Practically each week brings one other model partnership, manufacturing unit blueprint or financing deal associated to a polyester recycling startup. The area is crowded with younger corporations in search of to weave collectively a round financial system that pushes virgin polyester to the margins.

In just a few brief many years, polyester has displaced cotton because the dominant fiber. It’s present in practically two-thirds of latest fashions. As a result of it’s made with low-cost fossil gasoline byproducts, nevertheless, the attire business’s emissions shot up 7.5 % in 2023 after a modest dip, in keeping with a June report by the Attire Influence Institute. And because of this, the business accounts for nearly 2 % of all of the world’s local weather emissions.

Manufacturers striving to scale back that influence, together with its regulatory and operational dangers, plan to acquire extra recycled and “next-generation” supplies. Up to now, solely 12.5 % of polyester comes from recycled sources, 99 % of which begins as bottles relatively than textiles, in keeping with the Textile Trade.

It’s no simple feat to court docket companions in a brand new, waste-based provide chain inside the fragmented textile business. To start with, a startup wants an environment friendly expertise to rework undesirable materials into one thing new. It should additionally procure and type castoff clothes or manufacturing unit clippings from third events. As soon as the buttons, trims and zippers are eliminated, the fabric must be recycled right into a uncooked output, resembling polyethylene terephthalate (PET) pellets. Yet one more associate spins that into fiber, which another person turns right into a textile for a model.

The ultimate leg on this course of: environment friendly factories. “Ramping to full capability, which they need to function near if they’re to not less than break even, is the large problem,” stated Marcian Lee, an analyst with Lux Analysis.

Textile recycling executives insist that there’s room for a number of gamers to spin previous plastic threads into precious textiles. Right here’s how 5 of them are in search of to carry a textile-to-textile recycling system to life.

Circ

Circ is constructing a $500 million plant in northeastern France. Scheduled to open in 2028, it might be the most important industrial polycotton recycling operation.

Many artificial recycling startups say they settle for textile blends, together with polyester-cotton, to supply materials for contemporary polyester fibers. Circ distinguishes itself by recycling the cotton, too.

“You’re actually maximizing the financial worth of what’s in that beginning materials,” Conor Hartman, Circ’s chief working officer, advised Trellis in Might. “We’ve taken polycotton originating materials and made it into stunning lyocell merchandise and delightful polyester merchandise.”

Circ’s recycled cellulosic lyocell appeared in a small assortment final month from Zalando, which is an investor, as are Patagonia and Inditex. Circ just lately inked offers with fiber producers, too, together with China’s Tanshan Sanyou and Portugal’s Selenis.

Earlier this yr, Circ kicked off Fiber Membership, a collaboration to scale recycled fibers that Bestseller, Eileen Fisher, Everlane and fiber producers assist. Such bridge-building follows the Circ-Prepared neighborhood launch of companions a yr in the past.

Virginia-based Circ has attracted $76.6 million of funding, the latest coming in 2023 through a Collection B elevate of $25 million.

Ambercycle

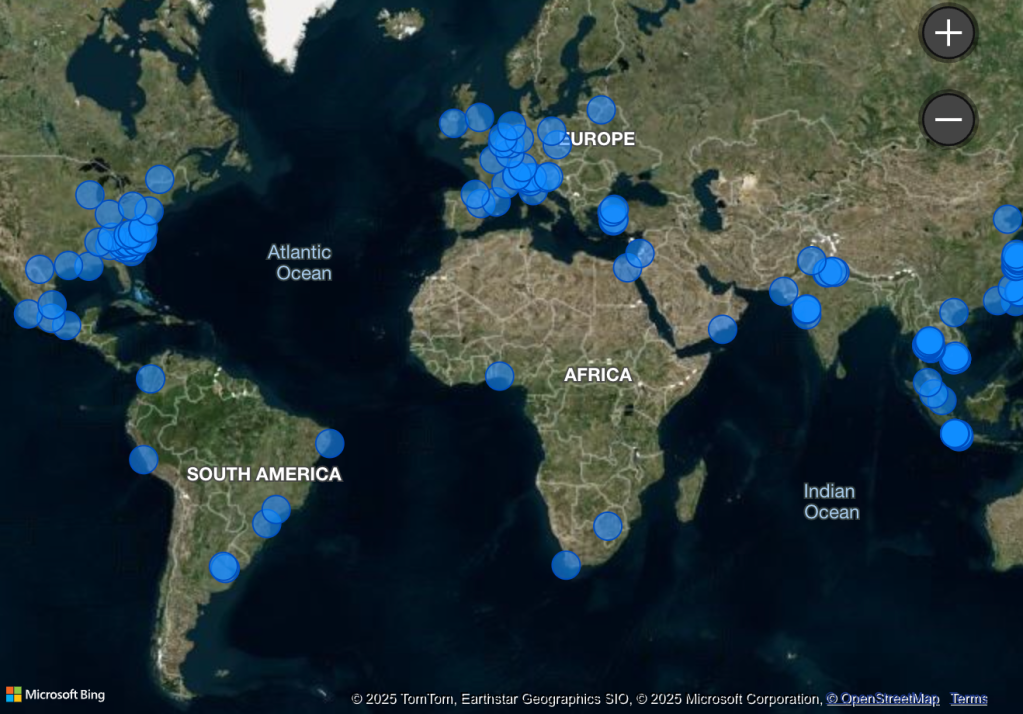

Ambercycle has partnered with Reformation, Arc’teryx and Hole’s Athleta in addition to essential textile and polyester corporations in North America, Europe and Asia, together with Shenghong Holding Group and Zhejiang Huilong New Supplies of China.

