Based mostly on outcomes from the primary half of 2025, local weather tech funding is in wait-and-see mode.

Grappling with shifting macroeconomic elements, geopolitical tensions and home coverage modifications, buyers have shored up money, ready for markets to seek out some semblance of certainty to begin re-allocating capital with confidence.

“We discovered an actual slowdown within the first half of the 12 months … individuals are simply not investing within the face of uncertainty,” mentioned Yi Jean, a companion at Clear Power Ventures, which invests in early stage firms scaling decarbonization options.

First half funding is down 19 % in comparison with 2024, in keeping with CTVC. And whereas “mega offers” (higher than $100 million) are up 31 %, early-stage local weather tech funding has decreased, with seed and Sequence A funding totals dropping by 26 % and 12 %, respectively,

This deceleration has compelled startups to get again to fundamentals. It’s essential for founders and buyers to acknowledge the second we’re in, mentioned Gabriel Kra, co-founder at Prelude Ventures, who’s been investing in local weather applied sciences since 2009: “In in the present day’s local weather tech new regular, money and unit profitability is extra essential than development.” In essence, he continued, “you possibly can’t promote an investor on a imaginative and prescient, you need to show unit economics and profitability, and the way you’re not depending on tax incentives to succeed in profitability.”

Whereas uncertainty weighs on each startups and buyers, how have the specifics of the Trump administration’s finances and coverage invoice, the “One Huge Lovely Invoice Act,” affected investor sentiment? Does it present extra certainty or muddy the waters additional?

Lower than disastrous

Whereas the invoice modifications the coverage outlook for local weather tech, tailwinds from the IRA aren’t absolutely gone.

“The sense of catastrophe has been overhyped,” mentioned Leonardo Banchik, funding director at early-stage enterprise agency Voyager. “Whereas the IRA may have been stronger, a number of essential provisions stay intact, which makes an actual distinction for the sector.”

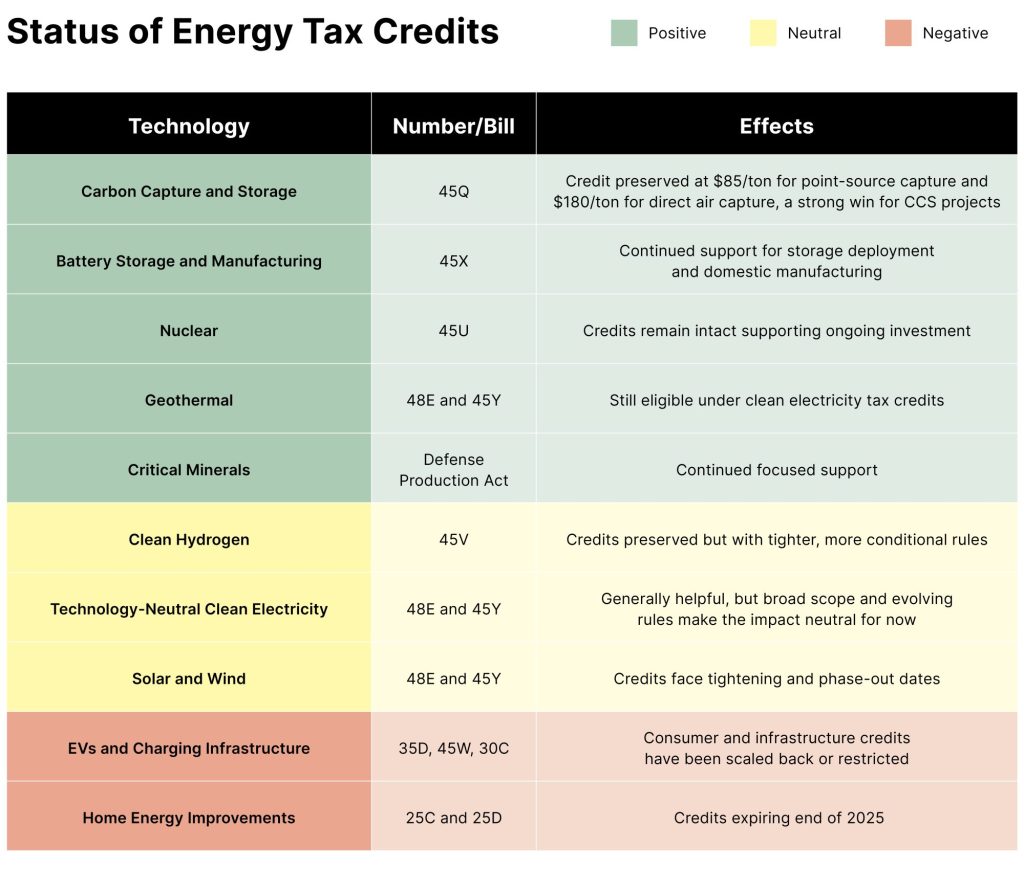

The desk beneath exhibits which sectors the brand new regulation is constructive, impartial or unfavorable for. For a complete breakdown of the invoice, I like to recommend exploring experiences, together with one from Columbia and one other from Rhodium Group.

Startups reply

It’s a blended bag for startups, depending on their tech and enterprise fashions.

The technique of Ateios Techniques, an early-stage battery startup that designs electrodes with out poisonous chemical compounds, is targeted on unit economics, working in direction of profitability with out assist from coverage, mentioned founder and CEO Rajan Kumar. The invoice “helps our enterprise [from the domestic manufacturing perspective] however it’s not the one factor,” he added. With tax credit for battery manufacturing nonetheless in place, Ateios ought to be capable to decrease its costs and improve its margins.

For Harvest Thermal, an early-stage sensible HVAC startup, the invoice is each enhance and drag. With dwelling power credit expiring on the finish of this 12 months, householders will now not be capable to declare a 30-percent tax credit score on applied sciences like Harvest Thermal’s. “Whereas the lack of 25D creates headwinds, it has additionally inspired us to deepen our partnerships with state and native packages, the place we see a lot of the momentum shifting anyway,” mentioned Jane Melia, the corporate’s co-founder and CFO.

The state of California, for instance, is providing as much as $25,000 in mixed incentives for techniques like Harvest Thermal’s. So whereas Washington retreats on sure tax credit, some regional gamers are filling the hole.

On the similar time, different tax credit, equivalent to 48E, present a 30-50 % credit score for superior HVAC techniques by way of 2033.

On the finish of the day, mentioned Melia, “coverage shifts like this remind us that incentives come and go, however buyer worth should stay everlasting.”

The case for optimism

Even below the present administration, tailwinds stay for quite a lot of local weather applied sciences. The present surroundings requires startups to get inventive with regional incentives and concentrate on creating superior merchandise.

Voyager’s Banchik expects the invoice to inject certainty into the market and gas extra funding in the remainder of the 12 months. “Whereas we spend money on firms with sturdy fundamentals that don’t rely on coverage incentives, having these provisions enshrined in regulation reduces danger and eliminates numerous hours of discussions to construct confidence,” he mentioned. “We’re already seeing this certainty within the investments we’re making. It’s so simple as: Credit are prolonged, so let’s transfer ahead.”

Kra of Prelude Ventures referenced James Taylor: He’s seen fireplace and he’s seen rain. Sooner or later, “markets will come roaring again,“ Kra mentioned, and “firms that meet that second with unit economics might be poised for development and great monetary success.”