Beginning a dropshipping enterprise is thrilling.

However there’s one query many new entrepreneurs neglect to ask:

What enterprise construction ought to I exploit, Sole Proprietorship or LLC?

This selection might sound small, however it may have a big impact on your corporation.

For those who’re unsure which one is best for you, you’re in the appropriate place.

On this article, I’ll clarify the distinction between a Sole Proprietorship and an LLC, particularly for dropshipping companies.

By the top, you’ll know precisely which construction most accurately fits your scenario.

Let’s get into it.

What’s a Sole Proprietorship?

A sole proprietorship is the best and most typical technique to begin a enterprise.

In truth, when you begin promoting merchandise on-line with out formally registering your corporation, you’re already thought-about a sole proprietor by default.

Professionals

- Simple to start out. You don’t have to file any particular paperwork (in most locations) to turn out to be a sole proprietor.

Perhaps you’ll need to register a enterprise title, also referred to as a DBA (“Doing Enterprise As”), when you don’t need to use your private title.

However even that may be a fast and low-cost course of in most states or nations.

- Low value. There are virtually no startup prices. You don’t have to pay for an LLC registration, annual charges, or a enterprise license (relying on the place you reside).

That is one purpose why many individuals select to start their dropshipping journey as a sole proprietor.

- Easy taxes. As a sole proprietor, your corporation earnings is handled as your private earnings. You report your income and losses in your private tax return. You don’t have to file a separate enterprise tax return.

Cons

- No authorized safety. That is the largest draw back of being a sole proprietor.

There’s no separation between you and your corporation. Meaning if somebody sues your corporation, your private belongings are in danger, like your financial savings, your automotive, and even your house in excessive circumstances.

For instance, think about a buyer claims your product prompted hurt, or a provider has a authorized challenge with you. As a sole proprietor, you’re personally accountable.

- Self-responsible for taxes. You’ll seemingly have to pay self-employment tax, which incorporates Social Safety and Medicare (when you’re within the US). This generally is a shock when you’re used to a conventional job the place your employer handles that for you.

Finest for

A sole proprietorship generally is a nice start line when you’re simply testing dropshipping.

Perhaps you’re not making a lot cash but or are nonetheless studying how the enterprise works.

It’s quick, low-cost, and straightforward.

Briefly: A sole proprietorship is like dipping your toe into the water. It is low danger to start out, however it presents little safety if issues go improper.

What’s an LLC (Restricted Legal responsibility Firm)?

An LLC, or Restricted Legal responsibility Firm, is a authorized enterprise construction that provides your dropshipping enterprise its personal identification, separate from you as an individual.

Meaning your corporation is now not simply you working a retailer. It turns into its personal authorized “entity.”

Professionals

- Private safety. A very powerful a part of an LLC is within the title: Restricted Legal responsibility. If one thing goes improper in your corporation, you’re normally not personally accountable. That’s why many dropshippers select an LLC as soon as they begin seeing traction.

Fast be aware: You continue to should act responsibly. For those who combine your private and enterprise funds or commit fraud, the “restricted legal responsibility” might be eliminated. That’s known as piercing the company veil, and sure, it’s as severe because it sounds.

