Promoting to EU prospects means coping with VAT, and for ecommerce sellers, it isn’t optionally available.

However determining when and cost VAT for cross-border dropshipping can really feel like fixing a puzzle with lacking items.

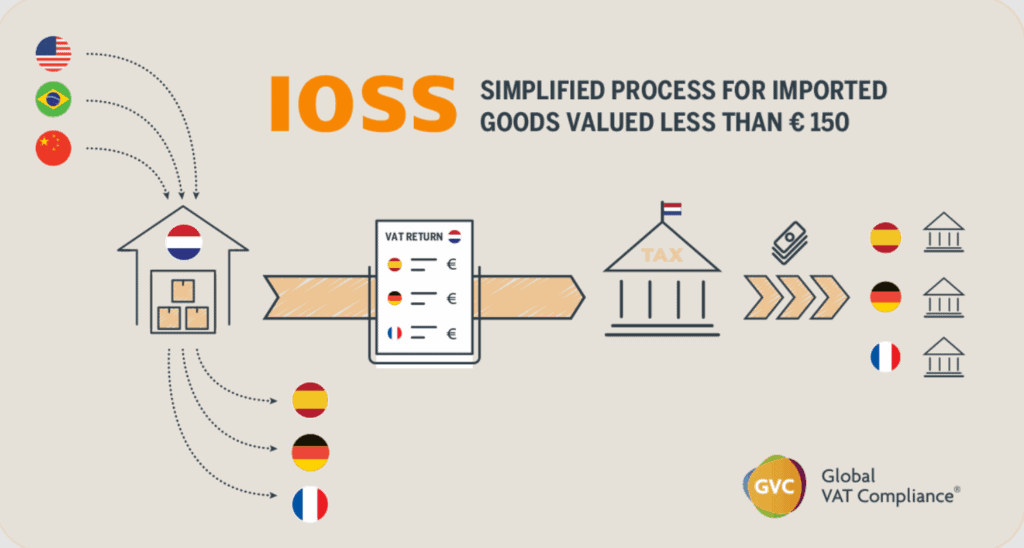

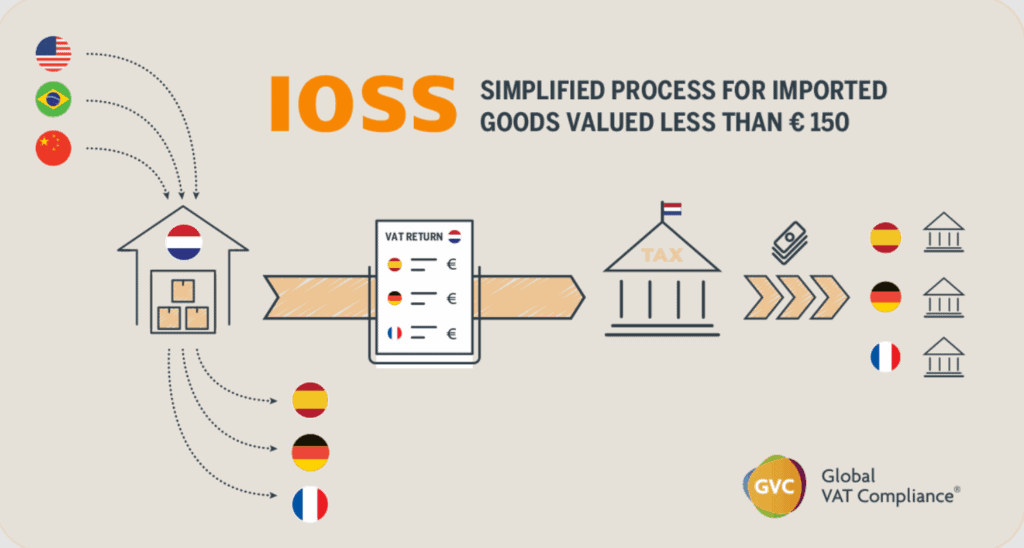

That is the place the IOSS (Import One-Cease Store) and OSS (One-Cease Store) programs are available in!

These EU tax frameworks are designed to simplify VAT for ecommerce sellers, however choosing the proper one depends upon how you use.

Fast Reply: How does IOSS and OSS assist with cross-border VAT for EU dropshipping?

IOSS and OSS simplify EU VAT compliance for dropshippers. Use IOSS for B2C imports into the EU below €150 to cost VAT at checkout and keep away from customs delays.

