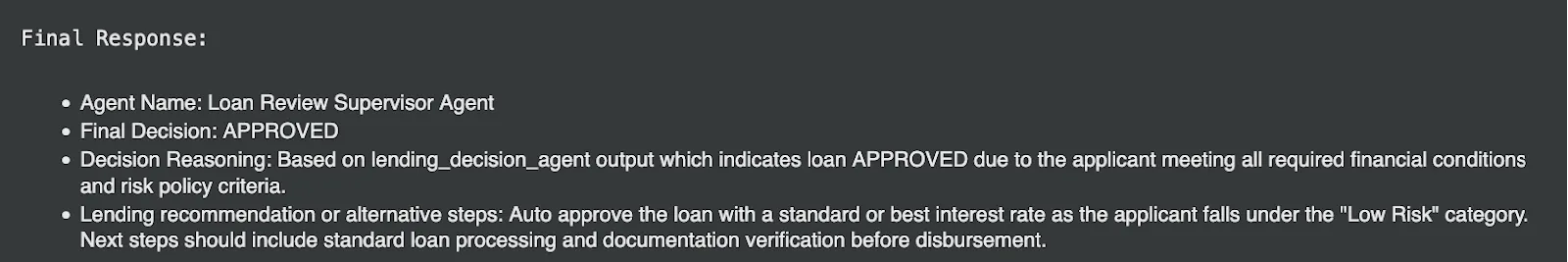

call_agent_system(loan_multi_agent, immediate, verbose=True)Output Evaluation:

While you run this, you will note a step-by-step execution hint:

- supervisor (to caseintakeagent): The supervisor initiates the method with directing the duty to the consumption agent.

- caseintakeagent Output: It’s an agent that may run its instrument to retrieve the document of applicant A101 and generate a clear monetary abstract.

- supervisor -> riskpolicycheckeragent: The supervisor notices that the consumption has been made and forwards the duty to the coverage checker.

- Output of riskpolicycheckeragent: The coverage agent will discover that A101 is a Low Threat coverage that satisfies all their profile necessities of a House Mortgage.

- supervisor -> lendingdecisionagent: The supervisor now instigates the last word decision-maker.

- lendingdecisionagent Output: This agent will suggest an auto-approval within the class of “Low Threat” class.

- supervisor -> FINISH: When the supervisor reaches FINISH, it treats the ultimate employee as full and produces a cumulative abstract.

The top product will likely be a effectively written message freed from any grime comparable to:

Colab Pocket book: Mastering Supervisor Brokers.ipynb

Conclusion

Utilizing a supervisor agent, we modified a sophisticated enterprise course of into predictable, strong and auditable workflow. Even one agent making an attempt to take care of information retrieval, danger evaluation, and decision-making concurrently would wish a way more difficult immediate and could be more likely to make an error.

The supervisor sample provides a powerful psychological mannequin and an architectural method to creating superior AI programs. It allows you to deconstruct complexity and assign distinct accountability and create good and automatic workflows that resemble the effectiveness of a well-coordinated human crew. The second technique to handle a monolithic problem is to not merely create an agent subsequent time, however a crew, and all the time have a supervisor.

Steadily Requested Questions

A. Reliability and modularity is the first energy. The general system turns into simpler to construct, debug, and preserve as a result of it breaks a posh process into smaller steps dealt with by specialised brokers, which ends up in extra predictable and constant outcomes.

A. Sure. On this setup, the supervisor reassigns a process to the identical agent when its output is incomplete. Extra superior supervisors can go additional by including error correction logic or requesting a second opinion from one other agent.

A. Whereas it shines in complicated workflows, this sample additionally handles reasonably complicated duties with simply two or three steps successfully. It applies a logical order and makes reasoning means of the AI considerably extra clear and auditable.

Login to proceed studying and revel in expert-curated content material.