This text signify the views of the creator and doesn’t in any method represent or suggest funding recommendation. The superior air mobility (AAM) trade is edging nearer to takeoff. Publicly traded firms corresponding to Joby Aviation (NYSE: JOBY) and Archer Aviation (NYSE: ACHR) are two of a number of names defining this new frontier, creating electrical vertical takeoff and touchdown plane (eVTOLs) designed to rework short-range journey. Each firms have reported progress towards certification and commercialization, and each have skilled sharp inventory swings that spotlight how dependent this market stays on regulation and public opinion.

Joby Aviation: Ultimate Steps Towards Certification

Joby Aviation introduced that it has begun power-on testing of its first FAA-conforming plane, a big milestone that marks the beginning of the ultimate section of kind certification. The corporate has additionally expanded its manufacturing footprint in Dayton, Ohio, the place it plans to supply key parts corresponding to propellers, and it continues to pursue worldwide approvals, together with work towards UAE certification focused for 2026.

At roughly fifteen {dollars} per share, Joby’s inventory has seen sharp intraday actions that replicate buyers’ enthusiasm for seen progress mixed with warning over timing. Institutional purchases, corresponding to latest acquisitions by Ring Mountain Capital, present rising confidence in Joby’s long-term potential. Nonetheless, certification and scale-up stay expensive, and any delay might shortly shift market sentiment.

