Now we have written quite a lot of articles on Good Knowledge Collective concerning the overlap between huge knowledge and finance. Some of the vital tendencies we’re seeing is the push for knowledge automation throughout the banking sector. You may already see how establishments are counting on algorithms to make quicker, extra correct selections. It’s altering the best way companies are delivered and the way buyer expectations are met.

You is perhaps stunned by how briskly funding on this space is rising. Analysis from Mordor Intelligence exhibits that the quantity of sources banks are investing in huge knowledge is rising 23.11% a 12 months over the following decade. There are few different industries experiencing this stage of development in knowledge spending. Hold studying to study extra.

Banking’s Knowledge Increase

You might be residing in a world the place knowledge volumes are climbing at an unprecedented tempo. Fabio Duarte of Exploding Matters stories that 402.74 million terabytes of information are created every day. There are large alternatives for banks to extract which means from this flood of knowledge. It’s very true for big corporations with the infrastructure to investigate buyer habits in close to actual time.

You must also think about the quantity of economic knowledge that international exchanges are processing. Trevir Nath, in an article for Investopedia, identified that the New York Inventory Alternate alone captures 1 terabyte of information every day. By 2016, there have been 18.9 billion community connections worldwide, averaging 2.5 connections per particular person. It’s no shock that finance is changing into extra reliant on real-time analytics to remain aggressive.

There are many causes that knowledge automation is gaining traction. You may spot it in mortgage underwriting, fraud detection, and buyer segmentation. It’s making selections quicker and decreasing handbook duties that had been liable to error. There are additionally fewer delays when clients want service throughout digital channels.

You’ll probably see much more modifications as AI and machine studying develop their function in banking. There are indicators that automation will quickly deal with much more superior duties, like predictive threat modeling and customized product suggestions. It is without doubt one of the clearest indicators that data-driven selections are not optionally available. You may count on banks that fall behind on this development to face main disadvantages.

In each firm, there are core questions that appear easy, however are surprisingly typically arduous to reply: Is that this provider actual? Is that this buyer already in our system? Can we belief this checking account?

Each enterprise, irrespective of how massive or small, is dependent upon this factor to operate easily: clear, dependable, and up-to-date knowledge. But, for a lot of firms, managing primary details about suppliers, clients, and enterprise companions stays handbook, repeatedly messy, and liable to error. In recent times, nevertheless, a quiet revolution has begun – one powered by automation, verified exterior knowledge, and a brand new mindset centered on belief.

That is the story of that shift.

The every day frustration of soiled knowledge

Let’s begin with the issue.

Most organizations nonetheless rely closely on handbook processes to create and preserve their enterprise associate grasp knowledge. Info is copied from emails or spreadsheets, fields are typed in by hand, checks are sometimes executed late within the course of, or in no way.

The consequence? Errors, duplicates, and delays develop into a part of every day operations:

- A provider’s checking account can’t be verified, so a cost is delayed.

- A reproduction buyer file causes confusion in gross sales or billing.

- A tax ID doesn’t match the federal government register, triggering compliance dangers.

These usually are not edge circumstances. They’re on a regular basis occurrences stemming from a foundational flaw: an excessive amount of of the information flowing into enterprise programs remains to be topic to human error. And as soon as that flawed knowledge is in, it spreads rapidly throughout invoices, contracts, stories, and buyer interactions.

The usual strategy? Reactive clean-up, which usually entails handbook error fixes, working batch validations, or delaying processes till somebody might double-check the main points. However as firms scale and transfer quicker, these previous methods merely don’t work anymore.

A brand new strategy: belief by design

The turning level doesn’t come from know-how alone, however somewhat from a shift in mindset: what if knowledge may very well be trusted the second it enters the system?

And which means greater than merely avoiding typos. Trusted knowledge is full, verified, and traceable. It’s knowledge that has been checked in opposition to dependable exterior sources like official enterprise registers, tax authorities, or sanction and watchlists. It’s correct by design, not by exception dealing with.

“While you construct belief into the system upfront, every little thing else will get simpler,” notes Kai Hüner, Chief Expertise Officer at CDQ. “You’re not counting on handbook gatekeeping, as an alternative you’re engineering belief immediately into the workflows and downstream processes.”

For instance, when one Fortune 500 firm reexamined their means of onboarding suppliers, they realized loud and clear simply what number of rounds of checks every new file required: tax ID affirmation, authorized standing evaluate, a name to substantiate financial institution particulars. And whereas the variety of roles concerned within the course of can fluctuate relying on the dimensions and construction of the group, it’s a frequent situation on this planet of information professionals.

Apart from being clearly time-consuming, this old-school strategy can be dangerous, and undoubtedly removed from reliable. If something is missed, the results imply missed funds, fraud publicity, or compliance gaps.

By integrating real-time lookups from trusted sources into onboarding, the corporate was capable of transfer most of those checks upstream. Now, if a provider’s checking account has a low belief rating or their registration quantity doesn’t match the official file, the system catches it earlier than the file is saved and flags uncommon or suspicious entries for handbook evaluate. Normally, no human intervention is required, because of the trusted knowledge that now types the spine of dependable and, in contrast to many rushed efforts to automate damaged processes, actually significant automation.

