From connectivity to cognition, how ought to telcos monetize AI on the edge?

As people, we discover consolation in predictability — in our habits, norms, and trade orthodoxies. But, as we explored in our first piece, predictability typically turns into a competency entice: when markets shift, these clinging to previous success patterns are left behind. On this remaining piece, we discover what comes subsequent: reframing telecom networks not as static pipes for knowledge, however as dynamic intelligence platforms that may spawn new income streams.

When Microsoft reinvented itself round Azure, it wasn’t merely launching a product; it was reshaping its identification. The corporate moved from perpetual software program licensing to a consumption-based, elastic material of interconnected providers. That shift created compounding worth. Right now, the identical alternative lies earlier than the telecommunications trade.

The bubble isn’t the story, the transformation is

Each main technological wave begins with exuberance that outpaces actuality. The dot-com bubble wasn’t a failure of the web; it was a market correction — the digestion of monumental potential. Valuations crashed, however the infrastructure and behaviors it unleashed endured. Amazon, Google, and Salesforce had been “bubble survivors” that went on to outline fashionable enterprise computing.

Now, the identical cycle is unfolding with AI. Many name it an “AI bubble,” pointing to inflated valuations and speculative startups. However beneath the noise lies a sturdy reality: AI is changing into infrastructure the place aggressive dynamics will probably be outlined. Simply because the early 2000s startup wave constructed the inspiration for the cloud period, as we speak’s AI cycle is setting up the groundwork for clever programs, inferencing materials, and distributed cognition on the edge.

The bubble is the correction, not the collapse. It clears hype and leaves functionality behind. These investing in actual, scalable AI infrastructure — hyperscalers, chipmakers, and more and more Telcos with edge presence — are getting ready for the post-bubble world, when AI stops being a narrative and begins being a utility.

AI’s put up “bubble” telco alternative

Throughout the Telecommunications trade the sentiment is acquainted; Telcos adopting AI to chop prices or enhance buyer satisfaction. These are legitimate targets — however they signify an effectivity mindset, not a development technique. Each main trade transformation begins with operational effectivity however scales by worth creation. The actual alternative for Telcos is to not use AI to optimize how networks run, however to reinvent what networks allow.

AI inferencing on the edge represents that inflection level — the place Telcos can transfer from connecting knowledge to deciphering it, from being the transport layer to being the intelligence layer the place proximity is the brand new energy. At its core, AI inferencing is about proximity — the nearer intelligence sits to the info, the sooner and extra contextually related it turns into. Telcos already function one of the crucial geographically distributed compute materials in existence. Their edge presence, coupled with 5G’s latency and bandwidth capabilities, positions them to turn out to be the bodily substrate of distributed AI.

Within the post-bubble financial system, this will probably be the place recent AI knowledge lives; throughout a mesh of clever, native inferencing nodes. For Telcos, that’s not a value heart; it’s the following platform.

From ARPU to AI yield

Microsoft’s reframing from perpetual licensing to cloud consumption set off a wave of change in the end reshaping how they constructed product, offered to clients and thru companions, and in the end how the markets evaluated their ahead wanting potential. We imagine Telco’s are approaching the same paradox and it’s as much as them to jot down their new playbook for the AI period.

