KrebsOnSecurity just lately heard from a reader whose boss’s electronic mail account acquired phished and was used to trick one of many firm’s clients into sending a big cost to scammers. An investigation into the attacker’s infrastructure factors to a long-running Nigerian cybercrime ring that’s actively concentrating on established firms within the transportation and aviation industries.

Picture: Shutterstock, Mr. Teerapon Tiuekhom.

A reader who works within the transportation business despatched a tip a couple of current profitable phishing marketing campaign that tricked an govt on the firm into coming into their credentials at a faux Microsoft 365 login web page. From there, the attackers shortly mined the chief’s inbox for previous communications about invoices, copying and modifying a few of these messages with new bill calls for that had been despatched to among the firm’s clients and companions.

Talking on situation of anonymity, the reader mentioned the ensuing phishing emails to clients got here from a newly registered area identify that was remarkably just like their employer’s area, and that no less than one in every of their clients fell for the ruse and paid a phony bill. They mentioned the attackers had spun up a look-alike area just some hours after the chief’s inbox credentials had been phished, and that the rip-off resulted in a buyer struggling a six-figure monetary loss.

The reader additionally shared that the e-mail addresses within the registration data for the imposter area — [email protected] — is tied to many such phishing domains. Certainly, a search on this electronic mail handle at DomainTools.com finds it’s related to no less than 240 domains registered in 2024 or 2025. Just about all of them mimic legit domains for firms within the aerospace and transportation industries worldwide.

An Web seek for this electronic mail handle reveals a humorous weblog submit from 2020 on the Russian discussion board hackware[.]ru, which discovered [email protected] was tied to a phishing assault that used the lure of phony invoices to trick the recipient into logging in at a faux Microsoft login web page. We’ll come again to this analysis in a second.

JUSTY JOHN

DomainTools exhibits that among the early domains registered to [email protected] in 2016 embody different helpful info. For instance, the WHOIS data for alhhomaidhicentre[.]biz reference the technical contact of “Justy John” and the e-mail handle [email protected].

A search at DomainTools discovered [email protected] has been registering one-off phishing domains since no less than 2012. At this level, I used to be satisfied that some safety firm absolutely had already printed an evaluation of this specific risk group, however I didn’t but have sufficient info to attract any stable conclusions.

DomainTools says the Justy John electronic mail handle is tied to greater than two dozen domains registered since 2012, however we are able to discover tons of extra phishing domains and associated electronic mail addresses just by pivoting on particulars within the registration data for these Justy John domains. For instance, the road handle utilized by the Justy John area axisupdate[.]web — 7902 Pelleaux Street in Knoxville, TN — additionally seems within the registration data for accountauthenticate[.]com, acctlogin[.]biz, and loginaccount[.]biz, all of which at one level included the e-mail handle [email protected].

That Rsmith Gmail handle is linked to the 2012 phishing area alibala[.]biz (one character off of the Chinese language e-commerce big alibaba.com, with a distinct top-level area of .biz). A search in DomainTools on the telephone quantity in these area data — 1.7736491613 — reveals much more phishing domains in addition to the Nigerian telephone quantity “2348062918302” and the e-mail handle [email protected].

DomainTools exhibits [email protected] seems within the registration data for the area seltrock[.]com, which was used within the phishing assault documented in the 2020 Russian weblog submit talked about earlier. At this level, we’re simply two steps away from figuring out the risk actor group.

The identical Nigerian telephone quantity exhibits up in dozens of area registrations that reference the e-mail handle [email protected], together with 26i3[.]web, costamere[.]com, danagruop[.]us, and dividrilling[.]com. A Internet search on any of these domains finds they had been listed in an “indicator of compromise” record on GitHub maintained by Palo Alto Networks‘ Unit 42 analysis workforce.

SILVERTERRIER

Based on Unit 42, the domains are the handiwork of an enormous cybercrime group based mostly in Nigeria that it dubbed “SilverTerrier” again in 2014. In an October 2021 report, Palo Alto mentioned SilverTerrier excels at so-called “enterprise e-mail compromise” or BEC scams, which goal legit enterprise electronic mail accounts by social engineering or laptop intrusion actions. BEC criminals use that entry to provoke or redirect the switch of enterprise funds for private acquire.

Palo Alto says SilverTerrier encompasses tons of of BEC fraudsters, a few of whom have been arrested in varied worldwide regulation enforcement operations by Interpol. In 2022, Interpol and the Nigeria Police Pressure arrested 11 alleged SilverTerrier members, together with a distinguished SilverTerrier chief who’d been flaunting his wealth on social media for years. Sadly, the lure of simple cash, endemic poverty and corruption, and low boundaries to entry for cybercrime in Nigeria conspire to supply a relentless stream of recent recruits.