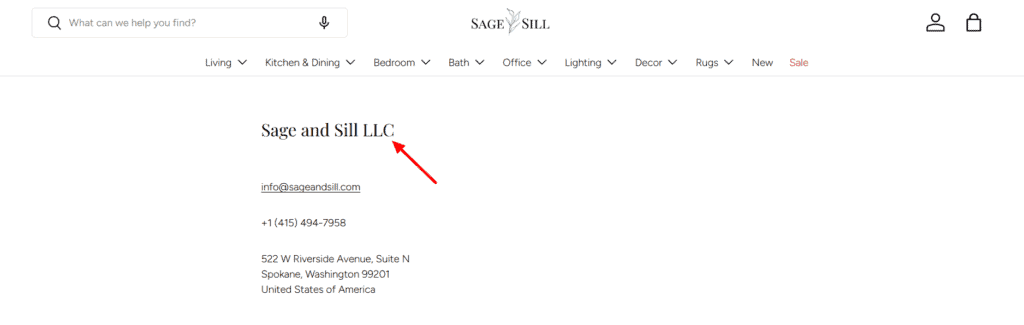

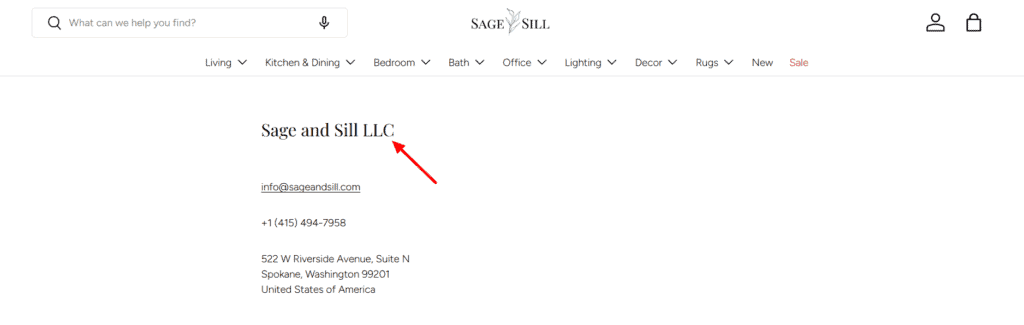

- Extra credibility. Having an LLC makes your corporation look extra skilled. While you apply for a enterprise checking account, fee processor (like Stripe or PayPal), and even attain out to suppliers, they’re extra more likely to take you severely when you’re working beneath an LLC.