Use OSS for intra-EU B2C gross sales to file one quarterly return throughout international locations. Collectively, they cut back registrations, velocity supply, and stop VAT errors.

We spent dozens of hours researching real-world VAT situations, reviewing official EU tax pointers, and analyzing the commonest dropshipping setups.

This information explains precisely how IOSS and OSS work, while you want them, and keep away from frequent VAT errors when promoting throughout the EU.

Let’s get began!

What’s VAT and the way does it work within the EU?

Earlier than we speak about IOSS and OSS, let’s be sure you absolutely perceive what VAT truly is.

VAT stands for Worth Added Tax. It is a kind of gross sales tax that’s added at every stage of a product’s journey, from manufacturing to last sale. Within the EU, it is charged on most items and providers.

If you happen to’re promoting to prospects within the EU, you nearly all the time want to incorporate VAT in your costs and pay it to the proper EU nation.

Here is a easy instance:

- You promote a product for €120 to a buyer in France.

- France’s VAT charge is 20%.

- Meaning you gather €120 – (€120/1.20) = €20 VAT from the shopper.

- You have to ship that €20 to the French tax workplace.

Straightforward sufficient, proper? However issues get extra sophisticated when:

And that is the place many dropshippers run into issues.

Vital: Every EU nation has its personal VAT charge, and you should apply the proper one primarily based in your buyer’s location.

As of 2025, EU customary VAT charges vary from 17% (Luxembourg) to 27% (Hungary):

| Nation | Customary VAT charge |

| Luxembourg | 17% (lowest) |

| Germany | 19% |

| France | 20% |

| Netherlands | 21% |

| Sweden | 25% |

| Hungary | 27% (highest) |

So, should you’re promoting to prospects in numerous international locations, it’s essential know which charge applies primarily based on their location.

As soon as you realize the VAT charge, it’s essential decide the place and pay it, particularly should you’re promoting throughout borders.

That is precisely what the IOSS and OSS programs had been constructed for.

How the EU VAT guidelines have modified (IOSS & OSS introduction)

Earlier than 2021, should you offered to a number of EU international locations, you usually needed to register for VAT in every nation, file a number of VAT returns, and preserve observe of complicated native guidelines.

Think about this: You are primarily based in Spain, however you are promoting to prospects in Germany, Italy, and France.

Below the previous guidelines, as soon as your gross sales in every nation handed a sure restrict (referred to as a distance promoting threshold), you needed to:

- Register for VAT in every nation

- File separate VAT returns

- Perceive native tax guidelines (in numerous languages!)

Small sellers needed to register for VAT in a number of international locations, file native returns, and manually handle overseas tax guidelines.

That is why the EU created IOSS and OSS in July 2021, to repair the complexity of multi-country VAT compliance for ecommerce sellers

And it labored!

With IOSS and OSS, sellers now have a a lot simpler solution to handle VAT when promoting to prospects in numerous EU international locations.

By the tip of 2024, over 170,000 companies had registered below the EU’s OSS/IOSS frameworks.

Here’s a fast overview of the 2 earlier than we dive deeper into each of them:

| Function | IOSS (Import One-Cease Store) | OSS (One-Cease Store) |

| Applies to | B2C imports into the EU | Gross sales inside the EU (cross-border) |

| Product worth restrict | ≤ €150 per consignment (intrinsic worth) | No cargo restrict (separate €10k annual threshold for place-of-supply) |

| VAT charged | At checkout (buyer’s VAT charge) | At checkout (buyer’s VAT charge) |

| Reporting frequency | Month-to-month | Quarterly |

| Customs simplification | Sure (IOSS quantity → sooner clearance) | Not relevant (OSS would not cowl imports) |

| Who can register | EU & non-EU (non-EU often want an EU middleman, besides the place EU has a VAT mutual-assistance pact, e.g., Norway) | EU & non-EU (Study right here what applies to you) |

What’s IOSS (Import One-Cease Store), and when do you want it?

If you happen to’re dropshipping merchandise from exterior the EU (for instance, from China), IOSS is the VAT system you may possible want.

IOSS (Import One-Cease Store) is a particular VAT system for items imported into the EU which can be:

- Price €150 or much less per order (excluding transport and insurance coverage).

- Offered on to EU shoppers (B2C).

- Shipped from exterior the EU.

As an alternative of shoppers paying VAT on the border (which regularly causes delays and shock charges), you gather the VAT at checkout after which report it by your IOSS quantity in a single month-to-month return.