In January, the startup secured an offtake settlement to interchange about 20 % of Danish model Ganni’s polyester utilization. That follows a three-year, 70-million-euro offtake settlement with Inditex in 2023 and one other binding take care of model Mas.

“We’ve tried to piece collectively the pathway to get to this business scale, as a result of the problem with us and actually everybody on this area is that, out the gate, the competitors with current fibers is fairly important,” CEO Shay Sethi advised Trellis in June.

Ambercycle is creating an enzymatic recycling function that may permit a multi-fiber output, enabling manufacturers a “one-stop store” if they need particular blends of, say, polyester, nylon or spandex, in keeping with Sethi.

Final yr, Taiwan’s Shinkong Artificial Fibers offered $10 million towards a business plant for Ambercycle, anticipated to open in 2026. Ambercycle, whose pilot plant has been operating in Los Angeles since 2022, has raised $56 million in its 10 years.

Sethi envisions an business that balances each centralized operations and regional manufacturing. “With textile waste, for higher or worse, there’s no scarcity wherever you look,” he stated.

Reju

With workplaces in Paris, Reju piggybacks on its Dutch mum or dad Technip Energies, which counted $6.9 billion in revenues final yr. The umbrella firm’s assets in engineering and chemical substances embrace polyester manufacturing.

Reju’s pilot plant in Frankfurt opened 20 months in the past. Subsequent, a large-scale manufacturing unit deliberate for the Chemelot industrial park within the Netherlands would recycle 300 million polyester clothes annually by 2027.

European Union guidelines that require manufacturers to take duty for his or her textile waste present a lift, however Reju is eyeing “regeneration hubs” elsewhere, too. It attached with Goodwill and Waste Administration final fall to put a basis in North America.

Reju makes use of IBM’s VolCat expertise, brief for unstable catalyst. “We’re coping with identified chemistry right here,” CEO Patrik Frisk advised Trellis in Might. “A part of what makes polyester really easy for the textile business is, to start with, the infrastructure for it has been totally developed during the last 70 or 80 years.”

That frees up Reju to construct out its round system, in keeping with Frisk, former CEO at Beneath Armour. Regardless of its problematic origins and contribution to microplastic waste, the fabric is endowed with helpful properties and thus right here to remain, he stated. “We’re in a position to remove all of the stuff that’s unhealthy, and create new once more.”

By giving the waste a second life, Reju can doubtlessly design supplies that shed fewer microfibers, Frisk added.

Samsara Eco

With machine studying, Samsara Eco customizes enzymes that “eat” polyester. Final yr, it proved it could possibly do the identical for nylon 6,6. The end result appeared in a long-sleeve Lululemon prime. In June, the startup established a decade-long offtake settlement, vying to supply doubtlessly one-fifth of Lululemon’s total fiber portfolio.

Along with making a $25 million R&D hub in Jerrabomberra, Australia, Samsara Eco is working with Israeli nylon producer Nilit on a recycling plant to open subsequent yr in Southeast Asia, residence of associate waste suppliers.

“However that can solely be the primary of our services the place we’re speaking carefully with polymerization companions in Europe and in North America as nicely throughout higher packaging and trend,” CEO Paul Riley advised Trellis final winter.

Samsara Eco has raised $107 million. It goals to present new life to 1.5 million tons of plastics yearly by 2030. That’s lower than half of 1 % of world plastic manufacturing annually, leaving loads of room for a number of recyclers, Riley urged.

“We’re taking a look at infinite recycling, true circularity throughout trend and packaging,” he stated, “and an essential factor to notice is that there isn’t a distinction between our molecule and a fossil gasoline molecule. We faucet straight into the provision chain.”

Syre in June touted strategic offers to produce Hole, Goal and Houdini Sportswear with its chemically recycled polyester, which it says carries solely 15 % of the CO2-equivalent footprint of the virgin commonplace. Hole alone would use 10,000 metric tons of Syre’s output yearly.

First, although, Syre has to interrupt floor on the 12 business scale vegetation it initially introduced for late 2026.

Earlier than it even had a demo facility, Syre had an eye-popping $600 million promise of seven years of assist from co-founder H&M. The Swedish startup’s long-term finish is to recycle not less than 3 million metric tons of polyester annually.

Syre is colocating a pilot plant in North Carolina with a Selenis polyester manufacturing facility. It has the ambition to carry “gigascale” vegetation to Vietnam and Iberia within the subsequent few years. “That is the beginning of the nice textile shift,” Syre CEO Dennis Nobelius advised Trellis in June.