Vodafone posted a 5.5% rise in service income in Q1 (to June 30), beating expectations, regardless of a reversal at its massive German op-co, albeit a slowing one, and softening progress in its house market within the UK, the place the Three merger is taking part in out. Its outlook stays unchanged.

Optimistic outlook – good outcomes, significantly in the remainder of Europe and Africa; respectable enterprise gross sales.

Germany steady – improved wholesale and enterprise gross sales partly offset a success from bulk TV offers.

UK, slower – good mounted gross sales, however enterprise and client contract churn, and Three integration.

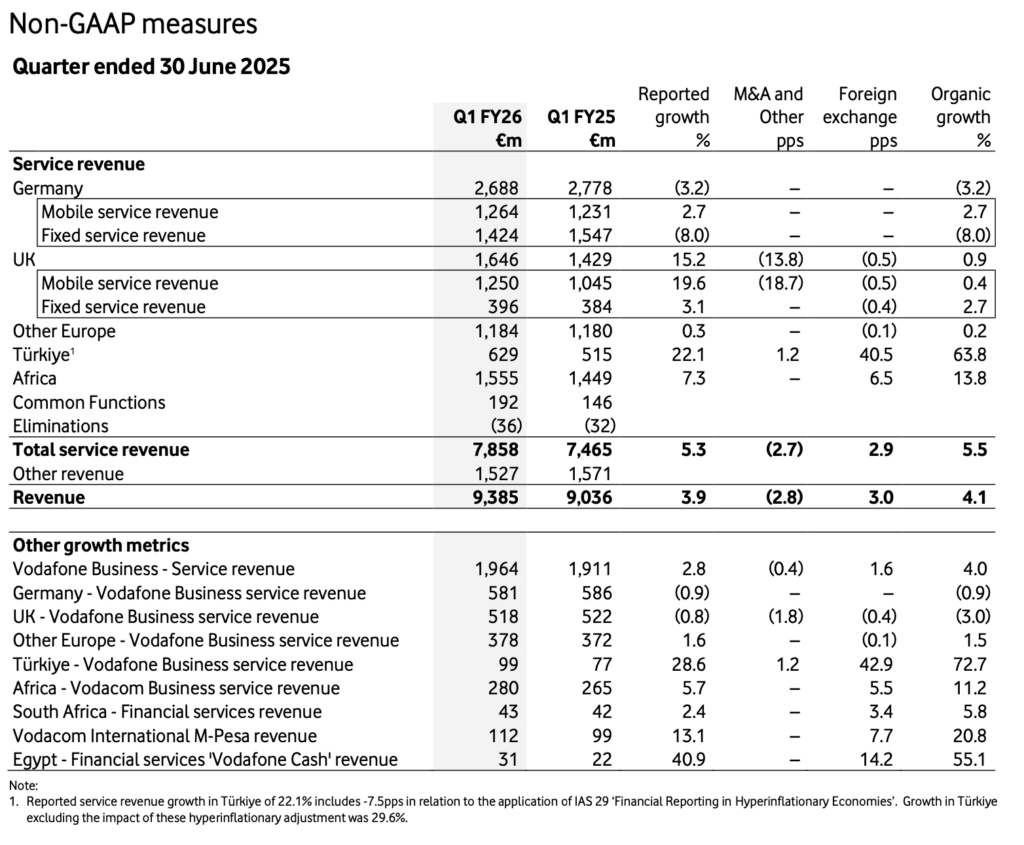

Vodafone reported a 5.5 % bounce in group service income to €7.86 billion within the quarter ending June 30, exceeding expectations of 4.9 %. The corporate’s first-quarter (2025/26) figures revealed an extra decline in Germany, its largest market, however a slower one – with a 3.2 % reversal, down from a six % decline within the earlier quarter. At house within the UK, its different massive market, natural service income was 0.9 % increased, down from 3.4 % final quarter – partly resulting from merger-related disruption following its tie-up with UK operator Three.

Collectively, these markets contributed 55 % of the group’s complete service income (€2.688 billion and €1.646 billion, respectively), throughout all segments. Its outlook is unchanged with full-year revenue steering set between €11.3 and €11.6 billion – up from €10.9 billion anticipated in 2025. Shares rose 4 % on the outcomes, and are up over 20 % within the year-to-date. The group’s complete income elevated by 3.9 % to €9.4 billion within the first quarter. Adjusted EBITDA rose 4.9 % to €2.7 billion, supported by a 0.2 % margin enchancment to 29.3 %.

Wholesale and enterprise gross sales drove its enchancment in Germany, versus final quarter – respectively with increased income from the migration of 1&1 roaming clients (driving cell service income up 2.7 %), and the “phasing of digital providers initiatives” (offset by ARPU stress within the enterprise sector; which means enterprise service income declined by 0.9 %). The decline, total, was right down to the influence from the tip of bulk TV contracting in ‘multi-dwelling models’ (MDUs) – residences, condominiums, duplexes, and such – on its fixed-line enterprise.

Its broadband, tv, and cell bases in Germany all declined within the interval. Vodafone Germany is within the midst of slashing 3,200 workers within the nation.

Within the UK, cell service income grew by 0.4 % with increased wholesale and decrease subscriber returns. It additionally cited “enterprise challenge milestones” from the fourth quarter, and a modified client combine with the Three merger. Fastened service income was up by 2.7 %, with 44,000 new clients; enterprise income declined by three % resulting from “deliberate managed providers contract terminations” and decrease ARPU – “partially offset by good demand for mounted connectivity and digital providers”.

Its cell base declined by 46,000 within the quarter due to the “timing of enormous contract disconnections in Enterprise and Three UK Client buyer losses”. The brand new VodafoneThree firm within the UK will make investments £11 billion over 10 years in 5G infrastructure, and generate price and capex synergies of £700 million each year – by the fifth yr after its completion. VodafoneThree is now the most important cell community operator within the UK with 28.8 million clients.

In the remainder of the group’s footprint, Türkiye was the standout, with service income up by 29.6 %. In Europe – excluding Germany and the UK, however together with Türkiye – natural service income progress was 0.2 % increased, with good gross sales to enterprises throughout the area, and declining gross sales to shoppers in Portugal and Romania. Africa additionally carried out effectively, with progress of 13.8 % within the quarter, notably in Egypt and throughout its Vodacom operations, together with from monetary providers.

A web page in its report exhibiting adjusted non-GAAP outcomes (as above), together with for Vodafone Enterprise, says enterprise gross sales (through Vodafone Enterprise) climbed 4 % throughout all territories to €1.964 billion. There isn’t a point out anyplace of the efficiency of Vodafone IoT, spun off from the remainder of the group in April 2024, however nonetheless owned by it.

Margherita Della Valle, chief govt at Vodafone Group, commented: “Germany has began its enchancment trajectory and our rising markets are delivering robust broad – based mostly progress. Within the UK, now we have accomplished the merger with Three and are shifting rapidly to mix our networks to profit clients. Right this moment, we reiterate our full yr steering of progress in revenue and money movement. After two years of transformation and alter, Vodafone is now effectively positioned for multi – yr progress throughout each Europe and Africa.”