Three sides of Business 4.0 – industrial 5G in numbers (half 1)

Personal 5G continues to outpace the broader telecoms market, with enterprise deployments increasing and industrial use circumstances taking form. New knowledge from Dell’Oro Group exhibits sustained almost-double-digit progress and a gradual shift in focus – from enterprise connectivity experiments to production-grade industrial purposes.

In sum – what to know:

Outlier-outrunner – income from personal 4G/5G programs grew 40% in 2024 and is monitoring 20% greater once more in 2025, in contrast with flat progress for public RAN.

Industrial momentum – adoption is accelerating past China and into important industrial environments – notably manufacturing, logistics, mining, and power.

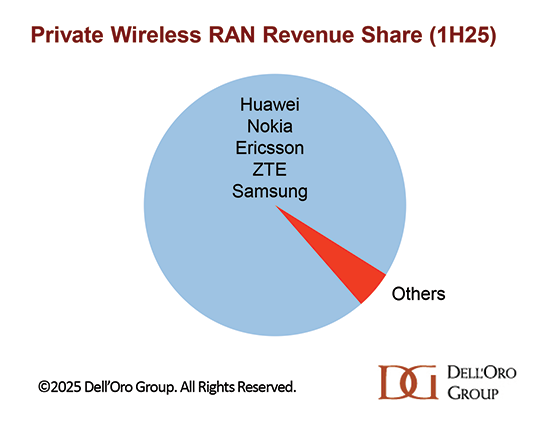

Concentrated market – the highest 5 RAN distributors are Huawei, Nokia, Ericsson, Samsung, and ZTE; integration and scale necessities favour established suppliers.

Be aware: this text is the primary in a brief three-part collection in regards to the new tech foundations of Business 4.0: industrial 5G (personal wi-fi), industrial IoT, and industrial AI – linked however distinct applied sciences that kind the connective, sensory, and cognitive layers of contemporary business, driving digitalisation in hard-nosed industrial environments. Right here is an element one, based mostly on figures from Dell’Oro Group, with some market-sizing in regards to the state of the personal 5G market. Half two (IoT) and half three (AI) can be found right here and right here.

International income from the sale of personal 4G and personal 5G radio entry community (RAN) programs to enterprises grew by practically 40 p.c final 12 months (2024), in keeping with analyst Dell’Oro Group. That momentum has “prolonged” by means of the primary half of 2025, it stated, and income progress will probably be about 20 p.c up on 2024 (on 40 p.c progress on 2023) by the top of the 12 months. Personal wi-fi continues to shine as a vibrant spot within the telecom market,” stated the agency.

Personal RAN gross sales are outrunning “flattish” gross sales in conventional public mobile networks, operated by massive operator teams, largely for customers. Personal 4G/5G now represents a “mid-single-digit share” of complete RAN gross sales, stated Dell’Oro Group. Adoption is “accelerating past China”, it stated, and “towards industrial purposes”. The temptation, right here, is to translate that non-public 4G/5G is being engaged extra carefully in operational expertise (OT) in Business 4.0.

The sense is that non-public mobile has discovered its métier in industrial environments – in manufacturing, logistics, oil and fuel, mining – the place it has been largely deployed, initially, for employee security and digital camera analytics, adjoining to manufacturing programs. However Dell’Oro Group doesn’t conclude, really, that non-public 4G/5G is now being deployed into exact important operations; it reckons, as an alternative, that the market has ‘pivoted’ from conventional enterprise environments”

It said: “The market stays extremely concentrated. The identical 5 main public RAN suppliers proceed to dominate the personal RAN panorama. This overlap displays the market’s pivot away from conventional enterprise environments towards industrial purposes, the place scale, efficiency, and integration necessities favour established distributors.” Huawei, Nokia, Ericsson, Samsung, and ZTE (listed in that order) are the highest suppliers, it stated.

Development within the first half was pushed by each local-area (campus) and wide-area deployments; the latter led the expansion, it stated. China was the most important market by income, however progress outdoors of China is accelerating at a quicker tempo. The highest suppliers by complete income this 12 months are Huawei, Nokia, and Ericsson; outdoors of China, The highest three are Nokia, Ericsson, and Samsung. Huawei leads for wide-area deployments within the interval, Nokia for local-area deployments.

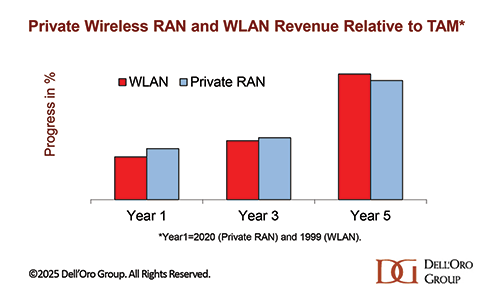

Dell’Oro Group described the market as a “still-untapped, high-growth alternative”. Whole personal 4G/5G RAN revenues have “accelerated quickly” within the first half of 2025, it stated, going from a “low single-digit share in 2022” to a “mid-single-digit share” of complete RAN revenues at the moment. Development is “monitoring carefully” with the trajectory of enterprise Wi-Fi adoption throughout its first 5 years. It would account for five-to-10 p.c of complete RAN by 2029; public RAN is anticipated to say no at a two p.c CAGR over the identical interval.

It said: “The high-level message has not modified – personal wi-fi is a large alternative. Nonetheless, it would take a while for enterprises to embrace personal mobile applied sciences.” Dell’Oro Group has a report all about it.