American shoppers and companies are experiencing sticker shock this summer season after they open their electrical energy payments.

A mixture of hovering demand from power-hungry knowledge facilities, scorching climate and pass-along prices from utility infrastructure investments is driving electrical energy costs — which had been comparatively secure for a decade or so previous to the pandemic — to alarming highs.

The consequences of President Donald Trump’s drastic tariffs may push energy costs even larger because the uncooked supplies for transmission traces develop into dearer and utilities scramble to maintain up with the demand of recent technology.

New U.S. manufacturing capability, aided by federal onshoring insurance policies, will additional drive will increase.

Vitality earthquake

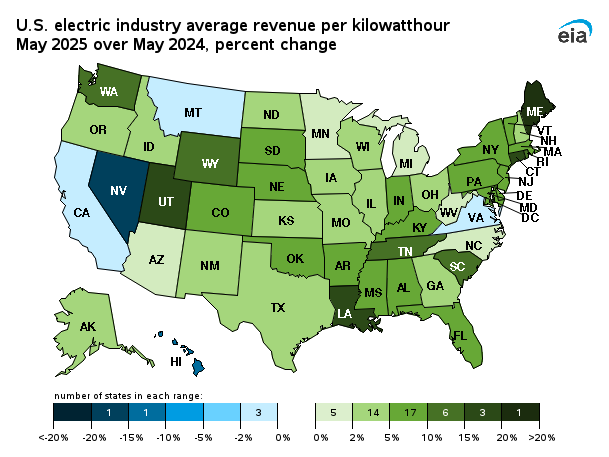

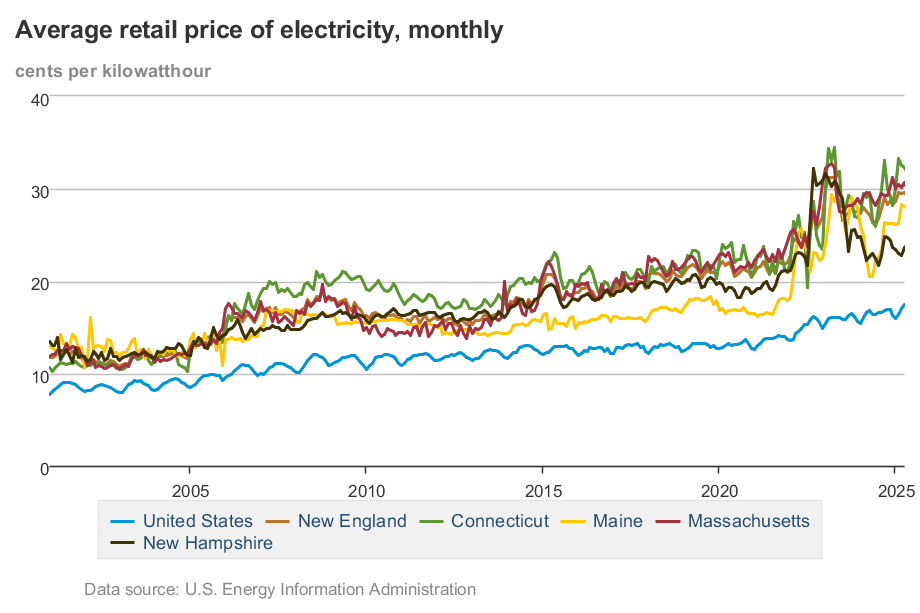

In response to the U.S. Vitality Data Administration, the common retail value of 1 kilowatt-hour of electrical energy within the U.S. rose 6.5 p.c, to 17.5 cents from 16.41 cents, between Might 2024 and Might 2025.

Some states have been hit particularly onerous: ratepayers in Maine noticed costs leap 36.3 p.c in that interval, adopted by Connecticut (18.4 p.c) and Utah (15.2 p.c).

The consequences are being felt by Las Vegas Strip retailers and New Jersey owners alike.

“Yesterday’s earthquake wasn’t tectonic,” wrote a member of the Midland Park, NJ Fb group on August 3. “It was each NJ resident opening their PSE&G invoice on the similar time.”

NV Vitality, which serves southern Nevada together with Las Vegas, requested a 9-percent fee improve from state regulators earlier this yr. The projected value of its big transmission challenge, Greenlink, has practically doubled, to $4.2 billion from $2.5 billion, and will balloon much more because of the administration’s 25 p.c tariffs on many related merchandise from Mexico.

Don’t blame renewables

It’s usually claimed by clear vitality opponents — together with U.S. Vitality Secretary Chris Wright — that extra renewable technology on the grid drives larger vitality costs, however the knowledge reveals in any other case (see this deep dive on Sustainability by numbers for the total image). Photo voltaic and wind, being variable sources, do drive volatility in costs, which helps contribute to public perceptions of an influence grid out of whack.

And the Trump administration’s assault on federal help for renewable vitality initiatives is sure to result in larger costs, in line with a latest report from suppose tank Vitality Innovation. Among the largest will increase will probably are available in purple states.

The first driver of value will increase, although, continues to be demand. Wanting forward, the data-center growth — and the ensuing demand spike — reveals no signal of slowing down.

Annual vitality use by knowledge facilities will practically triple, reaching between 74 and 132 gigawatts by 2028, in line with a latest forecast by Lawrence Berkeley Nationwide Laboratory; that represents 6.7-12 p.c of whole U.S. electrical energy demand. Many massive operators, like Google and Microsoft, are investing closely in low-carbon technology to satisfy their wants. Sadly, on the general public grid, renewables alone can not meet future demand progress.

Bloomberg NEF’s New Vitality Outlook 2025 discovered that future load progress will assist extend the hydrocarbon period. Sixty-four p.c of the elevated technology for knowledge facilities will come from fossil fuels, and “added data-center demand may assist prolong the lifetime of current coal and fuel vegetation.”