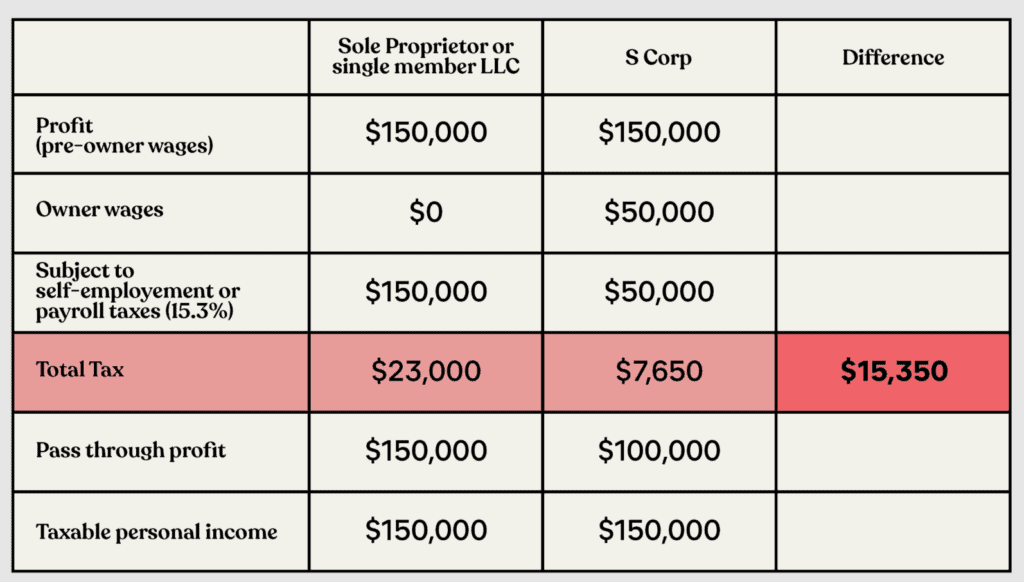

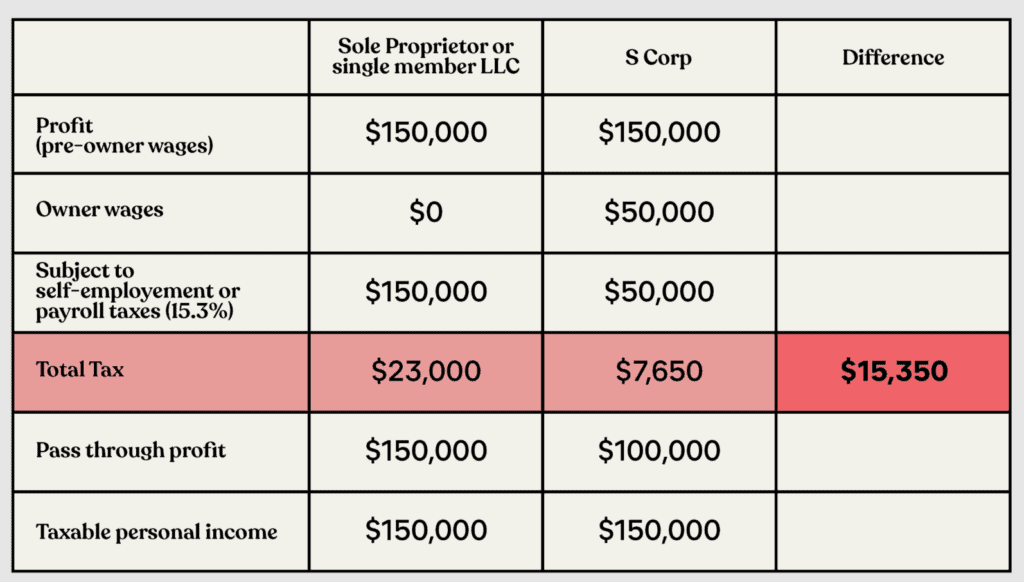

- Versatile taxes. By default, an LLC is taxed similar to a sole proprietor. However as you develop, you possibly can select to be taxed as an S-Company (within the US), which can show you how to lower your expenses on self-employment taxes as soon as you make constant earnings.

Cons

An LLC does include a bit extra work and obligations:

- You’ll seemingly have to file formation paperwork together with your state or nation.

- There are startup prices (typically between $50 and $500, relying on the place you reside).

- You’ll have to file annual reviews, pay renewal charges, and preserve higher data.

It’s not sophisticated, however it does require staying organized.

Finest for

An LLC is right if:

- You’re beginning to make constant gross sales (above $1k monthly in revenue).

- You’re constructing a model that you just need to defend.

- You need to separate your private life from your corporation.

- You’re trying to scale your dropshipping retailer long-term.

Briefly: For those who’re making constant revenue and treating dropshipping like an actual enterprise, it’s good (and infrequently safer) to type an LLC sooner slightly than later.

Head-to-head comparability: Sole Proprietorship vs LLC

Now that you recognize what a Sole Proprietorship and an LLC are, let’s put them side-by-side.

It will show you how to see how the 2 enterprise constructions evaluate for a dropshipping enterprise:

| Class | Sole Proprietorship | LLC |

| Setup time | Speedy (simply begin promoting) | Slower (should file paperwork with the state) |

| Startup value | $0–$50 (perhaps a DBA payment) | $50–$500+ (relying in your location) |

| Authorized safety | None (private belongings in danger) | Sure (separates private and enterprise belongings) |

| Taxes | Easy (reported on private tax return) | Versatile (can keep on with private or select S-Corp) |

| Banking | Tougher to get authorized | Simpler to get enterprise financial institution accounts & Stripe/PayPal |

| Skilled picture | Much less skilled (simply your title) | Extra credible (official enterprise title) |

| Admin & paperwork | Minimal (few guidelines or filings) | Reasonable, some ongoing necessities (varies by state) |

| Scalability | Restricted (not constructed for progress) | Excessive (higher for rising and defending a model) |

| Branding energy | Weak (normally beneath your private title) | Robust (enterprise title, authorized presence, safety) |

5 Dropshipping-specific concerns

Now that you just perceive the final variations between a Sole Proprietorship and an LLC, let’s look at 5 concerns that matter to you as a dropshipper:

1. Cost processors (Stripe, PayPal, Shopify Funds)

This one’s big.

Cost processors are the way you receives a commission, they usually have strict guidelines. In case your account will get flagged or frozen, your cash might be locked up for months:

Right here’s what it’s essential to know:

- Sole Proprietors typically get extra scrutiny. You’re simply a person promoting on-line.

- LLCs seem extra respectable. You have got a enterprise title, official paperwork, and a separate checking account. This builds belief with fee platforms.

Some processors even require an LLC or enterprise EIN (Employer Identification Quantity) as soon as your income hits a sure stage.

So, when you plan to make use of Stripe or PayPal for severe gross sales, having an LLC reduces the chance of getting flagged and helps you get authorized quicker.

2. Provider relationships

Many dropshippers depend on third-party suppliers, like Zendrop or personal brokers:

And guess what?