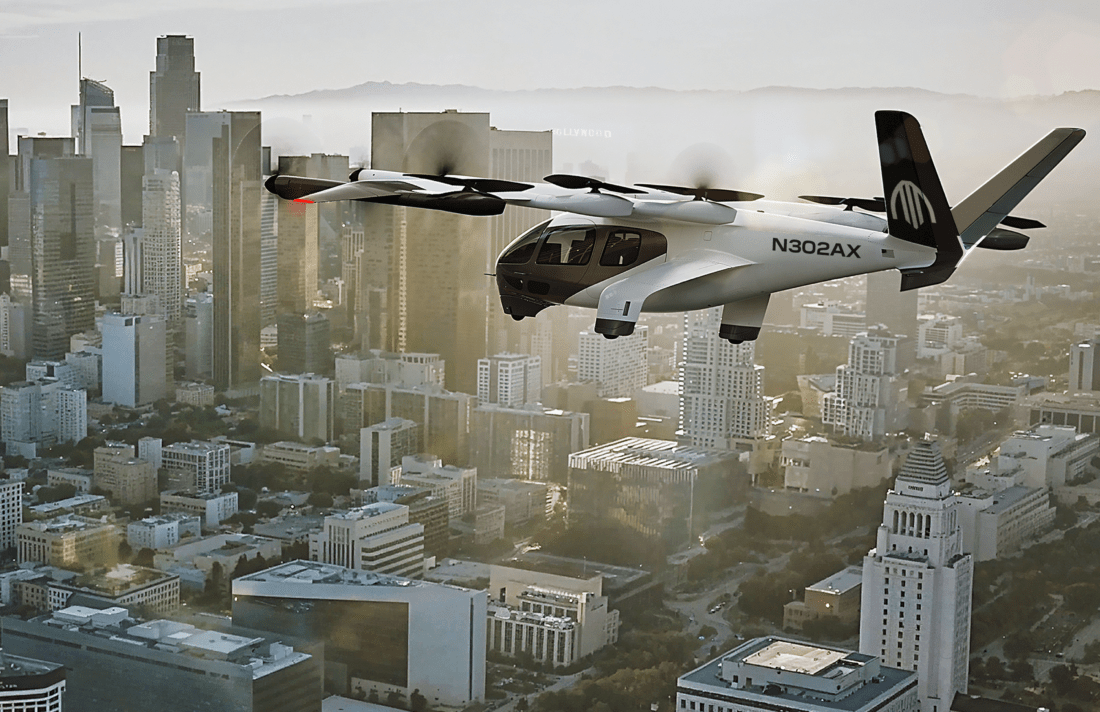

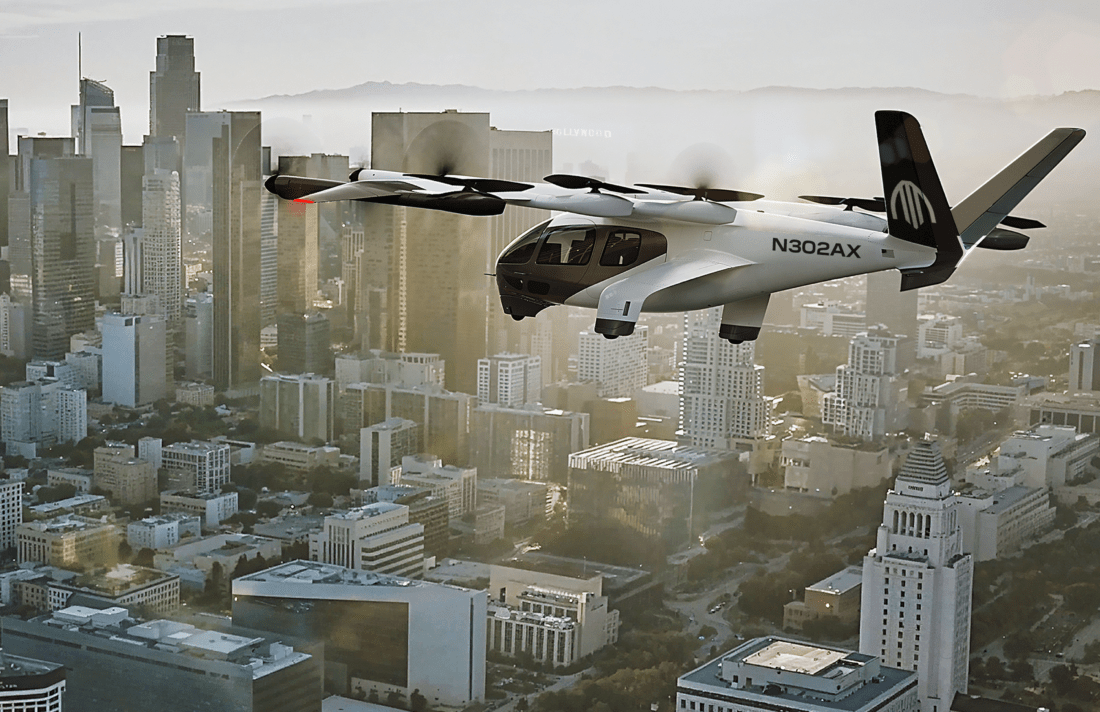

Archer Aviation: Partnerships and Strategic Positioning

Archer’s path ahead has targeted on partnerships and early income plans. The corporate was lately chosen to take part within the Tokyo Metropolitan Authorities’s eVTOL Implementation Program, working with Japan Airways to organize its “Midnight” plane to be used in Japan. Archer has mentioned it expects to see its first industrial income in early 2026, positioning itself as one of many earliest entrants into passenger operations.

The corporate’s management roster additionally displays an emphasis on regulatory credibility. Former Appearing FAA Administrator Billy Nolen joined Archer in 2023 as Chief Security Officer, lending insider data of the certification course of. Archer’s inventory, buying and selling round 9 {dollars} and fifty cents, has gained strongly over the previous yr however has additionally pulled again forward of quarterly earnings, underlining the volatility that accompanies any pre-revenue aerospace enterprise.

Volatility Throughout the Sector

Each Joby and Archer have proven pronounced inventory volatility, a mirrored image of the sector’s early-stage standing. Traders reply shortly to each certification replace, partnership, or timeline adjustment. When information is constructive, valuations rise sharply; when schedules slip, costs retreat.

This sample is frequent in industries approaching what many describe as their “web second,” the purpose the place a breakthrough know-how strikes from promise to public use. For AAM firms, that transition relies upon not solely on technical success but additionally on infrastructure readiness, airspace integration, and market belief.

Regulation and Public Acceptance: The Hidden Variables

AAM’s progress relies upon as a lot on authorities coverage and client notion as on engineering milestones. FAA kind certification, native flight approvals, and vertiport development can speed up shortly or stall for years. In the meantime, group sentiment about noise, security, and affordability will form how quickly air taxis grow to be a well-known sight.

Expertise throughout aviation and rising applied sciences reveals that these elements can change immediately, or linger in uncertainty. A single coverage shift or public incident can transfer each timelines and investor confidence in a single day.

A Lengthy Runway to Actuality

Joby and Archer often is the most seen public examples, however they signify solely a part of a broader ecosystem of air mobility builders racing towards industrial operations. Their progress reveals actual momentum but additionally the complexity of turning innovation into on a regular basis transportation.

For now, AAM’s trajectory stays outlined by volatility in markets, in regulation, and in public expectation. The subsequent yr might not ship large-scale passenger flights, but it might reveal which firms are greatest positioned to take off when the skies lastly open.

Learn extra:

Miriam McNabb is the Editor-in-Chief of DRONELIFE and CEO of JobForDrones, knowledgeable drone companies market, and a fascinated observer of the rising drone trade and the regulatory atmosphere for drones. Miriam has penned over 3,000 articles targeted on the industrial drone house and is a global speaker and acknowledged determine within the trade. Miriam has a level from the College of Chicago and over 20 years of expertise in excessive tech gross sales and advertising and marketing for brand spanking new applied sciences.

For drone trade consulting or writing, Electronic mail Miriam.

TWITTER:@spaldingbarker

Subscribe to DroneLife right here.