The Greenhouse Fuel Protocol, which publishes guidelines utilized by 97 p.c of firms that calculate and disclose their greenhouse gasoline emissions, is finalizing proposed revisions to how firms can report on emissions associated to their electrical energy utilization.

The advisable adjustments will make it extra sophisticated for firms — particularly ones with smaller electrical energy hundreds — to assert emissions reductions by signing digital energy buy agreements, a kind of contract that has financed the addition of 100 gigawatts of fresh electrical energy to the U.S. grid since 2014, in response to these aware of the proposal.

The prevailing GHG Protocol methodology, initially printed in 2015, lets firms declare emissions reductions for electrical energy, categorized as Scope 2, by matching their annual consumption with energy from renewable sources.

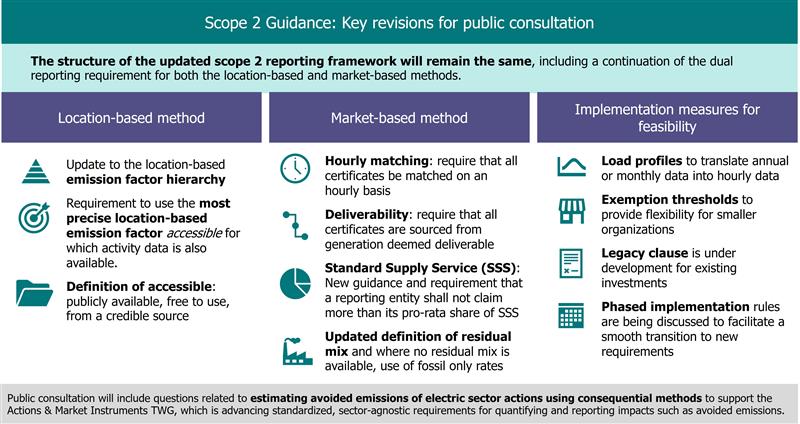

The revision being ready for public remark, drafted by a technical working group and permitted over the summer time with modifications by the GHG Protocol’s Unbiased Requirements Board, favors requiring firms to match their electrical energy hundreds on a a lot stricter hourly foundation utilizing native renewable sources on the identical grid as the corporate’s authentic consumption, in response to these with data of the method.

“Essentially the most regarding component of this proposal is the dearth of procurement choices that might help hourly matching for patrons of our measurement,” stated Jay Creech, supervisor of web zero for retailer REI Co-op, commenting about what is understood publicly. “Even now, a company as massive and complex because the co-op might battle to entry company procurements, which frequently have a minimal offtake of greater than double our annual electrical energy want.”

Work in progress

The GHG Protocol hints that it’s going to exempt smaller organizations from the strictest new necessities in a weblog printed Sept. 29, permitting firms to take the method that’s most possible for its particular person circumstances. The group can also be contemplating a legacy clause for current contracts, which is essential for the offers firms are scrambling to shut earlier than U.S. tax incentives go away in July 2026.

The requirements physique hasn’t made the main points for both of these concepts public, nevertheless it plans to current numerous choices when it opens a 60-day interval for public suggestions. The GHG Protocol plans to begin soliciting suggestions in October, however a spokesperson declined to share that date. Revisions to the present draft can be circulated in 2026, with a last model anticipated in 2027.

Will probably be a number of years earlier than the adjustments take impact, however company sustainability professionals and renewable power financing consultants stated the proposed revisions will make it tougher to justify investments in long-term energy buy agreements at a time when the U.S. market already has been hobbled by tariffs and more and more hostile federal insurance policies.

“Whereas all of us share the aim of a 24/7 clear power future, our focus now have to be on the trail ahead,” stated Mike Matterra, director of company sustainability and ESG officer at Akamai Applied sciences, referring to the push for a way that extra precisely displays a company’s investments in renewable electrical energy on a neighborhood foundation. “We should champion an natural evolution of our clear power assets by deploying them the place they’ll have the best influence — on our dirtiest grids — to make our 24/7 aim a actuality.”