With IOSS, you get:

- Quicker supply. Utilizing IOSS accelerates customs clearance as a result of VAT is pre-collected and validated at import, which carriers observe results in sooner transit instances.

- Happier prospects. No sudden VAT payments or dealing with charges when the package deal arrives.

- Less complicated reporting. You declare all of your EU import gross sales in a single place.

- A stage enjoying area. Non-EU sellers compete pretty with EU sellers, since VAT is all the time included.

Instance of how IOSS works

For instance you promote a telephone case from China to a buyer in France.

- Product value: €10

- French VAT charge: 20%

- Buyer pays: €12 (value + VAT)

You gather the €2 VAT at checkout. On the finish of the month, you report that VAT in your IOSS return and pay it to the French tax authority by your IOSS quantity.

The package deal arrives in France, customs checks the IOSS quantity, and the parcel is delivered on to the shopper.

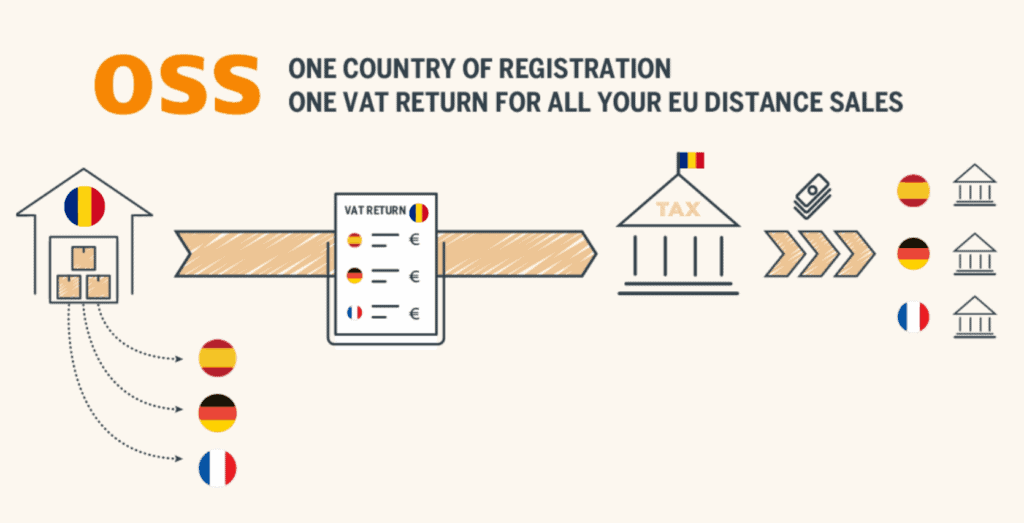

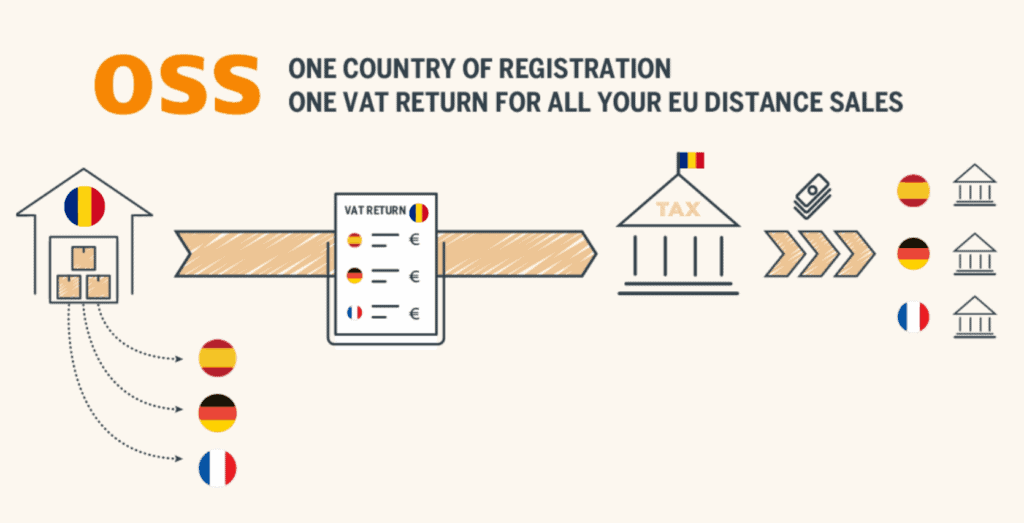

What’s OSS (One-Cease Store), and the way does it assist with intra-EU gross sales?