BEC scams had been the seventh most reported crime tracked by the FBI’s Web Crime Grievance Middle (IC3) in 2024, producing greater than 21,000 complaints. Nevertheless, BEC scams had been the second costliest type of cybercrime reported to the feds final yr, with practically $2.8 billion in claimed losses. In its 2025 Fraud and Management Survey Report, the Affiliation for Monetary Professionals discovered 63 % of organizations skilled a BEC final yr.

Poking at among the electronic mail addresses that spool out from this analysis reveals plenty of Fb accounts for individuals residing in Nigeria or within the United Arab Emirates, lots of whom don’t seem to have tried to masks their real-life identities. Palo Alto’s Unit 42 researchers reached an analogous conclusion, noting that though a small subset of those crooks went to nice lengths to hide their identities, it was normally easy to study their identities on social media accounts and the most important messaging companies.

Palo Alto mentioned BEC actors have grow to be much more organized over time, and that whereas it stays simple to search out actors working as a bunch, the follow of utilizing one telephone quantity, electronic mail handle or alias to register malicious infrastructure in help of a number of actors has made it much more time consuming (however not inconceivable) for cybersecurity and regulation enforcement organizations to kind out which actors dedicated particular crimes.

“We proceed to search out that SilverTerrier actors, no matter geographical location, are sometimes linked by just a few levels of separation on social media platforms,” the researchers wrote.

FINANCIAL FRAUD KILL CHAIN

Palo Alto has printed a helpful record of suggestions that organizations can undertake to attenuate the incidence and impression of BEC assaults. Lots of these suggestions are prophylactic, reminiscent of conducting common worker safety coaching and reviewing community safety insurance policies.

However one suggestion — getting conversant in a course of referred to as the “monetary fraud kill chain” or FFKC — bears particular point out as a result of it provides the one finest hope for BEC victims who’re in search of to claw again funds made to fraudsters, and but far too many victims don’t comprehend it exists till it’s too late.

Picture: ic3.gov.

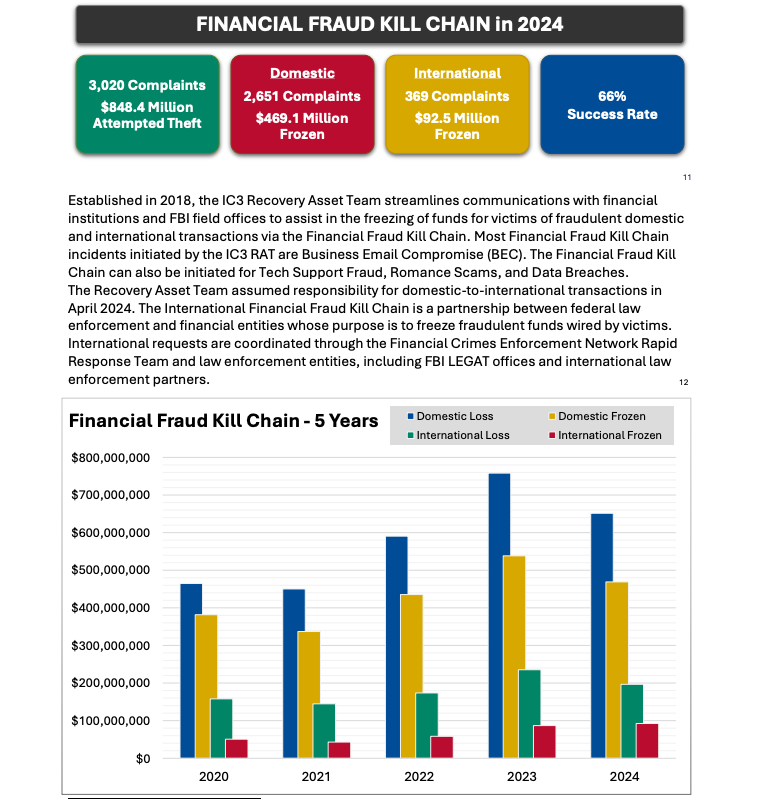

As defined in this FBI primer, the Worldwide Monetary Fraud Kill Chain is a partnership between federal regulation enforcement and monetary entities whose function is to freeze fraudulent funds wired by victims. Based on the FBI, viable sufferer complaints filed with ic3.gov promptly after a fraudulent switch (usually lower than 72 hours) will probably be routinely triaged by the Monetary Crimes Enforcement Community (FinCEN).

The FBI famous in its IC3 annual report (PDF) that the FFKC had a 66 % success fee in 2024. Viable ic3.gov complaints contain losses of no less than $50,000, and embody all data from the sufferer or sufferer financial institution, in addition to a accomplished FFKC kind (offered by FinCEN) containing sufferer info, recipient info, financial institution names, account numbers, location, SWIFT, and any extra info.