A separate proposal that would supply a approach for firms to be acknowledged for various kinds of offers, equivalent to contracts that embody power storage expertise or that add extra photo voltaic or wind energy on grids closely depending on fossil fuels, was referred to a distinct work stream with the GHG Protocol for added dialogue.

That metric is not a part of the Scope 2 revision course of however should be, given the massive quantity of renewable capability that must be added to the worldwide grid annually to scale back emissions, stated Miranda Ballentine, senior advisor with consulting agency Inexperienced Methods. “We have now to unleash markets, not hamper markets,” she stated.

Unintended penalties

The GHG Protocol’s rationale for updating the Scope 2 guidelines “mirror a contemporary reporting panorama, evolving grids and nearer scrutiny of claims,” in response to the nonprofit’s weblog. Market consultants agree that an overhaul is warranted however fear that it’s going to decelerate challenge improvement at a time when renewable electrical energy adoption must be accelerated.

The Clear Vitality Patrons Affiliation, which despatched a letter to GHG Protocol in Might urging it to not make the revisions too strict, stated offering extra certainty round whether or not current contracts can be exempt below the brand new guidelines is essential for encouraging continued company funding in renewable power over the subsequent three years.

“Our fundamental stance has not modified since we put the letter out, however circumstances have modified dramatically,” stated the affiliation’s CEO, Wealthy Powell, pointing to the decimation of U.S. tax incentives for photo voltaic and wind. “We proceed to suppose this can do extra hurt than good, and threat shrinking the market.”

The brand new guidelines threat limiting market participation to an elite class of the biggest electrical energy customers, stated Michael Leggett, co-founder of Ever.inexperienced, which facilitates company renewable contracts, and the writer of an exhaustive doc that outlines the potential influence of the proposed adjustments.

Amongst his many factors: Fewer than a dozen firms, together with Google, Ingka Group, JPMorgan Chase, Mercedes-Benz and Microsoft do hourly Scope 2 accounting right now. Companies play a vital position in challenge finance for grid-integrated initiatives that isn’t adequately thought of within the present revisions, and by reducing out all however the largest patrons, “it might decelerate, as a substitute of velocity up, addressing local weather change,” Leggett stated.

The present revision will inspire some company renewable patrons to maneuver away from long-term contracts to as a substitute purchase renewable power certificates from current initiatives nearer to their operations, which might sluggish new renewable additions supported by company offtake agreements, stated Patti Smith, electrical energy decarbonization lead for advisory agency Carbon Direct.

“Some really feel it creates a deterrent to renewable power funding by favoring areas which have higher sources of renewable power and favoring the organizations that may web site themselves close to these sources,” she stated.

Rising costs

The adjustments as proposed will “massively improve complexity round monitoring and reporting,” stated Roberta Barbieri, vice chairman of world sustainability, local weather and water, at PepsiCo. It’ll additionally improve renewable contract costs for company patrons, since it would power them to mitigate electrical energy hundreds from services individually fairly than aggregating them and negotiating a extra favorable worth, she stated.

This received’t have an effect on PepsiCo’s quick plans, nevertheless it comes at a time when a rising variety of massive firms together with Apple, Mars, PepsiCo and Walmart have been negotiating contracts on behalf of smaller firms inside their provide chains. Mars disclosed its newest such transaction Oct. 7, masking 100 small photo voltaic initiatives in Poland.

Contracts for photo voltaic and wind initiatives are already dearer — a mean of 4 p.c since Republicans handed the One Massive Stunning Invoice Act, which eliminates credit many firms had been utilizing to buffer their prices, stated Patrick Swords, carbon and renewable power advisor with consulting agency Anthesis. The value for unbundled renewable power certificates, which many smaller firms use to assert reductions in Scope 2, are additionally on the rise.

“Corporations who haven’t made commitments but, you may even see them suppose twice or delay making commitments at this level,” Swords stated.