If IOSS is for imports into the EU, then OSS is for gross sales that occur inside the EU.

So, if your dropshipping provider is EU-based and also you’re promoting to prospects in different EU international locations, then OSS is the software you want.

With OSS, you’ll be able to:

- Register for VAT in only one EU nation.

- File one quarterly VAT return that covers all of your EU cross-border gross sales.

- Pay the VAT you’ve gotten collected, and the tax workplace in your house nation will distribute it to the opposite EU international locations in your behalf.

Straightforward, proper?

Instance of how OSS works

For instance you are a vendor primarily based in Germany. You retailer inventory in a German warehouse and ship to prospects throughout the EU.

- You promote €500 value of merchandise to prospects in France (VAT charge 20%)

- You promote €1,000 value of merchandise to prospects in Italy (VAT charge 22%)

- You promote €800 value of merchandise to prospects in Sweden (VAT charge 25%)

As an alternative of registering for VAT in France, Italy, and Sweden, you merely report these gross sales in your OSS return by the German tax authority.

Then, Germany’s tax workplace routinely forwards the VAT to every nation.

Which VAT scheme applies to your dropshipping enterprise?

Nonetheless not sure which system you want?

It depends upon your provider location and the place your prospects reside. Let’s stroll by the commonest situations for dropshippers:

1. Dropshipping from exterior the EU (e.g., China) to the EU

That is the basic dropshipping mannequin. You’re taking an order from a buyer within the EU and your provider in China ships the product straight to them.

If the order is value €150 or much less, you should use IOSS to:

- Gather VAT at checkout

- Keep away from customs delays

- Preserve your prospects joyful (no shock charges)

Word: If you happen to’re not primarily based within the EU, you should register for IOSS by an EU-based middleman.

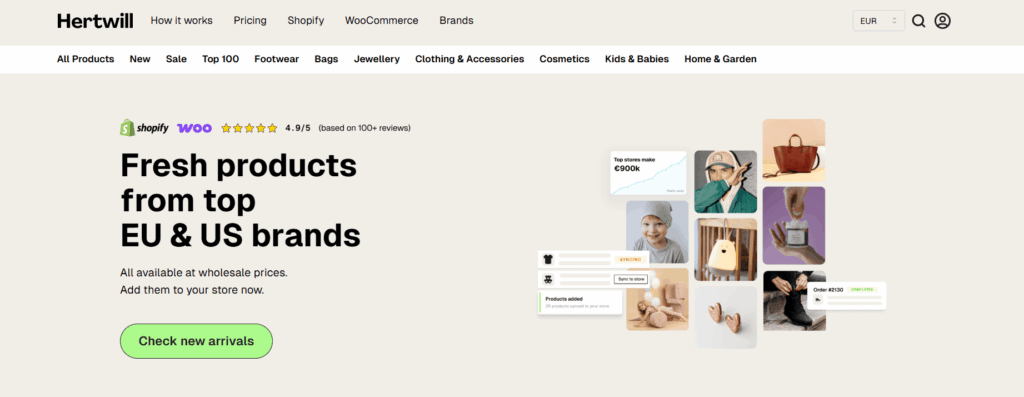

2. Dropshipping from an EU provider to different EU international locations

This can be a frequent setup in 2025 for dropshippers focusing on the EU market.

As an alternative of importing merchandise from exterior the EU, you’re employed with a European provider like Hertwill.

This provider is predicated within the EU and ships on to your buyer when an order is available in.

Here is the way it works:

- You purchase the product from Hertwill at a wholesale (B2B) value, often with out VAT (should you’re VAT registered).

- You promote the product to an EU client (B2C) by way of your personal retailer.

- Hertwill ships the product from inside the EU, so there are not any import taxes or customs delays.

- You gather the fee and concern the bill to the shopper.

Because you’re liable for the ultimate sale, and your prospects are situated in a number of EU international locations, you should:

- Register for VAT in your house nation.

- Register for the OSS (One-Cease Store) scheme.

- Cost the proper VAT charge primarily based on the shopper’s location.

- Report all cross-border gross sales in a single easy OSS return every quarter.

Instance

You are primarily based in Estonia, utilizing Hertwill as your EU provider:

A buyer in France buys a product out of your retailer for €50.