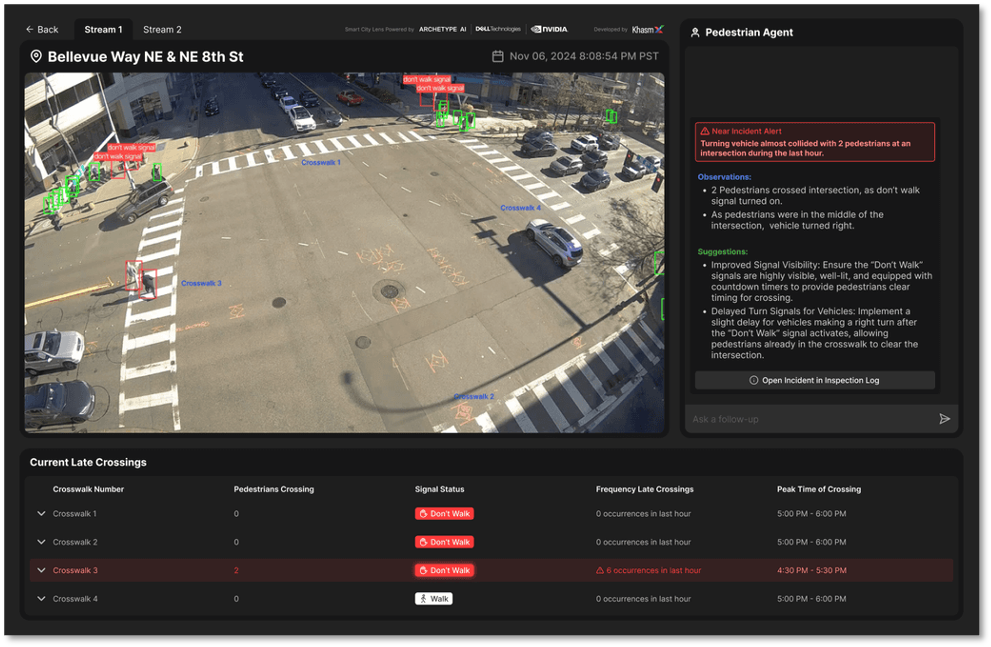

Metropolis of Bellevue’s Imaginative and prescient Zero is an ideal instance of the Telco AI alternative. It’s a real-world demonstration of Edge AI can allow capabilities that weren’t potential earlier than. Bellevue’s daring “Imaginative and prescient Zero” to scale back accident fatalities has introduced collectively the innovation ecosystem the place Telco is taking part in an necessary function in leveraging AI bodily foundational mannequin on the edge and giving site visitors intersection insights that had been simply not potential earlier than. The Telco enterprise mannequin right here shouldn’t be gigabyte-based ARPU however relatively value-based income stream.

As workloads transfer to the sting, the Telco enterprise mannequin should evolve with them. Conventional metrics like ARPU or gigabytes consumed will give option to AI yield — income tied to inference cycles, latency ensures, or determination throughput. On this world, the community shouldn’t be promoting bandwidth; it’s promoting intelligence availability.

The winners will probably be those that design programmable, consumption-based fashions for AI workloads — the place enterprises can deploy, scale, and measure efficiency as simply as they do within the cloud as we speak.

The divergence of worth: Cloud vs. connectivity

In 2008, the world’s expertise and telecom leaders had been virtually friends in market worth.

- Microsoft was valued at roughly $127 billion

- Google at $117 billion, and

- Amazon at simply $29 billion — nonetheless considered largely as an internet retailer.

On the identical time, the Large 4 U.S. telcos — AT&T, Verizon, Dash, and T-Cell — collectively had been value simply over $310 billion, barely greater than the mixed worth of these three future cloud titans. Quick ahead to 2025, and the equation has flipped fully.

- Microsoft now stands at $3.85 trillion

- Alphabet (Google) at $2.98 trillion, and

- Amazon at $2.35 trillion.

Collectively, these three signify almost $9.2 trillion in market capitalization; a 40× improve over 17 years. In the meantime, the U.S. telecom sector, now consolidated into T-Cell ($259B), AT&T ($193B), and Verizon ($184B), totals about $636 billion mixed — barely a sixth of Microsoft’s worth alone. The divergence isn’t about attain or infrastructure; it’s about the place the worth moved. Cloud gamers constructed scalable, software-defined platforms that flip compute and knowledge into ecosystems. Telcos, in contrast, remained anchored in connectivity — indispensable, however commoditized.

Conclusion: From connectivity to cognition

Microsoft reinvented its platform technique by betting on the cloud. Right now, Telcos stand at the same inflection level — however this time, the platform alternative is on the edge. For many years, operators have lived inside regulatory frameworks that formed how they constructed, deployed, and monetized networks. These guidelines protected nationwide infrastructure and ensured reliability — however additionally they constructed a tradition of constraint.

Paradoxically, the businesses redefining the way forward for knowledge — hyperscalers, AI labs, and digital-native platforms function virtually solely with out such regulation. They transfer quick, experiment freely, and form markets earlier than coverage catches up. That’s to not say Telcos ought to abandon their regulatory compliance; relatively, it’s to focus on how regulation has turn out to be a mindset as a lot as a mandate.AI inferencing represents greater than one other workload; it’s the inspiration of a brand new digital financial system constructed on proximity, latency, and perception. The selection for Telcos shouldn’t be whether or not to undertake AI, however whether or not to turn out to be the platform that allows it. Those that act now will redefine their function from shifting bits to shifting selections — from connectivity to cognition. The subsequent platform period has already begun; the query is who will personal it.