Suppliers take you extra severely whenever you’re an LLC. They’re extra more likely to:

- Supply higher costs or quicker transport

- Be open to personal labeling or customized packaging

- Share product knowledge, like stock and monitoring instruments

While you ship them an e mail with “[email protected]” and an LLC behind you, they know you imply enterprise.

3. Returns, refunds, and disputes

In dropshipping, returns and chargebacks are a part of the sport.

Not each product works out. Prospects get upset, and issues go improper.

- For those who’re a sole proprietor, you’re personally accountable for any main buyer complaints or authorized claims.

- For those who’re an LLC, your private belongings are normally protected.

Additionally, having an LLC makes it simpler to arrange clear refund insurance policies, rent a digital assistant for help, and construct a system that feels skilled (not similar to one individual dealing with issues manually).

4. Enterprise taxes & deductions

Each Sole Proprietors and LLCs can write off enterprise bills like Shopify subscriptions or Fb Advertisements.

However with an LLC, you possibly can elect S-Corp taxation (when you’re within the US), saving you hundreds per yr by decreasing self-employment tax (particularly in case your income are over $50,000 per yr).

5. Belief, branding, and progress

Individuals purchase from manufacturers they belief.

Having an LLC exhibits your retailer is an actual enterprise. It permits you to:

- Register a trademark

- Open a enterprise checking account

- Apply for enterprise bank cards

- Appeal to traders or companions (when you go massive)

And let’s not neglect: Most profitable 6- and 7-figure dropshipping manufacturers function as LLCs or companies, not as people:

Frequent misconceptions to keep away from

There may be numerous confusion about selecting between a sole proprietorship and an LLC.

You’ll hear recommendation in YouTube movies and Reddit threads, however not all of it’s true or useful.

This is an summary of the most typical myths:

False impression #1

I don’t want an LLC until I’m making some huge cash.

Actuality:

You don’t should be wealthy to learn from an LLC.

Even when you’re making simply $1,000/month, you’re already uncovered to dangers like fee processor holds or provider points.

On this case, an LLC is like insurance coverage; you hope you by no means want it, however you’ll be glad you could have it if one thing goes improper.

False impression #2

LLCs are costly and complex.

Actuality:

Forming an LLC is definitely fairly easy, and infrequently cheaper than you suppose.

- In lots of US states, you possibly can register an LLC for beneath $200.

- In some locations, it’s even lower than $100.

- You don’t want a lawyer; many individuals use reasonably priced companies for assist or do it themselves on-line.

False impression #3

If I register an LLC, I’ve to pay additional taxes.

Actuality:

Not true for most individuals.

By default, an LLC is taxed similar to a Sole Proprietor.

In truth, forming an LLC provides you extra choices to save lots of on taxes later (like electing S-Corp standing whenever you begin making constant income).

False impression #4

I can’t type an LLC as a result of I’m not within the US.

Actuality:

You don’t should be a US resident to type a US-based LLC.

Tons of worldwide dropshippers type LLCs in states like Wyoming or Delaware to:

- Use Stripe or PayPal

- Promote to US clients

- Construct belief with suppliers

- Get higher entry to instruments and platforms

Some companies assist with this course of for non-residents. It takes just a little extra effort, however it’s 100% attainable, and infrequently value it.

Last verdict

Alright, now that you just’ve seen each side, right here’s the sincere reply:

Each a Sole Proprietor and an LLC can work for dropshipping.

However which one is greatest for you relies on the place you’re in your journey.

Let’s make it tremendous clear:

Begin a sole proprietorship if:

- You’re simply getting began and need to take a look at issues out

- You’re making little to no cash but

- You need to preserve issues easy and low-cost

- You’re not able to commit absolutely (but)

For those who’re working your retailer as a facet hustle otherwise you’re nonetheless figuring issues out, a Sole Proprietorship is quick, straightforward, and nice for short-term use.

Nevertheless, change to or begin with an LLC if:

- You’re beginning to make constant gross sales

- You need to defend your private belongings

- You’re constructing a severe model for the long run

- You’re able to scale

An LLC provides you the security web, flexibility, and credibility you’ll want as you develop.

And once more, you possibly can at all times begin as a Sole Proprietor and improve to an LLC when the time is true!

Need to study extra about dropshipping?

Prepared to maneuver your dropshipping retailer to the following stage? Try the articles beneath:

Plus, don’t neglect to take a look at our in-depth information on learn how to begin dropshipping right here!