- You purchase the product from Hertwill for €25 (VAT-free, B2B).

- You cost the French buyer €50, together with 20% French VAT.

- You report the sale utilizing OSS by the Estonian tax workplace.

- You pay the collected VAT to Estonia, which forwards it to France.

3. You utilize each non-EU and EU suppliers

- You might want: Each IOSS and OSS

Some bigger dropshipping companies combine each fashions.

For instance:

- You dropship most merchandise (

- You retailer best-sellers in a Dutch warehouse for quick EU supply (use OSS).

Sure, you should use each programs on the similar time.

Simply double-check that every transaction is reported below the proper scheme and by no means reported in each.

Do IOSS or OSS apply if I take advantage of a market like Amazon or Etsy?

In lots of instances, no. When {the marketplace} qualifies because the deemed provider, it takes accountability for VAT assortment and reporting.

Below EU VAT guidelines, platforms like Amazon, Etsy, or eBay are thought of the provider in two instances:

- Any sale by a vendor exterior the EU to a client contained in the EU (together with home gross sales or intra-EU distance or distant gross sales)

- European and non-European sellers promoting imported items to shoppers at distance with consignments not exceeding €150

In each instances, the platform sometimes collects VAT at checkout and submits it to the tax authorities. You do not want your personal IOSS or OSS registration for these particular transactions.

For instance, Etsy and eBay use and submit their very own IOSS numbers for qualifying low-value imports.

Whether or not the deemed provider rule applies depends upon whether or not {the marketplace} facilitates the transaction. This implies the complete checkout course of takes place on the platform.

Nevertheless, some obligations should still apply. For instance, should you retailer stock in an EU warehouse, you sometimes must register for VAT within the nation the place the warehouse is situated.

If you’re not sure, verify the VAT coverage of {the marketplace} or seek the advice of your tax advisor.

Find out how to keep VAT compliant as a dropshipper in 2025

By now, you perceive what IOSS and OSS are and the way they apply to your dropshipping enterprise.

However the factor is: Understanding the foundations is not sufficient. You additionally must comply with them constantly and appropriately.

So, let’s cowl an important compliance steps:

1. Register for VAT

For IOSS (Import One-Cease Store):

- If you happen to’re a non-EU vendor, you should register for IOSS by an EU-based middleman (consider them like your tax consultant within the EU).

- If you happen to’re an EU vendor, you’ll be able to register for IOSS straight in your house nation.

- You’ll obtain a singular IOSS quantity. This quantity have to be included in your transport documentation in order that customs is aware of VAT is already paid.

For OSS (One-Cease Store):

- Register for OSS in your house nation.

- As soon as registered, you’ll be able to report all of your EU cross-border B2C gross sales in a single quarterly return.

2. File and report VAT month-to-month or quarterly

Staying compliant means reporting on time, each time.

Here is what you may must do:

| Scheme | Reporting frequency | What you report |

| IOSS | Month-to-month | Whole VAT collected on all imports below €150 |

| OSS | Quarterly | Whole VAT on cross-border B2C gross sales inside the EU |

- Returns have to be filed electronically.

- You have to pay the VAT owed by the deadline. No delays.

- Preserve correct information for a minimum of 10 years (required by EU legislation).

Tip: You should utilize automated VAT instruments or rent a VAT service supplier to simplify this.

3. Invoicing and recordkeeping

Even should you use an automation software, you are still liable for your compliance.

You have to:

- Subject VAT-compliant invoices (when required by the shopper or nation).

- Retailer all transaction information, transport paperwork, and VAT studies securely.

- Be prepared to indicate these information throughout a VAT audit (sure, they do occur).

4. Keep away from the frequent errors

Let’s speak about what to not do.

These are probably the most frequent errors that dropshippers make:

| ❌ Mistake | ✅ Resolution |

| Utilizing IOSS for orders above €150 | Solely use IOSS for items valued at €150 or much less (excluding transport/insurance coverage) |

| Forgetting to incorporate your IOSS quantity on customs types | Make sure that your provider provides your IOSS quantity correctly |

| Reporting gross sales twice in IOSS and OSS | Double-check which scheme applies to which transaction |

| Lacking submitting deadlines | Set reminders or automate your VAT returns with software program |

| Utilizing a nasty VAT middleman | Select a licensed, skilled agency with EU tax information |

Instruments for staying VAT compliant when dropshipping

In relation to staying VAT compliant within the EU, manually managing every thing will be irritating and gradual.