This strategy, backed by trusted knowledge, creates significant automation as an alternative of dashing damaged processes. It strikes firms from reactive fixes to sustainable, agile, and trusted knowledge frameworks that ship velocity, scale, and accuracy.

Automating what can (and will) be automated

The concept is sort of easy: if the information is dependable and the method is repeatable, software program ought to deal with it.

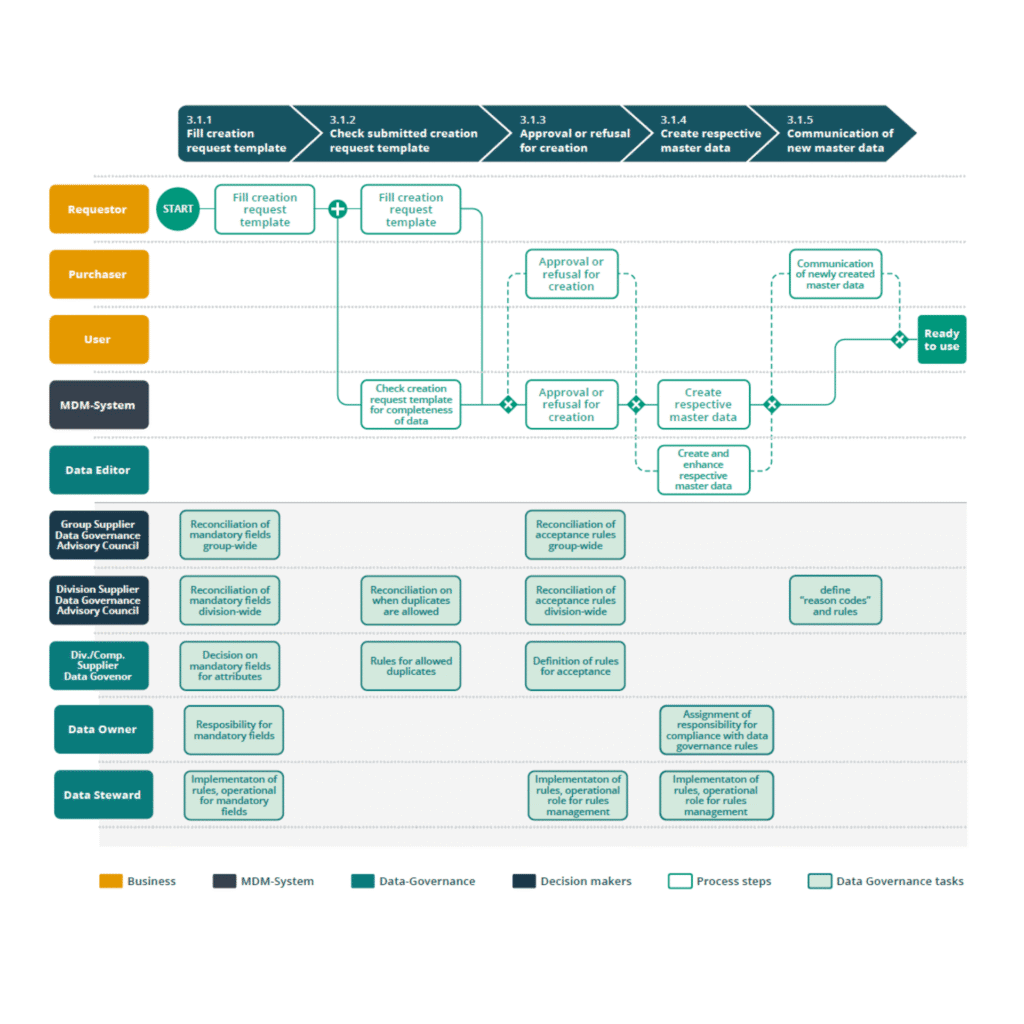

As a substitute of manually processing every request for a brand new enterprise associate, buyer, or vendor, firms are organising workflows that consider whether or not a brand new entry is legitimate, distinctive, and full. That features every little thing from enriching firm profiles with up-to-date data, to routinely detecting duplicates, to deciding whether or not a brand new or change request wants human approval.

As a pure consequence of sensible automation, effectivity grows quickly.

When one international industrial group launched automation into its MDM platform, the time required to course of new provider information dropped from quarter-hour per file to beneath a minute. One other firm minimize its time from buyer inquiry to permitted gross sales quote from one month to a single day. All by eradicating handbook and reactive interventions from the crucial path.

The advantages go effectively past simply saving time. By automating routine selections and flagging solely the exceptions, companies can concentrate on what actually issues: advanced circumstances, edge situations, strategic selections, and alternatives for scale.

These good points are detailed in an MDM automation case research from CDQ and SAP that outlines how enterprise workflows can shift from knowledge correction to knowledge confidence, with real-world metrics from early adopters.

Knowledge sharing: the community impact of belief

One other shift gaining floor and strengthening dependable MDM automation is knowledge sharing. Not simply inside an organization, however throughout ecosystems.