That is why there are instruments accessible to assist dropshippers such as you.

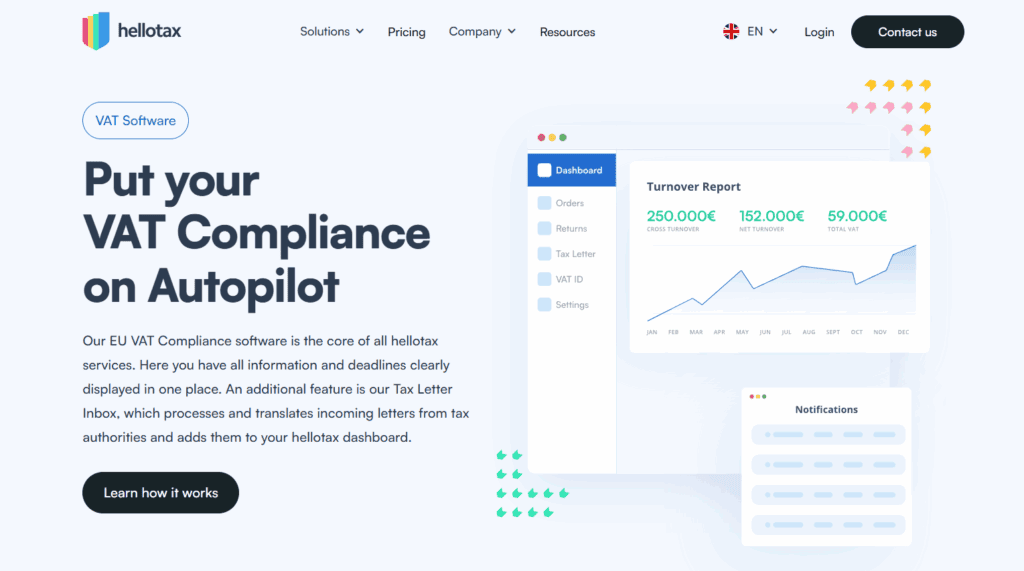

For instance, hellotax.

hellotax is a VAT software program platform mixed with a crew of actual tax consultants. It is designed for on-line sellers who must handle VAT throughout Europe, with out hiring a number of accountants or combating spreadsheets.

If you happen to’re utilizing IOSS, hellotax can:

- Register you for IOSS, even should you’re a non-EU vendor.

- Act as your EU middleman (a authorized requirement!).

- Gather and submit your month-to-month IOSS VAT returns.

- Assist you embrace your IOSS quantity on customs paperwork to keep away from delays.

Or, should you’re utilizing OSS, hellotax makes this straightforward by:

- Dealing with Union OSS registration.

- Submitting your quarterly OSS returns.

- Monitoring gross sales throughout EU international locations and making use of the proper VAT charges.

- Ensuring your VAT is appropriately paid to every nation by a single return.

You may observe your gross sales and VAT liabilities in actual time by their dashboard:

And so they even combine with widespread dropshipping platforms like Shopify:

If you happen to’re , you’ll be able to go to their web site for extra data right here.

Abstract

Earlier than we go, we have created a fast abstract of this text for you, so you’ll be able to simply bear in mind it:

- You have to cost VAT appropriately when promoting to EU prospects, primarily based on every nation’s charge.

- Use IOSS for low-value items (below €150) shipped from exterior the EU to EU shoppers.

- Use OSS for gross sales inside the EU when utilizing an EU provider.

- You should utilize each IOSS and OSS if your small business entails each import and intra-EU gross sales.

- To remain compliant, register for the proper scheme, file returns on time, and preserve correct information.

- Instruments like hellotax can automate your VAT course of, deal with registrations and filings, and combine with platforms like Shopify.

Conclusion

VAT compliance is without doubt one of the largest challenges new dropshippers face when coming into the EU market.

But it surely would not must be scary.

The IOSS and OSS programs are designed to simplify every thing, from charging VAT appropriately to submitting returns.

If you happen to select the proper setup and comply with the foundations, your retailer stays compliant, prospects keep joyful, and your small business grows sooner.

Now go put that information to work and construct a compliant, scalable, and profitable dropshipping enterprise within the EU!

Need to be taught extra about dropshipping?

Prepared to maneuver your dropshipping retailer to the subsequent stage? Take a look at the articles beneath:

Plus, remember to take a look at our in-depth information on begin dropshipping right here!