No single enterprise has excellent knowledge on each buyer, provider, or entity it offers with. However most of firms are in reality coping with the identical information. When organizations share verified enterprise associate knowledge, particularly issues like authorized entity names, tax IDs, and addresses, they create a community impact.

As a substitute of every firm validating the identical knowledge inside its personal 4 partitions, collaborative knowledge networks enable verified information to be reused throughout contributors. This community impact will increase the reliability of information for everybody concerned. When a number of firms verify the identical provider handle, checking account, or tax ID, the boldness in that file grows. And if one thing modifications, like enterprise standing or new handle, the replace propagates by the community – routinely.

This sort of community-based belief mannequin helps firms cut back duplication, streamline compliance efforts, and reply quicker to enterprise associate knowledge modifications. It’s additionally an antidote to knowledge decay, as a result of if somebody updates a file within the community, everybody advantages.

Embedding belief into the workflows

For belief and automation to actually stick, they will’t be handled as IT add-ons. They must be embedded in day-to-day enterprise processes. Meaning:

- Integrating real-time validation into ERP, CRM, and different enterprise programs

- Guiding customers to reuse present information as an alternative of making duplicates

- Auto-filling fields with verified, country-specific knowledge based mostly on official sources

As an illustration, when a person creates a brand new buyer or provider, the system checks if it already exists. If it does, the person is guided to make use of the present file. If it doesn’t, the system pulls in trusted knowledge (akin to the right firm title, country-specific tax fields, or verified handle) in order that the brand new entry begins clear.

This additionally applies to bulk knowledge operations. Throughout mergers or system consolidations, tens of 1000’s of information must be imported. Automating this course of ensures that every file is validated, enriched, and de-duplicated earlier than it enters the system. This avoids the entice of importing soiled knowledge and spending months cleansing it later beneath the strain of already derailed timelines and critical reputational, monetary, and regulatory dangers looming in.

A broader enterprise case: horizontal worth throughout the group

For knowledge groups, the return on trusted and automatic MDM is transformative. As a substitute of being caught in a reactive, error-fixing mode, they transfer right into a strategic, high-impact function. Key advantages embrace:

- Fewer firefights: Errors are prevented on the supply, decreasing the necessity for fixed cleanup and root trigger evaluation.

- Clear accountability: With guidelines and validation embedded, knowledge possession turns into clear and simpler to handle.

- Scalable governance: Knowledge groups can outline requirements as soon as and apply them constantly throughout international programs.

- Improved knowledge high quality KPIs: Automated checks assist groups constantly hit high quality thresholds for completeness, accuracy, and timeliness.

- Strategic function elevation: Knowledge stewards and MDM leads transfer past “knowledge janitor” duties to concentrate on structure, analytics readiness, and cross-functional enablement.

However the worth of sensible MDM automation doesn’t cease with the information groups. As soon as clear, verified, and automatic grasp knowledge turns into commonplace, its ripple results remodel the whole group. When belief and automation are embedded on the core:

- Finance avoids cost errors and fraud because of verified checking account knowledge.

- Procurement quickens provider onboarding and threat evaluation.

- Gross sales and advertising acquire confidence in buyer segmentation and outreach.

- Compliance groups cut back regulatory publicity with out counting on handbook checks.

- Analytics and AI fashions get higher enter, main to raised predictions and selections.

- Govt management will get quicker, extra dependable reporting and confidence in decision-making rooted in correct, real-time data.

Tradition change and warning

Clearly, none of this occurs with software program alone. It requires a cultural shift. One the place knowledge high quality is everybody’s enterprise, and the place automation is trusted as a result of it’s clear and significant for the whole group from knowledge groups to enterprise stakeholders.

Meaning setting clear guidelines: which sources are thought of authoritative? What stage of completeness or match is required to auto-approve a file? What will get flagged, and why?

Constructing these guidelines collaboratively throughout IT, knowledge groups, and the enterprise helps safe buy-in and steadily builds belief: within the knowledge, within the programs, and within the course of itself. When folks see that automation makes their lives simpler with out shedding management, adoption follows naturally.

Nonetheless, there are challenges to look at for. Automating dangerous processes simply makes dangerous outcomes occur quicker. Or within the phrases of George Westerman, Senior Lecturer and Principal Analysis Scientist at MIT Sloan College of Administration, “When digital transformation is completed proper, it’s like a caterpillar turning right into a butterfly, however when executed mistaken, all you will have is a extremely quick caterpillar.”

So, the muse have to be robust: beginning with clear, verified, and trusted knowledge core and well-defined governance.

The trail ahead

As extra firms transfer towards digital working fashions, the strain to get enterprise knowledge basis proper will solely develop. Whether or not it’s onboarding a brand new provider in Asia, integrating a brand new acquisition in Europe, or validating a buyer in North America, velocity and accuracy are each anticipated. And not elusive to mix.

The excellent news is that the instruments, frameworks, and networks to make it occur exist already. What is required is the need to rethink the function of grasp knowledge, not simply as an asset to handle, however as a functionality to automate and scale.

In that future, grasp knowledge gained’t “simply” help enterprise. It can empower it.